Table of Contents

- Introduction: Why Tokenomics 2.0 Matters in the UAE

- Evolution of Tokenomics in the Region

- The Three Pillars: Utility, Velocity, and Sink Design

- Understanding Velocity: Managing Circulation and Speculation

- Designing Token Utility for Real Ecosystem Value

- Building Effective Token Sinks for Sustainability

- Case Study: Venom Foundation’s Utility Layer in ADGM

- Regulatory and Compliance Context in the UAE

- Risks and Mistakes in Tokenomics Design

- Market Outlook 2025–2030

- FAQs on Tokenomics UAE

- Final Thoughts

- Work with Websima

Introduction: Why Tokenomics 2.0 Matters in the UAE

The UAE has become a global epicenter for blockchain innovation. From Abu Dhabi Global Market (ADGM) to Dubai’s Virtual Assets Regulatory Authority (VARA), the nation’s frameworks now support compliant, long-term token economies.

However, many early Web3 ventures in the Emirates struggled. Their token models were inflationary, speculative, or lacked genuine use cases. Tokens pumped — then collapsed.

That’s where Tokenomics 2.0 comes in: an evolved design philosophy focusing on utility, velocity control, and deflationary sinks that sustain ecosystems over time.

This article explores how advanced tokenomics UAE models combine strong economic design with compliance under ADGM and VARA oversight.

Evolution of Tokenomics in the Region

Wormhole is announcing the next major chapter for the $W token with the release of upgraded W 2.0 Tokenomics, including:

– The Wormhole Reserve

– 4% Base Yield on W

– Unlock OptimizationRead more ⤵️ pic.twitter.com/p8rApBeees

— Wormhole (@wormhole) September 17, 2025

Dubai’s Blockchain Strategy 2031 spurred an early wave of tokenization projects. Yet without regulation, most lacked fiscal balance. The introduction of the VARA Virtual Assets and Related Activities Regulations 2023 brought clear guardrails — distinguishing legitimate utility tokens from speculative assets.

Meanwhile, ADGM’s DLT Foundations Regime gave decentralized projects legal standing. This structure enables DAOs and token-governed entities to operate transparently while maintaining compliance.

According to Chainalysis data, the UAE ranks among the world’s top 15 crypto markets by transaction volume — a sign that regulatory maturity has built investor trust.

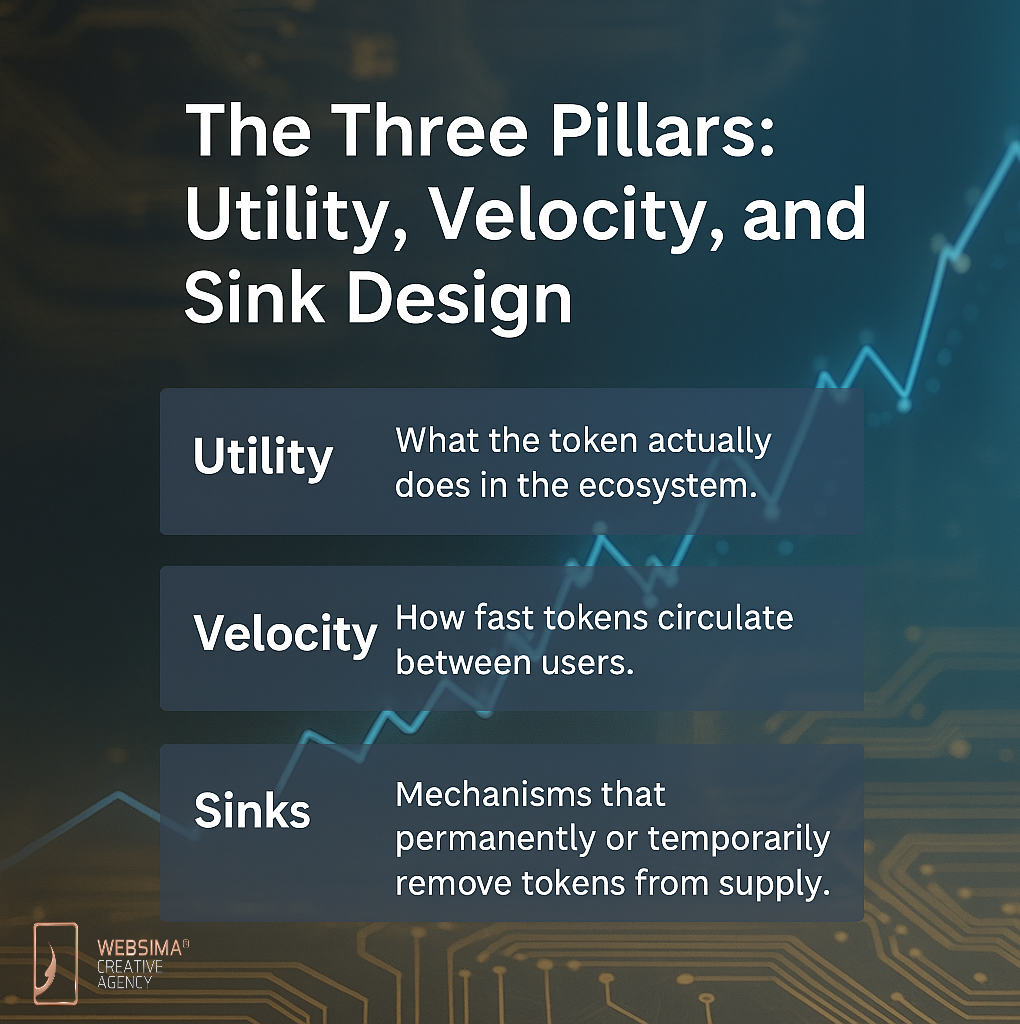

The Three Pillars: Utility, Velocity, and Sink Design

Modern tokenomics hinges on three fundamentals:

- Utility – What the token actually does in the ecosystem.

- Velocity – How fast tokens circulate between users.

- Sinks – Mechanisms that permanently or temporarily remove tokens from supply.

Balancing these factors ensures network stability, encouraging long-term participation instead of speculative churn.

Understanding Velocity: Managing Circulation and Speculation

Velocity determines the pace of token movement. High velocity often signals speculation and weak retention. To moderate it, UAE projects use:

- Staking & Lockups: Encourage long-term holding.

- Governance Rewards: Incentivize loyal participants.

- Native Fee Payments: Create recurring demand.

- Vesting Schedules: Match supply release with growth milestones.

Projects like Venom Foundation apply these mechanisms effectively, aligning token circulation with genuine ecosystem growth.

Designing Token Utility for Real Ecosystem Value

Utility separates speculative tokens from functional assets.

Common utility patterns within tokenomics UAE projects include:

- Access Tokens: Required for platform or service usage.

- Governance Tokens: Power community decisions and protocol votes.

- Transactional Tokens: Used for in-app or cross-chain payments.

- Network Tokens: Reward validators and oracles for maintaining uptime.

- Reputation Tokens: Encourage verified participation under UAE KYC norms.

A strong utility layer directly correlates to user retention and sustainable demand. Utility-driven models can also enable Web3-based crowdfunding platforms in Dubai, where contributors receive on-chain tokens that represent governance or revenue share

Building Effective Token Sinks for Sustainability

Token sinks ensure deflationary pressure by removing tokens from active supply.

Examples:

- Fee Burns: A fraction of every transaction is destroyed.

- Collateral Locks: Tokens held as staking collateral or liquidity.

- Subscription Consumption: Tokens spent for premium features.

- NFT Redemption: Burning tokens in exchange for digital or physical rewards.

In Dubai’s DMCC-licensed GameFi projects, burn-as-you-play systems already maintain equilibrium between token release and destruction.

Case Study: Venom Foundation’s Utility Layer in ADGM

The Venom Foundation, regulated under ADGM, offers a clear example of compliant, sustainable tokenomics.

Key Features

- Multi-Layer Staking: Validators stake VENOM for network security, locking supply.

- Dynamic Fee Burns: A percentage of each transaction is burned.

- Governance Access: Token holders vote on upgrades and grants.

- Cross-Chain Utility: VENOM works across multiple subnets for higher liquidity.

- Regulatory Oversight: ADGM licensing guarantees transparency and auditability.

Venom’s approach demonstrates how tokenomics 2.0 aligns incentives, velocity, and compliance.

Regulatory and Compliance Context in the UAE

UAE regulators have made tokenomics compliance a formal discipline:

- VARA Rulebooks 2023 – cover issuance, marketing, and custody standards.

- ADGM DLT Foundations Framework – defines governance and reporting requirements.

- CBUAE Stablecoin Regulation (2024) – sets payment token parameters.

These frameworks ensure that economic design aligns with legal and consumer-protection standards — making the UAE one of the world’s safest jurisdictions for token deployment. Token frameworks must also align with data localization rules, as explored in Web3 data residency practices in the UAE, which define how on-chain user data complies with national privacy standards

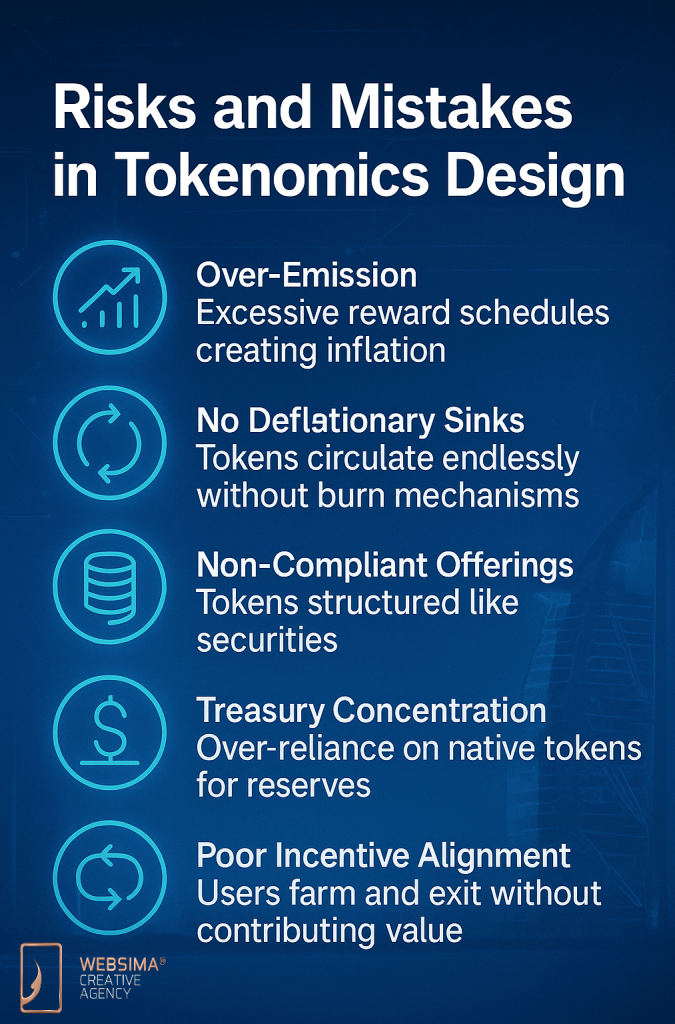

Risks and Mistakes in Tokenomics Design

Frequent missteps seen in early Web3 projects:

- Over-Emission: Excessive reward schedules creating inflation.

- No Deflationary Sinks: Tokens circulate endlessly without burn mechanisms.

- Non-Compliant Offerings: Tokens structured like securities.

- Treasury Concentration: Over-reliance on native tokens for reserves.

- Poor Incentive Alignment: Users farm and exit without contributing value.

Avoiding these pitfalls requires a blend of game theory, compliance, and financial modeling.

Market Outlook 2025–2030

Between now and 2030, tokenomics UAE will evolve into a backbone for regulated DeFi, RWA tokenization, and enterprise blockchain.

Key trends to watch:

- Real-World Asset Tokenization: Real estate, commodities, and sukuk.

- Dual-Utility Tokens: Combining governance and transactional use.

- AI-Driven Burn Adjustments: Automated supply stabilization.

- Cross-Regulatory Tokenization: Bridging VARA and ADGM ecosystems.

- Institutional Participation: Banks launching tokenized settlement rails.

McKinsey’s “From Ripples to Waves: The Transformational Power of Tokenizing Assets” estimates global tokenized assets could exceed $10 trillion by 2030, with the UAE among the fastest-growing jurisdictions.

Frequently Asked Questions (FAQs)

Q: What does tokenomics mean in the UAE?

A: Tokenomics refers to the structured economic model behind a crypto asset. In the UAE, it’s shaped by VARA and ADGM rules to ensure compliance and long-term sustainability.

Q: How does velocity affect tokenomics UAE models?

A: Velocity impacts supply pressure. Controlled velocity through staking, burns, and utility prevents inflation.

Q: What are token sinks in UAE projects?

A: Sinks are mechanisms like burns or locked collateral that reduce circulating supply, supporting token value.

Q: How are UAE regulators influencing token design?

A: VARA, ADGM, and CBUAE require transparent governance and economic disclosures in all token issuance frameworks.

Q: Which UAE projects exemplify tokenomics 2.0?

A: Venom Foundation and HaloFi illustrate how compliant token utilities and sinks sustain ecosystem growth.

Final Thoughts

Tokenomics UAE has evolved from a speculative frontier into a cornerstone of the nation’s digital economy strategy. What began as experimental token issuance has matured into structured economic architecture that bridges finance, regulation, and innovation.

The UAE’s unique position — with VARA’s transparent rulebooks, ADGM’s legal recognition for decentralized foundations, and CBUAE’s payment-token oversight — creates an ecosystem few jurisdictions can match. This regulatory trifecta not only attracts startups but also major institutional players looking to tokenize real-world assets, loyalty systems, and cross-border payment networks.

Looking ahead to 2030, expect the next phase of tokenomics UAE to merge with broader smart-economy initiatives — digital identity, DeFi–RWA integration, AI-driven governance, and green finance tokenization. As these pillars converge, token economies in the UAE will transform from financial experiments into the digital infrastructure of tomorrow’s global capital markets.

Work with Websima

At Websima, we help UAE-based blockchain ventures design sustainable, compliant token economies.

Our expertise covers:

- Emission & vesting modeling

- Sink design and burn logic

- VARA / ADGM compliance

- RWA & DeFi token frameworks

Contact Websima to design a regulatory-ready tokenomics model that balances growth, governance, and longevity.

Websima — Engineering sustainable blockchain economies for the UAE’s Web3 future.