Table of Contents

- Introduction

- Why Fiat–Crypto Infrastructure Matters in the UAE

- Understanding On-Ramps & Off-Ramps

- Infrastructure Models for Building Smooth Flows

- Case Studies from Global and UAE Context

- Regulatory Landscape in the UAE

- Mistakes to Avoid in Designing On-/Off-Ramp Solutions

- Risks & Challenges for Crypto Onramps UAE

- Outlook 2025–2030

- Final Thoughts

- FAQs

- Partner with Websima

Introduction

As Dubai cements its role as a global Web3 hub, the ability to move seamlessly between fiat currency and crypto assets is crucial. A compliant, user-friendly crypto onramp UAE solution allows retail users, investors, and enterprises to convert AED into tokens—and back again—without friction.

Crypto onramps are essentially the bridges that connect traditional finance to digital assets. Without them, blockchain ecosystems remain siloed—powerful but inaccessible. For the UAE, where expats make up over 85% of the population and remittances exceed USD 47 billion annually, the ability to easily and legally move money into and out of digital assets is not just a convenience—it’s a necessity.

Globally, many users encounter roadblocks when trying to link bank accounts or credit cards to crypto apps. The UAE aims to position itself differently: by enabling licensed, compliant, and institutionally trusted ramps, it can attract both retail adoption and institutional inflows.

Who’s excited for decentralized P2P fiat on-ramps and off-ramps to Cardano? pic.twitter.com/MvSLGvwhcn

— Mynth (@_mynth_) January 13, 2024

The Dubai Land Department’s tokenization pilot (Dubai Land Department) demonstrates how government-led initiatives are laying the foundation for fiat–crypto integration across sectors, from property to finance.

Why Fiat–Crypto Infrastructure Matters in the UAE

There are several reasons why seamless on-/off-ramps are critical to the UAE’s digital asset ambitions:

- High adoption potential – The UAE ranks among the top MENA countries in crypto adoption. According to industry estimates, nearly one in five residents has exposure to digital assets, making user-friendly onramps a national priority.

- Remittance flows – With expats sending billions abroad annually, the UAE has a natural demand for low-cost, fast crypto remittances dApps for Indians and Pakistanies. A secure on-/off-ramp system reduces reliance on expensive intermediaries.

- Institutional trust – For family offices, funds, and asset managers, a reliable crypto onramp UAE builds credibility, enabling broader exposure to tokenized assets.

- Government oversight – VARA, CBUAE, DIFC, and ADGM frameworks ensure any infrastructure is compliant, instilling confidence in both retail and corporate users.

A PwC report on the UAE’s virtual assets market highlights that regulatory clarity is the single biggest driver of institutional adoption in the Emirates.

Understanding On-Ramps & Off-Ramps

What is an On-Ramp?

An on-ramp allows users to convert fiat (AED, USD, EUR) into crypto assets. This can happen via:

- Direct bank transfers

- Credit or debit card purchases

- Licensed exchanges offering AED trading pairs

What is an Off-Ramp?

An off-ramp enables users to cash out crypto back into fiat. This is essential for:

- Withdrawals to UAE bank accounts

- Remittance transfers abroad

- Spending crypto gains in real-world commerce

The key lies in compliance. Both on- and off-ramps must follow UAE’s strict AML/KYC standards, ensuring platforms filter out illicit transactions.

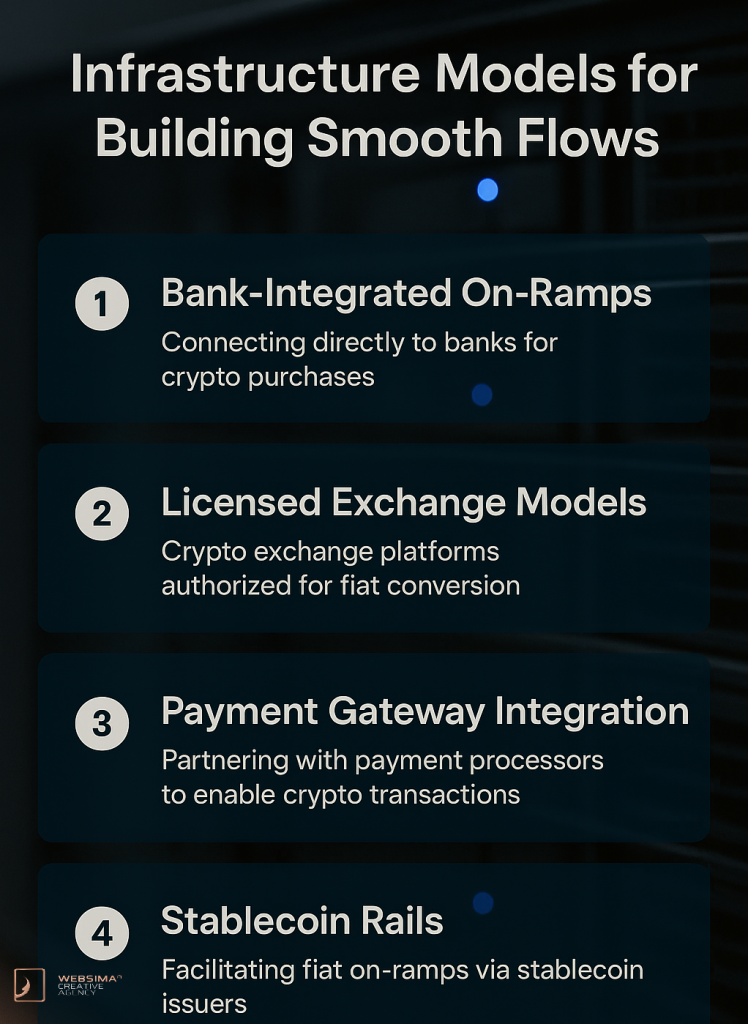

Infrastructure Models for Building Smooth Flows

1. Bank-Integrated On-Ramps

- How it works: Partnerships with local banks allow direct fiat-to-crypto deposits.

- Benefits: Fast, trusted, and familiar for UAE residents.

- Challenges: Banks remain cautious; integration requires deep compliance alignment.

2. Licensed Exchange Models

- How it works: Users convert AED to crypto through VARA-licensed exchanges.

- Benefits: Secure, regulated, and often integrated with wallets/custody solutions.

- Challenges: Liquidity can be limited; regulatory approval processes are lengthy.

3. Payment Gateway Integration

- How it works: Users buy crypto with credit/debit cards through licensed gateways.

- Benefits: Easy for retail users; supports impulse adoption.

- Challenges: Higher fees; fraud risk if not tightly controlled.

4. Stablecoin Rails

- How it works: AED-backed stablecoins function as bridges between banks and crypto.

- Benefits: Fast, low-cost, programmable.

- Challenges: Regulatory and banking support needed for scale.

- Regulation: This aligns with the CBUAE’s Payment Token Services Regulation (2024), which governs issuance and conversion of digital payment tokens (Central Bank of the UAE Rulebook).

Case Studies from Global and UAE Context

Globally, the smoothest ramps combine regulatory trust with user experience:

- Coinbase: Deep banking integrations in the US.

- Kraken: Institutional focus, with global fiat pairs.

- Singapore: MAS-approved gateways, including stablecoin pilots.

In the UAE:

- BitOasis: Among the earliest licensed platforms, but faced challenges with banking partnerships.

- Rain Exchange: Licensed in Bahrain, serving UAE users with AED pairs.

- Binance MENA: Piloted AED onramps under close oversight.

As Support Legal observes, compliance is no longer optional—it’s the core differentiator between scalable onramps and failing platforms.

Regulatory Landscape in the UAE

The UAE has built a multi-tier regulatory structure to govern crypto:

- VARA (Dubai) – Oversees licensing for exchanges, brokers, and custodians.

- CBUAE – Regulates payment tokens and stablecoins.

- DIFC & ADGM – Offer innovation sandboxes and attract fintech startups.

Importantly, the UAE’s removal from the FATF grey list in 2024 boosted its reputation, signaling stronger AML/CFT oversight and opening the door to greater institutional flows.

Hacken highlights that VARA’s rules are globally recognized as among the most advanced, giving exchanges and wallet providers clear pathways to compliance.

Mistakes to Avoid in Designing On-/Off-Ramp Solutions

- Overlooking compliance – Failing to secure VARA/CBUAE licenses risks suspension.

- Poor UX – Complicated onboarding drives users to unlicensed alternatives.

- Underestimating liquidity – Platforms must maintain reserves for heavy withdrawal cycles.

- Fraud oversight – Weak fraud prevention can damage trust.

- Overcomplicating KYC – Too many steps discourage mainstream adoption.

Risks & Challenges for Crypto Onramps UAE

- Regulatory drift: FATF/OECD changes could force new compliance layers.

- Banking hesitation: Not all UAE banks are ready to embrace crypto fully.

- Cybersecurity: Hacks and API vulnerabilities remain high-risk.

- Liquidity pressure: High redemptions can strain fiat reserves.

- Reputation risk: Failures by unlicensed providers could hurt overall trust.

Outlook 2025–2030

Looking forward:

- Mainstream adoption: Expect integration into fintech super-apps (Careem Pay, e& Money).

- AED stablecoin: Likely to become the backbone of UAE ramps.

- Cross-border corridors: UAE–India corridor digitization could channel billions via crypto.

- Institutional grade ramps: Family offices and funds will demand bank-like rails.

The UAE is also participating in CBDC pilots such as Project mBridge with Hong Kong and China, signaling its intent to pioneer cross-border tokenized settlements.

Final Thoughts

Building a compliant and user-friendly crypto onramp UAE is not just a technical challenge—it is about trust, regulation, and user experience.

The UAE has already proven its commitment with real estate tokenization and stablecoin regulations, showing that it understands the importance of bridging traditional and digital economies. For businesses, the winners will be those that prioritize compliance, liquidity management, and intuitive user design.

For Dubai, this isn’t just about smoother user experiences—it’s about cementing its status as a regional and global settlement hub, where fiat, stable coins and crypto flows meet seamlessly under one of the world’s most advanced regulatory regimes.

FAQs

- What is a crypto onramp UAE?

It’s a service allowing UAE users to convert AED into crypto tokens via exchanges, gateways, or bank transfers. - Is it legal to buy crypto with AED?

Yes, but only through platforms licensed under VARA, CBUAE, DIFC, or ADGM. - What is the safest way to cash out crypto in Dubai?

Using regulated off-ramps integrated with UAE banks. - Do UAE banks support crypto directly?

Partnerships exist, but widespread support is still evolving. - What risks exist in crypto on-/off-ramps?

Regulatory changes, liquidity crunches, and cybersecurity vulnerabilities.

Partner with Websima

At Websima, we specialize in crypto, blockchain, and Web3 infrastructure development in Dubai. From fiat–crypto onramp design to smart contract programming, our team builds compliant, scalable, and user-centric solutions that align with VARA and CBUAE regulations.

If you’re exploring how to design or integrate crypto onramp UAE systems for your business, we can help map the full journey—from compliance to deployment.

Ready to build the next generation of crypto–fiat flows in the UAE? Contact Websima today to get started.