Introduction: The Rising Importance of Smart Contract Security

The UAE continues to position itself as a global hub for blockchain innovation. With Dubai’s Virtual Assets Regulatory Authority (VARA) setting frameworks for digital assets and smart contracts, the demand for reliable, transparent, and secure smart contract development is surging. In this landscape, smart contract audit UAE is no longer an afterthought—it is a regulatory necessity and the legal recognition of smart contracts in the UAE would be a trust-building mechanism for startups, enterprises, and public blockchain projects.

Introducing Audit AI: comprehensive smart contract health checks in one click

Smart contract audits are expensive, time-consuming, and easily outdated.

But not anymore.

Here’s how you can ship faster without compromising on security.… pic.twitter.com/BmHpdJq3zY

— FailSafe (@getfailsafe) September 5, 2024

From DeFi applications and NFT platforms to tokenized real estate and DAO governance models, any bug or vulnerability in a smart contract could result in catastrophic financial loss. According to Chainalysis, over $2.2 billion worth of crypto funds were stolen globally in 2024, primarily due to flaws in unaudited or insecure smart contracts. Most of these breaches could have been prevented through proper auditing and risk mitigation protocols.

Why Smart Contract Audits Matter in the UAE

As Web3 adoption accelerates in the UAE, government-backed blockchain initiatives and crypto-friendly free zones (such as DIFC, DMCC, and ADGM) are attracting international blockchain firms. However, this growth comes with heightened regulatory expectations. Here’s why auditing is essential:

Regulatory Compliance

Dubai’s VARA and the UAE’s Securities and Commodities Authority (SCA) expect projects dealing with tokenized assets or DeFi protocols to demonstrate security diligence. Audits serve as a compliance benchmark, especially for projects seeking licensing or exchange listings.

Investor and User Trust

Investors are unlikely to stake capital in unaudited smart contracts. Similarly, users need assurance that their funds won’t vanish due to vulnerabilities. Security audits provide third-party validation, enhancing user confidence.

Prevention of Financial Exploits

Well-known attacks like the The DAO hack (Ethereum, 2016) or Wormhole bridge exploit (2022) underline the devastating impact of overlooked code flaws. In a growing UAE ecosystem, such incidents would erode credibility and slow adoption.

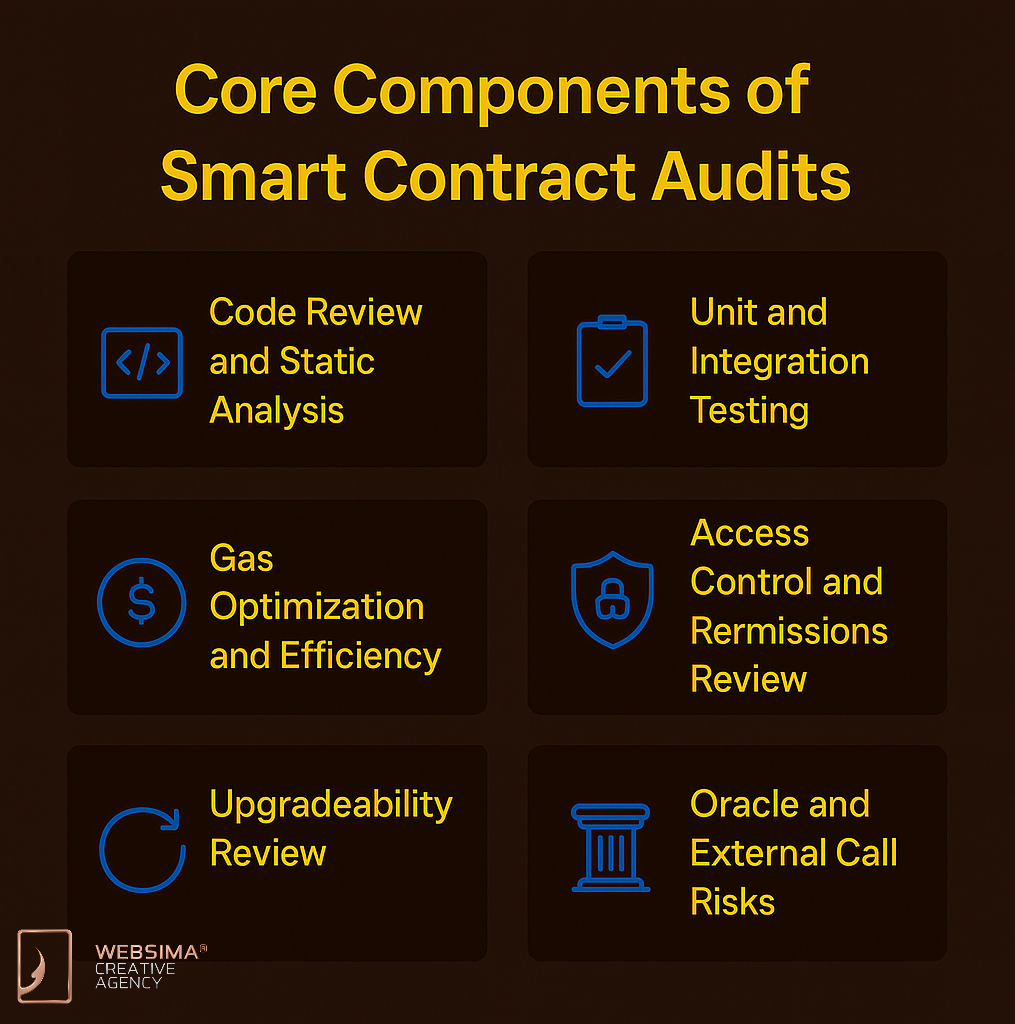

Core Components of Smart Contract Audits

A professional smart contract audit UAE covers multiple dimensions beyond just code review. These include:

1. Code Review and Static Analysis

- Detects logic bugs, reentrancy issues, overflow/underflow vulnerabilities, and access control flaws.

- Tools like MythX, Slither, and Solhint are commonly used for automated review.

- Auditors manually assess business logic and compare against protocol documentation.

2. Unit and Integration Testing

- Ensures each smart contract function behaves as intended.

- Uses frameworks like Hardhat, Truffle, or Foundry for automated tests.

- Test coverage reports validate the robustness of code across edge cases.

3. Gas Optimization and Efficiency

- Inefficient code increases gas costs and deters users.

- Audit reports include optimization suggestions that align with Ethereum Virtual Machine (EVM) best practices.

4. Access Control and Permissions Review

- Verifies that only authorized accounts can perform sensitive actions like minting, pausing, or upgrading contracts.

- Auditors assess Role-Based Access Control (RBAC) schemes and time-lock mechanisms.

5. Upgradeability Review

- Many smart contracts in the UAE use proxy patterns for upgradability (e.g., OpenZeppelin’s UUPS).

- Audits evaluate upgrade paths to prevent misconfigurations that could brick the protocol or allow malicious takeovers.

6. Oracle and External Call Risks

- Projects using off-chain data (like Chainlink or Band Protocol) must handle potential oracle manipulation.

- External calls are reviewed for reentrancy and gas griefing risks.

Best Practices Followed by UAE-Based Auditors

Adherence to International Standards

Most UAE-based auditors align with OWASP, ISO/IEC 27001, and NIST security standards. Some also follow CERT guidelines for software vulnerability handling.

Use of Formal Verification

Advanced audits involve formal verification techniques, which use mathematical models to prove that smart contract logic behaves as expected under all possible conditions.

Audit Disclosure Policies

Reputable UAE firms follow public disclosure practices, publishing audit reports, security scores, and risk ratings on GitHub or the project’s website.

Third-Party Certifications

Some UAE blockchain firms seek third-party attestation from organizations like CertiK, Hacken, or Trail of Bits to boost credibility with investors and regulators.

Real-World Use Cases in UAE

Case Study 1: Tokenized Real Estate Platform

A real estate tokenization startup in Dubai sought to fractionalize commercial properties using ERC-3643 tokens. Before launch, they completed a full smart contract audit by a UAE-based Web3 security firm. Findings:

- Logic vulnerability in token redemption flow

- Missing circuit breaker for emergency shutdown

- Access control incorrectly assigned to public functions

The audit helped them secure VARA sandbox approval.

Case Study 2: DeFi Lending Protocol in ADGM

An Abu Dhabi-based protocol offering collateralized crypto loans underwent two audit rounds and formal verification before mainnet deployment. As a result, they obtained SCA clearance and attracted over $12M in TVL (Total Value Locked) within 3 months.

Common Smart Contract Vulnerabilities in the Region

- Reentrancy attacks in DeFi lending contracts

- Timestamp dependencies in staking pools

- Arithmetic overflows in vesting schedules

- Hardcoded admin wallets without multisig (Multi Signature) protection

- Unverified proxy upgrades

UAE-based Web3 startups must address these risks early to comply with the region’s maturing legal ecosystem. Besides, it is quite important for developers and investors to identify the best platforms for smart contract deployment in the UAE.

How to Choose a Smart Contract Auditor in the UAE

- Verify Their Experience

Look for prior audits of protocols similar to yours (NFTs, DAOs, DeFi, STOs, etc.). - Check Certifications and Public Reports

Ensure they publish full audit reports and follow responsible disclosure standards. - Ask for Their Tool Stack

Advanced auditors use automated tools, manual reviews, formal verification, and fuzz testing. - Assess Their Legal Familiarity

UAE regulations around digital assets are evolving. Choose firms familiar with VARA, SCA, and DIFC rules.

Future of Smart Contract Security in UAE

- Regulatory Alignment: VARA may soon require mandatory smart contract audits for licensing, especially for DeFi and tokenized asset platforms.

- Security-as-a-Service (SaaS): Continuous audit monitoring tools (e.g., Forta) are expected to be adopted across UAE blockchain firms.

- AI for Code Audits: AI-powered static analyzers will accelerate threat detection in complex contracts.

- Greater Emphasis on On-Chain Insurance: Audited contracts may qualify for decentralized insurance services, adding an extra layer of risk protection.

Risks of Skipping a Smart Contract Audit

- Loss of user funds through exploitation

- Inability to secure regulatory licenses or bank partnerships

- Loss of credibility in public token offerings (IEOs, ICOs)

- Smart contract immutability locking in flawed logic

- Legal liabilities if customer assets are compromised

Skipping audits is never worth the short-term cost savings.

FAQ: Smart Contract Audit UAE

Is smart contract auditing mandatory in the UAE?

While not yet legally mandated, regulators like VARA and SCA strongly recommend audits for DeFi, tokenization, and Web3 projects.

How long does an audit typically take?

Depending on complexity, 1–4 weeks. Multi-contract systems may take longer.

Do UAE auditors offer formal verification?

Yes, several UAE firms now provide formal verification as part of advanced audit packages.

What’s the cost of a smart contract audit in Dubai?

Costs range from $5,000–$50,000 depending on contract complexity, lines of code, and urgency.

Are audits recognized by VARA or SCA?

Yes—audits by reputable firms are often part of regulatory licensing applications.

Work with Blockchain Security Experts at Websima

At Websima, we don’t just build smart contracts—we secure them. Our team combines deep expertise in Solidity, formal verification, and UAE blockchain law to ensure your Web3 project is audit-ready and compliant with local frameworks.

Whether you’re developing a DeFi platform in Abu Dhabi, launching an NFT marketplace in Dubai, or tokenizing real estate assets under DIFC, Websima offers:

- Pre-deployment smart contract audits

- Regulatory-aligned security documentation

- Post-launch vulnerability monitoring

- Upgrade audits and multisig wallet integration

Take the next step toward security and compliance:

Speak with our experts today and get your smart contracts audit-ready for the UAE market.