Table of Contents

- Introduction: UAE’s Fertile Ground for Blockchain

- What Drives Blockchain Success in the UAE?

- Case Studies of Successful Blockchain Startups in the UAE

- MidChains (Abu Dhabi)

- Biconomy (Dubai)

- Virtuzone x TOKO

- Verofax

- Scaling Strategies That Work

- Regulatory Alignment

- Tokenization Models

- Smart Contract Utility

- Strategic Partnerships

- Government Support and Initiatives

- Common Challenges and How Startups Overcome Them

- FAQs

- Conclusion

- CTA: Launch and Scale Your Blockchain Venture with Websima

Introduction: UAE’s Fertile Ground for Blockchain

The UAE is no longer just an oil-rich powerhouse—it’s now a global incubator for blockchain innovation. From crypto exchanges to tokenized real estate, the UAE has become a launchpad for next-gen startups. By 2023, over 1,400 blockchain-based entities were registered across Dubai and Abu Dhabi, according to the UAE’s Ministry of Economy. Many of these aren’t just surviving—they’re thriving, as top blockchain business models in Dubai and the UAE.

This article explores the success stories and scaling strategies of some of the most successful blockchain startups in the UAE and the ecosystem that fuels their growth.

Dubai’s hot but what’s even hotter here is the digital asset future

Our MENA CEO Rifad Mahasneh joins the VARA CEO, Further Ventures MP & Nine Blocks Capital Management MP to discuss UAE’s rise as a global crypto leader.

Here’s to a compliant & decentralized future pic.twitter.com/N3edtsZIIW

— OKX (@okx) May 1, 2025

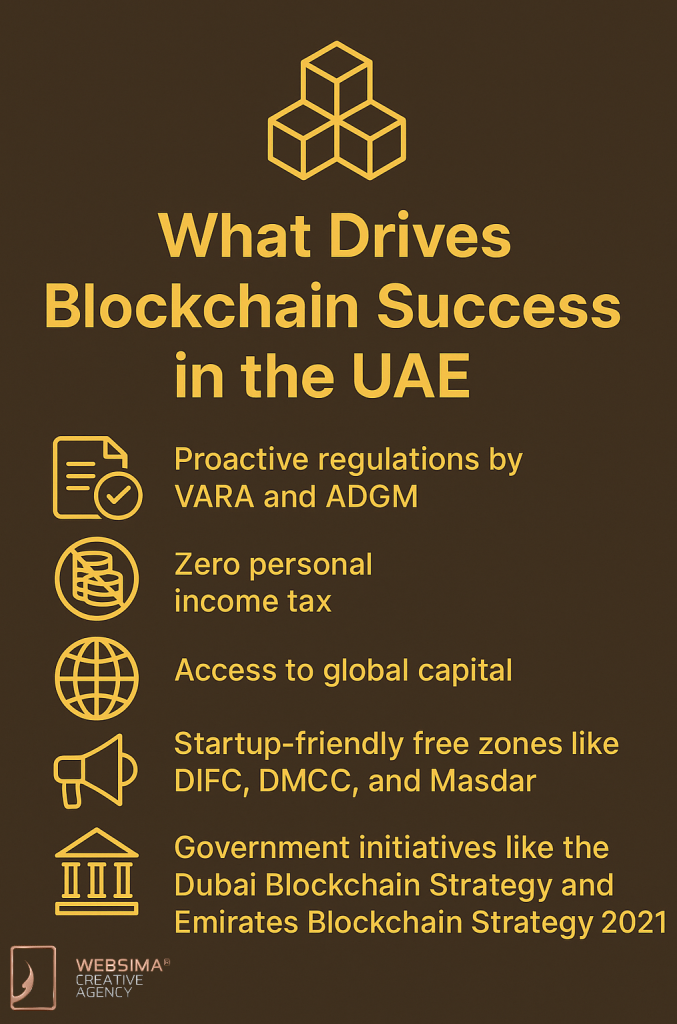

What Drives Blockchain Success in the UAE?

Several unique factors contribute to the rise of successful blockchain startups in the UAE:

- Proactive regulations by VARA and ADGM

- Zero personal income tax

- Access to global capital

- Startup-friendly free zones like DIFC, DMCC, and Masdar

- Government initiatives like the Dubai Blockchain Strategy and Emirates Blockchain Strategy 2021

Add to this the country’s ambition to digitize everything from property to trade logistics, and you have a landscape primed for blockchain disruption.

Case Studies of Successful Blockchain Startups in the UAE

1. MidChains (Abu Dhabi)

Licensed by ADGM, MidChains is one of the UAE’s first fully regulated digital asset exchanges. Unlike traditional platforms, it uses blockchain for post-trade transparency and real-time settlement.

Success Indicators:

- Fully regulated by ADGM’s Financial Services Regulatory Authority

- Raised millions from Mubadala Capital

- Offers institutional-grade security and custody services

2. Biconomy (Founded in Dubai)

Biconomy focuses on simplifying blockchain transactions through gasless and multichain transactions. Although the company has expanded globally, its roots lie in the UAE.

Key Success Metrics:

- Secured $11.5M Series A led by Coinbase Ventures

- Processes over 50 million transactions across Ethereum and Polygon

- Enables DeFi and NFT apps to offer seamless user onboarding

3. Virtuzone x TOKO

Virtuzone, a UAE business formation provider, partnered with TOKO, a tokenization platform backed by DLA Piper, to offer business setup via crypto payments.

Achievements:

- First to accept cryptocurrency payments for company registration in the UAE

- Launched tokenized business structures with legal compliance

- Bridging regulatory gaps between Web2 and Web3 business entities

4. Verofax

Verofax uses blockchain for supply chain traceability, serving luxury, retail, and healthcare sectors. Its identity verification engine leverages smart contracts to guarantee product authenticity.

Why It’s Successful:

- Approved by Microsoft’s Startups Program

- Partnered with GS1 UAE for retail verification

- Deployed in Carrefour and Lulu Group chains

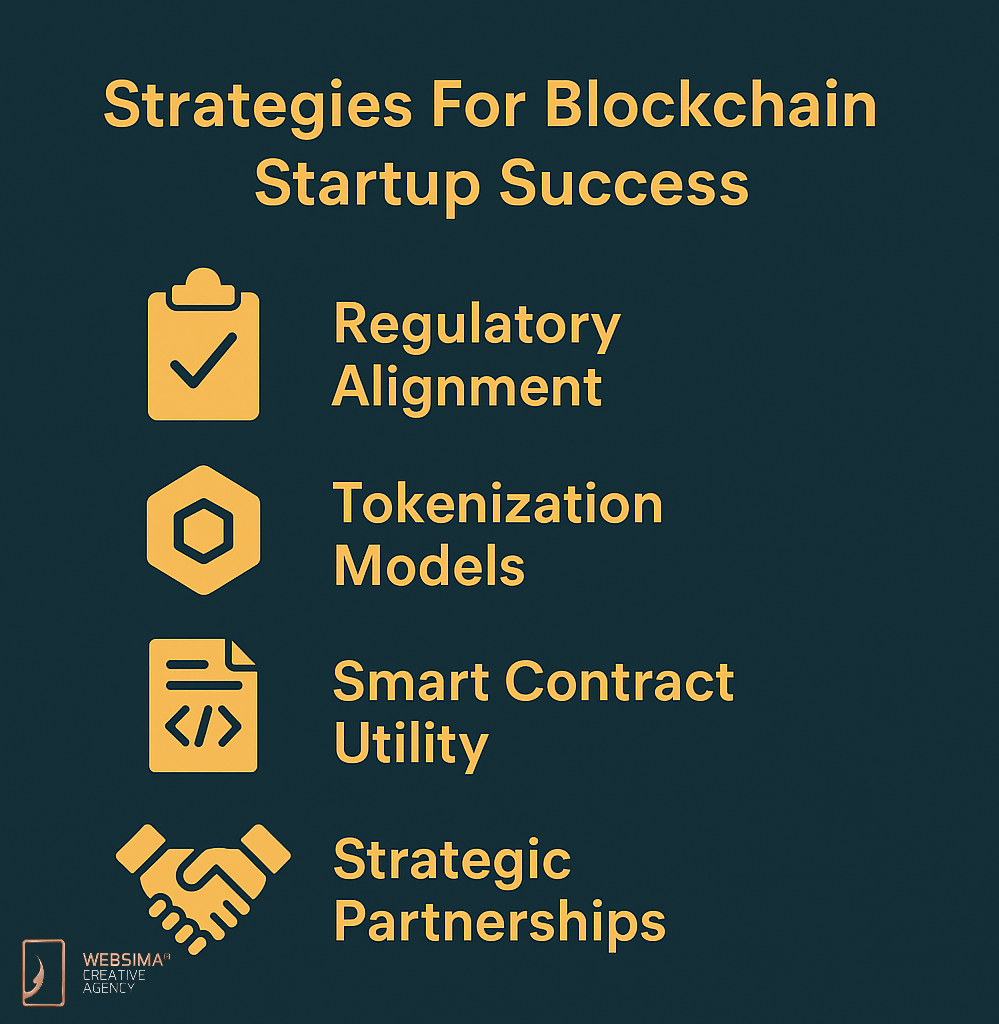

Scaling Strategies That Work

Regulatory Alignment

It is essential to have a clear overview of UAE’s blockchain regulation in 2025 as the first step. Startups succeeding in the UAE tend to register early with VARA or ADGM, gaining legal clarity. This:

- Opens banking channels

- Builds trust with investors

- Ensures sustainable operations

Tokenization Models

Many startups use utility or asset-backed tokens to:

- Raise funds through token sales or SAFEs

- Provide services via microtransactions

- Represent physical assets like real estate or carbon credits

Smart Contract Utility

Deploying well-audited smart contracts is central to scaling. Use cases include:

- Escrow for real estate (e.g., Dubai REST)

- Royalty automation for NFT platforms

- DeFi protocols for microloans and staking

Strategic Partnerships

From government accelerators to multinational VCs, alliances are critical:

- Hub71 (Abu Dhabi) provides up to AED 1M in funding

- In5 Dubai offers smart workspace access

- Global partners like ConsenSys and Chainlink Labs assist in tech integration

Government Support and Initiatives

The UAE government plays a pivotal role through:

- VARA (Virtual Assets Regulatory Authority): First of its kind globally

- Emirates Blockchain Strategy 2021: Digitizing 50% of government transactions

- Dubai Metaverse Strategy: Aims to add $4B to the economy by 2030

- DIFC Innovation Hub: Incubates blockchain, fintech, and Web3 startups

Common Challenges and How Startups Overcome Them

| Challenge | Mitigation Strategy |

| Regulatory ambiguity | Register under sandbox programs or use legal advisors |

| Banking difficulties | Partner with crypto-friendly banks like Wio or Zand |

| Token launch risks | Use vetted launchpads and follow KYC/AML best practices |

| Developer scarcity | Outsource smart contract auditing and hire globally |

FAQs

Q: How long does it take to launch a blockchain startup in the UAE?

A: The timeline varies depending on your jurisdiction, regulatory approvals, and business activities. While basic free zone setups may complete in 4–6 weeks, regulated blockchain ventures (especially those requiring VARA or ADGM licensing) can take 8 to 20 weeks or more due to compliance reviews, KYC/AML procedures, and smart contract evaluations.

Q: Can foreign nationals fully own a blockchain startup in the UAE?

A: Yes. Most UAE free zones allow 100% foreign ownership, even for Web3 and blockchain-based entities.

Q: What are the startup costs?

A: Startup costs range widely from AED 70,000 to AED 300,000+, depending on your licensing authority (e.g., DMCC vs. DIFC), the complexity of your platform (e.g., tokenization, DeFi, NFT marketplace), and regulatory compliance needs (e.g., audits, legal advisory, VARA applications).

Q: Are ICOs allowed in the UAE?

A: ICOs remain unregulated. Instead, most compliant startups pursue Security Token Offerings (STOs) or utility token models that align with VARA and ADGM expectations.

Conclusion

The UAE has become a proving ground for successful blockchain startups. Thanks to smart regulations, venture capital influx, and government-backed innovation zones, the country has enabled bold ideas to scale into fully operational ventures.

From crypto exchanges like MidChains to tokenized supply chains via Verofax, the UAE is not just supporting blockchain—it’s accelerating its adoption with structure and intent.

If you’re building or investing in blockchain, there’s no better time than now, and no better place than the UAE.

Launch and Scale Your Blockchain Venture with Websima

At Websima, we specialize in launching and scaling high-performance blockchain startups in the UAE. Whether you’re focused on smart contract deployment, DeFi lending, tokenization, or NFTs—we’re here to support your Web3 goals.

We help with:

- Free zone company registration (DIFC, ADGM, DMCC)

- Custom blockchain architecture and tokenomics

- Legal structuring for STOs, DAOs, and utility tokens

- Smart contract development & auditing

- MVP-to-mainnet product development

Let’s build your blockchain success story in the UAE. Get in touch now.