Dubai’s real estate sector has long been recognized for its dynamism, global appeal, and innovation-driven policies. Now, as blockchain technology matures and finds increasingly practical applications, a powerful intersection is taking shape between digital assets and property ownership. Enter NFT real estate tokenization Dubai—a paradigm shift that is redefining how assets are created, owned, traded, and financed.

By combining the immutability and transparency of blockchain with the non-fungible capabilities of NFTs, real estate tokenization is unlocking new pathways for investment, liquidity, and compliance. Dubai, with its forward-thinking regulatory framework and ambition to be the global capital of Web3, is at the forefront of this movement.

BREAKING: DUBAI INTRODUCES

A PILOT PHASE TO TOKENIZE REAL

ESTATE ASSETS ON BLOCKCHAIN. pic.twitter.com/s4Ybz5Kyih— Ash Crypto (@Ashcryptoreal) March 20, 2025

Understanding Real Estate Tokenization via NFTs

What is Tokenization?

Tokenization refers to the process of converting rights to an asset into a digital token on a blockchain. In the case of real estate, this means fractionalizing a property into smaller, tradable units represented digitally—either as fungible tokens or NFTs.

NFTs (non-fungible tokens), unlike their fungible counterparts, represent unique and indivisible ownership rights. This makes them especially useful for tokenizing individual real estate units, property deeds, title documents, or unique investment agreements.

Why Use NFTs for Real Estate in Dubai?

Dubai’s property market is diverse—ranging from luxury villas to affordable apartments and commercial towers. NFTs offer the flexibility to tokenize these assets in a way that accommodates legal documentation, proof of ownership, and access to property benefits. As a result, NFT-backed properties can streamline the traditional paperwork-heavy real estate process into a transparent, digital-first experience.

For a deeper look at real estate tokenization, visit the World Economic Forum’s blockchain report.

Dubai’s Regulatory Infrastructure Supporting Tokenized Real Estate

The Role of VARA and DLD

The Dubai Land Department (DLD) and the Virtual Assets Regulatory Authority (VARA) are actively developing the framework for digital asset-backed property transactions. With the launch of Dubai’s Blockchain Strategy, the emirate aims to conduct all real estate records and property transactions through blockchain by 2030.

This paves the way for NFTs to serve as verifiable records for property deeds, reducing fraud and manual verification. Legal clarity is a major enabler in the NFT real estate tokenization Dubai ecosystem, attracting both domestic and international blockchain investors.

Read more about DLD’s blockchain integration on the Dubai Land Department’s official website.

Free Zones and Tokenization Startups

Dubai’s free zones—particularly DIFC, DMCC, and Dubai Silicon Oasis—are now hosting multiple blockchain startups focused on asset tokenization. These include ventures working on smart contracts for rental income distribution, DAO-based property management, and fractional sales of hotel units or branded residences.

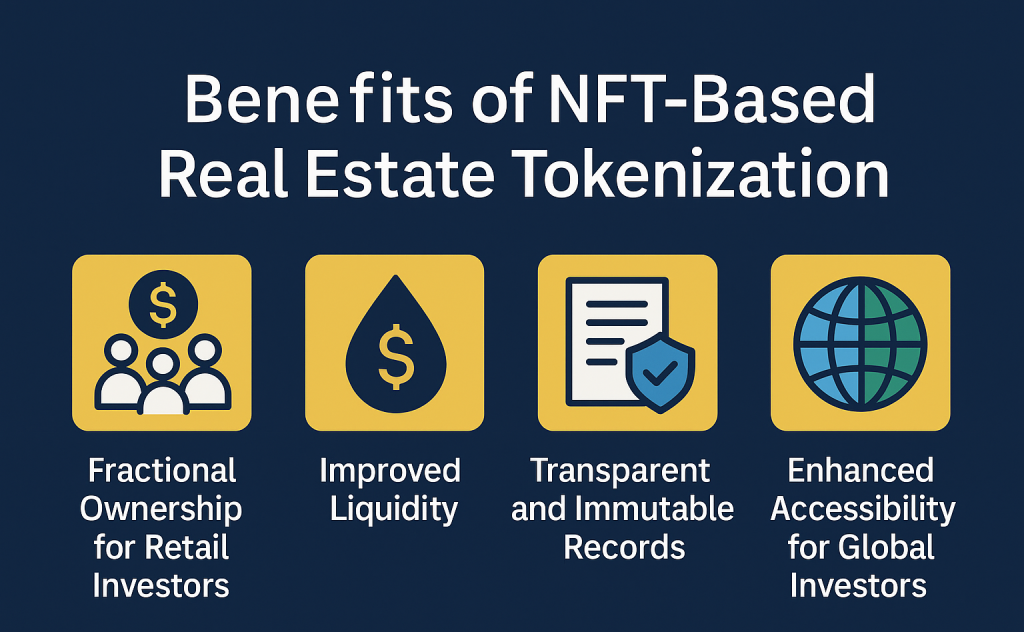

Benefits of NFT-Based Real Estate Tokenization

1. Fractional Ownership for Retail Investors

Traditional real estate investments in Dubai often require substantial capital, making them inaccessible to smaller investors. Blockchain is transforming real estate in Dubai by enabling NFTs to allow properties being split into digital shares, where individuals can own fractions of high-value assets and still earn passive rental income or capital appreciation.

This aligns with Dubai’s broader economic vision of financial inclusion and investor diversification.

2. Improved Liquidity

One of the key pain points in real estate is illiquidity. Selling or transferring ownership can take weeks, if not months. However, NFT real estate tokenization Dubai facilitates near-instant transfer of ownership, often via peer-to-peer transactions or secondary NFT marketplaces in Dubai. This new liquidity layer benefits both buyers and developers looking to raise capital quickly.

3. Transparent and Immutable Records

Every NFT carries metadata including ownership history, valuation data, maintenance records, and tenant details. Since this information is recorded on a public blockchain, it provides unmatched transparency and simplifies due diligence for buyers, sellers, and regulators.

4. Enhanced Accessibility for Global Investors

Investors from any part of the world can now buy NFT-backed Dubai real estate without having to travel, deal with complicated legal paperwork, or engage intermediaries. As long as they meet the KYC requirements and local regulations, they can participate in Dubai’s real estate market digitally and securely.

Read how global investors are entering UAE real estate through tokenized assets in this Forbes article.

Use Cases Already Emerging in Dubai

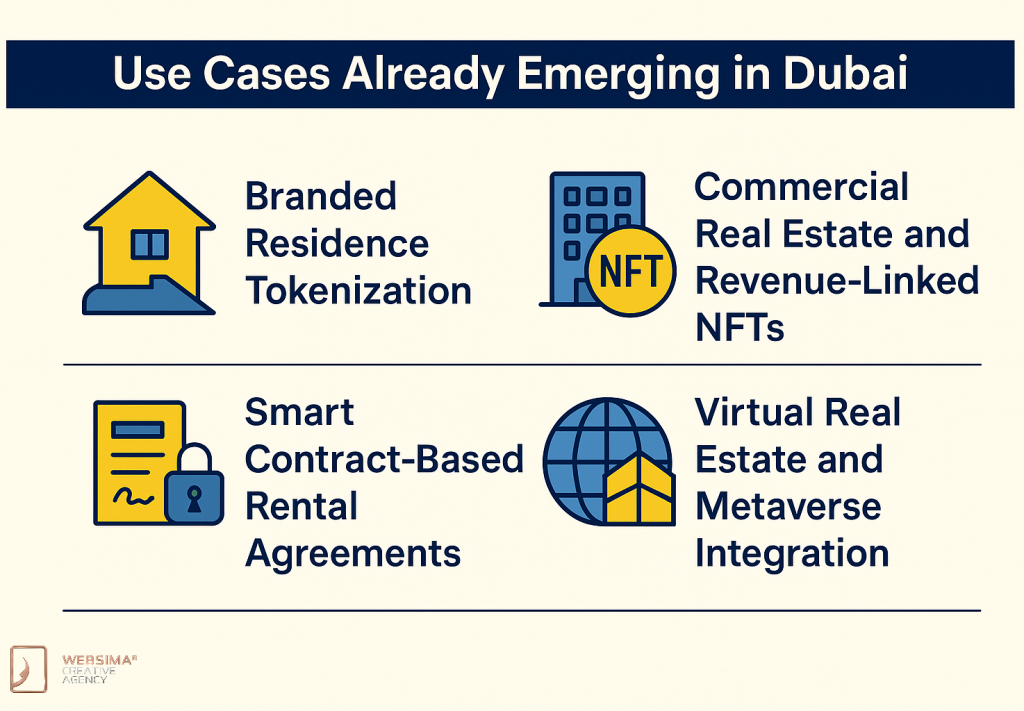

Branded Residence Tokenization

Luxury real estate developers are experimenting with NFTs to tokenize suites in branded residences—offering investors digital ownership of prime units. These NFTs may also include access to concierge services, hospitality perks, and resale on secondary markets.

Commercial Real Estate and Revenue-Linked NFTs

Some Dubai startups are launching NFTs that represent not just ownership but also revenue rights. For example, owning a “Tier 1” NFT could entitle the holder to a percentage of annual rental income from a commercial tower or retail plaza. These token models are governed by smart contracts ensuring automated revenue distribution.

Smart Contract-Based Rental Agreements

NFTs can also be used to manage lease agreements. A digital rental contract embedded in an NFT can automate payment collection, enforce tenancy rules, and even include penalties for non-compliance—without relying on manual processing or legal arbitration.

Virtual Real Estate and Metaverse Integration

In parallel, Dubai is a global hub for metaverse development. Tokenized virtual land is already being sold in platforms like Decentraland and Sandbox, with some Dubai-based firms enabling hybrid experiences—where NFT ownership of virtual plots links to benefits in real-world properties.

Risks and Legal Considerations

Regulatory Hurdles

Although Dubai is ahead in blockchain regulation, real estate tokenization introduces complex legal challenges. For example, determining whether NFT-based property interests count as securities or utility tokens affects how they’re taxed and regulated.

Technical Vulnerabilities

Smart contracts must be rigorously audited. A flaw in an NFT’s smart contract could result in ownership disputes, data corruption, or even asset loss. It’s essential that platforms implementing tokenization employ proven code security protocols and regular vulnerability checks.

Market Maturity and Education

The concept of owning real estate through a token or NFT is still relatively new. Public understanding remains low, requiring education campaigns, user-friendly platforms, and support from real estate agents who can bridge the gap between traditional and digital property markets.

The Future of NFT-Powered Real Estate in Dubai

By 2030, experts predict that more than 20% of real estate transactions in Dubai could be executed via blockchain or tokenized platforms. This is plausible given the government’s commitment to digital transformation and investor-friendly policies.

Future trends may include:

- AI-powered real estate marketplaces built on Web3

- DAO-governed smart communities where NFT holders vote on building policies

- Real-world assets bundled with metaverse twins

- NFT-based mortgages and DeFi-lending models

- ESG scoring embedded in tokenized property metadata

NFTs may also play a role in green real estate, where holders are rewarded with additional tokens for supporting sustainable developments or energy-efficient buildings.

Conclusion

NFTs are not just changing art and collectibles—they are revolutionizing property ownership and investment. The rise of NFT real estate tokenization Dubai is opening the door to more inclusive, transparent, and liquid markets, where global investors can participate with minimal barriers and maximum confidence.

From fractional ownership and smart leases to NFT-based revenue streams and virtual land deals, Dubai is rapidly evolving into a tokenized real estate hub. As the legal infrastructure matures and public adoption grows, the future of real estate lies on the blockchain—and Dubai is leading the charge.

Ready to Tokenize Your Real Estate Vision in Dubai?

At Websima, we specialize in the development of secure, regulation-aligned platforms for real estate tokenization. Whether you’re a property developer, real estate investor, or Web3 entrepreneur, our team can help you launch:

- NFT-based asset tokenization frameworks

- Smart contract-powered rental and sales agreements

- Secondary marketplaces for real estate NFTs

- Legal structuring to ensure compliance with Dubai regulations

- Secure wallet and KYC integrations for investor onboarding

Let us help you transform your real estate venture into a blockchain-native powerhouse.

Connect with Websima and unlock the future of NFT-powered property solutions in Dubai.