Dubai has emerged as a global leader in the regulation of virtual assets, establishing the Virtual Assets Regulatory Authority (VARA) to oversee and guide the burgeoning digital asset industry. This article delves into the various license types offered by VARA, the compliance processes required for Virtual Asset Service Providers (VASPs), and the pivotal roles VARA plays in fostering a secure and innovative virtual asset ecosystem in Dubai.

Table of Contents

- Introduction to VARA Dubai: Setting the Global Standard for Digital Asset Regulation

- VARA License Types

- Compliance Processes for VASPs

- Roles and Responsibilities of VARA

- Benefits of VARA Licensing

- Challenges and Considerations

- Conclusion: A New Era for Virtual Assets Begins with Regulatory Confidence

- Partner with Websima to Navigate VARA Compliance Confidently

- FAQs

Introduction to VARA Dubai: Setting the Global Standard for Digital Asset Regulation

As the world accelerates toward digital transformation, few jurisdictions have demonstrated the foresight and agility of the United Arab Emirates—especially Dubai. With its status as a global hub for fintech, blockchain innovation, and digital finance, Dubai recognized early on the importance of establishing a strong regulatory framework to govern virtual assets. In response, the Virtual Assets Regulatory Authority (VARA) was established under Dubai Law No. 4 of 2022, positioning Dubai as one of the first governments in the world to formalize a standalone regulatory entity focused exclusively on virtual assets like blockchain regulations in UAE 2025.

VARA Dubai plays a critical role in shaping the local and international digital economy. It governs Virtual Asset Service Providers (VASPs) across a broad range of activities, ensuring security, transparency, and innovation are at the forefront of every transaction. From cryptocurrency exchanges and NFT platforms to custodial services and token issuers, VARA’s jurisdiction encompasses a wide range of modern business models that would otherwise operate in a legal gray zone.

Solana Foundation just signed an MOU with VARA, Dubai’s Virtual Assets Regulatory Authority. It sets the stage for deep collaboration between crypto builders and regulators:

> Talent development programs

> Sharing economic impact + sector data

> Workshops + advisory sessions for… pic.twitter.com/vFXCDqzkZx— Solana (@solana) June 3, 2025

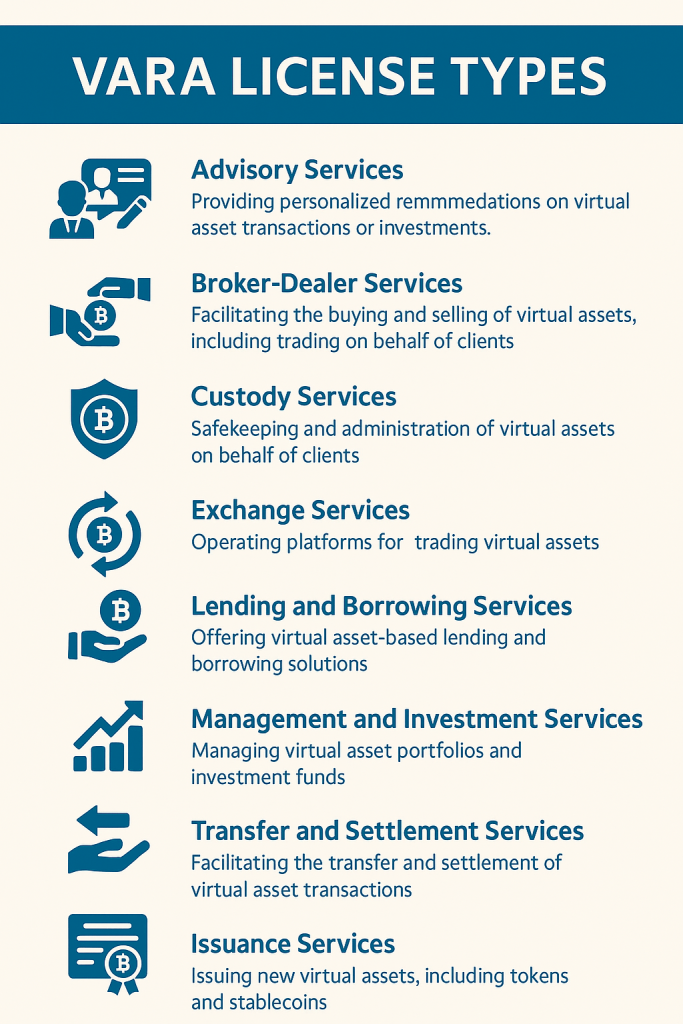

VARA License Types

VARA offers a comprehensive licensing framework tailored to various virtual asset activities including crypto licensing for Web3 companies. The eight primary license categories include:

- Advisory Services: Providing personalized recommendations on virtual asset transactions or investments.

- Broker-Dealer Services: Facilitating the buying and selling of virtual assets, including trading on behalf of clients.

- Custody Services: Safekeeping and administration of virtual assets on behalf of clients.

- Exchange Services: Operating platforms for trading virtual assets.

- Lending and Borrowing Services: Offering virtual asset-based lending and borrowing solutions.

- Management and Investment Services: Managing virtual asset portfolios and investment funds.

- Transfer and Settlement Services: Facilitating the transfer and settlement of virtual asset transactions.

- Issuance Services: Issuing new virtual assets, including tokens and stablecoins.

Each license type has specific requirements and obligations, ensuring that VASPs operate within defined parameters.

Compliance Processes for VASPs

To maintain the integrity of Dubai’s virtual asset ecosystem, VARA mandates stringent compliance processes for all licensed entities:

- Licensing Application: Entities must apply for the appropriate license, providing detailed information about their operations, governance structures, and compliance frameworks (VARA Rulebook).

- Compliance and Risk Management: VASPs are required to implement robust compliance programs, including appointing a Compliance Officer and establishing internal controls to manage risks (VARA Compliance).

- AML/CFT Measures: Adherence to Anti-Money Laundering and Counter-Terrorism Financing regulations is mandatory, with VASPs expected to conduct customer due diligence and report suspicious activities.

- Regular Audits and Reporting: Licensed entities must undergo periodic audits and submit regular reports to VARA, ensuring ongoing compliance and transparency.

Non-compliance can result in penalties, including fines, suspension, or revocation of licenses.

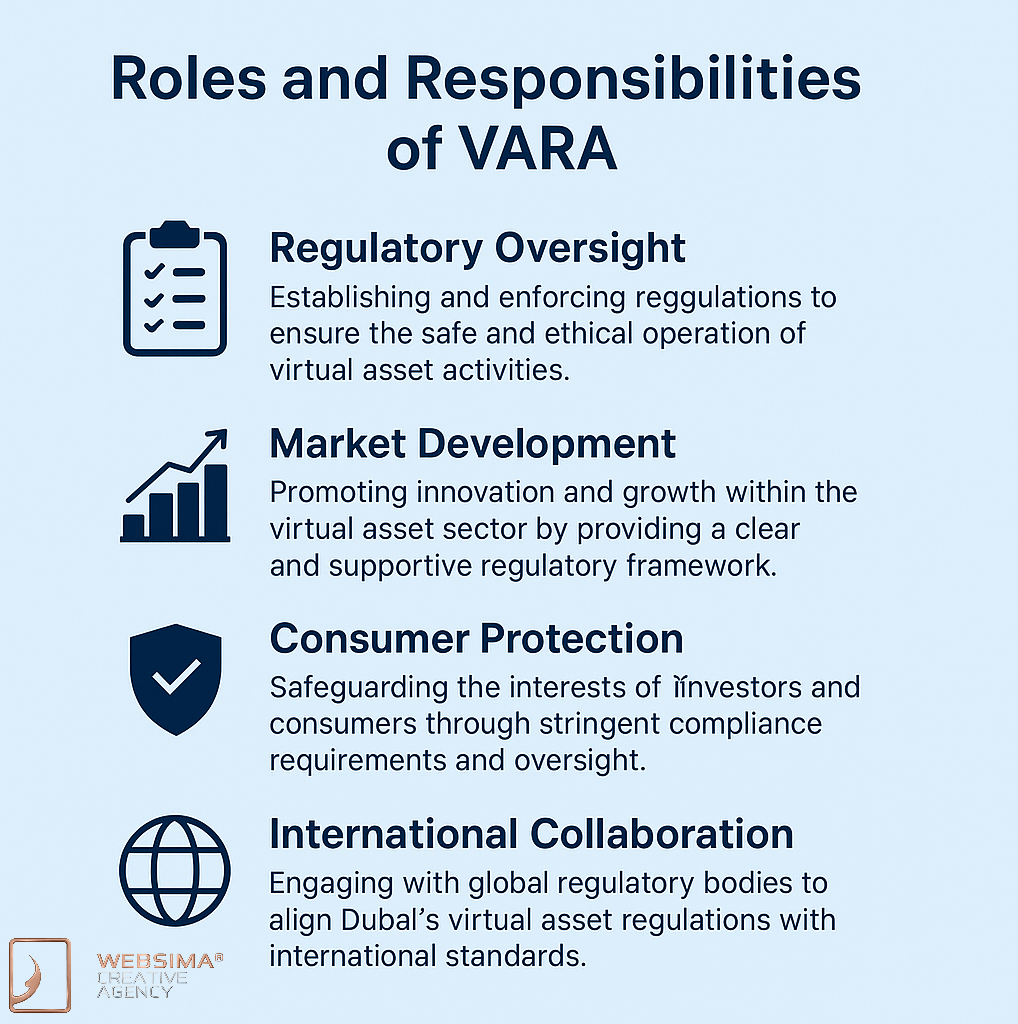

Roles and Responsibilities of VARA

VARA plays a multifaceted role in shaping Dubai’s virtual asset landscape:

- Regulatory Oversight: Establishing and enforcing regulations to ensure the safe and ethical operation of virtual asset activities.

- Market Development: Promoting innovation and growth within the virtual asset sector by providing a clear and supportive regulatory framework.

- Consumer Protection: Safeguarding the interests of investors and consumers through stringent compliance requirements and oversight.

- International Collaboration: Engaging with global regulatory bodies to align Dubai’s virtual asset regulations with international standards.

Benefits of VARA Licensing

Obtaining a VARA license offers several advantages for virtual asset businesses:

- Credibility: A VARA license signifies adherence to high regulatory standards, enhancing trust among clients and investors.

- Market Access: Licensed entities can operate legally within Dubai’s thriving virtual asset market.

- Regulatory Clarity: Clear guidelines and expectations reduce uncertainty, allowing businesses to focus on growth and innovation.

- Supportive Ecosystem: VARA’s commitment to fostering a dynamic virtual asset environment provides businesses with opportunities for collaboration and development (Filings.ae).

Challenges and Considerations

While VARA’s regulatory framework offers numerous benefits, businesses must navigate certain challenges:

- Compliance Costs: Implementing and maintaining compliance programs can be resource-intensive.

- Regulatory Updates: Staying abreast of evolving regulations requires continuous monitoring and adaptation.

- Operational Requirements: Meeting VARA’s operational standards, including staffing and technological infrastructure, necessitates careful planning.

Businesses must weigh these considerations against the advantages of operating within a regulated environment.

Conclusion: A New Era for Virtual Assets Begins with Regulatory Confidence

Dubai’s vision for a future powered by digital finance is becoming reality through proactive regulation and strategic governance. With the creation of VARA Dubai, the emirate has not only addressed the need for clarity and compliance in the virtual assets space but also set an example for the rest of the world. The authority’s comprehensive, forward-thinking approach reflects the delicate balance between encouraging technological advancement and enforcing strict compliance to safeguard consumers and financial systems.

For businesses, a VARA license is not merely a regulatory requirement—it’s a badge of legitimacy. It signals to customers, partners, and global investors that your operations are transparent, secure, and aligned with international standards. It also unlocks access to a booming regional market that is increasingly comfortable with digital assets, tokenization, and blockchain-based financial services.

As other global jurisdictions grapple with fragmented or outdated crypto regulations, Dubai—through VARA—is offering a blueprint for sustainable virtual asset growth. Whether you’re launching a crypto exchange, managing client wallets, or issuing tokenized real estate shares, understanding and aligning with VARA is your first step toward success in the MENA digital economy.

Partner with Websima to Navigate VARA Compliance Confidently

Whether you’re a blockchain startup or an established VASP planning to operate in Dubai, aligning with VARA’s regulatory standards is non-negotiable for long-term success. But navigating these complexities—license selection, audit compliance, risk reporting, and KYC frameworks—requires more than just good intentions. It demands expert guidance.

Websima specializes in helping blockchain-driven businesses like yours achieve full compliance with Dubai’s Virtual Asset Regulatory Authority (VARA). Our services are tailored to your needs—whether you’re applying for your first license, scaling operations across license categories, or undergoing VARA audits.

We assist with:

- License preparation and submission

- Regulatory strategy consulting

- Smart contract and token structure alignment

- KYC/AML integration

- Ongoing VARA reporting compliance

- Audit readiness and risk mitigation

Start your compliance journey today with Websima.

Click here to contact us

FAQs

- What is VARA Dubai?

VARA (Virtual Assets Regulatory Authority) is Dubai’s dedicated regulatory body overseeing virtual asset activities, including licensing and compliance, to ensure a secure and transparent digital asset ecosystem. - Who needs a VARA license?

Any entity intending to engage in virtual asset activities within Dubai (excluding DIFC) must obtain the appropriate VARA license corresponding to their specific operations. - How long does the VARA licensing process take?

The duration varies based on the complexity of the application and the entity’s preparedness. Typically, the process involves initial application submission, review, and approval stages. - Are there penalties for non-compliance with VARA regulations?

Yes, VARA can impose penalties, including fines, suspension, or revocation of licenses, for entities that fail to adhere to regulatory requirements. - Can foreign companies apply for a VARA license?

Yes, foreign entities can apply for a VARA license, provided they meet all regulatory requirements and establish a presence within Dubai.