Introduction

The global cryptocurrency ecosystem is defined by innovation, experimentation, and sometimes, controversy. Among the most debated developments are privacy coins—cryptocurrencies like Monero (XMR) and Zcash (ZEC) that prioritize anonymity. These coins allow transactions to be shielded from public view, unlike Bitcoin or Ethereum, where transaction histories are transparent on the blockchain.

While privacy coins provide legitimate benefits such as protecting personal financial data, they also pose regulatory concerns. Governments and regulators worldwide worry about their use in illicit activities, such as money laundering, tax evasion, or terrorism financing. This tension is especially relevant in jurisdictions like the United Arab Emirates (UAE), where the crypto ecosystem is growing rapidly but under careful oversight.

✈️ Travelers in the UAE can now book flights with Bitcoin, Ethereum, USDT & more through Emirates, Travala, and Air Arabia.

Best place in the world to live especially if you are a crypto millionaire! ❤️ pic.twitter.com/3iwRZQvtM3

— MANDO CT (@XMaximist) August 16, 2025

In this article, we will explore the Privacy Coins UAE debate—what they are, why regulators in the Emirates are wary of them, and how their future may unfold in light of evolving rules and international frameworks.

Table of Contents

- What Are Privacy Coins?

- Why Do Users Choose Privacy Coins?

- The UAE’s Regulatory Landscape for Virtual Assets

- Dubai VARA and the Explicit Ban on Privacy Coins

- DIFC and DFSA Approach to Privacy Tokens

- Federal UAE Laws on Crypto and AML/CTF Measures

- Legal Risks for Individuals and Businesses in the UAE

- Privacy Coins vs. Other Cryptocurrencies in the UAE

- International Approaches to Privacy Coins and Comparisons

- The Regulatory Outlook for Privacy Coins UAE

- Opportunities for Compliance and Innovation

- Risks and Challenges for Stakeholders

- Final Thoughts

- FAQs

What Are Privacy Coins?

Privacy coins are a subset of cryptocurrencies designed to enhance user anonymity. Unlike Bitcoin, which is pseudonymous but still traceable, privacy coins use advanced cryptography to obscure details of transactions, such as sender, recipient, and transaction amount.

- Monero (XMR): Uses stealth addresses, ring signatures, and RingCT to hide transaction data.

- Zcash (ZEC): Offers both transparent and shielded transactions using zero-knowledge proofs (zk-SNARKs).

- Dash (DASH): Previously offered “PrivateSend” features, though now phased out to reduce regulatory pressure.

These tools are useful for protecting personal privacy but also complicate enforcement of financial crime regulations.

Why Do Users Choose Privacy Coins?

- Financial Privacy: Individuals can transact without leaving a permanent trace on public blockchains.

- Security: Privacy features help protect against hacking, phishing, and data leaks.

- Freedom of Choice: Privacy coins allow users to control how much of their transaction history is visible.

- Protection Against Surveillance: Activists, journalists, or citizens in restrictive jurisdictions may use privacy coins for safety.

However, regulators worry that these same features can shield illicit activities.

The UAE’s Regulatory Landscape for Virtual Assets

The UAE is positioning itself as a global hub for digital assets. From Dubai’s Virtual Assets Regulatory Authority (VARA) to Abu Dhabi’s ADGM, the country has introduced comprehensive frameworks for virtual asset service providers (VASPs), token issuance, and trading platforms.

Key principles in UAE regulation include:

- Licensing and registration requirements for exchanges and crypto businesses.

- AML/CTF compliance, aligned with Financial Action Task Force (FATF) standards.

- Consumer protection and transparency, ensuring investors are safeguarded.

- Innovation support, with sandboxes and hubs encouraging blockchain adoption.

Within this framework, privacy coins present a unique challenge—balancing innovation with traceability.

Dubai VARA and the Explicit Ban on Privacy Coins

In February 2023, Dubai’s VARA announced a ban on privacy coins. Under VARA’s Virtual Asset Rulebook:

- Anonymity-enhancing cryptocurrencies like Monero and Zcash are prohibited.

- Virtual asset service providers (VASPs) are not allowed to issue, trade, or facilitate transactions involving privacy coins.

- The rationale: these assets prevent regulators from tracing transactions and hinder AML/CTF compliance.

This was a landmark move, signaling Dubai’s commitment to international standards and its desire to maintain a reputation as a transparent, well-regulated financial hub.

(Source: CoinDesk)

DIFC and DFSA Approach to Privacy Tokens

The Dubai International Financial Centre (DIFC), regulated by the Dubai Financial Services Authority (DFSA), also prohibits privacy tokens. In its Crypto Token Regime:

- Privacy tokens are listed under “prohibited tokens.”

- DIFC’s framework emphasizes transparency, investor protection, and compliance with global AML/CTF requirements.

- The Digital Assets Law No. 2 of 2024 further codified restrictions on certain high-risk crypto categories.

This ensures that financial activity within DIFC aligns with international best practices.

(Source: Charltons Quantum)

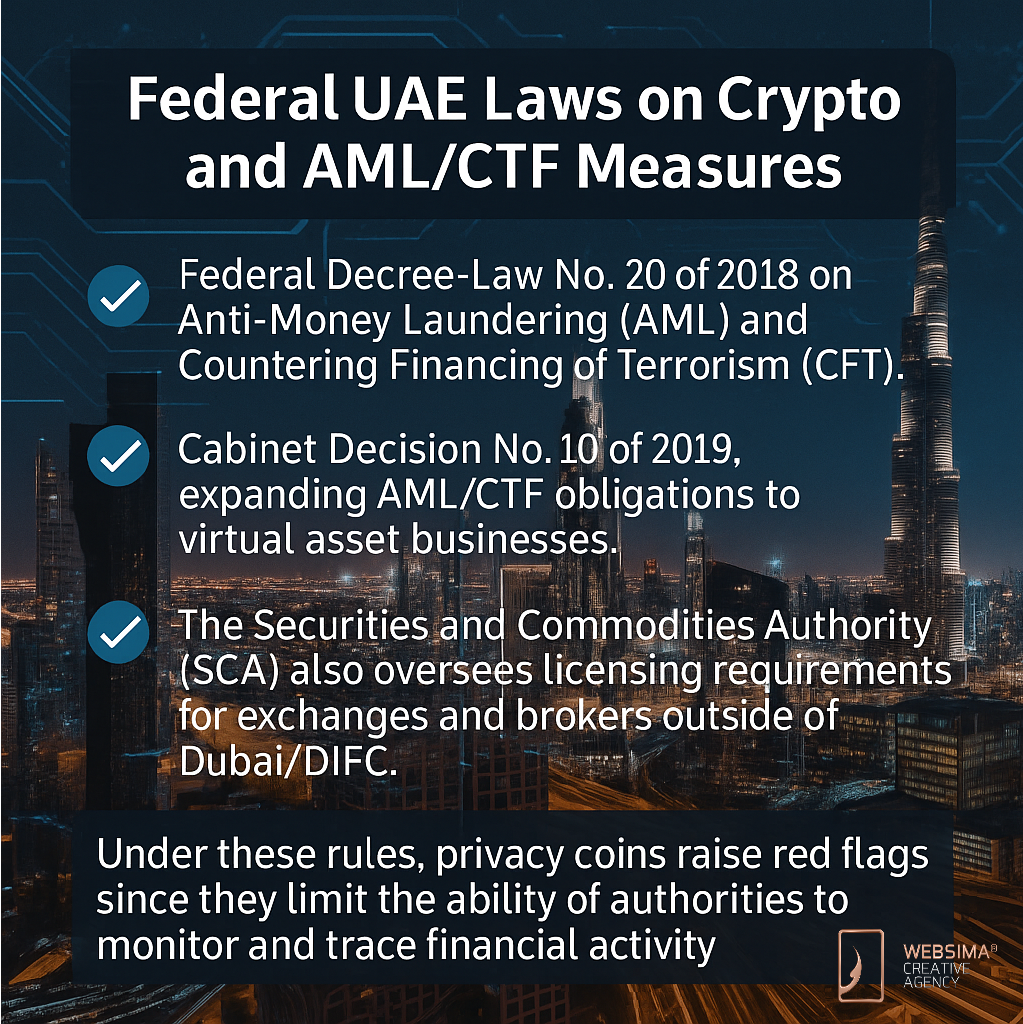

Federal UAE Laws on Crypto and AML/CTF Measures

At the federal level, the UAE has implemented a unified framework for cryptocurrencies:

- Federal Decree-Law No. 20 of 2018 on Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT).

- Cabinet Decision No. 10 of 2019, expanding AML/CTF obligations to virtual asset businesses.

- The Securities and Commodities Authority (SCA) also oversees licensing requirements for exchanges and brokers outside of Dubai/DIFC.

Under these rules, privacy coins raise red flags since they limit the ability of authorities to monitor and trace financial activity.

(Source: Elliptic)

Legal Risks for Individuals and Businesses in the UAE

- For Individuals: Holding privacy coins may not itself be criminal, but trading, issuing, or transacting through unlicensed means is risky. Authorities may interpret such activity as non-compliant.

- For Businesses: Exchanges and VASPs cannot support privacy coins if they want to operate legally. Licensing applications involving Monero, Zcash, or similar assets will likely be rejected.

- Enforcement: Violations can result in fines, license suspension, or even criminal liability under UAE cybercrime and financial laws.

Privacy Coins vs. Other Cryptocurrencies in the UAE

| Feature | Bitcoin & Ethereum | Privacy Coins (Monero, Zcash) |

| Traceability | Transparent, public ledger | Obscured, shielded transactions |

| UAE Legality | Permitted under licensed exchanges | Prohibited under VARA & DFSA |

| AML/CTF Compliance | Easier to monitor and enforce | Difficult or impossible |

| Investor Accessibility | Widely available | Blocked in regulated UAE markets |

International Approaches to Privacy Coins

- Japan & South Korea: Privacy coins are banned from licensed exchanges.

- United States: Not banned outright, but exchanges delist them to avoid regulatory heat.

- European Union: Stricter AML rules under MiCA make privacy coins difficult to support.

- Switzerland: Exchanges may support Zcash, but only in transparent mode.

The UAE is aligned with global norms in restricting privacy coins, ensuring its reputation as a compliant jurisdiction.

The Regulatory Outlook for Privacy Coins UAE

- Stronger Enforcement: Expect continued monitoring and penalties for non-compliant activities.

- Tech-Enabled Solutions: Some regulators may explore conditional use of privacy features if they allow traceability when required.

- Cross-Jurisdictional Coordination: The UAE will align with FATF recommendations, ensuring its rules are consistent with other global hubs.

- Innovation in Privacy Tech: Zero-knowledge proofs may find regulatory-friendly applications outside pure privacy coins.

Opportunities for Compliance and Innovation

While privacy coins are banned, innovation in privacy technologies is not. Blockchain developers in the UAE are pivoting toward:

- Enterprise-grade encryption that still allows selective disclosure.

- Regulatory-friendly zero-knowledge proofs used in KYC and identity verification.

- Privacy-preserving smart contracts that protect data while remaining auditable.

This balance ensures that blockchain innovation continues within compliant frameworks.

Risks and Challenges for Stakeholders

- Investors: May face portfolio restrictions due to prohibitions.

- Businesses: Need to ensure systems automatically reject privacy coin transactions.

- Regulators: Must balance compliance with the UAE’s ambition to be a global crypto hub.

Final Thoughts

The debate over Privacy Coins UAE reflects the broader challenge of balancing financial privacy with regulatory transparency. While privacy coins like Monero and Zcash offer compelling use cases, their features are incompatible with the UAE’s AML/CTF regime. For the foreseeable future, privacy coins will remain prohibited in Dubai, DIFC, and across the Emirates’ regulatory frameworks.

However, the innovation driving privacy technologies may find new life in other blockchain applications—from identity verification to enterprise compliance. The UAE’s approach signals a clear commitment: it seeks to remain a trusted, forward-looking hub for digital assets by aligning with global regulatory standards.

FAQs

- Are privacy coins legal in the UAE?

No. Privacy coins like Monero and Zcash are prohibited under Dubai’s VARA and the DFSA’s frameworks. - Can I hold privacy coins in my private wallet in the UAE?

Technically possible, but using or trading them through regulated channels is not permitted and may pose risks. - Why are privacy coins banned in the UAE?

Because they prevent transaction tracing, which conflicts with anti-money laundering and counter-terrorism financing obligations. - How do privacy coins differ from Bitcoin?

Bitcoin is transparent, with all transactions visible on a public ledger. Privacy coins conceal key details, making oversight difficult. - Could UAE regulation on privacy coins change in the future?

Unlikely in the near term. International frameworks are moving toward greater transparency, not less. - What alternatives exist for privacy-focused users in the UAE?

Users can explore regulated assets with optional privacy features or decentralized identity solutions that meet AML/CTF requirements.

Websima: Helping You Navigate Blockchain Regulations in Dubai

At Websima, we specialize in helping businesses navigate the evolving blockchain and cryptocurrency regulatory landscape in the UAE. Whether you are:

- Launching a new blockchain-based platform,

- Exploring tokenization and DeFi solutions, or

- Seeking legal and compliance support for Web3 ventures,

Our team ensures your projects are built within the UAE’s legal frameworks. While privacy coins may be off-limits, opportunities abound in tokenization, smart contracts, and compliant digital asset services.

Get in touch with our experts today to discuss how to build your blockchain business in Dubai with confidence: Contact Websima.