Table of contents

- Why this matters now

- Green sukuk 101 (and how tokenization helps)

- What MRV means in practice (and why investors care)

- Policy & market context in the UAE

- A reference architecture: green sukuk on-chain with dMRV

- Data model & KPIs for impact reporting

- Verification & assurance: aligning Shariah and sustainability

- Case study: rooftop solar sukuk with smart-meter MRV

- Issuance & operating costs (what to budget for)

- Risks, pitfalls, and how to mitigate them

- Data integrity risk

- Greenwashing & disclosure risk

- Oracle/bridge risk

- Regulatory drift

- Carbon-market controversy

- Outlook 2025–2030

- More labeled issuance

- dMRV by default

- Performance-linked features

- Regional harmonization

- FAQs

- Work with Websima (CTA)

Introduction

Investors increasingly demand decision-grade impact data rather than marketing claims. On-chain measurement, reporting, and verification (MRV) connects financed assets to investors with cryptographic proof and transparent audit trails. That improves credibility, shortens reporting cycles, and reduces greenwashing risk. For issuers, tokenizing the instrument streamlines registrar/transfer operations, enables smaller denominations with compliant gatekeeping, and elevates the investor experience with real-time metrics.

Demonstration of UAE’s Blockchain based system.♂️

Watch. https://t.co/ghrcmSlF5p pic.twitter.com/3XyTOrfR00

— SMQKE (@SMQKEDQG) March 29, 2025

Green Sukuk 101 (and How Tokenization Helps)

A sukuk represents undivided beneficial interests in assets or projects structured to comply with Shariah (e.g., Ijārah over tangible assets, Wakālah over a managed pool, or Mushārakah partnerships). Green sukuk earmarks proceeds for eligible environmental projects—renewables, energy-efficiency retrofits, green buildings, clean transport, and water reuse—within a documented framework and reporting plan.

Tokenized Sukuk in Dubai keeps the legal structure intact while digitizing lifecycle operations:

- Programmable transfer restrictions (jurisdiction, investor type), lock-ups, and cap-table controls via smart contracts.

- Automated distributions and event management (record dates, coupons, redemptions).

- Impact-aware portals where investors see allocation and performance KPIs pulled from verified MRV oracles.

Result: better transparency and potentially broader distribution without sacrificing Shariah governance or venue compliance.

What MRV Means in Practice (and Why Investors Aare)

MRV answers three investor questions: What did you finance? What did it achieve? Who verified it?

With digital MRV (dMRV), asset telemetry (smart meters, building management systems, telematics) is signed and timestamped, hashed, and referenced on-chain. Calculators apply documented formulas; investors receive comparable, auditable outputs.

- Impact templates that investors recognize: ICMA Impact Reporting Handbook

- Principles for digital MRV integrity and auditability: World Bank – Technical Guidance on Digital MRV

Policy & Market Context in the UAE

The UAE is building a supportive environment for sustainable debt and sukuk—clarifying labeled-issuance expectations, disclosure principles, and the mechanics of impact reporting across venues. ADGM has published supplementary guidance that recognizes green sukuk designations and outlines expectations for sustainable-finance instruments and reporting, offering issuers a clear policy anchor. See: ADGM Sustainable Finance Supplementary Guidance.

Market precedent also signals capacity and investor appetite. A notable early placement was a UAE corporate’s benchmark green sukuk that listed in Dubai and disclosed use-of-proceeds and impact reporting—helping normalize the product with regional and global investors. Reference: Majid Al Futtaim – World’s First Benchmark Corporate Green Sukuk (Press Release).

A Reference Architecture: Green Sukuk On-Chain with dMRV

Roles

- Issuer/SPV: framework design, offering documents, allocation, ongoing disclosure.

- Shariah Supervisory Board (SSB): pre-issuance review and ongoing oversight.

- Trustee/agents: registrar, paying agent, calculation agent coordination.

- Oracle provider: validates MRV inputs, posts KPI summaries on-chain under SLAs.

- Verifier/auditor: pre-issuance opinion/assurance; annual impact verification.

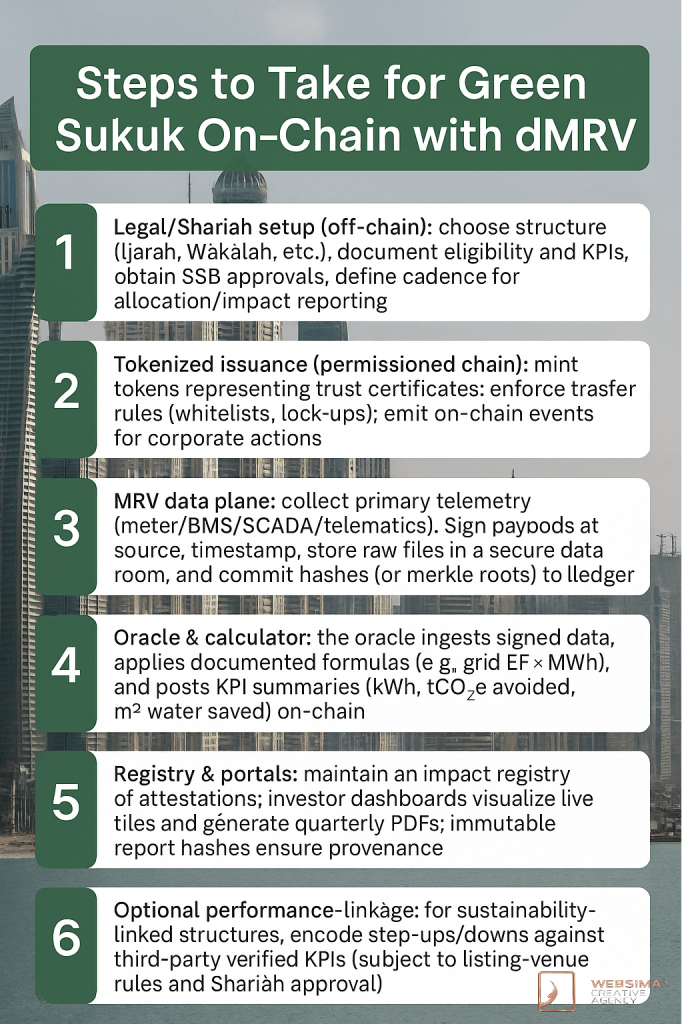

Step-by-step

- Legal/Shariah setup (off-chain): choose structure (Ijārah, Wakālah, etc.), document eligibility and KPIs, obtain SSB approvals, define cadence for allocation/impact reporting.

- Tokenized issuance (permissioned chain): mint tokens representing trust certificates; enforce transfer rules (whitelists, lock-ups); emit on-chain events for corporate actions.

- MRV data plane: collect primary telemetry (meter/BMS/SCADA/telematics). Sign payloads at source, timestamp, store raw files in a secure data room, and commit hashes (or merkle roots) to the ledger.

- Oracle & calculator: the oracle ingests signed data, applies documented formulas (e.g., grid EF × MWh), and posts KPI summaries (kWh, tCO₂e avoided, m³ water saved) on-chain.

- Registry & portals: maintain an impact registry of attestations; investor dashboards visualize live tiles and generate quarterly PDFs; immutable report hashes ensure provenance.

- Optional performance-linkage: for sustainability-linked structures, encode step-ups/downs against third-party verified KPIs (subject to listing-venue rules and Shariah approval).

Identity & compliance

- KYC/KYB and wallet whitelisting; role-based keys for issuer, oracle, verifier.

- Multi-sig for registry updates; event logs for regulator/SSB read-access.

- Parameterized calculators so updated factors (e.g., grid EF) don’t require code rewrites.

Data Model & KPIs for Impact Reporting

Per-asset fields

- Asset ID, GPS, commissioning date, technology/capacity

- Meter IDs, sampling frequency, firmware, authoritative time source

- Baselines and grid emission factor (EF) with source/version

- Allocation ratio from the sukuk (proportional attribution)

KPI examples & sample formula

- Renewables: MWh generated; tCO₂e avoided = MWh × grid EF (tCO₂e/MWh)

- Efficiency retrofits: kWh saved vs. baseline; payback; tCO₂e avoided

- Transport: km electrified; liters of fuel avoided

- Water: m³ saved/reused; energy saved via efficiency

Illustrative calculation: A PV portfolio generates 1,800 MWh in a year. With a conservative EF of 0.40 tCO₂e/MWh, tCO₂e avoided = 1,800 × 0.40 = 720 tCO₂e. If the sukuk financed 60% of capex, pro-rata avoidance is 432 tCO₂e. Store EF sources/versions and show them in report footnotes for auditability.

Cadence

- Quarterly investor factsheets with year-to-date metrics; annual assurance with selective site re-measurement and calculator re-runs.

Verification & Assurance: Aligning Shariah and Sustainability

- Pre-issuance: framework review (use-of-proceeds, eligibility, KPIs), SSB approval, and a second-party opinion (SPO).

- Ongoing: annual allocation/impact assurance; verifier checks data lineage from device → data room → oracle → registry.

- Controls: segregate duties (data operator, oracle provider, issuer); secure time sources; immutable hash references for PDFs/datasets; documented change-logs for methodologies.

Case Study: Rooftop Solar Sukuk with Smart-Meter MRV

A UAE issuer aggregates 500 villa rooftops (average 5 kW each; ~2.5 MWp total). Each site has a bi-directional smart meter. The SPV structures an Ijārah sukuk to finance PV kits and O&M.

On-chain workflow

- Asset onboarding: register each rooftop as an asset NFT with meter IDs, GPS, commissioning dates.

- Data ingestion: meters stream hourly exports/imports; adapters sign and batch payloads; daily merkle roots go on-chain.

- Calculations: the oracle computes MWh and tCO₂e avoided using the documented EF; applies proportional attribution to the sukuk.

- Investor UX: dashboards show cumulative generation, YTD avoidance, and allocation; quarterly PDFs map to ICMA templates; report hashes appear on-chain.

- Assurance: the verifier samples 10% of rooftops, cross-checks meter logs with on-chain hashes, and re-runs calculations on raw files.

Context on local net-metering: DEWA – Shams Dubai.

Issuance & Operating Costs (What to Budget for)

Indicative ranges; venue, size, and service choices matter.

- Shariah governance: SSB setup + ongoing: ~USD 20k–80k equivalent.

- SPO/assurance: pre-issuance opinion + annual impact verification: ~USD 40k–150k.

- Legal & venue: offering docs, trustee/agent, listing/CSD, ESG designation: ~USD 150k–400k+.

- Data stack: MRV adapters, oracle SLAs, dashboards, cybersecurity: ~USD 50k–200k first year, then lower run-rate.

- Operations: O&M, audits, secure data room, pen-tests: variable (size, technology, warranties).

Cost hygiene tips: prioritize data you already collect (smart meters, BMS), keep the on-chain footprint to hashes/summaries, and park detailed files in a secure data room. That preserves auditability while controlling chain/storage costs.

Risks, Pitfalls, and How to Mitigate them

Data integrity risk

Issue: sensor drift, clock errors, or spreadsheet baselines distort KPIs.

Mitigation: redundant meters where feasible, periodic calibration, authoritative time sources, signed payloads at source, and hashing of raw files to lock provenance.

Greenwashing & disclosure risk

Issue: mislabeling eligibility or over-claiming outcomes undermines trust.

Mitigation: conservative baselines, ICMA-aligned templates, independent verification, and transparent change-logs for methodologies.

Oracle/bridge risk

Issue: a single oracle can be a failure point.

Mitigation: multi-sig oracles with quorum thresholds, contractual SLAs, and manual fallback procedures approved by the SSB and trustee.

Regulatory drift

Issue: definitions, labels, and disclosure rules evolve across venues.

Mitigation: annual framework refreshes, board-level reporting, and early dialogue with venue teams; build calculators so EF/version updates are parameter changes, not code rewrites.

Carbon-market controversy

Issue: low-integrity offsets and tokenization controversies can taint investor confidence.

Mitigation: anchor MRV in primary telemetry (smart meters/BMS) or vetted nature-based projects with recognized validation; avoid double-counting via registry checks.

Outlook 2025–2030

More labeled issuance

As frameworks mature and investor demand grows, expect more corporates and public entities to adopt green/sustainable sukuk, drawing on local precedents and clearer venue guidance.

dMRV by default

As dashboards and audit trails become standard, near real-time, signed metrics will move from differentiators to table stakes. Issuers that automate MRV should see faster reporting cycles and potentially tighter spreads over time.

Performance-linked features

Structures may tie coupons to verified KPIs with transparent triggers. That rewards credible impact while maintaining Shariah and venue compliance.

Regional harmonization

UAE/GCC taxonomy alignment will reduce reporting friction, enhance comparability, and broaden the investor base for green sukuk blockchain UAE offerings.

FAQs

What’s the difference between green sukuk and sustainability-linked sukuk?

Green sukuk are use-of-proceeds instruments that finance eligible projects; sustainability-linked sukuk tie economics (e.g., coupons) to achieving KPIs. The same dMRV pipeline can support both.

Is tokenization compatible with Shariah?

Yes. Tokenization digitizes operations; Shariah compliance still depends on the underlying contracts, eligible assets, and SSB approvals.

Which assets are ideal for on-chain MRV?

Assets with native telemetry: solar PV (smart meters/SCADA), energy-efficient buildings (BMS), EV fleets (telematics), and water reuse systems (flow meters).

Can coupons be linked to performance?

Potentially yes, via sustainability-linked structures—provided KPIs are independently verified and venue/Shariah requirements are met.

Work with Websima

Plan and prototype your green sukuk—on-chain, the right way.

Websima provides architecture and advisory around tokenized sukuk and dMRV (digital MRV) data pipelines—covering framework design, technical blueprints, vendor/oracle selection, and investor reporting dashboards.

- We do not arrange, underwrite, list, or broker securities, and we do not provide investment advice.

- When projects require regulated activities, we coordinate with your licensed counsel, trustee/agents, assurance providers, Shariah scholars, and listing venues to ensure compliance.

If you’re exploring green sukuk on blockchain in the UAE, we can help you scope requirements, compare options, and build a POC that aligns with your governance and reporting needs.

→ Start your framework and data stack scoping: Contact Websima Today