As decentralized finance (DeFi) continues to disrupt traditional banking and finance across the globe, Dubai is emerging as one of the most promising destinations for launching DeFi projects. The emirate’s progressive regulatory framework, supportive ecosystem, and strategic initiatives have made it a magnet for blockchain and fintech innovation. For founders looking to launch a DeFi project in this dynamic city, understanding the landscape—from tokenomics design to regulatory licensing and partnership building—is crucial.

In this comprehensive guide, we outline the step-by-step process to successfully launch a DeFi project in Dubai, navigate its regulatory complexities, and unlock long-term growth through Dubai’s world-class Web3 infrastructure.

Table of Contents

- Why Dubai Is Ideal for DeFi Projects

- Step 1: Design Tokenomics and Utility

- Step 2: Select a Legal Structure and Free Zone

- Step 3: Engage with VARA for Licensing

- Step 4: Ensure AML/KYC and Compliance Readiness

- Step 5: Build Ecosystem Partnerships

- Step 6: Launch MVP and Conduct Audits

- Step 7: Promote, Scale, and Iterate

- Risks and Considerations

- Conclusion

- FAQs

- Partner with Websima to Launch Your DeFi Venture

Why Dubai Is Ideal for DeFi Projects

BREAKING: Dubai just launched a $16B tokenized real estate project on XRP Ledger.

Buy property for just $500.

Habibi money is loading. #RWA pic.twitter.com/rdYpptVzoj

— Real World Asset Watchlist (@RWAwatchlist_) May 26, 2025

Dubai has positioned itself as a global hub for blockchain and virtual asset innovation. In 2022, it established the Virtual Assets Regulatory Authority (VARA), the world’s first independent regulator dedicated to digital assets. With zero personal income tax, streamlined business registration, and access to top-tier infrastructure, Dubai presents unique advantages for DeFi entrepreneurs:

- Progressive and transparent regulations

- Proximity to Web3 hubs like DIFC and DMCC

- Supportive government-backed initiatives like the Dubai Blockchain Strategy

- Access to global capital and experienced investors

- A growing population of crypto-native users

Dubai is a hotspot for blockchain startups in 2025 due to its strategic location that enables seamless connections to MENA, Europe, and Asia, making it a launchpad for global DeFi operations.

Step 1: Design Tokenomics and Utility

A well-structured tokenomics model forms the foundation of a DeFi project. It defines how tokens are issued, distributed, and used within your protocol. Key elements include:

- Supply model (fixed, deflationary, inflationary)

- Governance rights (DAO participation)

- Staking or liquidity incentives

- Fee structure and redistribution logic

Engage tokenomics consultants and legal advisors early to ensure your model complies with both economic viability and Dubai’s legal standards regarding utility vs. security tokens.

Step 2: Select a Legal Structure and Free Zone

DeFi founders must choose an appropriate business entity and free zone to register in Dubai. Recommended free zones include:

- DIFC – for fintech and institutional DeFi use cases

- DMCC – highly crypto-friendly with streamlined licensing

- DWTC – home to VARA, ideal for virtual asset operations

- Meydan Free Zone – budget-friendly and startup-focused

You should decide between:

- Sole Establishment

- Free Zone Company (FZCO)

- Branch Office (for foreign entities)

Working with local corporate service providers can streamline setup and registration.

Step 3: Engage with VARA for Licensing

To operate legally in Dubai, DeFi platforms must obtain the appropriate license through VARA. Depending on your model, you may need one or more of the following licenses:

- trades)

- Management and Investment Services Exchange Services (if offering token swaps)

- Custody Services (for managing user funds)

- Broker-Dealer Services (for aggregating for DeFi yield strategies)

Visit VARA’s official rulebooks for a breakdown of licensing categories and their compliance criteria.

Step 4: Ensure AML/KYC and Compliance Readiness

Even though DeFi prides itself on decentralization, projects operating in Dubai must integrate Know-Your-Customer (KYC) and Anti-Money Laundering (AML) processes to meet regulatory standards. Ensure that your protocol features:

- Integration with on-chain KYC providers (e.g., Civic, Shyft)

- Transaction monitoring tools

- Smart contract audits

- Privacy policies and user consent systems

VARA mandates detailed compliance reporting, so prepare to build an internal compliance function.

Step 5: Build Ecosystem Partnerships

Strategic partnerships are key to scaling your DeFi protocol. In Dubai, this may include:

- Local exchanges like BitOasis or Crypto.com MENA

- Payment gateways like Telr or Stripe UAE

- Launchpads and accelerators like Ghaf Labs, Seed Group

- Legal advisors and auditors experienced in Web3

These alliances can improve product-market fit, expand your user base, and streamline access to liquidity.

Step 6: Launch MVP and Conduct Audits

Before going live, launch a Minimum Viable Product (MVP) and subject all smart contracts to external security audits. Consider these trusted audit firms:

- CertiK

- OpenZeppelin

- Hacken

- ConsenSys Diligence

A well-audited MVP builds trust and is often required by both partners and regulators before full deployment.

Step 7: Promote, Scale, and Iterate

Use a mix of growth marketing strategies, community-building efforts, and investor outreach to expand:

- Launch community airdrops or staking incentives

- Establish a DAO for governance

- Attend Web3 and fintech events in Dubai (e.g., Future Blockchain Summit, GITEX)

- Seek partnerships with VCs Venture Capital firms) and angel investors through venture capital platforms in Dubai.

Iterate based on user feedback and regulatory updates.

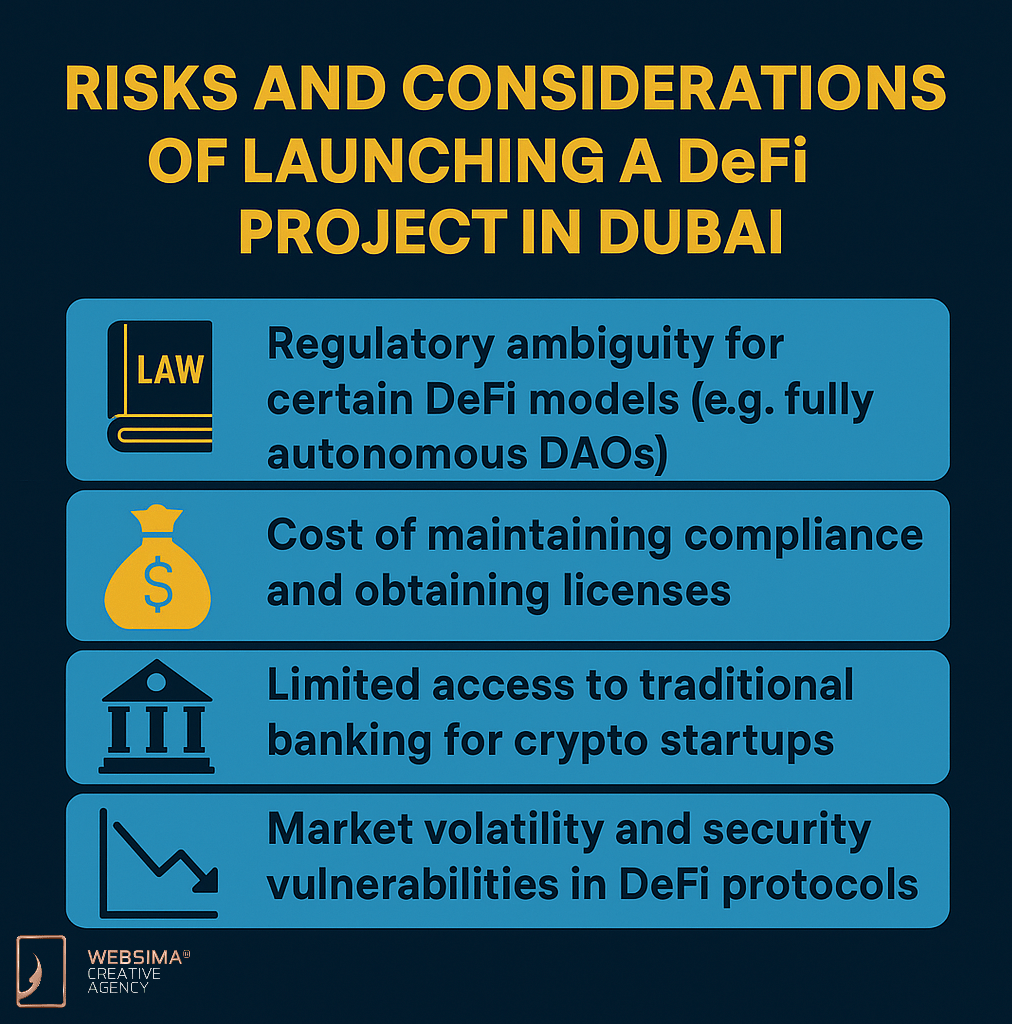

Risks and Considerations

Launching a DeFi project in Dubai, while promising, comes with challenges:

- Regulatory ambiguity for certain DeFi models (e.g., fully autonomous DAOs)

- Cost of maintaining compliance and obtaining licenses

- Limited access to traditional banking for crypto startups

- Market volatility and security vulnerabilities in DeFi protocols

Mitigating these risks requires legal foresight, strong internal governance, and robust technical architecture.

Conclusion

Dubai represents one of the most fertile grounds for launching a successful DeFi venture. Its supportive regulatory framework, innovative ecosystem, and access to global markets make it an exceptional environment for Web3 entrepreneurs. However, to succeed, founders must embrace both technical innovation and regulatory compliance as core pillars.

Despite the challenges facing blockchain startups in the UAE, Dubai is leading the way for blockchain adoption, from tokenomics to KYC, from smart contract audits to licensing via VARA—each step is crucial. The most successful DeFi projects in Dubai will be those that balance decentralization with accountability, and innovation with legal structure.

Partner with Websima to Launch Your DeFi Venture

Navigating the complexities of launching a DeFi project in Dubai doesn’t have to be overwhelming. At Websima, we specialize in guiding blockchain and DeFi startups from ideation to launch.

Our DeFi services include:

- Tokenomics design & legal structuring

- VARA license application support

- KYC/AML integration strategies

- Technical architecture reviews

- Smart contract auditing coordination

- Whitepaper & investor deck development

Whether you’re planning to launch a decentralized exchange, lending protocol, or yield aggregator, Websima helps you build compliant, scalable, and secure Web3 businesses in Dubai.

Let’s shape the future of decentralized finance together.

Get started with Websima →

FAQs

- Can I launch a DeFi project in Dubai as a non-resident?

Yes. Many free zones allow full foreign ownership and remote registration, making it easy for non-residents to launch DeFi startups. - How long does it take to get a VARA license?

The process can vary depending on your business model and the completeness of your application, but typically ranges from 2 to 3 months, including submission, review, and approval stages. - What is the minimum capital requirement for DeFi startups?

Minimum capital requirements depend on the selected free zone. For instance, DMCC mandates a minimum of AED 50,000, but other zones may vary. Always consult the specific free zone authority or legal advisor for the most accurate requirement. (Source) - Is full decentralization allowed under VARA regulations?

While decentralization is encouraged, full autonomy without legal accountability is discouraged. VARA expects identifiable responsible parties. - What taxes apply to DeFi businesses in Dubai?

Currently, there is 0% personal income tax and 0% corporate tax for most free zone businesses not dealing with mainland UAE markets. - Do corporate taxes apply if my DeFi business deals with mainland UAE clients?

Yes. If your DeFi project generates income from the UAE mainland market, it may become subject to 9% corporate tax, as per the UAE Corporate Tax Law implemented in 2023. Businesses operating in free zones must ensure they maintain compliance and assess whether they derive any income from mainland operations. Always consult with a licensed tax advisor to structure your operations correctly.

Currently, there is 0% personal income tax and 0% corporate tax for most free zone businesses not dealing with mainland UAE markets.