Table of Contents

- Introduction

- What Are Chain Analytics and On-Chain Forensics?

- Why Crypto Forensics Matters in the UAE

- How Startups and Exchanges Operationalize Forensics

- Tools Used by Startups and Regulators

- Case Study: Detecting Suspicious Wallet Activity

- Regulatory Drivers in the UAE

- Benefits for Compliance Teams and Startups

- Risks and Challenges in Crypto Forensics

- Common Mistakes to Avoid

- Costs and Resource Considerations

- Future Outlook: AI + Forensics in Web3

- Final Thoughts

- FAQs

- Strengthening Compliance With Websima

Introduction

The operating reality for UAE crypto firms

The UAE has positioned itself as a regulated, innovation-friendly hub for digital assets. That positioning comes with an expectation: demonstrable control over risky flows. Exchanges, brokers, custodians, DeFi teams, token issuers, and TradFi banks touching virtual assets all face the same question from supervisors and partners: Can you see what’s happening on-chain — and can you prove you responded appropriately?

That’s the core purpose of crypto forensics UAE programs: convert raw blockchain data into risk intelligence, case files, and audit-worthy decisions. The best programs don’t just flag issues; they shorten time-to-insight, standardize escalation, and document outcomes that satisfy regulators, banking partners, and internal governance.

NEW: UAE signs OECD’s global Crypto-Asset Reporting Framework (CARF).

➡️ Crypto exchanges & service providers to report detailed user transactions.

➡️ Automatic sharing of crypto tax info with other countries begins by 2027.

➡️ Public consultation open until Nov 8, 2025… pic.twitter.com/LYAF2tQwKN

— Crypto India (@CryptooIndia) September 22, 2025

Why this matters now

- Licensing momentum: Virtual asset regimes in Dubai, ADGM, and DIFC require real transaction monitoring and event-driven escalation — not screenshots after the fact.

- Cross-border exposure: The UAE’s investor base spans dozens of jurisdictions; exposure to sanctioned entities, exploit clusters, and high-risk bridges can surface unpredictably.

- Institutional expectations: Banks and institutional counterparties want forensics-grade controls and repeatable narratives, not one-off assessments.

- Scalability: As product lines expand (spot, OTC, staking, custody, tokenization, NFT, RWA), risk surfaces change. Forensics and analytics are what keep the operating model scalable and defensible.

Who this guide is for

Founders, MLROs, compliance officers for UAE on-chain compliance purposes, investigators, and risk leaders who need a practical playbook: how to design rules, investigate alerts, assemble STR packs, brief boards, and demonstrate effectiveness to regulators — without stalling product or growth.

What Are Chain Analytics and On-Chain Forensics?

Chain analytics translates public ledger data into entities, counterparties, typologies, and risk scores. It answers: Who’s likely behind this wallet? Which clusters has it touched? What typologies are implicated (sanctions, darknet, ransomware, scams, mixers, bridges, stolen funds)?

On-chain forensics is the applied, investigative layer that compliance teams use to reach decisions and create evidence:

- Screen and score wallets before onboarding (KYW).

- Monitor ongoing customer flows against risk rules.

- Trace funds across multiple hops, L2s, and bridges to reconstruct provenance.

- Produce evidence packs (hash paths, graphs, timestamps, analyst conclusion) that hold up in audits or supervisory reviews.

Outcome: repeatable, regulator-grade documentation of what you saw, why you acted, and how you de-risked.

Why Crypto Forensics Matters in the UAE

Licensing expectations and investor trust

Supervisory regimes in Dubai, ADGM, and DIFC don’t just ask whether you have tools — they expect documented monitoring, event-driven escalation, board reporting, and defensible STRs. Investors and banking partners mirror these expectations.

Cross-border exposure and typologies

UAE firms interact with flows across continents, token families, and bridges. That increases the odds of touching sanctions-linked clusters, exploit paths, mixers, or fraud rings. Good analytics narrows uncertainty and cuts false positives.

Reputation, access, and growth

Clear forensic narratives strengthen banking access, correspondent relationships, and institutional deals. Internally, they accelerate approvals because risk owners can rely on consistent, high-quality evidence.

How Startups and Exchanges Operationalize Forensics

Pre-onboarding screening (KYC/KYB + KYW)

- Collect declared wallets from applicants; screen for historical exposure to typologies.

- Score jurisdictions, counterparties, and token types.

- Capture graphs and screenshots; store in the customer record to support later decisions.

Ongoing monitoring & alerting

- Rules for volume spikes, fresh exposure to mixers/bridges, sudden counterparty risk changes, and pattern anomalies.

- Case creation → analyst triage → action (approve, hold, block, offboard, STR).

- Feedback loop: every closed case updates risk models and whitelists.

Escalation, STRs, and board reporting

- Defined SLAs for analyst review and committee escalation.

- If suspicion persists, prepare an STR pack and file via goAML (see FIU link below).

- Summarize trends for board/ExCo: top typologies, time-to-close, repeat counterparties, control changes made.

Control testing and training

- Quarterly control testing (rule precision/recall, case quality).

- Mock investigations and table-top exercises; post-incident reviews with remediation actions.

Tools Used by Startups and Regulators

Chainalysis

Broad data coverage and clustering, strong case management, mature training ecosystem for investigators and MLROs.

TRM Labs

Real-time monitoring, flexible APIs and typology updates, solid DeFi/NFT/bridge visibility for emerging product lines.

Elliptic

Granular policy controls, sanctions/mixer analytics, clear risk scoring and explainability for screening and monitoring.

Crystal

Powerful graph exploration for complex cross-border traces and detailed investigative reconstructions.

How to choose: run a 30-day POC on your own traffic; measure alert precision, median analyst time per case, export quality of evidence packs, API flexibility, and how quickly your team can tune rules without vendor tickets.

Case Study: Detecting Suspicious Wallet Activity

Trigger

A Dubai OTC desk sees a new client funding via an L2. Alerts fire for volume anomalies and upstream exposure to a bridge implicated in a recent exploit.

Investigation

Analysts trace three hops back, correlating timestamps with public incident intel; a portion of funds touches an exploit-linked cluster. EDD is initiated. The client’s source-of-funds narrative doesn’t reconcile with the on-chain path.

Outcome

Funds are held; the client is offboarded; an STR is prepared with path diagrams, hashes, and timestamps and filed via goAML. Controls are updated: new thresholds, fresh typology rules, analyst refresher training.

Why this matters

- Prevented secondary laundering exposure for the VASP.

- Produced a clear narrative that matched regulator expectations.

- Institutional partners (bank, liquidity providers) were reassured by the evidence-first approach.

Regulatory Drivers in the UAE

- Dubai — VARA: Licensing, conduct, and AML/CFT obligations are structured under the Virtual Assets & Related Activities Regulations and activity rulebooks: VARA Rulebook – Regulations & structure.

- Abu Dhabi — ADGM/FSRA: Scope of virtual-asset activities, custody, market integrity, and AML expectations in the latest FSRA guidance: Regulation of Virtual Asset Activities in ADGM (June 2025).

- DIFC — DFSA: Token categories, recognition, conduct, and AML obligations in the Crypto Token regime: DFSA Crypto Token Rulebook (PDF, 2025).

- UAE Central Bank (CBUAE): Risk-based expectations for LFIs interacting with virtual assets and VASPs: Guidance for LFIs on Risks Related to Virtual Assets & VASPs (2023).

- UAE FIU — goAML: How to register/report and file Suspicious Transaction Reports: STR Process & goAML.

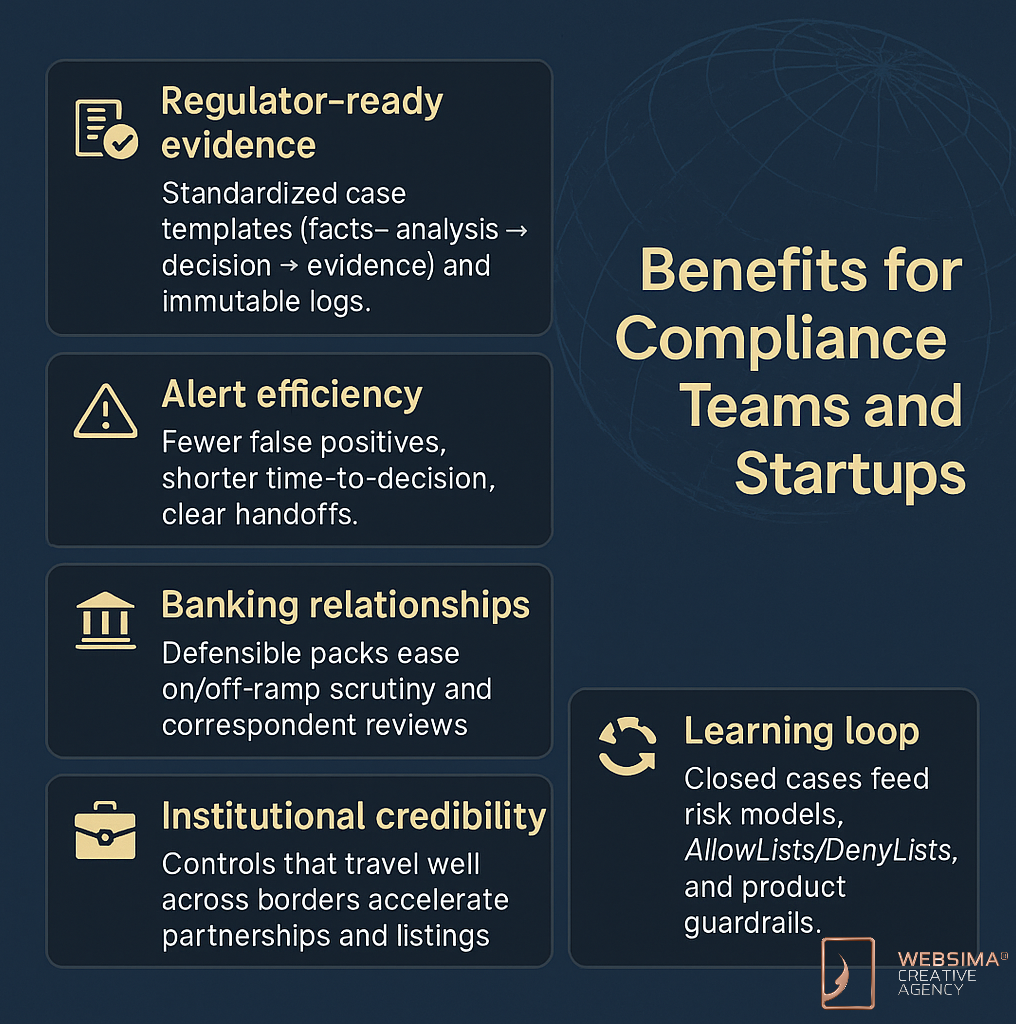

Benefits for Compliance Teams and Startups

- Regulator-ready evidence: Standardized case templates (facts → analysis → decision → evidence) and immutable logs.

- Alert efficiency: Fewer false positives, shorter time-to-decision, clear handoffs.

- Banking relationships: Defensible packs ease on/off-ramp scrutiny and correspondent reviews.

- Institutional credibility: Controls that travel well across borders accelerate partnerships and listings.

- Learning loop: Closed cases feed risk models, allowlists/denylists, and product guardrails.

Risks and Challenges in Crypto Forensics

Alert fatigue and model drift

Start conservative, review weekly, and track precision/recall. Refresh typologies after major incidents; retire stale rules.

Cross-chain obfuscation

Ensure visibility into L2s, bridges, and mixers; treat exploit-linked paths as higher-risk until fully resolved.

Skills and bandwidth

Certify analysts, run mock investigations, and maintain a living playbook with screenshots and examples.

Privacy, access, and record-keeping

Enforce RBAC, MFA, and redaction where appropriate. Keep tamper-evident logs of case activity.

Vendor lock-in and portability

Negotiate export rights and test bulk exports; maintain an internal case index independent of the tool UI.

Common Mistakes to Avoid

- Assuming tools are “set & forget” — governance and board-level reporting are required.

- Over-focusing on sanctions while underweighting fraud/scam typologies.

- Ignoring off-chain context (KYC mismatches, device/IP geos, behavioral signals).

- Weak or ambiguous escalation paths and SLAs.

- Duplicating alerts across systems without a deduplication layer.

Costs and Resource Considerations

Software

Mid-market VASPs often budget $40k–$120k/year across monitoring, investigations, API usage, and data add-ons (volume-dependent).

People

Very rough guide: 1–3 analysts per ~10k active users, plus an MLRO/compliance lead. Complexity (OTC, derivatives, cross-chain activity) raises demand.

Training & certification

Vendor courses, internal workshops, and table-top exercises; aim for shared mental models and consistent write-ups.

Integrations

SIEM/BI connectors, alert webhooks, case-management APIs, and evidence exports. Prioritize “no-code” config for faster rule iteration.

Contingency and time

Monthly rule tuning, quarterly control reviews, and post-incident retros. Budget hours for audits and supervisory requests.

Future Outlook: AI + Forensics in Web3

AI-assisted investigations

Entity resolution, anomaly narratives, and auto-assembled evidence packs will compress case times and improve consistency.

Cross-domain visibility

Supervisory focus will deepen on bridges, L2s, and privacy tooling. Expect policy clarity around cross-chain provenance and MEV/DEX behaviors.

Tokenized RWAs and NFTs

Provenance + KYC overlays will standardize; RWA due diligence will blend on-chain metadata with off-chain attestations.

Collaborative intelligence

Structured, privacy-respecting sharing of wallet risk among VASPs, banks, and regulators will reduce duplicate work and improve early detection.

Final Thoughts

What “good” looks like for UAE teams

A high-performing crypto forensics UAE program is more than a license checkbox. It’s a living control system where rules evolve weekly, analysts write crisp narratives, and leaders see clear metrics (alert precision, time-to-close, STR conversion, repeat counterparties). Evidence is exportable, portable, and reproducible — so supervisory reviews and banking audits become predictable rather than stressful.

Why this creates durable advantage

When your investigations are fast, consistent, and well-documented, everything upstream gets easier: banking, institutional partnerships, listings, and market expansion. Internally, product can move faster because risk knows the guardrails are real — not a PowerPoint aspiration.

The risk of waiting

Delaying investment in analytics and forensics doesn’t just create regulatory risk — it slows growth. Missing a bridge exposure, mishandling an STR, or failing to escalate a pattern can jeopardize banking access and long-term credibility.

The path forward

Start with a 30-day POC on your own traffic. Define 8–12 core rules. Measure precision/recall weekly. Standardize the case template. File your first goAML STR with complete, reproducible evidence if warranted. Then iterate. In the UAE, trust is built through operational discipline, not slogans — and disciplined forensics is the shortest route to trust.

FAQs

What should an STR pack include?

A clear hypothesis, path diagrams with hashes and timestamps, counterparties, screenshots/graphs, and a concise conclusion — filed via the FIU’s goAML portal.

Do we need different tools for L1s and L2s?

Prefer providers that cover major L1s, popular L2s, bridges, and mixers to avoid visibility gaps.

How often should rules be tuned?

Monthly by default; weekly during new typology waves or after significant incidents.

Can banks rely on our forensics evidence?

Yes — reproducible paths and timestamps improve correspondent reviews and onboarding with fiat partners.

Fastest way to start?

Run a 30-day POC; define a small rule set; measure precision/recall; formalize escalation and board reporting.

Strengthening Compliance With Websima

Websima helps UAE startups and enterprises implement crypto-forensics programs that regulators respect and partners trust — without slowing your roadmap. We support:

- Tool selection and 30-day POCs (Chainalysis, TRM, Elliptic, Crystal).

- Rule-set design, alert tuning, and case templates.

- Licensing support across VARA / ADGM / DFSA requirements.

- Integrations with SIEM/BI and case-management systems.

Ready to harden your compliance stack? Talk to Websima.