Introduction

Dubai has established itself as a global hub for blockchain innovation, attracting startups, crypto exchanges, and government-backed pilot projects. But beyond the buzz around exchanges and regulations, one factor is silently driving mainstream adoption: the rise of digital wallets. From remittances to retail payments, Digital Wallet Crypto Dubai adoption is reshaping how everyday residents interact with cryptocurrencies. User-friendly wallets, combined with Dubai’s progressive regulatory stance, are making crypto not only an investment tool but also a functional payment instrument in daily life.

✈️EMIRATES AIRLINES EMBRACES CRYPTO

Emirates Airlines and Dubai Duty Free will soon accept digital assets.

A new MoU with Crypto .com marks a major step for #crypto adoption in global travel. pic.twitter.com/dkqvX4v851

— Coin Bureau (@coinbureau) July 9, 2025

This article explores how digital wallets are driving crypto usage across Dubai, what it means for investors and businesses, and the opportunities ahead.

Table of Contents

- Why Digital Wallets Matter for Crypto Adoption

- The Current Landscape of Digital Wallet Crypto Dubai

- Government and Regulatory Support in the UAE

- How Digital Wallets Simplify Crypto Payments

- Accessibility and ease of use

- Security and compliance features

- Integration with local payment systems

- Consumer Use Cases in Dubai

- Retail shopping and dining

- Cross-border remittances

- Real estate tokenization payments

- Business Use Cases in Dubai

- SMEs and startups accepting crypto

- E-commerce integrations

- B2B settlements

- Statistics on Wallet Adoption and Crypto Payments

- Risks and Challenges for Wallet Users

- Case Study: Digital Wallet Adoption in Dubai’s Retail Sector

- Mistakes to Avoid When Using Crypto Wallets

- 2025 Outlook: Wallets and the Future of Crypto in Dubai

- FAQs

- Final Thoughts

- Websima: Building Secure Wallets and Blockchain Platforms

Why Digital Wallets Matter for Crypto Adoption

A digital wallet is the bridge between blockchain and the end user. While exchanges allow buying and selling, wallets allow people to store, send, and spend crypto securely.

Without user-friendly wallets, cryptocurrencies remain complex, discouraging mainstream adoption. Dubai’s emphasis on fintech-friendly ecosystems has allowed wallets to flourish, paving the way for broader usage.

The Current Landscape of Digital Wallet Crypto Dubai

Dubai’s residents, many of whom are expatriates sending remittances abroad, are increasingly exploring crypto as a cost-efficient alternative to bank transfers. Wallet providers such as Binance Pay, BitOasis, and global apps like Coinbase Wallet are seeing growing traction.

According to Chainalysis, the UAE received over $30 billion in crypto between July 2023 and June 2024, placing it among the top 40 countries globally for adoption (Chainalysis).

Government and Regulatory Support in the UAE

The UAE, and specifically Dubai, has taken a proactive role in regulating digital assets.

- Dubai’s Virtual Assets Regulatory Authority (VARA) maintains the Virtual Assets and Related Activities Regulations (2023), the operative rulebook for virtual asset service providers (VASPs), including wallet operators (VARA Rulebook).

- The Central Bank of the UAE introduced the Payment Token Services Regulation (2024), covering stablecoin issuance, custody, transfer, and conversion — a key foundation for licensed wallet providers (CBUAE Rulebook).

This dual structure (VARA + CBUAE) provides both market conduct oversight and monetary authority alignment, creating a secure framework for wallet-driven adoption.

How Digital Wallets Simplify Crypto Payments

Accessibility and Ease of Use

Wallets today are designed with mobile-first interfaces, making it easy for Dubai residents to pay for coffee, transfer money abroad, or purchase NFTs.

Security and Compliance Features

Modern wallets offer multi-signature authentication, biometric logins, and private key encryption, giving users confidence in handling digital assets.

Integration with Local Payment Systems

Some wallets integrate directly with UAE-based fintechs, allowing users to swap between dirhams (AED) and stablecoins seamlessly.

Consumer Use Cases in Dubai

Retail Shopping and Dining

Select Dubai cafés, luxury retailers, and even car dealerships accept crypto payments through wallet apps.

Cross-Border Remittances

With nearly 90% of Dubai’s population being expatriates, wallets provide and design dApps remittance in UAE, as an alternative to costly remittance services, offering faster and cheaper transfers.

Real Estate Tokenization Payments

Developers and blockchain startups are piloting wallet-based payment systems for fractional property ownership and real estate tokenization.

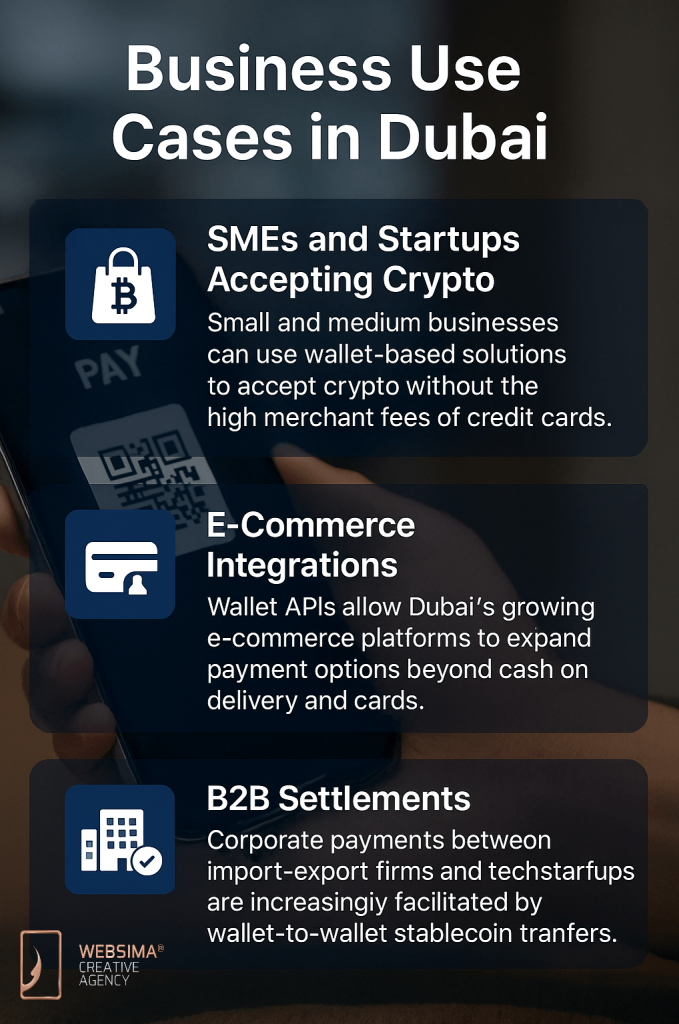

Business Use Cases in Dubai

SMEs and Startups Accepting Crypto

Small and medium businesses can use wallet-based solutions to accept crypto without the high merchant fees of credit cards.

E-Commerce Integrations

Wallet APIs allow Dubai’s growing e-commerce platforms to expand payment options beyond cash on delivery and cards as well as building cross-border cryptopayment for Dubai ecommerces.

B2B Settlements

Corporate payments between import-export firms and tech startups are increasingly facilitated by wallet-to-wallet stablecoin transfers.

Statistics on Wallet Adoption and Crypto Payments

- The UAE ranked among the top 40 crypto economies worldwide by transaction volume in 2024 (Chainalysis).

- VARA’s 2023 rulebook provides explicit licensing categories for custodians and wallet services, ensuring compliance (VARA Rulebook).

- The Central Bank’s 2024 regulation legally enables payment token (stablecoin) services to connect wallets with UAE’s monetary system (CBUAE Rulebook).

Risks and Challenges for Wallet Users

- Cybersecurity threats: Phishing scams and malware remain a risk.

- Private key management: Losing access to seed phrases can mean losing funds.

- Regulatory uncertainty: While the UAE is progressive, global wallet interoperability is still fragmented.

Case Study: Digital Wallet Adoption in Dubai’s Retail Sector

A mid-sized café chain in Downtown Dubai integrated crypto payments through a wallet provider in 2024. Within six months:

- 12% of total sales came through wallet-based crypto payments.

- Customer footfall increased due to younger demographics seeking crypto-friendly venues.

- The company reduced payment processing fees by 30% compared to credit cards.

This demonstrates how wallets are bridging crypto adoption in consumer-facing industries.

Mistakes to Avoid When Using Crypto Wallets

- Storing all funds in hot wallets — always diversify between hot and cold storage.

- Ignoring KYC requirements — non-compliant wallets may be restricted in Dubai.

- Falling for “too good to be true” apps — always use licensed VARA-approved wallet providers.

- Failing to back up private keys — losing recovery details can permanently lock funds.

2025 Outlook: Wallets and the Future of Crypto in Dubai

Wallet adoption is expected to accelerate further with:

- Integration into government services (e.g., utility bill payments via stablecoins).

- AI-driven fraud detection in wallets.

- Cross-chain compatibility, allowing Dubai users to transact across Ethereum, Polygon, Solana, and beyond.

The UAE’s target of becoming a global blockchain hub by 2030 places digital wallets at the heart of financial innovation.

FAQs

- Can Dubai residents legally use crypto wallets?

Yes, as long as the wallet provider complies with VARA and CBUAE rules. - Which wallets are most popular in Dubai?

BitOasis, Binance Pay, and MetaMask are widely used, alongside local fintech-integrated wallets. - Can I use a digital wallet for real estate in Dubai?

Yes, several developers are piloting wallet-based payment systems for tokenized property. - Is crypto income taxable in Dubai?

No, Dubai currently imposes 0% personal income tax on crypto gains. - Are wallets safe for storing large amounts of crypto?

For security, use cold wallets for long-term storage and hot wallets for daily transactions.

Final Thoughts

The expansion of Digital Wallet Crypto Dubai adoption marks a turning point for blockchain in the UAE. By making crypto usable in everyday transactions, wallets are not only fueling adoption but also reshaping how residents perceive money itself.

For businesses, this means new customers and reduced payment costs. In terms of consumers, it means speed, accessibility, and global reach. For regulators, it means balancing innovation with safeguards.

Websima: Powering the Future of Wallet Adoption

At Websima, we specialize in blockchain platforms that power next-generation financial ecosystems. From developing secure digital wallets to integrating crypto payments for businesses, we help Dubai’s innovators adopt blockchain safely and effectively.

Whether you’re an SME, a real estate firm, or a fintech startup, Websima can design and implement wallet solutions tailored to your business.

Learn how to leverage wallet adoption for your crypto project: Contact Websima.