Table of Contents

- Introduction

- Understanding UAE’s Cross-Border Remittance Landscape

- Structural Pain Points in Traditional Remittance Systems

- Why Blockchain is Ideal for Remittance Optimization

- Designing the Architecture of a Blockchain Remittance dApp

- FX Hedging and Instant Settlement Frameworks

- Case Study: Building a Corridor Prototype Between UAE and the Philippines

- Risks and Challenges

- Mistakes to Avoid When Building Blockchain Remittance Corridors

- Outlook for 2025 and Beyond

- Frequently Asked Questions

- Final Thoughts

- Websima Expertise and Collaboration Opportunities

Introduction

Dubai’s fintech and blockchain landscape continues to evolve at an extraordinary pace, with remittances emerging as one of the most immediate and tangible real-world applications. The UAE is home to one of the world’s most diverse expatriate populations, with millions of workers supporting families in India, Pakistan, and the Philippines through monthly remittance transfers.

As of 2024, the UAE ranked among the top three remittance-sending nations globally, contributing over US$39 billion in annual outbound flows. According to the World Bank’s global remittance database, total remittances to low- and middle-income countries surpassed foreign direct investment inflows that same year — underscoring how critical this sector is for economic stability in developing economies.

This article explores how blockchain-based decentralized applications (dApps) can redefine cross-border payment systems within these corridors, reduce transfer costs, and improve transparency. It also examines the regulatory, architectural, and operational design principles required to make such systems viable across the UAE’s leading remittance routes.

Understanding UAE’s Cross-Border Remittance Landscape

BOOOOOOOOOOOM! Dubai has officially given the green light to Ripple for international remittances, signaling that the UAE is embracing #XRP! $XRP RIPPLE DUBAI. pic.twitter.com/bmopUwK42t

— Captain mallard (@Brett_Crypto_X) August 19, 2024

The UAE’s labor market has long been dominated by workers from India, Pakistan, and the Philippines. Together, these three corridors account for more than 50 percent of all outbound remittances from the Emirates. Data from Zawya shows that India alone receives roughly 30 percent of total UAE remittances, followed by Pakistan (12 percent) and the Philippines (8 percent).

Yet, despite digital transformation across UAE banks and fintechs, the average transfer cost remains high — about 5.8 percent for a US$200 remittance, according to the World Bank’s Remittance Prices Worldwide Index.

Beyond cost, delays and inefficiencies persist due to reliance on correspondent banking networks, limited interoperability, and liquidity mismatches across time zones.

This is precisely where blockchain remittance corridors UAE developers are focusing their innovation: a decentralized yet regulated system capable of enabling real-time value transfer across national boundaries, without exposing participants to FX volatility or compliance gaps.

Structural Pain Points in Traditional Remittance Systems

The legacy remittance infrastructure relies heavily on intermediaries: correspondent banks, settlement agents, and local payout partners. This creates structural frictions that are both costly and slow.

Hidden FX Spreads

Traditional money-transfer operators (MTOs) profit largely from the exchange-rate margin. In many UAE corridors, users face hidden markups of up to 3–4 percent above interbank rates.

Multi-Day Settlement Windows

Cross-border payments can take from several hours to multiple days to settle, creating liquidity and float inefficiencies.

Counterparty and Compliance Risk

Each leg of the transaction is governed by separate AML/KYC standards, increasing friction and operational exposure.

Lack of Transparency

Customers rarely see real-time transaction visibility; error resolution is manual and slow.

Fragmented User Experience

Users depend on different apps or agents per corridor, lacking unified dashboards or integrated reporting.

These inefficiencies collectively open the door for blockchain’s automation, auditability, and programmable settlement.

Why Blockchain is Ideal for Remittance Optimization

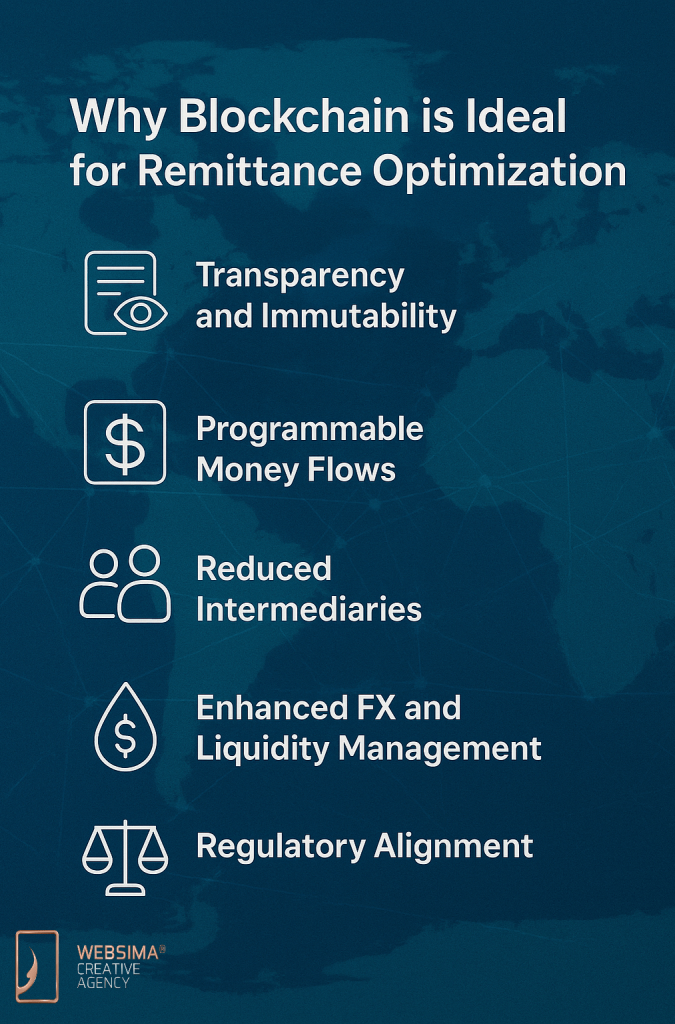

Blockchain directly addresses these long-standing inefficiencies while introducing programmable money movement and trust-based transparency.

Global institutions have begun acknowledging blockchain’s potential to reshape money transfers. A detailed analysis by the OECD on blockchain and remittance costs concludes that decentralized architectures can reduce transaction fees by up to 50 percent when integrated with regulated on- and off-ramps.

Transparency and Immutability

Every transaction recorded on-chain provides audit trails accessible to permissioned entities, supporting compliance and trust.

Programmable Money Flows

Smart contracts can automatically trigger settlements, escrow releases, or refund conditions — removing manual reconciliation delays.

Reduced Intermediaries

Decentralized ledgers minimize dependency on correspondent banks, improving both cost efficiency and speed.

Enhanced FX and Liquidity Management

On-chain stablecoins or synthetic assets can bridge multiple fiat currencies with real-time exchange-rate referencing.

Regulatory Alignment

When combined with permissioned chain designs and regulated stablecoins, blockchain rails can integrate directly into frameworks approved by the UAE’s Virtual Assets Regulatory Authority (VARA) and the Central Bank of the UAE.

Blockchain is therefore not a theoretical fix but a foundational infrastructure upgrade for global payments — especially in high-volume worker corridors.

Designing the Architecture of a Blockchain Remittance dApp

The core of an effective remittance dApp lies in modular design. A well-structured architecture enables interoperability between on-chain settlement layers and off-chain fiat rails.

Core Modules

| Component | Function | Design Notes |

| User Interface | Web/mobile dashboard for senders and recipients | Local language support, transparent rates |

| Onboarding & KYC Layer | Digital identity verification and screening | Integration with UAE Pass or third-party KYC APIs |

| On-Ramp/Off-Ramp Gateways | Fiat ↔ stablecoin conversion | Must align with licensed payment providers |

| Settlement Engine | Executes and confirms value transfers | Smart-contract escrow logic |

| Liquidity Pools | Maintain corridor-specific float in AED, INR, PKR, PHP | Can integrate algorithmic market makers |

| FX Hedging Module | Real-time rate locking | Forward contracts or stablecoin hedging |

| Compliance & Reporting Layer | Exportable logs for regulators | Audit-ready design under AML standards |

| Monitoring Dashboard | Operational alerts, reconciliation tools | Automated failure detection |

Architecture Principles

- Hybrid Model: On-chain settlement with off-chain reconciliation ensures scalability and compliance.

- Corridor-Specific Liquidity Shards: Each corridor maintains separate liquidity pools to isolate exposure.

- Programmable Escrow: Smart contracts hold remittance value until both sides of the transaction are confirmed.

- Dynamic Routing: The system automatically selects optimal paths based on liquidity, cost, and FX conditions.

- APIs for Bank/Fintech Partners: Enables seamless integration with payment gateways, mobile wallets, and custodians.

The same routing and compliance architecture is now being repurposed for cross-border crypto payment gateways in UAE eCommerce, linking remittance innovation with merchant settlement flows.

FX Hedging and Instant Settlement Frameworks

FX volatility is one of the most significant risks in remittance corridors. A well-built blockchain system must include robust hedging and liquidity management tools.

Corridor-Based Liquidity Pools

Maintaining local-currency pools reduces conversion latency. For instance, a remittance dApp can pre-fund INR or PHP liquidity through regulated partners, ensuring instant payout. Similar design logic already powers emerging stablecoin settlement infrastructure in Dubai’s retail ecosystem, where stablecoins streamline point-of-sale payments and improve multi-currency reconciliation for merchants.

Dynamic Hedging via Smart Contracts

Smart contracts can automatically lock exchange rates for a defined window. When a user confirms a transaction, the dApp executes a synthetic forward trade or swaps into a pegged stablecoin — locking the rate at that moment.

Instant Settlement Through Layer-2 Scaling

Using Layer-2 (L2) rollups or sidechains enhances throughput and lowers fees. This ensures funds settle within seconds rather than hours.

Hybrid Settlement Pathways

In corridors where blockchain adoption is restricted, partial on-chain settlement can coexist with existing fiat rails, ensuring regulatory compliance while retaining efficiency gains.

Liquidity Credit Lines

For high-volume remitters, liquidity credit allows near-instant payouts before full settlement finalization, reducing user wait times.

This approach merges blockchain’s programmability with traditional financial safeguards, balancing innovation and prudence.

Case Study: Building a Corridor Prototype Between UAE and the Philippines

The Philippines is a practical pilot market for blockchain remittance due to its open regulatory stance toward digital payments.

Project Overview

A UAE-based fintech consortium launched a remittance dApp pilot in 2024 connecting AED-to-PHP transfers. Using stablecoin rails, the platform achieved settlement times under 45 seconds, compared to 2–3 hours in legacy systems.

Mechanism

- AED deposits tokenized via a licensed UAE on-ramp.

- Smart-contract escrow holds equivalent value in USD-pegged stablecoin.

- Off-ramp partner in Manila converts stablecoin to PHP through a regulated e-money institution.

- FX risk mitigated by instantaneous hedge within the AED/USD pair.

- All transactions recorded on a permissioned blockchain with encrypted user identity metadata.

Outcomes

- Cost reduction: Transfer fees dropped from ~4 % to below 1 %.

- Speed: Near-real-time payout confirmation.

- Transparency: Users could track transaction hash directly.

- Compliance: Full AML/KYC integration aligned with BSP and UAE Central Bank requirements.

The pilot demonstrates how blockchain remittance corridors UAE innovators envision can realistically operate under existing financial frameworks.

Risks and Challenges

Regulatory Uncertainty

Different interpretations of digital-asset classification across jurisdictions may cause operational bottlenecks. Coordination between VARA, SCA, BSP, and other regulators is essential.

Counterparty Reliability

Dependence on local payout partners introduces credit and operational risk; escrow mechanisms mitigate but cannot eliminate it.

Smart-Contract Vulnerabilities

A coding error or exploit could compromise user funds. Continuous audits are mandatory.

Volatility of Non-Stable Assets

If corridors rely on non-pegged tokens, even short-term exposure to volatility can affect margin stability.

User Adoption and Trust

Many blue-collar workers remain unfamiliar with blockchain wallets. UX simplification and education are essential for mainstream use.

Mistakes to Avoid When Building Blockchain Remittance Corridors

- Ignoring Last-Mile Partners: Without compliant on- and off-ramps, the system remains isolated from real economies.

- Using Unregulated Stablecoins: Integrate only stablecoins recognized under UAE or destination-market frameworks.

- Underestimating FX Exposure: Hedging must be dynamic; static pools invite losses during volatility spikes.

- Neglecting Compliance Automation: Manual AML processes defeat blockchain’s efficiency purpose.

- Over-engineering UX: A simple, multilingual interface is more valuable than complex token mechanics.

Learning from these missteps accelerates scalability and regulatory approval readiness.

Outlook for 2025 and Beyond

The coming years will likely see convergence between digital-asset regulation and mainstream financial infrastructure.

According to PwC Middle East, stablecoins and CBDCs are set to transform cross-border value movement. The UAE’s proactive regulatory ecosystem positions it to serve as a regional hub for compliant remittance innovation.

Trends to watch include:

- Integration of CBDC-linked corridors between UAE and India through bilateral payment agreements.

- Expansion of AI-based routing algorithms to optimize liquidity and FX pricing.

- Growth of DeFi-enabled micro-remittance pools, offering yield to idle liquidity.

- Emergence of institutional-grade compliance oracles that automate reporting.

- Evolution toward interoperable global remittance meshes, connecting multiple corridors under unified infrastructure.

By 2027, blockchain corridors could process a meaningful share of the UAE’s outbound flows, reducing transaction costs by over 60 percent relative to traditional channels.

Frequently Asked Questions

Is blockchain remittance legal in the UAE?

Yes — when structured through licensed entities under the Central Bank, SCA, or VARA supervision. Non-custodial components must integrate compliant fiat gateways.

Do users need to hold crypto wallets?

Not necessarily. Custodial solutions can abstract wallet complexity while maintaining on-chain transparency.

How are exchange rates managed?

Through automated FX-hedging modules that lock rates in real time and manage corridor-specific liquidity.

What are the major obstacles to scale?

Regulatory harmonization and user adoption remain the two largest hurdles, followed by integration with banks in destination countries.

Can stablecoins replace fiat fully?

No, but they provide efficient bridging instruments for settlement before conversion back into local currency.

Final Thoughts

Designing effective blockchain remittance corridors in the UAE requires balancing innovation with compliance. The key lies not in replacing banks but in augmenting the remittance ecosystem with transparent, programmable settlement layers.

As corridor-specific liquidity deepens and regulatory clarity advances, blockchain will transition from pilot projects to production-grade infrastructure — enabling faster, cheaper, and safer money transfers for millions of expatriates.

Websima Expertise and Collaboration Opportunities

Websima is a Dubai-based blockchain development and regulatory advisory firm specializing in Web3 infrastructure, DeFi platforms, and tokenized finance solutions.

Our expertise includes:

- End-to-end design of blockchain-based remittance systems

- Smart-contract development and audit for financial compliance

- Integration with VARA and Central Bank-aligned frameworks

- Corridor-specific liquidity modeling and FX risk management

- Enterprise pilot deployment and technical advisory

If your organization aims to launch or scale a remittance dApp within the UAE’s evolving cross-border corridors, Websima’s blockchain and compliance teams can support you from concept to deployment.

Contact Websima to discuss how our experience in regulated blockchain systems can help you build the next generation of remittance solutions.