Table of Contents

- Introduction: Why the Travel Rule Matters for Dubai’s Crypto Sector

- Understanding the FATF Travel Rule

- How the Travel Rule Applies to UAE Virtual Asset Service Providers (VASPs)

- Key Components of Compliance Architecture

- Technical Implementation: Data Transmission Standards

- UX vs. Compliance: Balancing the User Experience

- Regulatory Landscape: VARA, FSRA, and the Central Bank of the UAE

- Case Study: Travel Rule Adoption by a Dubai Exchange

- Challenges and Mitigation Strategies

- Outlook 2025–2030: Global Convergence and UAE Leadership

- Frequently Asked Questions (FAQs)

- Final Thoughts

- Websima’s Role in VASP Compliance Innovation

Introduction: Why the Travel Rule Matters for Dubai’s Crypto Sector

Dubai’s crypto and blockchain ecosystem has rapidly evolved into one of the world’s most sophisticated environments for digital asset innovation. However, as the sector matures, compliance with international anti-money-laundering (AML) and counter-terrorist-financing (CFT) standards has become a top priority.

Among these global standards, the Financial Action Task Force (FATF) Travel Rule is central. It mandates that Virtual Asset Service Providers (VASPs) — including exchanges, brokers, custodians, and wallet providers — must collect, store, and share sender and recipient information for crypto transactions above specific thresholds.

UAE Just Did What the U.S. Was Too Scared to Do.

UAE official predicts:

“In just 2 years, you’ll use crypto more than dollars or dirhams even for coffee and groceries.” ☕Guess which coins have almost no fees?

He also says “Mark my words, I believe in actions,… pic.twitter.com/mDbUu3r66U

— Stellar Rippler (@StellarNews007) May 30, 2025

For UAE-licensed entities operating under VARA, ADGM FSRA, or DIFC DFSA, Travel Rule compliance is no longer optional — it is fundamental to maintaining legitimacy in cross-border transactions.

According to the FATF mutual evaluation of the UAE, the country has made significant strides in virtual-asset oversight, but consistent implementation remains critical to global recognition.

Understanding the FATF Travel Rule

The Travel Rule originates from FATF Recommendation 16, which was first applied to traditional wire transfers. In 2019, FATF extended the rule to virtual assets, ensuring the same transparency in crypto transfers.

What the Travel Rule Requires

- Originator Data: Name, wallet address, account number (if applicable), and location or ID.

- Beneficiary Data: Name, wallet address, and account number (if applicable).

- Transmission Obligation: VASPs must securely transmit this data to the receiving VASP before or concurrently with the transaction.

This ensures traceability in crypto transfers, helping regulators detect illicit activity such as money laundering and terrorism financing while maintaining market integrity.

How the Travel Rule Applies to UAE Virtual Asset Service Providers (VASPs)

The UAE has adopted FATF standards through both federal and emirate-level frameworks.

1. VARA (Dubai Mainland)

The VARA Rulebooks explicitly require VASPs to exchange verified sender and recipient data before transfers. These rules align with Dubai’s objective to be a globally trusted jurisdiction for digital assets.

2. ADGM (Abu Dhabi Global Market)

The FSRA Guidance outlines obligations for firms engaging in virtual-asset activities in ADGM, emphasizing Travel Rule compliance and AML record-keeping.

3. Central Bank of the UAE (CBUAE)

The CBUAE AML/CFT Guidelines for Financial Institutions extend due-diligence obligations to institutions interacting with crypto, promoting interoperability between the fiat and virtual-asset sectors.

Together, these frameworks make the UAE one of the first jurisdictions in the MENA region to operationalize FATF-aligned Travel Rule enforcement across multiple regulators.

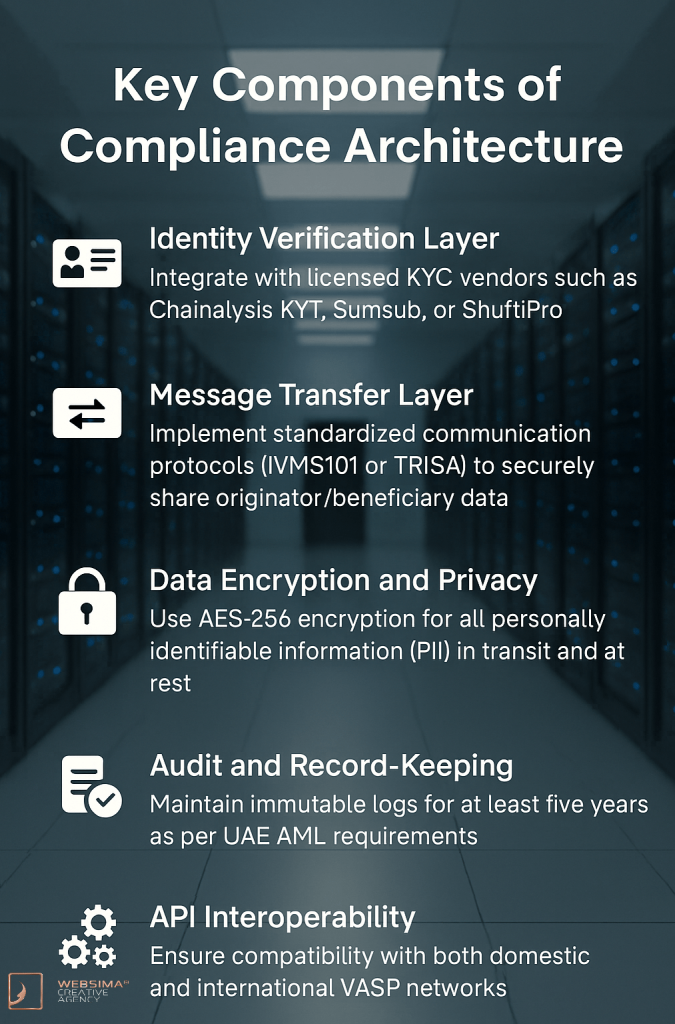

Key Components of Compliance Architecture

To achieve FATF-grade compliance, VASPs need a modular design integrating both legal and technical layers:

- Identity Verification Layer:

Integrate with licensed KYC vendors such as Chainalysis KYT, Sumsub, or ShuftiPro. - Message Transfer Layer:

Implement standardized communication protocols (IVMS101 or TRISA) to securely share originator/beneficiary data. - Data Encryption and Privacy:

Use AES-256 encryption for all personally identifiable information (PII) in transit and at rest. - Audit and Record-Keeping:

Maintain immutable logs for at least five years as per UAE AML requirements. - API Interoperability:

Ensure compatibility with both domestic and international VASP networks.

Technical Implementation: Data Transmission Standards

Two dominant global standards govern how VASPs exchange Travel Rule data:

1. IVMS101 (InterVASP Messaging Standard)

Developed by InterVASP, IVMS101 defines a universal schema for transmitting compliance data. It ensures uniformity between VASPs, minimizing errors and reducing integration costs.

2. TRISA (Travel Rule Information Sharing Alliance)

TRISA adds peer-to-peer identity verification through digital certificates, ensuring that only trusted counterparties exchange data.

Many Dubai-based exchanges now combine IVMS101’s structured data model with TRISA’s encryption layer for hybrid compliance — balancing precision, privacy, and speed.

UX vs. Compliance: Balancing the User Experience

Compliance is essential, but excessive friction deters users. Successful UAE VASPs build UX-centric workflows that make compliance nearly invisible.

Best Practices

- Seamless KYC: Merge verification into signup flows.

- Progressive Disclosure: Ask for only what’s needed based on transaction risk.

- Automated Prefill: Auto-populate recurring user data via encrypted APIs.

- Transparency: Explain compliance benefits to users to build trust.

Balancing regulatory rigor and smooth UX is the hallmark of successful crypto travel rule UAE implementation.

Regulatory Landscape: VARA, FSRA, and the Central Bank of the UAE

The UAE’s regulatory framework for virtual assets is among the most cohesive worldwide:

- VARA Rulebooks: Define VASP licensing, AML reporting, and Travel Rule data-exchange standards.

- ADGM FSRA Guidance: Aligns the Abu Dhabi market with FATF principles, emphasizing information-sharing compliance.

- CBUAE Guidelines: Bridge fiat institutions and crypto entities through AML harmonization.

The FATF recognized this multi-layer model as one of the most comprehensive approaches to virtual-asset oversight globally.

Case Study: Travel Rule Adoption by a Dubai Exchange

In 2024, a Dubai-based exchange launched a Travel Rule compliance module built using IVMS101 formatting and TRISA encryption.

Key results:

- 97.8% of outbound transfers exchanged compliance data successfully.

- Latency reduced to under 3 seconds per transmission.

- AI-driven address screening lowered false-positive alerts by 68%.

By embedding compliance APIs directly into transaction flows, the exchange achieved near-real-time reporting with minimal UX disruption.

Challenges and Mitigation Strategies

| Challenge | Impact | Solution |

| Data Privacy Conflicts | Clash between FATF and GDPR-style laws | End-to-end encryption, zero-knowledge proofs |

| Interoperability Gaps | VASPs using different Travel Rule protocols | Hybrid IVMS101/TRISA integration |

| High Development Costs | Complex compliance stack | Adopt open-source reference frameworks |

| User Resistance | Fear of privacy loss | Build transparency into onboarding |

| Regulatory Divergence | Varying rules across jurisdictions | Use RegTech dashboards with live rulebook feeds |

Frequently Asked Questions (FAQs)

- What is the FATF Travel Rule for crypto transfers in the UAE?

The FATF Travel Rule requires UAE-licensed Virtual Asset Service Providers (VASPs) to collect and transmit detailed sender and recipient data for cryptocurrency transfers above a certain threshold to ensure traceability and prevent money laundering. - Is Travel Rule compliance mandatory for all UAE crypto exchanges and VASPs?

Yes. Every VASP, crypto exchange, and wallet provider licensed by VARA, ADGM, or the Central Bank of the UAE must comply with the FATF-aligned crypto travel rule UAE framework to maintain operational approval. - Which global standards are used to implement the crypto Travel Rule in the UAE?

Most compliant UAE crypto platforms use IVMS101 for structured data exchange and TRISA for encrypted identity verification to meet FATF and UAE AML/CFT obligations. - Does the UAE Travel Rule apply to personal crypto wallets or peer-to-peer transfers?

No. The crypto travel rule UAE only applies when at least one regulated Virtual Asset Service Provider (VASP) is involved in a transaction, not between private wallets. - How does Travel Rule compliance affect user experience on UAE crypto platforms?

Leading UAE VASPs integrate the Travel Rule into their platforms through seamless KYC and automated verification systems, keeping compliance in the background while ensuring legal safety and smooth onboarding. - What happens if a UAE crypto exchange fails to meet Travel Rule requirements?

Failure to comply with the FATF Travel Rule in the UAE can result in regulatory penalties, license suspension, and restricted access to international liquidity networks. - How does the Travel Rule support Dubai’s reputation as a regulated crypto hub?

By enforcing the crypto travel rule UAE, regulators such as VARA and ADGM strengthen investor protection, transparency, and global trust in Dubai’s growing Web3 and blockchain ecosystem.

Final Thoughts

The crypto travel rule UAE regime reflects the country’s evolution into a digitally compliant and globally trusted jurisdiction.

By uniting FATF principles, UAE law, and technological innovation, the system achieves a balance between transparency and user privacy.

For developers and exchanges, compliance is not merely regulatory — it is a competitive advantage that strengthens reputation, investor confidence, and cross-border interoperability.

Websima’s Role in VASP Compliance Innovation

At Websima, we help VASPs design and deploy Travel Rule-compliant infrastructures tailored to UAE regulations.

Our expertise includes:

- IVMS101/TRISA interoperability layers,

- Smart-contract-based KYC and auditing,

- Automated AML/CFT dashboards,

- Integration with VARA, ADGM, and Central Bank rulebooks.

If your project requires regulatory alignment without sacrificing UX, contact Websima — and let’s build the future of compliant crypto together.