Table of Contents

- Introduction

- Understanding Token Vesting in Web3

- Why Token Vesting Matters for Startups

- Common Token Vesting Models

- Dubai’s Regulatory Framework for Token Vesting

- Compliance Strategies for Dubai-Based Startups

- Case Study: Token Vesting in a Dubai Web3 Project

- Common Mistakes and Risks to Avoid

- Future of Token Vesting in Dubai’s Web3 Ecosystem

- FAQs

- Conclusion

- Websima Guidance

Introduction

Dubai has rapidly emerged as one of the world’s leading Web3 innovation hubs, fueled by forward-looking policies and regulatory clarity. The rise of tokenized assets, NFT marketplaces, and real-world asset (RWA) tokenization in Dubai is driving explosive demand for structured token vesting compliance strategies.

In 2024 alone, the UAE tokenization market generated USD 66.3 million and is expected to reach USD 307.3 million by 2030, growing at a 24.3% CAGR (Grand View Research). Within Dubai’s thriving USD 18 billion real estate market, approximately USD 400 million worth of properties have already been tokenized (Medium).

Dubai Tightens Crypto Rules!

The Virtual Assets Regulatory Authority (VARA) in Dubai has introduced stricter regulations for the marketing, advertising, and promotion of cryptocurrencies, setting a new global standard for transparency and consumer protection.

— MamaFi (@mamafi_platform) October 4, 2024

In this fast-paced environment, a solid token vesting compliance strategy Dubai startups adopt can make the difference between regulatory setbacks and long-term success.

Understanding Token Vesting in Web3

Token vesting refers to the structured release of tokens over a defined period to:

- Prevent insider-driven “token dumps”

- Align founders, investors, and communities with long-term growth

- Build market confidence and protect token value

For Dubai-based startups, vesting timelines must increasingly comply with VARA’s disclosure requirements, especially as tokenized products span DeFi, NFTs, and RWAs.

Why Token Vesting Matters for Startups

- Investor Confidence: Transparent vesting schedules build credibility and attract funding.

- Community Trust: Protects retail token holders from volatility and manipulation.

- Founder Accountability: Locks founders into long-term value creation.

- Regulatory Alignment: Reduces the risk of tokens being classified as unregistered securities under UAE frameworks.

Common Token Vesting Models

1. Time-Based Vesting

Tokens unlock gradually at fixed intervals — widely used for team allocations and advisors.

2. Milestone-Based Vesting

Tokens are released upon achieving specific project goals like launching an MVP or acquiring a set number of users.

3. Hybrid Vesting

Combines time-based and milestone-based triggers to balance flexibility and predictability.

4. Cliff Vesting

Tokens remain fully locked until an initial “cliff” period ends, commonly 6-12 months for founders and team members.

Dubai’s Regulatory Framework for Token Vesting

Dubai’s Virtual Assets Regulatory Authority (VARA) leads the UAE’s blockchain regulations, providing legal clarity for Web3 startups:

- VARA Token Issuance Guidelines: Require startups to disclose vesting schedules in whitepapers and investor reports.

- Securities Classification Tests: Tokens are assessed to determine whether they’re utility or security tokens.

- Free Zone Oversight: Startups in DIFC or ADGM must comply with DFSA or FSRA frameworks.

- AML & CFT Regulations: Token distribution mechanisms must align with anti-money laundering requirements to avoid fines and delays.

Reference: Dubai VARA Official Site.

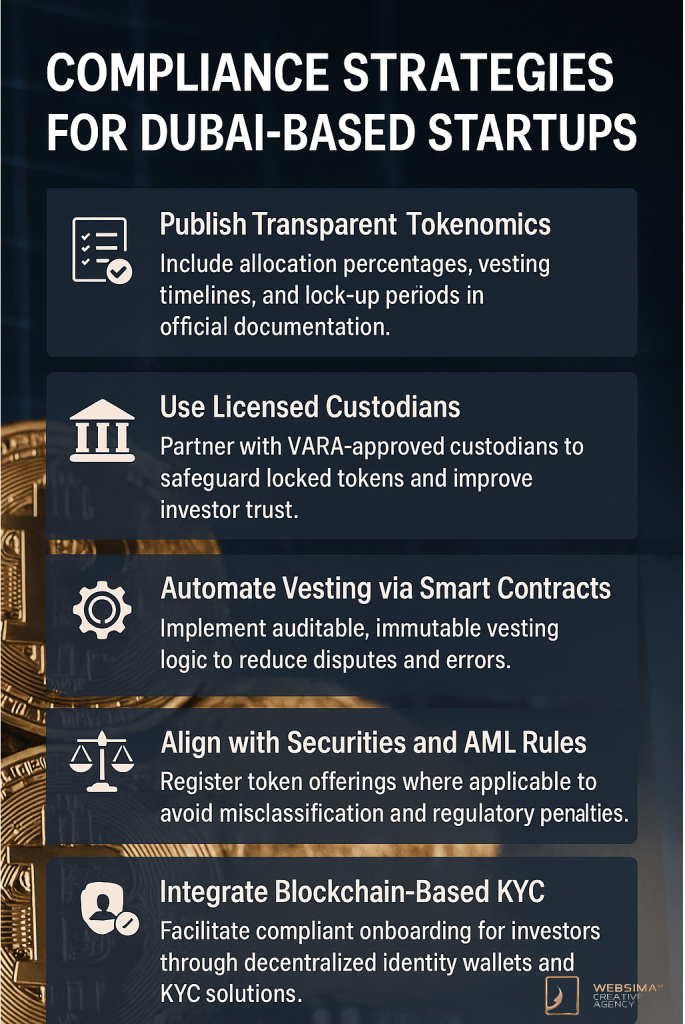

Compliance Strategies for Dubai-Based Startups

- Publish Transparent Tokenomics

- Include allocation percentages, vesting timelines, and lock-up periods in official documentation.

- Use Licensed Custodians

- Partner with VARA-approved custodians to safeguard locked tokens and improve investor trust.

- Automate Vesting via Smart Contracts

- Implement auditable, immutable vesting logic to reduce disputes and errors.

- Align with Securities and AML Rules

- Register token offerings where applicable to avoid misclassification and regulatory penalties.

- Integrate Blockchain-Based KYC

- Facilitate compliant onboarding for investors through decentralized identity wallets and KYC solutions.

Case Study: Token Vesting in a Dubai Web3 Project

Startup: A Dubai-based NFT gaming platform

Challenge: Balancing regulatory compliance with investor liquidity needs

Solution:

- Deployed 12-month cliff vesting for founders

- Staggered investor token releases over 36 months

- Secured VARA pre-approval of tokenomics structure like Tokenomics 2.0 for UAE projects

Outcome:

- Enhanced investor trust and minimized speculative volatility

- Strengthened the project’s compliance posture

- Enabled the startup to close a USD 10 million seed round successfully

Common Mistakes and Risks to Avoid

- No Vesting Schedule: Leads to uncontrolled token dumps and market crashes.

- Non-Compliance with VARA: Results in fines or operational suspension.

- Overcomplicated Tokenomics: Confuses investors and dilutes trust.

- Skipping Smart Contract Audits: Leaves vulnerabilities open to exploitation.

Future of Token Vesting in Dubai’s Web3 Ecosystem

Dubai’s Web3 economy is evolving rapidly:

- Tokenization Boom: Real estate tokenization alone could account for AED 60 billion (~USD 16 billion) by 2033, around 7% of the city’s property market (Dubai Land Department).

- Greater VARA Oversight: Expect stricter disclosures on vesting schedules and investor protections.

- Decentralized Identity Integration: Wallet-based KYC and automated vesting processes will become the norm.

- Global Leadership: Dubai is positioning itself as a tokenization capital, attracting startups and investors worldwide.

FAQs

Is token vesting mandatory in Dubai?

Not always, but VARA strongly encourages vesting to safeguard investors and communities.

Can Dubai startups offer unrestricted token sales?

No, unrestricted distributions may result in security misclassification and fines.

How does VARA affect token vesting compliance strategy Dubai startups need?

VARA enforces transparency in vesting disclosures to ensure investor protection and compliance.

What’s the typical lock-up period for founders?

Founders typically face a 6-12 month cliff depending on token utility and investor agreements.

Conclusion

In Dubai’s fast-evolving Web3 ecosystem, a robust token vesting compliance strategy is a strategic advantage. With the UAE tokenization market projected to grow from USD 66.3 million in 2024 to USD 307.3 million by 2030, startups must implement transparent vesting schedules, adopt automated smart contracts, and align fully with VARA’s regulatory framework to remain competitive and compliant.

By prioritizing investor trust, regulatory alignment, and community transparency, Dubai-based Web3 startups can position themselves to attract funding, scale sustainably, and thrive in a rapidly expanding USD 400 million+ tokenized asset market.

Websima Guidance

At Websima, we specialize in helping Dubai-based Web3 startups design secure, compliant token vesting frameworks tailored to investor and regulatory requirements. Our expertise covers:

- Tokenomics consulting

- Smart contract development & audits

- VARA-compliant token distribution

- Integration of decentralized identity for KYC onboarding

As Dubai cements its role as a global leader in Web3 and tokenization, we help startups build, launch, and scale projects with full compliance and investor confidence.

Contact Websima today to develop your future-ready token vesting compliance strategy and unlock opportunities in Dubai’s booming blockchain ecosystem.