Introduction

Dubai has rapidly transformed into one of the world’s most attractive destinations for blockchain innovation and investment. With a strong regulatory foundation, tax-friendly business environment, and forward-thinking leadership, the city is drawing the attention of global capital flows seeking opportunities in Web3, DeFi, NFTs, and tokenized assets.

In this article, we explore how Blockchain investors in Dubai has become more than just a trend—it’s a strategic movement. We’ll examine the factors behind this surge, the role of government policy, and the key sectors driving blockchain investment in the emirate.

Why Dubai Appeals to Blockchain Investors

Marhaba

From skyscrapers to blockchain, Dubai is leading the way in innovation!

Join us at #BinanceBlockchainWeek and see how it is becoming the global hub for crypto. pic.twitter.com/C0CyCxsZwv

— Binance (@binance) October 26, 2024

Regulatory Certainty and Government Support

One of the top reasons why blockchain investors are pouring capital into Dubai is the regulatory clarity. The establishment of VARA (Virtual Assets Regulatory Authority) has positioned Dubai as a global leader in digital asset governance. VARA provides clear guidelines for:

- Token issuance and trading

- Custody and wallet services

- NFT and metaverse platforms

This certainty encourages investors to confidently back Web3 startups, DeFi protocols, and blockchain infrastructure projects knowing they operate under a secure and transparent legal framework.

Tax Incentives and Business-Friendly Jurisdictions

Dubai offers 0% personal and corporate tax in many free zones, no capital gains tax on crypto holdings, and full foreign ownership in key sectors. Popular free zones like DMCC, DIFC, and ADGM are tailored to support blockchain ventures with streamlined setup processes and access to international investors.

These conditions reduce operational risk and maximize ROI, making Dubai a logical base for blockchain-focused funds and entrepreneurs.

A Thriving Ecosystem of Blockchain Innovation

Dubai as a Web3 Hub

The government’s strategic push to become a global metaverse and blockchain capital has resulted in robust digital infrastructure, including:

- The Dubai Metaverse Strategy, which aims to attract over 1,000 blockchain and metaverse companies

- Launch of the Dubai AI and Web3 Campus at DIFC, a dedicated ecosystem for emerging tech firms

These initiatives support a fertile environment where investors can discover early-stage startups building transformative solutions.

Presence of Global Blockchain Firms

Dubai has attracted several leading blockchain entities, including:

- Crypto.com, which opened its regional headquarters in the city

- Binance, which received a license to operate under VARA

- Bybit, which relocated its global HQ to Dubai

Their presence not only enhances credibility but also drives investment activity by establishing Dubai as a central node in the global blockchain network.

Key Areas Driving Investor Interest

1. DeFi and Fintech Protocols

DeFi is transforming the banking sector in Dubai, as investors are backing decentralized financial platforms offering tokenized securities, P2P lending, cross-border payments, and non-custodial wallets. The region’s growing demand for inclusive financial services makes DeFi particularly appealing.

2. Real Estate Tokenization

Dubai’s real estate market is being revolutionized by blockchain-based property ownership models. Tokenized assets allow international investors to purchase fractional shares in premium real estate, lowering entry barriers and creating liquidity in an otherwise illiquid market.

This trend is particularly attractive to blockchain VCs looking to diversify portfolios with tangible assets.

3. NFTs and Metaverse Infrastructure

Opportunities for NFTs and virtual real estate in Dubai through metaverse are emerging. Also, art, music, fashion, and gaming are increasingly blending into Web3 through NFT projects and metaverse storefronts. Dubai has hosted NFT exhibitions, digital twin showcases, and token-gated events—making it a hotbed for creative blockchain investments.

Role of Free Zones in Enabling Investment

DMCC – Crypto Centre

Located in Jumeirah Lake Towers, the DMCC Crypto Centre is home to hundreds of blockchain businesses. It offers:

- Licensing support

- Token issuance guidance

- Networking with global blockchain experts

Investors seeking vetted projects often explore DMCC as a source of innovation.

DIFC Innovation Hub

DIFC provides legal certainty through common law frameworks and connects investors to fintech and blockchain startups via its Innovation Hub. The recent launch of the Dubai AI and Web3 Campus further boosts investor interest in enterprise-grade Web3 infrastructure.

ADGM – Abu Dhabi’s Financial Center

Abu Dhabi Global Market (ADGM) offers a blockchain-friendly regulatory environment and is home to digital asset exchanges like MidChains. Investors looking for regulatory-first environments often gravitate to ADGM’s sandbox programs.

Global Events and Investment Forums

Dubai frequently hosts high-impact blockchain events that connect global investors with emerging startups. Some of the most notable gatherings include:

- Future Blockchain Summit

- TOKEN2049 Dubai

- GITEX Global x Ai Everything

These platforms allow institutional investors, VC firms, and angel backers to assess the region’s Web3 opportunities and form strategic alliances.

Venture Capital and Fund Activity

Dubai has seen a surge in the launch of blockchain-focused VC funds and investment firms. Prominent names include:

- Cypher Capital: A $100 million blockchain fund based in Dubai Marina

- Shorooq Partners: Backers of multiple Web3 startups in the MENA region

- Ghaf Capital: Focused on digital identity and DeFi infrastructure

According to MAGNiTT – UAE Blockchain Investment Report, the UAE accounts for over 40% of MENA’s blockchain investment, making Dubai the regional capital of Web3 venture activity.

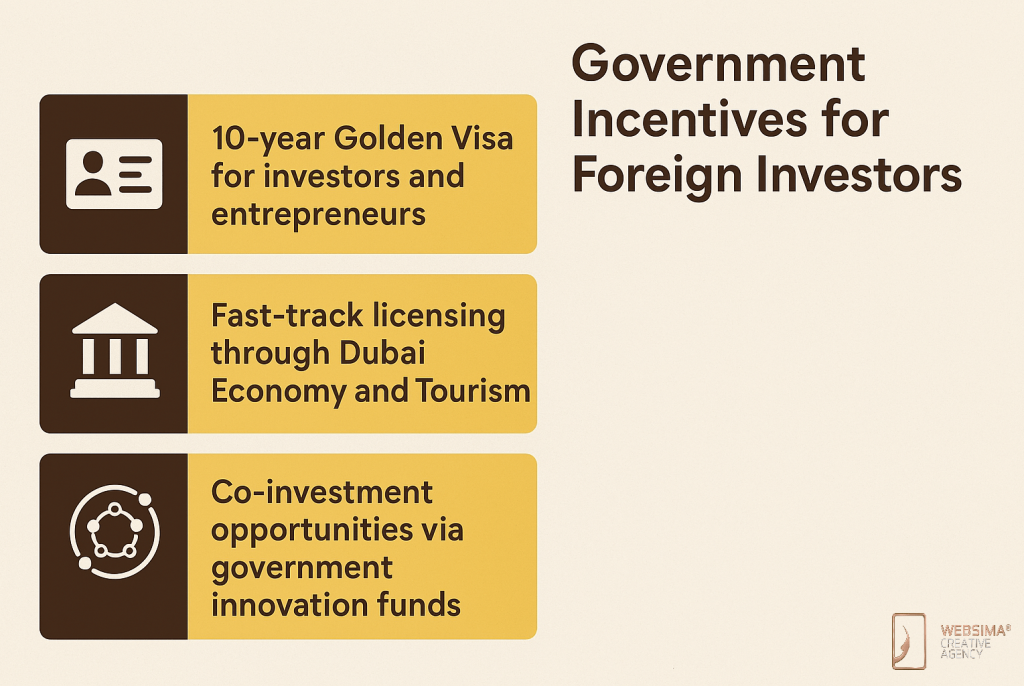

Government Incentives for Foreign Investors

Dubai actively offers visa programs and incentives to attract global investors, including:

- 10-year Golden Visa for investors and entrepreneurs

- Fast-track licensing through Dubai Economy and Tourism

- Co-investment opportunities via government innovation funds

These mechanisms lower entry barriers and position Dubai as one of the most investor-friendly blockchain jurisdictions globally.

Challenges and Mitigation Strategies

1. Market Saturation

As the ecosystem grows, investor competition increases. Startups must differentiate through utility, tokenomics, and long-term value creation.

2. Regulatory Adaptation

While Dubai has advanced frameworks, global investors must navigate multi-jurisdictional regulations related to security tokens, cross-border taxation, and KYC compliance.

3. Education Gaps

Investors new to blockchain need support in understanding DeFi mechanics, NFT dynamics, and smart contract security. Dubai’s accelerators and investor workshops help bridge this knowledge gap.

What the Future Holds for Blockchain Investors in Dubai

In the next five years, we can expect:

- Tokenized public-private partnerships

- Growth in ESG-compliant blockchain investment vehicles

- Cross-border VC syndicates anchored in Dubai

- Enhanced regulation for stablecoins and DAOs

With continued government commitment and growing global credibility, Blockchain investors Dubai will remain a key pillar of the city’s economic diversification and tech leadership.

Ready to Attract Blockchain Investors in Dubai?

Whether you’re looking to raise capital, tokenize assets, or build a blockchain-based platform in Dubai, Websima is your go-to technology partner. We help startups and established firms with Web3 development, smart contract solutions, and blockchain-ready company formation services.

Contact our team today to position your venture in front of global blockchain investors.