Table of Contents

- Introduction

- Why Fraud Detection Matters for UAE Startups

- Challenges Facing UAE Fintech & Web3 Businesses

- How AI Transforms Fraud Detection

- The Role of Blockchain in Fraud Prevention

- AI + Blockchain: A Hybrid Approach to Fraud Detection

- UAE Regulatory Landscape for Fraud Prevention

- Key Use Cases for UAE Startups

- Benefits of AI + Blockchain for UAE’s Digital Economy

- Future Outlook: AI and Blockchain in UAE Fraud Detection by 2030

- FAQs on AI Blockchain Fraud Detection UAE

- Conclusion

- Partner with Websima

Introduction

The UAE has become one of the world’s fastest-growing fintech and Web3 hubs, home to over 600 fintech startups and a thriving blockchain ecosystem. Under initiatives like the Dubai Blockchain Strategy and UAE AI Strategy 2031, the country is investing heavily in advanced technologies.

However, as digital adoption accelerates, fraud-related risks are escalating across payments, crypto trading, and decentralized finance. The global AI in fraud detection market alone was valued at USD 12.1 billion in 2023 and is expected to reach USD 108.3 billion by 2033, growing at a CAGR of 24.5% (market.us).

Scams. Deepfakes. DeFi crime.

Indonesia’s Bareskrim is cracking down hard on crypto-related fraud — and they’re using AI and blockchain to do it.

Inside their bold new strategy to trace and tackle financial crime in Web3.

Dive in https://t.co/4652UuTXkc pic.twitter.com/AWD6SfcpuD

— Binance (@binance) May 18, 2025

To thrive, UAE startups need smarter, scalable, and transparent solutions — and combining AI with blockchain provides exactly that.

Why Fraud Detection Matters for UAE Startups

Startups in fintech, Web3, and payments face a growing range of fraud threats:

- Identity theft during KYC onboarding

- Money laundering through cross-border crypto channels

- Card-not-present fraud in e-commerce

- Rug pulls and protocol exploits in DeFi ecosystems

- NFT scams and fake asset manipulation

According to the Dubai International Financial Centre (DIFC) reports, UAE fintech companies have experienced a steady rise in fraud-related losses in proportion to increased transaction volumes.

This makes AI Blockchain Fraud Detection UAE critical for startups aiming to scale securely and post-deployment security while maintaining investor confidence. More importantly, Dubai ecommerce can use crypto cross-border payment to improve security and expand their business safely.

Challenges Facing UAE Fintech & Web3 Businesses

1. Speed vs. Security

Many startups prioritize rapid launches, but underinvest in fraud frameworks.

2. Regulatory Pressures

Entities operating in Dubai and Abu Dhabi must comply with VARA and FSRA anti-fraud guidelines or risk penalties.

3. Data Complexity

With multiple payment gateways, on-chain wallets, and digital IDs, monitoring risk patterns in real time is complex.

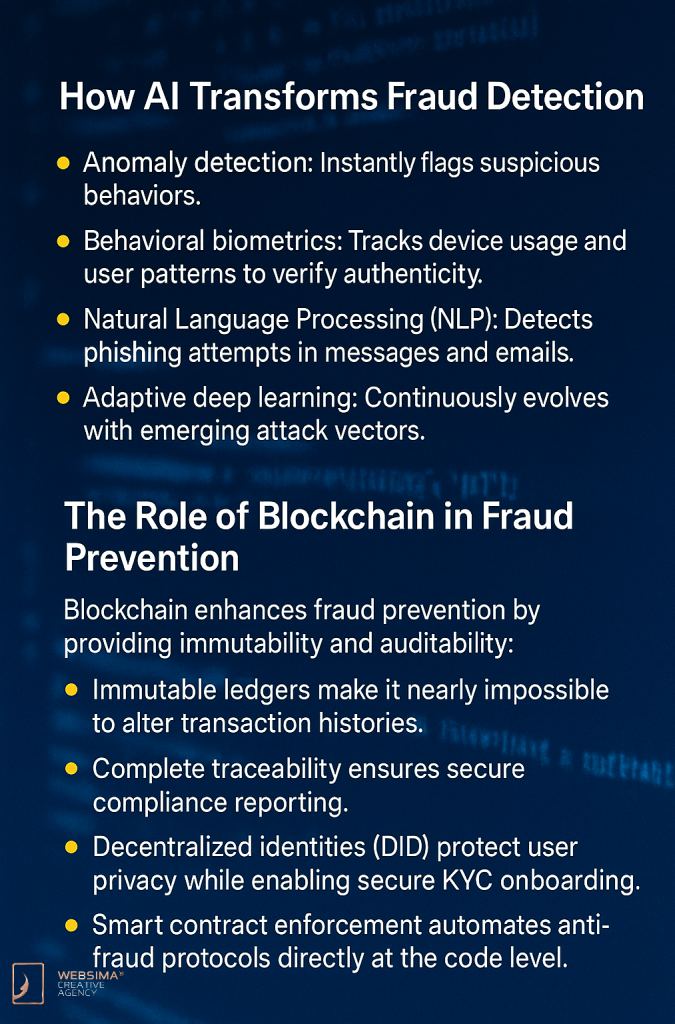

How AI Transforms Fraud Detection

AI introduces predictive, real-time intelligence into fraud detection:

- Anomaly detection: Instantly flags suspicious behaviors.

- Behavioral biometrics: Tracks device usage and user patterns to verify authenticity.

- Natural Language Processing (NLP): Detects phishing attempts in messages and emails.

- Adaptive deep learning: Continuously evolves with emerging attack vectors.

AI is also proving effective in payments: in Dubai’s fintech sector, AI-driven systems have improved transaction acceptance rates by 30–40% while enhancing fraud detection accuracy (aijourn.com).

The Role of Blockchain in Fraud Prevention

Blockchain enhances fraud prevention by providing immutability and auditability:

- Immutable ledgers make it nearly impossible to alter transaction histories.

- Complete traceability ensures secure compliance reporting.

- Decentralized identities (DID) protect user privacy while enabling secure KYC onboarding.

- Smart contract enforcement automates anti-fraud protocols directly at the code level.

For UAE startups, blockchain forms the trust foundation of AI Blockchain Fraud Detection UAE.

AI + Blockchain: A Hybrid Approach to Fraud Detection

The combined power of AI and blockchain delivers intelligent, real-time, and verifiable fraud detection:

| Capability | AI’s Role | Blockchain’s Role |

| Detection Speed | Real-time anomaly scoring | Instant on-chain validation |

| Data Integrity | Predictive threat analysis | Immutable audit trails |

| Identity Security | Automated AML/KYC | Decentralized identities |

| Compliance | AI-generated risk reports | On-chain proofs for regulators |

This synergy allows startups to detect threats earlier, respond faster, and secure their ecosystems.

UAE Regulatory Landscape for Fraud Prevention

The UAE’s regulators are aligning fintech and Web3 compliance:

- VARA (Dubai): Governs virtual asset platforms and mandates KYC/AML protocols (VARA Rulebook 2023).

- FSRA (Abu Dhabi): Regulates crypto exchanges and sets fraud detection benchmarks.

- UAE AI Strategy 2031: Encourages AI integration across finance and cybersecurity.

Startups embedding AI + blockchain frameworks future-proof their fraud detection systems while ensuring compliance.

Key Use Cases for UAE Startups

1. Real-Time Payment Fraud Detection

AI models analyze transaction patterns instantly and block high-risk activity.

2. On-Chain AML & KYC Verification

Blockchain-based identities streamline onboarding while securing user data.

3. NFT & Web3 Marketplace Security

AI identifies wash trading and manipulations; blockchain proves ownership authenticity.

4. DeFi Protocol Monitoring

AI detects flash loan attacks and exploits before liquidity drains occur.

Benefits of AI + Blockchain for UAE’s Digital Economy

- Investor confidence: Transparent, auditable frameworks attract global funding.

- Regulatory alignment: Built-in compliance reduces audit risks.

- Operational efficiency: Automating fraud detection reduces costs.

- Competitive positioning: UAE startups gain an edge in international fintech markets.

Future Outlook: AI and Blockchain UAE Fraud Detection by 2030

By 2030, the UAE is set to emerge as a global fraud detection leader:

- AI-driven predictive analytics will reduce financial crime by up to 30%, based on early UAE payment sector trials.

- Blockchain-based decentralized identity (DID) solutions will become industry standard for KYC and onboarding.

- UAE startups will pioneer regulator-approved Web3 ecosystems integrating fraud detection by design.

FAQs on AI Blockchain Fraud Detection UAE

Q1. Why combine AI and blockchain for fraud detection?

AI identifies patterns, while blockchain ensures data integrity and transparency.

Q2. Are UAE startups required to integrate fraud prevention tools?

Yes. Under VARA and FSRA, robust anti-fraud and KYC/AML systems are mandatory.

Q3. Can AI detect Web3-specific exploits?

Absolutely — AI tracks on-chain anomalies and smart contract behaviors in real time.

Q4. Is blockchain mandatory for compliance?

Not yet, but blockchain-powered auditability is increasingly preferred by regulators.

Q5. Does Websima build AI + blockchain fraud detection platforms?

Yes. We specialize in custom, regulator-ready fintech and Web3 solutions.

Conclusion

AI Blockchain Fraud Detection UAE is revolutionizing financial security for startups across fintech, Web3, and DeFi ecosystems. By integrating AI’s predictive analytics with blockchain’s immutable trust layer, UAE businesses can detect threats faster, secure customer data, and comply with evolving regulations.

Fraud detection is also becoming a strategic advantage: the UAE AI in finance market alone is projected to grow from USD 67 million in 2023 to USD 514 million by 2032, at a CAGR of 25.3% (credenceresearch.com). Startups adopting AI + blockchain hybrid systems today will be better prepared to attract investors, build trust-first platforms, and scale globally.

With the UAE’s vision under the Dubai Blockchain Strategy and AI Strategy 2031, intelligent, transparent fraud detection isn’t optional anymore — it’s becoming the new standard for sustainable growth.

Partner with Websima

At Websima, we design next-generation, VARA-compliant fraud detection platforms that blend AI-powered intelligence with blockchain-backed transparency.

Our Expertise

- AI-driven fraud analytics → anomaly detection, predictive modeling, behavioral biometrics.

- Blockchain-powered security → decentralized identity, immutable records, and on-chain auditability.

- Compliance-ready architecture → aligned with VARA and FSRA regulations.

- Custom Web3 & fintech solutions → tailored for UAE startups and digital innovators.

Talk to Websima Today to secure your startup with AI + blockchain-powered fraud detection.