Introduction: Navigating the UAE’s Rapidly Evolving Crypto Regulatory Landscape

The United Arab Emirates (UAE) is rapidly emerging as one of the most crypto-forward jurisdictions in the world. Known for its business-friendly policies and progressive technology adoption, the UAE has made significant strides in creating a regulated environment for cryptocurrencies and NFTs. Investors—both domestic and international—are increasingly drawn to the Emirates, especially Dubai and Abu Dhabi, for their structured yet innovation-friendly regulations. That’s why regulating crypto and NFTs become important.

However, as with any fast-evolving sector, understanding crypto NFT regulations UAE is critical. From licensing to compliance, tax rules to investor protection—staying updated with the UAE’s legal landscape is a prerequisite for long-term success in the Web3 ecosystem.

In this comprehensive guide, we’ll explore how the UAE is regulating crypto and NFTs, which authorities are involved, what frameworks exist, and what every investor should be aware of.

The UAE’s Vision for Digital Asset Regulation

Today, we approved the virtual assets law and established the Dubai Virtual Assets Regulatory Authority. A step that establishes the UAE’s position in this sector. The Authority will cooperate with all related entities to ensure maximum transparency and security for investors. pic.twitter.com/LuNtuIW8FM

— HH Sheikh Mohammed (@HHShkMohd) March 9, 2022

The UAE doesn’t see cryptocurrency or NFTs as a threat—it sees them as a pillar of the future digital economy. This strategic openness is underscored by its national blockchain strategy and ambition to become a global capital for digital finance and Web3 development.

The government has emphasized three guiding principles for regulation:

- Innovation Enablement

- Risk Mitigation

- Global Alignment

This approach has led to the development of robust regulatory frameworks tailored to the unique risks and opportunities presented by digital assets.

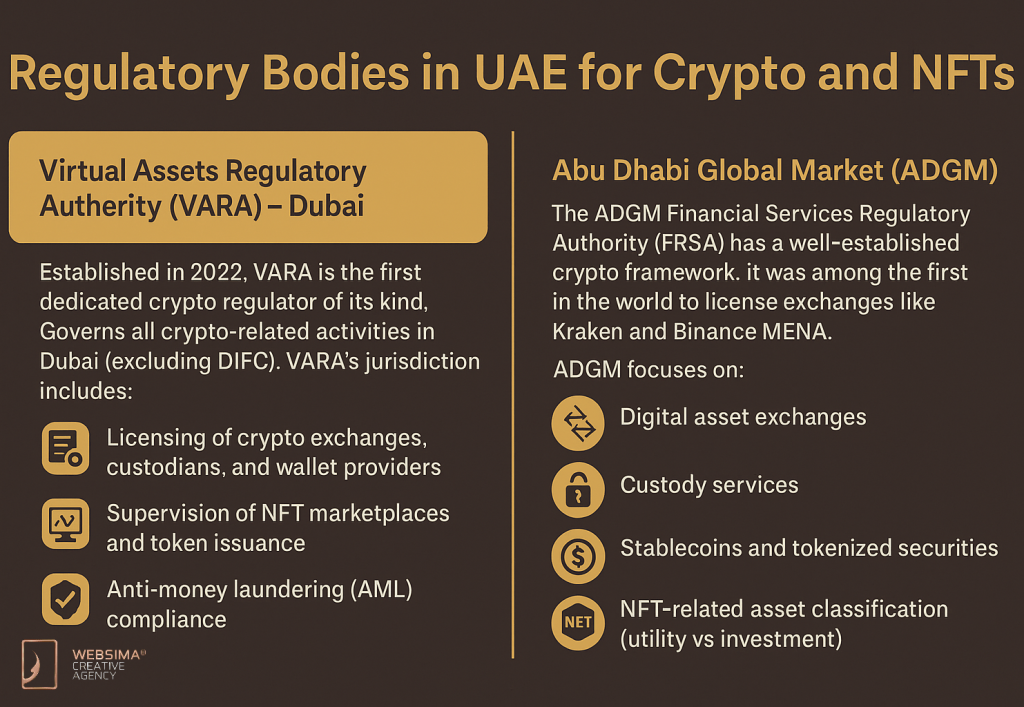

Who Regulates Crypto and NFTs in the UAE?

Multiple authorities play roles in regulating crypto and NFTs in the UAE, depending on the location and nature of the activity:

Virtual Assets Regulatory Authority (VARA) – Dubai

Established in 2022, VARA is the first dedicated crypto regulator of its kind. It governs all crypto-related activities in Dubai (excluding DIFC). VARA’s jurisdiction includes:

- Licensing of crypto exchanges, custodians, and wallet providers

- Supervision of NFT marketplaces and token issuance

- Anti-money laundering (AML) compliance

VARA has become known globally for its Metaverse headquarters in The Sandbox, symbolizing Dubai’s future-centric approach.

Abu Dhabi Global Market (ADGM)

The ADGM Financial Services Regulatory Authority (FSRA) has a well-established crypto framework. It was among the first in the world to license exchanges like Kraken and Binance MENA. ADGM focuses on:

- Digital asset exchanges

- Custody services

- Stablecoins and tokenized securities

- NFT-related asset classification (utility vs investment)

More info on ADGM’s crypto guidelines

Dubai International Financial Centre (DIFC)

Although under a separate legal system, DIFC is developing its own crypto rules under the Dubai Financial Services Authority (DFSA), which has started licensing security tokens and investment tokens.

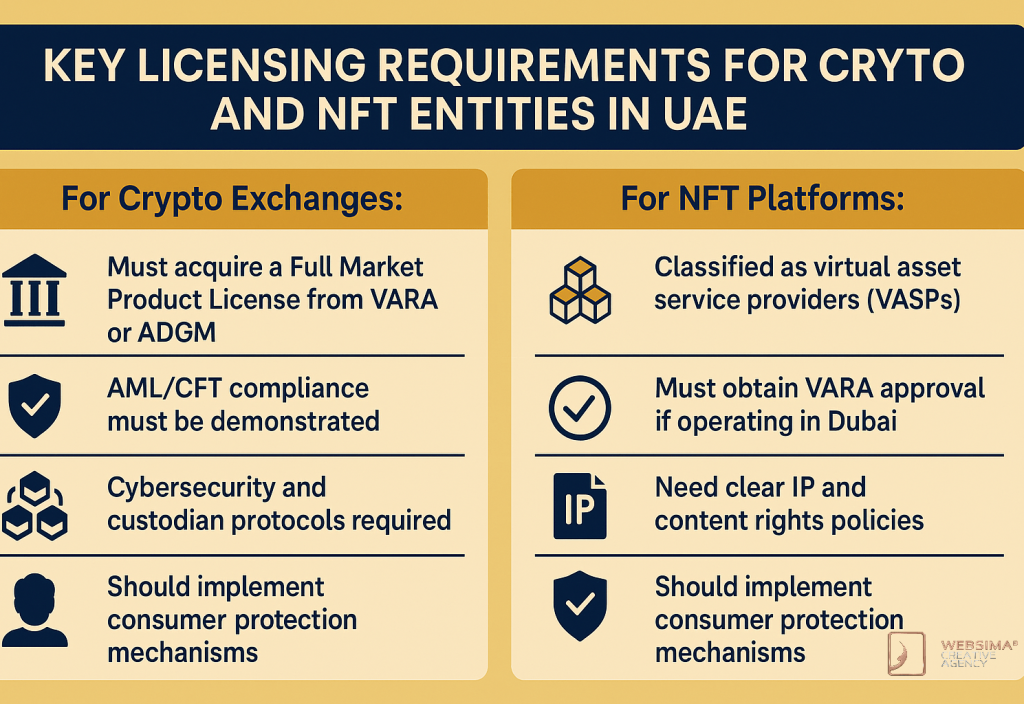

Key Licensing Requirements for Crypto and NFT Entities

If you plan to operate a crypto or NFT business in the UAE, licensing is mandatory. The process varies by zone and business type.

For Crypto Exchanges:

- Must acquire a Full Market Product License from VARA or ADGM

- AML/CFT compliance must be demonstrated

- Cybersecurity and custodian protocols required

For NFT Platforms:

- Classified as virtual asset service providers (VASPs)

- Must obtain VARA approval if operating in Dubai

- Need clear IP and content rights policies

- Should implement consumer protection mechanisms

Businesses found operating without proper licensing may face fines, suspension, or criminal liability under UAE law.

NFT Regulations: Beyond the Art Market

NFTs in the UAE are not merely about digital collectibles or art. They are now being applied in:

- NFTs and real estate tokenization in Dubai

- Event ticketing

- Loyalty and rewards programs

- Intellectual property licensing

As such, crypto NFT regulations UAE are evolving to address these diverse use cases. While NFTs themselves are not considered securities, the nature of the underlying asset may trigger additional oversight.

The UAE authorities have advised that:

- Utility NFTs (access passes, collectibles) are generally low-risk

- Investment-grade NFTs (that offer returns or profits) may require FSRA or DFSA scrutiny

- Advertising and promotion of NFTs must follow consumer protection and marketing rules

Anti-Money Laundering and KYC Obligations

AML compliance is a cornerstone of the UAE’s digital asset framework. All crypto and NFT platforms are required to:

- Implement KYC procedures for all users

- Report suspicious transactions to the UAE’s Financial Intelligence Unit (FIU)

- Keep detailed transaction records

- Employ blockchain analytics tools for monitoring

Failure to comply may result in penalties, business license revocation, or blacklisting from free zones like DMCC and DAFZA.

Taxation on Crypto and NFTs in the UAE

The UAE currently offers zero personal income tax and 0% capital gains tax on crypto. However:

- Corporate tax (9%) applies to businesses earning above AED 375,000/year

- VAT (5%) may apply to NFT sales, especially those involving physical services or goods

- Cross-border NFT sales may require digital services tax compliance based on buyer jurisdiction

While this tax-friendly environment attracts investors, businesses must still maintain accurate accounting and reporting for compliance.

Security and Custody Frameworks

Investor safety is a top concern. The UAE requires all licensed operators to maintain:

- Cold wallet storage policies

- Multi-signature access protocols

- Disaster recovery systems

- Regular cybersecurity audits

In 2023, ADGM released additional guidelines for digital asset custody, reinforcing best practices and investor protection standards for wallet providers and exchanges.

Dispute Resolution and Legal Recourse

Investors operating in the UAE benefit from well-defined legal recourse mechanisms:

- VARA-licensed firms must offer dispute resolution protocols

- ADGM and DIFC offer common law arbitration courts for contractual and investment disputes

- Customers can escalate issues to the UAE Securities and Commodities Authority (SCA) or Ministry of Economy

Investors should verify if the platform or project is licensed before engagement and always request terms of service and liability disclosures.

International Collaboration and FATF Compliance

The UAE is actively aligning with international standards such as:

- FATF travel rule compliance

- Participation in global crypto risk assessments

- Mutual licensing agreements with Hong Kong, Singapore, and Switzerland

These efforts make UAE’s role in the global NFT market significant, as a compliant, globally integrated crypto jurisdiction, while reinforcing its commitment to long-term investor trust.

Risks and Cautions for Investors

Despite a favorable environment, investors should approach UAE’s crypto markets with informed caution:

- Project Scams: Unregulated token offerings still exist outside free zones

- Volatility: Crypto and NFT markets are inherently volatile

- Legal Grey Zones: Some DeFi applications and token types still lack formal guidance

- Jurisdictional Differences: Rules in Dubai, Abu Dhabi, and DIFC may differ

Performing due diligence, using licensed platforms, and consulting legal professionals remain essential for risk mitigation.

The Future of Crypto and NFT Regulation in the UAE

Looking ahead, UAE regulators are expected to:

- Introduce NFT taxation clarity

- Expand rules for DeFi protocols and DAOs

- Launch national standards for digital asset audits

- Incentivize green and utility-based NFTs in climate and ESG initiatives

As crypto NFT regulations UAE continue to evolve, the Emirates remains focused on enabling innovation while protecting stakeholders—making it a unique destination for responsible digital asset investment.

Partner with Experts to Navigate UAE’s Crypto Legal Framework

At Websima, we empower startups, exchanges, and NFT platforms to launch compliant blockchain projects in the UAE. From licensing advisory to full-stack development, our team guides you through every legal, technical, and strategic challenge.

Our Blockchain and Web3 Services Include:

- Legal structuring for crypto and NFT startups

- Technical development of smart contracts, wallets, and NFT marketplaces

- VARA and ADGM compliance support

- Secure integrations for AML/KYC and custody frameworks

- Regulatory audit prep and documentation

We understand the nuances of crypto NFT regulations UAE and help you minimize legal exposure while maximizing market potential. Whether you’re launching your first tokenized project or migrating a global crypto platform to Dubai—we ensure your vision is aligned with the UAE’s legal infrastructure.

Contact Websima today to schedule a consultation and take your Web3 venture forward in the UAE.