Table of Contents

- Introduction: The Digital Evolution of Islamic Finance

- Fundamentals: What Are Sukuk and How Tokenization Works

- Why Tokenized Sukuk Are Transforming Islamic Capital Markets

- Shariah & Regulatory Foundations in the UAE

- Structural Design: How Tokenized Sukuk Work Technically

- Integrating Tokenized Sukuk with Islamic DeFi

- Major Stakeholders and Pilot Programs in Dubai

- Risks, Governance, and Market Readiness

- Case Study: Blockchain Sukuk Pilot in DIFC

- Long-Term Outlook: 2025–2030 and Beyond

- Frequently Asked Questions (FAQs)

- Final Thoughts

- Websima Insight

Introduction: The Digital Evolution of Islamic Finance

Islamic finance has always been built around trust, tangible assets, and ethical allocation of wealth. Now, blockchain and smart contracts are enabling these values to take digital form.

Dubai, already ranked among the world’s top Sukuk-issuing centers, is now extending this dominance into the blockchain era. Tokenized Sukuk—digitally represented, Shariah-compliant investment certificates—offer global investors the ability to participate in real assets through transparent, compliant, and efficient instruments.

UAE Just Opened the RWA Floodgates!

Dubai has officially approved the FIRST-EVER tokenized money market fund — a historic milestone for real-world assets.

RWAs are now fully legal and tradable on-chain in Dubai. pic.twitter.com/Kd3P4dMxOj

— Coin Bureau (@coinbureau) July 8, 2025

Unlike traditional Sukuk, where issuance and settlement can take weeks, tokenized structures allow instant, blockchain-based verification and distribution. Dubai’s Virtual Assets Regulatory Authority (VARA) and Dubai Financial Services Authority (DFSA) have created the legal clarity necessary for this transformation, while the Higher Shari’ah Authority (HSA) under the Central Bank of the UAE ensures faith-based integrity throughout.

Fundamentals: What Are Sukuk and How Tokenization Works

A Sukuk is a Shariah-compliant financing instrument that represents undivided ownership in an asset or project. It pays profits derived from the performance of that asset—through rent, sales, or joint ventures—rather than interest, which is prohibited under Islamic law.

Common Sukuk Structures:

- Ijara: lease-based Sukuk where income is generated from rental payments.

- Mudaraba: profit-sharing partnership where one party provides capital and the other expertise.

- Musharaka: equity-based joint venture model.

- Murabaha: cost-plus sale arrangement ensuring transparency.

Tokenization, meanwhile, converts these ownership rights into digital tokens recorded on a blockchain. Each token corresponds to a fraction of the underlying Sukuk asset. Transactions—issuance, transfer, and profit distribution—are executed via smart contracts.

The process removes intermediaries, reduces friction, and enhances transparency—while maintaining Shariah compliance.

Why Tokenized Sukuk Are Transforming Islamic Capital Markets

According to Fitch Ratings’ Global Sukuk Outlook Dashboard 2025, global Sukuk issuance reached USD 205 billion in 2024, with the GCC region—especially the UAE—leading in innovation and secondary-market appetite.

Traditional Sukuk markets face challenges such as limited liquidity, high issuance costs, and complex legal structuring. Tokenization mitigates these by:

Lowering Entry Barriers

Tokenized Sukuk can be issued in smaller denominations, allowing retail investors to participate in high-value projects like real estate or renewable infrastructure with as little as USD 100.

Streamlining Distribution

Smart contracts automatically distribute profits and redemptions to investors’ digital wallets—removing manual reconciliation.

Creating Secondary Liquidity

Blockchain-based trading venues allow compliant peer-to-peer transfers, giving Sukuk a tradable after-market similar to conventional bonds but without breaching Shariah principles.

Enabling Global Access

Investors from Indonesia, Malaysia, or Europe can invest in Dubai’s Sukuk directly using licensed digital-asset gateways, broadening Islamic capital inclusion.

Shariah & Regulatory Foundations in the UAE

Dubai’s regulatory ecosystem is uniquely positioned to bridge Islamic finance with blockchain innovation. Each authority contributes to a comprehensive compliance landscape:

- Higher Shari’ah Authority (HSA) – Sets nationwide standards for Islamic banking and finance, ensuring all tokenized structures align with Shariah (CBUAE HSA official page).

- Virtual Assets Regulatory Authority (VARA) – Issues and enforces activity-based licenses for token issuance, custody, and trading through its Rulebooks Portal.

- Dubai Financial Services Authority (DFSA) – Supervises securities, Sukuk, and crypto-tokens within DIFC’s legal environment under the Crypto Token Rulebook.

- DIFC Innovation Hub – Provides regulatory sandboxes and capital-raising support for fintechs building tokenized Sukuk systems (DIFC Innovation Hub).

Together, they ensure that innovation remains firmly within Dubai’s ethical and legal framework, balancing blockchain speed with religious authenticity.

Structural Design: How Tokenized Sukuk Work Technically

The architecture of a tokenized Sukuk blends Shariah-compliant finance with Web3 infrastructure:

- Asset Selection: The underlying project must be tangible and halal—commonly real estate, energy, or infrastructure.

- SPV Formation: A Special Purpose Vehicle (SPV) established in DIFC or ADGM holds legal title to the asset.

- Token Issuance: The SPV issues blockchain tokens, each representing fractional ownership.

- Smart-Contract Layer: Automates distribution of rental or profit income, KYC verification, and redemption schedules.

- Custody & Compliance: VARA-licensed custodians secure investor assets.

- Trading & Settlement: DFSA-regulated digital marketplaces enable compliant liquidity and secondary trades.

This process transforms Sukuk from static certificates into programmable, liquid instruments—opening a global Islamic capital network accessible 24/7.

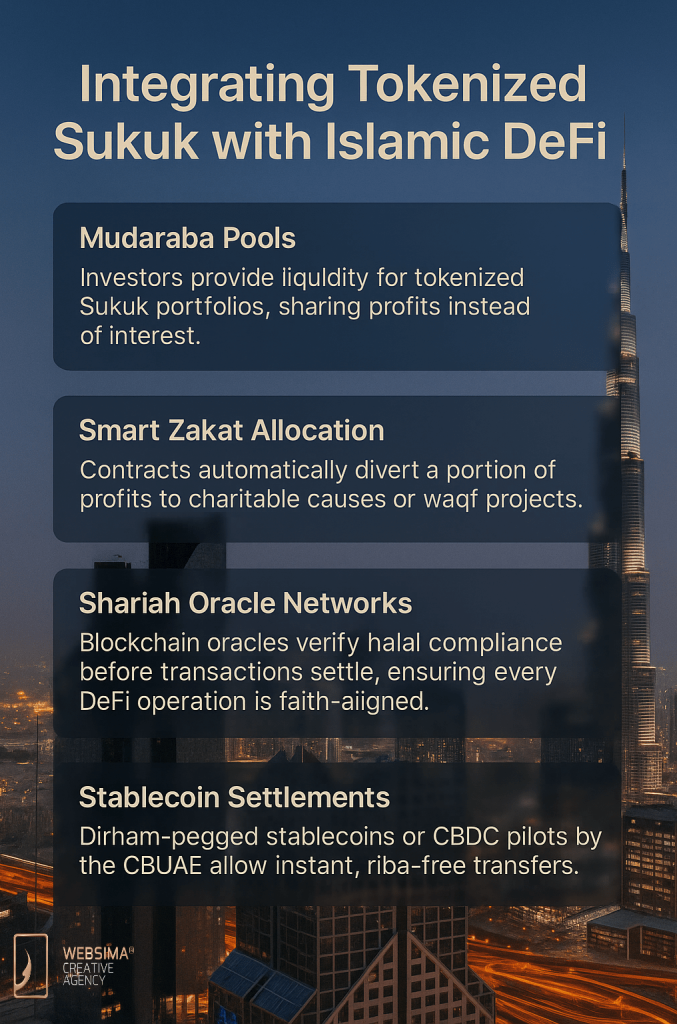

Integrating Tokenized Sukuk with Islamic DeFi

Dubai’s ecosystem is pioneering Shariah-compliant DeFi protocols to enhance liquidity and accessibility. These integrate with tokenized Sukuk platforms to form decentralized yet ethical financial systems.

Examples of Integration

- Mudaraba Pools: Investors provide liquidity for tokenized Sukuk portfolios, sharing profits instead of interest.

- Smart Zakat Allocation: Contracts automatically divert a portion of profits to charitable causes or waqf projects.

- Shariah Oracle Networks: Blockchain oracles verify halal compliance before transactions settle, ensuring every DeFi operation is faith-aligned.

- Stablecoin Settlements: Dirham-pegged stablecoins or CBDC pilots by the CBUAE allow instant, riba-free transfers.

This hybrid model blends Dubai’s DeFi innovation with the principles of Islamic jurisprudence—creating a new digital Islamic finance paradigm.

Major Stakeholders and Pilot Programs in Dubai

Several financial institutions and fintechs are developing tokenized sukuk Dubai projects:

- Dubai Islamic Bank (DIB): Integrating blockchain into Sukuk lifecycle management and investor reporting.

- IsDB Blockchain Lab: Testing blockchain-based Sukuk for infrastructure and renewable energy across OIC nations.

- Emirates Islamic Bank: Exploring token issuance for SME financing aligned with Musharaka principles.

- DIFC Sandbox Projects: Startups like Fasset and SRX Global are building DeFi-ready Sukuk issuance modules for cross-border investors.

- ADGM Digital Lab: Supporting interoperability for Islamic securities tokenization under common legal standards.

These pilots confirm that Dubai’s Islamic-finance sector is transitioning from theoretical innovation to regulated market implementation.

Risks, Governance, and Market Readiness

Despite rapid growth, challenges remain before tokenized Sukuk achieve full-scale adoption:

Regulatory Coordination

Overlap between DFSA, VARA, and CBUAE mandates can create compliance uncertainty. Ongoing alignment is key to seamless market function.

Shariah Divergence

Interpretations may differ between global scholars—particularly around DeFi profit models or secondary Sukuk trading. Standardization from the HSA is essential.

Technology & Cybersecurity

Custody breaches or smart-contract vulnerabilities could undermine investor trust. Certified audits are critical.

Market Liquidity

Early-stage adoption means limited trading depth. VARA-regulated exchanges must attract consistent market makers.

Education Gap

Investors and institutions need training in tokenized finance and blockchain compliance frameworks.

Case Study: Blockchain Sukuk Pilot in DIFC

A DIFC-licensed fintech structured a USD 50 million Ijara Sukuk for a solar-energy asset in Ras Al Khaimah in 2024.

Technical Highlights

- Each token represented a USD 1,000 Sukuk unit.

- On-chain verification replaced paper-based subscription processes.

- Profit distributions were settled in an AED-pegged stablecoin through VARA-compliant custody.

- Shariah compliance was continuously monitored by accredited scholars using real-time blockchain dashboards.

Outcomes

- Issuance and settlement time reduced from 3 weeks to 72 hours.

- Operational cost savings of ~35%.

- 40% increase in investor participation from GCC and Southeast Asia.

This project demonstrated how blockchain-driven Sukuk issuance could uphold Islamic values while dramatically improving efficiency and transparency.

Long-Term Outlook: 2025–2030 and Beyond

By 2030, tokenized Islamic assets could exceed USD 500 billion, according to Dubai-based fintech projections. Key trends shaping the next phase include:

- Regulated retail access: VARA-licensed marketplaces offering small-scale Sukuk to individual investors.

- Cross-border interoperability: Smart contracts connecting Dubai with Malaysia’s Labuan IBFC and Saudi Arabia’s Fintech Saudi.

- AI-driven Shariah validation: Machine-learning tools auditing transactions for compliance automatically.

- Green Sukuk on-chain: Financing solar, wind, and ESG projects aligned with the Dubai Clean Energy Strategy 2050.

- CBDC Settlement: The CBUAE’s digital dirham enables atomic settlement for Islamic securities.

Dubai’s integration of digital-asset governance, blockchain technology, and Islamic finance ethics positions it as the global capital of tokenized Sukuk and Islamic DeFi.

Frequently Asked Questions (FAQs)

What are tokenized Sukuk in Dubai?

They are blockchain-based versions of Shariah-compliant Sukuk certificates representing fractional ownership in halal assets.

Who regulates tokenized Sukuk in Dubai?

Issuances fall under DFSA and VARA, while Shariah compliance is governed by the Higher Shari’ah Authority of the CBUAE.

Are tokenized Sukuk legally recognized?

Yes. The DFSA’s Crypto Token Rulebook and VARA’s Rulebooks Portal outline tokenization and compliance requirements.

Can investors trade tokenized Sukuk like crypto?

They can be traded on licensed exchanges under VARA oversight, provided the assets remain fully backed and compliant with Shariah.

How is Shariah compliance maintained?

Through pre-issuance reviews and ongoing monitoring by certified scholars under the HSA, supported by blockchain audit trails.

Which institutions are driving tokenized Sukuk innovation?

Dubai Islamic Bank, DIFC Innovation Hub startups, Emirates Islamic, and the IsDB Blockchain Lab are all developing pilots.

Final Thoughts

Tokenized sukuk Dubai are more than digital certificates—they symbolize the fusion of faith and technology. By embedding Islamic finance within blockchain infrastructure, Dubai is reinforcing its vision as the global leader in ethical digital finance.

This evolution ensures Shariah integrity is not compromised but enhanced through traceability, automation, and inclusivity. The emirate’s combination of legal precision, fintech maturity, and faith-aligned governance is redefining what Islamic finance looks like in the Web3 age.

Websima Insight

At Websima, we design, audit, and deploy tokenized finance ecosystems that align blockchain innovation with Shariah governance. Our expertise includes:

- Tokenized Sukuk platform architecture

- Smart-contract programming for Islamic finance

- DFSA and VARA licensing consultation

- Legal structuring under DIFC and ADGM jurisdictions

- Integration with stablecoin or CBDC settlement systems

As Dubai leads the world in blockchain-enabled Islamic finance, Websima empowers innovators, banks, and startups to stay compliant, scalable, and secure.

Connect with our experts: https://websima.ae/contactus/

Let’s build the next generation of Islamic DeFi ecosystems—where Shariah principles meet decentralized innovation.