Crypto Tax, IFRS Treatment & Bookkeeping for UAE Web3 Firms

Table of Contents

- Introduction: Why Web3 Accounting Matters in the UAE

- Regulatory Context for Crypto and Accounting in Dubai

- VARA, DIFC, ADGM, and CBUAE frameworks

- Alignment with global standards

- IFRS Treatment of Crypto Assets in UAE Accounting

- IFRS guidance for intangible assets and inventory

- Fair value vs. cost models

- Stablecoins, NFTs, and DeFi tokens

- Taxation of Crypto and Web3 Income in the UAE

- Corporate tax implications

- VAT treatment for tokens

- Cross-border transactions and reporting

- Bookkeeping Challenges for Web3 Startups

- Multi-chain wallets and reconciliations

- Stablecoin and fiat conversion tracking

- Payroll in tokens

- Case Study: Token Treasury Accounting for a Dubai Web3 Firm

- Fees and Costs of Professional Web3 Accounting Services

- Risks and Challenges in UAE Web3 Accounting

- Regulatory drift

- Audit gaps

- Technology risk

- Common Mistakes Web3 Startups Make in UAE Accounting

- Outlook for Web3 Accounting in the UAE (2025–2030)

- Final Thoughts

- Frequently Asked Questions (FAQs)

- Partner with Websima for Web3 Accounting Excellence

Introduction: Why Web3 Accounting Matters in the UAE

As Web3 firms scale in Dubai and Abu Dhabi, accounting and compliance become as important as tokenomics and growth. While many startups focus on raising capital and building dApps, gaps in crypto tax treatment, IFRS frameworks, and bookkeeping standards can create real risks with regulators, investors, and banks.

Partnering with @Ignyte_AE and @DIFC to open Web3 opportunities across the UAE.

We’re providing startups with what they need most: education, mentorship from industry leaders, and practical tools to build.

Excited to see what this community creates. pic.twitter.com/Z3yGd1Iydn

— Richard Teng (@_RichardTeng) October 1, 2025

This article explores how Web3 accounting UAE practices are evolving, highlighting IFRS treatment, tax obligations, and treasury management for blockchain-based businesses.

Regulatory Context for Crypto and Accounting in Dubai

VARA, DIFC, ADGM, and CBUAE Frameworks

- Dubai VARA oversees virtual assets, exchanges, and token issuance.

- DIFC and ADGM apply IFRS-based financial reporting rules, ensuring crypto assets are aligned with international standards.

- CBUAE regulates stablecoins under its 2024 Payment Token Services Regulation.

Alignment with Global Standards

The UAE’s approach mirrors OECD and FATF guidelines, ensuring that bookkeeping practices for Web3 firms align with international reporting expectations. This helps Web3 startups strengthen banking relationships and investor confidence.

IFRS Treatment of Crypto Assets in UAE Accounting

IFRS Guidance for Intangible Assets and Inventory

The IFRS Interpretations Committee (IFRIC) clarified in its 2019 agenda decision that cryptocurrencies are generally treated as intangible assets under IAS 38, unless held for sale in the ordinary course of business, in which case IAS 2 (Inventory) may apply.

Fair Value vs. Cost Models

- Cost Model: Carry assets at cost minus impairment.

- Revaluation (Fair Value) Model: Allowed if active markets exist — highly relevant for BTC, ETH, and widely traded tokens.

EY guidance highlights that most Web3 firms in the UAE prefer fair value accounting, as it better reflects token volatility and satisfies investor reporting needs.

Stablecoins, NFTs, and DeFi Tokens

- Stablecoins: Sometimes treated as cash equivalents if redemption rights are enforceable.

- NFTs: Classified as intangibles; revenue recognition depends on usage.

- Governance tokens: May require careful analysis between equity vs. liability classification.

Taxation of Crypto and Web3 Income in the UAE

Corporate Tax Implications

The UAE introduced a 9% corporate tax on business profits exceeding AED 375,000. For Web3 firms, trading gains, DeFi yields, and NFT revenues may all fall under taxable business income.

VAT Treatment for Tokens

In 2023, the UAE clarified VAT rules, with certain crypto transfers and conversions exempt from VAT (Cointelegraph). Utility tokens may still attract VAT, while security tokens are typically exempt.

Cross-Border Transactions and Reporting

International token transfers can trigger reporting obligations under AML/CFT regulations. Bookkeeping must document every transaction to protect firms’ reputations and banking access.

(PwC Global Crypto Tax Report 2024)

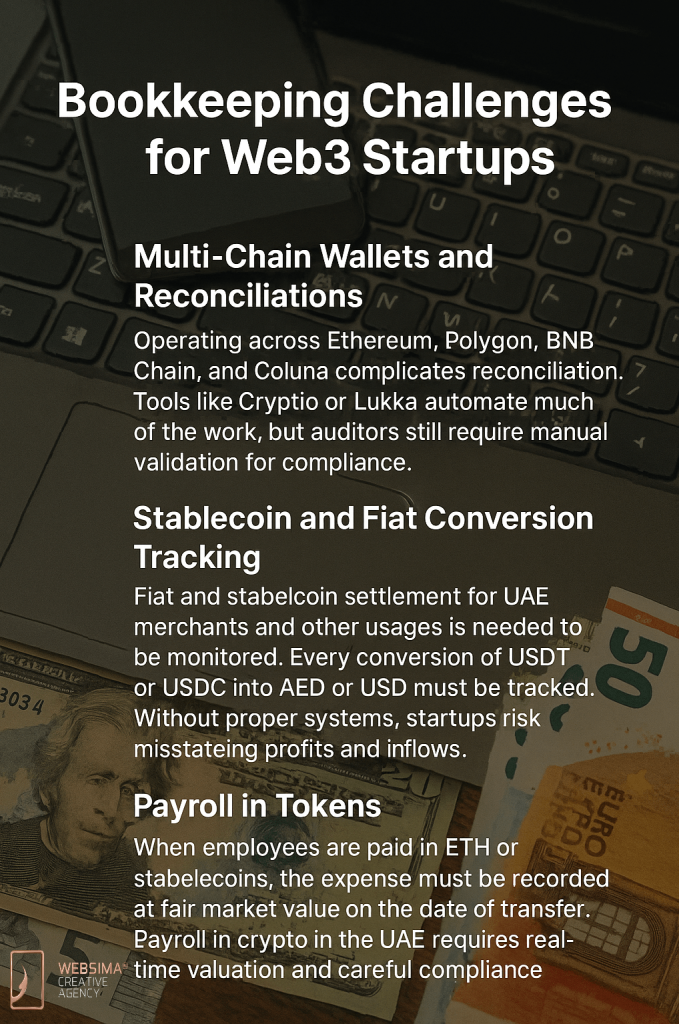

Bookkeeping Challenges for Web3 Startups

Multi-Chain Wallets and Reconciliations

Operating across Ethereum, Polygon, BNB Chain, and Solana complicates reconciliation. Tools like Cryptio or Lukka automate much of the work, but auditors still require manual validation for compliance.

Stablecoin and Fiat Conversion Tracking

Fiat and stablecoin settlement for UAE merchants and other usages is needed to be monitored. Every conversion of USDT or USDC into AED or USD must be tracked. Without proper systems, startups risk misstating profits and inflows.

Payroll in Tokens

When employees are paid in ETH or stablecoins, the expense must be recorded at fair market value on the date of transfer. Payroll in crypto in the UAE requires real-time valuation and careful compliance with UAE labor law.

Case Study: Token Treasury Accounting for a Dubai Web3 Firm

A Dubai DeFi startup raised $10 million USDT in seed funding:

- 50% allocated to stablecoin yield farming

- 30% into ETH reserves

- 20% into liquidity provisioning

Accounting treatment:

- USDT = cash equivalent

- ETH = intangible asset

- LP tokens = financial instruments

Monthly reconciliations included mark-to-market adjustments for ETH and LP tokens. This framework enabled the startup to pass a Big Four audit and secure Series A investment — showing how disciplined accounting directly supports fundraising.

Fees and Costs of Professional Web3 Accounting Services

- Startup bookkeeping packages: $1,500–$3,000 per month

- IFRS audits for token treasuries: $20,000–$50,000

- VAT advisory for token models: $5,000–$10,000

(PwC UAE Doing Business Guide)

While fees may appear high, they protect access to banking, licensing, and future VC rounds.

Risks and Challenges in UAE Web3 Accounting

- Regulatory Drift: Rules are evolving, and firms risk falling out of compliance if frameworks are not updated.

- Audit Gaps: Not all auditors understand token accounting, creating delays in fundraising and compliance.

- Technology Risk: Hacks and poor custody solutions can undermine accounting integrity, especially if records are not backed up securely.

Common Mistakes Web3 Startups Make in UAE Accounting

- Treating crypto as “off-balance sheet.”

- Ignoring VAT on token services.

- Mixing founders’ personal wallets with company accounts.

- Failing to record gas fees and transaction costs as business expenses.

- Assuming the UAE’s low-tax reputation means no reporting obligations.

Outlook for Web3 Accounting in the UAE (2025–2030)

- Institutional Adoption: DIFC and ADGM banks will require audited token treasuries.

- Integration with Tokenization: Real estate, sukuk, and RWAs will blur traditional vs. crypto reporting.

- AI-driven Bookkeeping: Smart reconciliation tools will automate entries and reduce manual work.

The next five years will see web3 accounting UAE move from niche to mainstream. Firms that prepare early will raise funds more easily and scale faster.

Final Thoughts

For Web3 firms in Dubai, accounting excellence is both a compliance necessity and a competitive advantage. With IFRS treatment evolving and tax rules tightening, startups must align bookkeeping with international standards if they want sustainable growth.

Robust frameworks for crypto tax, token treasury audits, and IFRS reporting are no longer optional. They are investor trust signals. By mastering web3 accounting UAE, founders can secure banking relationships, satisfy regulators, and stand out in a fast-growing digital economy.

Frequently Asked Questions (FAQs)

- Do UAE firms pay tax on crypto gains?

Yes. Under the 9% corporate tax, trading gains and token income may be taxable for businesses. - Can crypto be treated as cash in accounting?

Generally no, except for some stablecoins with enforceable redemption rights. Most tokens are intangible assets. - Are NFTs taxed in the UAE?

Yes, NFT sales can trigger corporate tax and sometimes VAT depending on the nature of the transaction. - Do auditors in Dubai understand Web3?

Big Four firms (EY, PwC, Deloitte, KPMG) have dedicated Web3 teams, though smaller firms may lack depth. - Can payroll in tokens be legal in Dubai?

Yes, but wages must be recorded at fair market value, and firms must comply with UAE labor laws.

Partner with Websima for Web3 Accounting Excellence

At Websima, we help Web3 startups and established firms navigate the complexities of web3 accounting UAE. From IFRS-compliant bookkeeping to token treasury audits and VAT advisory, we bridge the gap between blockchain innovation and financial compliance.

With Dubai positioning itself as a global hub for digital assets, your accounting framework must keep pace with international standards and local regulations.

Let’s future-proof your startup’s financials. Contact Websima today to discuss how we can support your growth.