Table of Contents

- Introduction: Why Dubai for Web3 Startups?

- Overview of Legal Frameworks for Web3 Startups

- Step-by-Step Process to Register a Web3 Startup in Dubai

- Choose the Right Free Zone or Jurisdiction

- Determine the Business Activities and Legal Structure

- Submit Initial Approvals and Trade Name

- Regulatory Approvals from VARA or DIFC Innovation Hub

- Finalize Licensing and Office Setup

- Key Authorities: VARA, DIFC, and DMCC Compared

- Compliance Obligations After Registration

- Common Challenges and How to Avoid Them

- Case Study: Launching a DeFi Startup in DMCC

- Legal Costs and Fees Breakdown

- Mistakes to Avoid When Registering a Web3 Startup

- FAQs

- Conclusion

- Launch Your Web3 Startup with Confidence

Introduction: Why Dubai for Web3 Startups?

Join Us at Dubai Marina!

Building the Future: Decentralized Future Lab Connect with InitVerse for an evening of Web3 innovation, networking, and fresh ideas! Dive into the latest updates on InitVerse, DePIN, and the groundbreaking DATS project—over coffee and a great… pic.twitter.com/fYBXBVJNpL— InitVerse (@InitVerse) April 23, 2025

Dubai has emerged as a global hub for blockchain innovation, thanks to its government-backed support for Web3 ecosystems and favorable tax frameworks. Whether you’re building a DeFi app, NFT marketplace, or DAO, Dubai is leading for Web3 global adoption by offering cutting-edge infrastructure, crypto-friendly regulators, and free zone environments that make it ideal for register Web3 startup Dubai.

Key incentives include:

- Zero personal income tax

- 100% foreign ownership in free zones

- Access to the Dubai Virtual Assets Regulatory Authority (VARA)

- Tech-focused hubs like DIFC Innovation Hub and DMCC Crypto Centre

Overview of Legal Frameworks for Web3 Startups

Registering a Web3 startup in Dubai involves navigating multiple legal layers:

- Corporate licensing through a free zone like DIFC or DMCC

- Virtual asset regulatory approval via VARA

- Compliance with AML/CFT, KYC, and data privacy standards

- Token issuance and utility classification, depending on the business model

Different zones have varying degrees of regulatory independence, and understanding these frameworks is key to choosing the right setup for your venture.

Step-by-Step Process to Register a Web3 Startup in Dubai

1. Choose the Right Free Zone or Jurisdiction

Each jurisdiction offers distinct advantages:

- VARA (Dubai Mainland): Best for virtual asset exchanges, custodians, or token issuance platforms.

- DIFC: Ideal for fintech, smart contract development, DeFi, and blockchain infrastructure startups.

- DMCC: Home to the DMCC Crypto Centre, suitable for NFT projects, DAOs, and crypto services.

Research licensing types and consult legal advisors to align your activities with regulatory permissions.

2. Determine the Business Activities and Legal Structure

You’ll need to define:

- Business activity (e.g., software development, digital asset brokerage)

- Company name (must not reference “crypto” or “blockchain” without approval)

- Shareholders, directors, and capital structure

- Office location (physical or Flexi-desk in the free zone)

3. Submit Initial Approvals and Trade Name

Apply for:

- Name reservation

- Initial approval certificate

- Preliminary business plan

These are usually submitted through the portal of the chosen free zone, such as DMCC’s online registration platform.

4. Regulatory Approvals from VARA or DIFC Innovation Hub

If your Web3 startup handles digital assets (trading, custody, issuance), you must seek licensing from VARA.

VARA Licensing Process:

- Submit VASP license application

- Provide detailed tokenomics (if applicable)

- Undergo financial and cybersecurity audits

- Comply with VARA’s Virtual Assets and Related Activities Regulations 2023

DIFC companies may also require approval if providing regulated fintech services, governed by the DFSA.

5. Finalize Licensing and Office Setup

After receiving regulatory approvals:

- Sign MoA and lease agreement

- Submit all documents for license issuance

- Open a UAE business bank account

- Apply for visas, if applicable

Once completed, your Web3 startup will receive a trade license and can operate legally in Dubai.

Key Authorities: VARA, DIFC, and DMCC Compared

| Authority | Best For | Key Advantage | Regulatory Body |

| VARA | Exchanges, Token Projects | First virtual asset regulator globally | VARA |

| DIFC | Fintech, Smart Contracts | English Common Law legal system | DFSA |

| DMCC | NFT Platforms, DAOs | Crypto Centre ecosystem | DMCC |

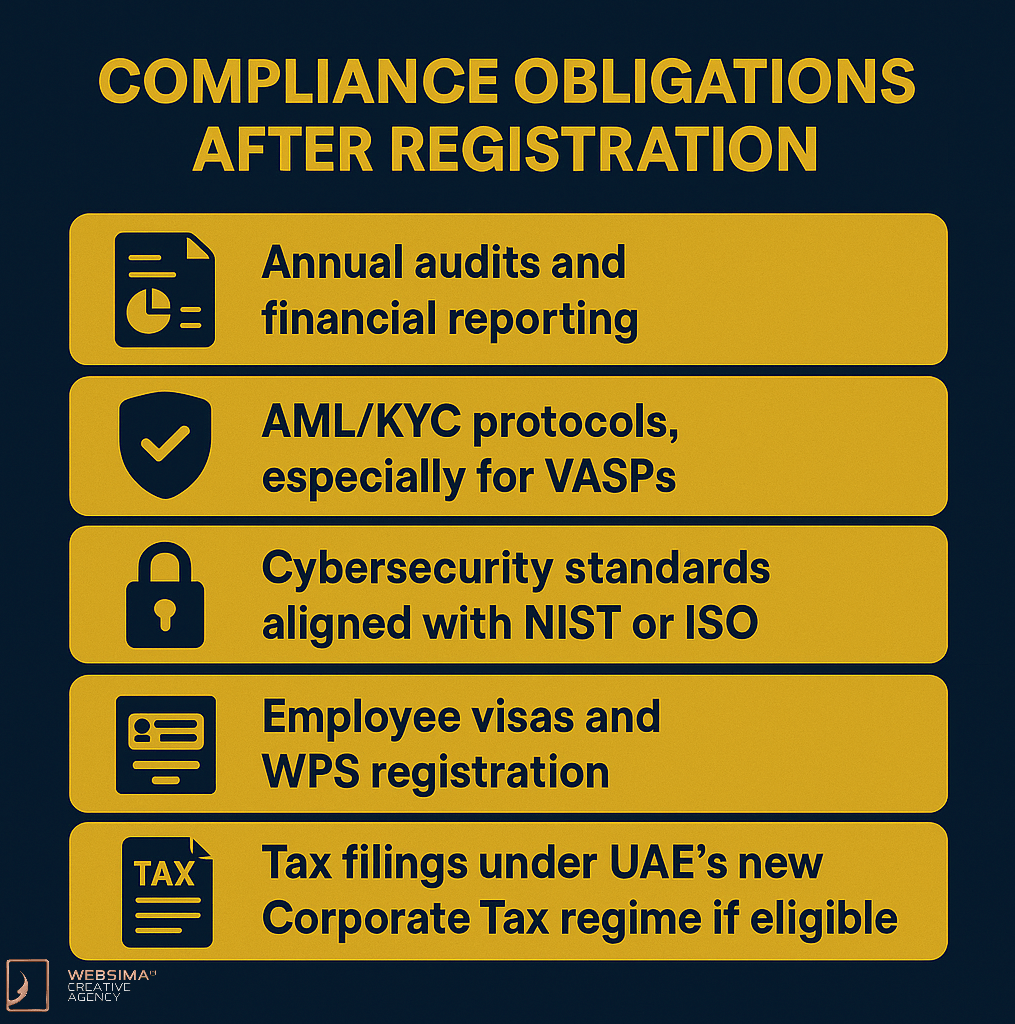

Compliance Obligations After Registration

Once registered, your Web3 startup must adhere to:

- Annual audits and financial reporting

- AML/KYC protocols, especially for VASPs

- Cybersecurity standards aligned with NIST or ISO frameworks

- Employee visas and WPS registration

- Tax filings under UAE’s new Corporate Tax regime if eligible

Failure to comply can result in license suspension or fines.

Common Challenges and How to Avoid Them

| Challenge | How to Overcome |

| Delayed approvals from VARA | Submit full technical documentation and compliance reports early |

| Bank account rejections | Use banks experienced with crypto startups, like WIO or RAKBANK |

| Token misclassification | Consult legal experts on VARA’s utility vs. security token criteria |

| Visa delays | Use a business setup service familiar with tech sector |

Case Study: Launching a DeFi Startup in DMCC

A Swiss-based team registered a DeFi liquidity platform in DMCC’s Crypto Centre. They:

- Registered as a tech development firm (not financial services)

- Partnered with a UAE compliance consultant

- Received approval for a tokenized staking product under VARA’s oversight

- Opened a business account through a crypto-friendly banking partner

By proceeding in compliance with how to launch a DeFI project in Dubai, they launched within 5 months, fully licensed and compliant.

Legal Costs and Fees Breakdown

| Item | Estimated Cost (AED) |

| Company registration (DMCC or DIFC) | 15,000–25,000 |

| VARA VASP license | 40,000–200,000+ (depending on activity) |

| Office lease (Flexi-desk) | 10,000–20,000/year |

| Legal consultation | 5,000–15,000 |

| Bank account setup | Free to 5,000 (varies by bank) |

Mistakes to Avoid When Registering a Web3 Startup

- Skipping legal consultation on token classification

- Using prohibited terms (e.g., “ICO”) in trade name

- Underestimating KYC/AML requirements

- Choosing the wrong free zone (not aligned with activities)

- Not budgeting for compliance audits and banking delays

FAQs

Q: Do I need a local partner to start a Web3 company in Dubai?

A: No, in free zones like DMCC and DIFC, 100% foreign ownership is allowed.

Q: Can I operate globally from Dubai?

A: Yes, Dubai-based Web3 startups can offer services internationally, depending on regulatory compliance.

Q: What licenses are required to issue tokens?

A: VARA approval is mandatory for any form of token issuance in Dubai.

Q: Can I open a crypto bank account in the UAE?

A: Some banks support crypto companies with proper licensing and documentation (e.g., WIO Bank, Zand).

Q: How long does the registration process take?

A: t typically takes 8 to 20 weeks, depending on your business model and regulatory requirements. For complex activities like token issuance, DeFi platforms, or NFT marketplaces that fall under VARA’s scope, the process can take up to 6 months due to additional compliance checks and cybersecurity reviews.

Q: How much does it cost to register a Web3 startup in Dubai?

A: The total cost typically ranges between AED 70,000 to AED 300,000 or more, depending on the free zone, business activity, and whether VARA licensing is required.

- On the lower end (AED 70,000–100,000), you can register a basic Web3 services company (e.g., software or consulting) in DMCC or DIFC without handling virtual assets.

- On the higher end (AED 200,000–300,000+), the cost includes VARA’s licensing, compliance audits, legal consultation, token approval processes, and office lease commitments for regulated virtual asset businesses.

Conclusion

Dubai offers one of the world’s most advanced and supportive regulatory frameworks for Web3 startups. Whether you’re launching a DeFi protocol, NFT marketplace, or decentralized app, aligning your business with VARA, DIFC, or DMCC ensures long-term scalability, legal protection, and access to capital. The key lies in understanding the licensing routes, preparing for strict compliance, and choosing the right jurisdiction.

Launch Your Web3 Startup with Websima

At Websima, we specialize in guiding founders through the entire Web3 business journey—from concept to launch. Whether you’re building on Ethereum, Solana, or a custom blockchain, we help you:

- Navigate licensing with VARA, DIFC, and DMCC

- Structure your company legally with smart contract integration

- Develop and audit tokenomics for compliance

- Launch a high-conversion Web3 platform

Start your Web3 venture with a trusted blockchain partner. Contact us today.