Table of Contents

- Introduction

- What Are Smart Contracts and How Do They Work?

- The UAE’s Vision for Blockchain and Legal Innovation

- Current Legal Status of Smart Contracts in the UAE

- Recent Regulatory Developments Supporting Smart Contracts

- Key Legal Use Cases of Smart Contracts in the UAE

- Technical Standards and Legal Enforceability

- Case Study: Smart Contracts in UAE’s Real Estate Sector

- Challenges and Legal Risks of Smart Contracts in the UAE

- Common Mistakes to Avoid

- Legal Fees, Licensing, and Compliance Costs

- FAQs About Smart Contracts Legal UAE

- Conclusion

- Ready to Integrate Smart Contracts into Your UAE Business?

Introduction

The UAE has consistently led the Middle East in technological adoption, particularly in the areas of blockchain and digital transformation. One of the most groundbreaking elements of this movement is the rise of smart contracts—automated, self-executing agreements that are changing how businesses and legal processes operate. Yet as these contracts gain traction, questions around smart contracts legal UAE compliance become more urgent. Considering current smart contracts legal UAE, are they enforceable in court? What regulations apply? How do businesses adopt them legally and securely?

https://t.co/GkoQvYGPdy has been issued a limited licence by Dubai’s Virtual Assets Regulatory Authority (VARA) to offer derivatives in the UAE ✅ pic.twitter.com/EIYNOp8eIz

— Christiaan (@ChristiaanDefi) March 14, 2025

In this article, we delve into the future of smart contracts within the UAE’s legal framework, addressing their current status, the trajectory of legislative reform, and how businesses can leverage them without legal risk.

What Are Smart Contracts and How Do They Work?

Smart contracts are digital agreements written in code that automatically execute when predefined conditions are met. They typically run on blockchain platforms like Ethereum, Solana, or Tezos.

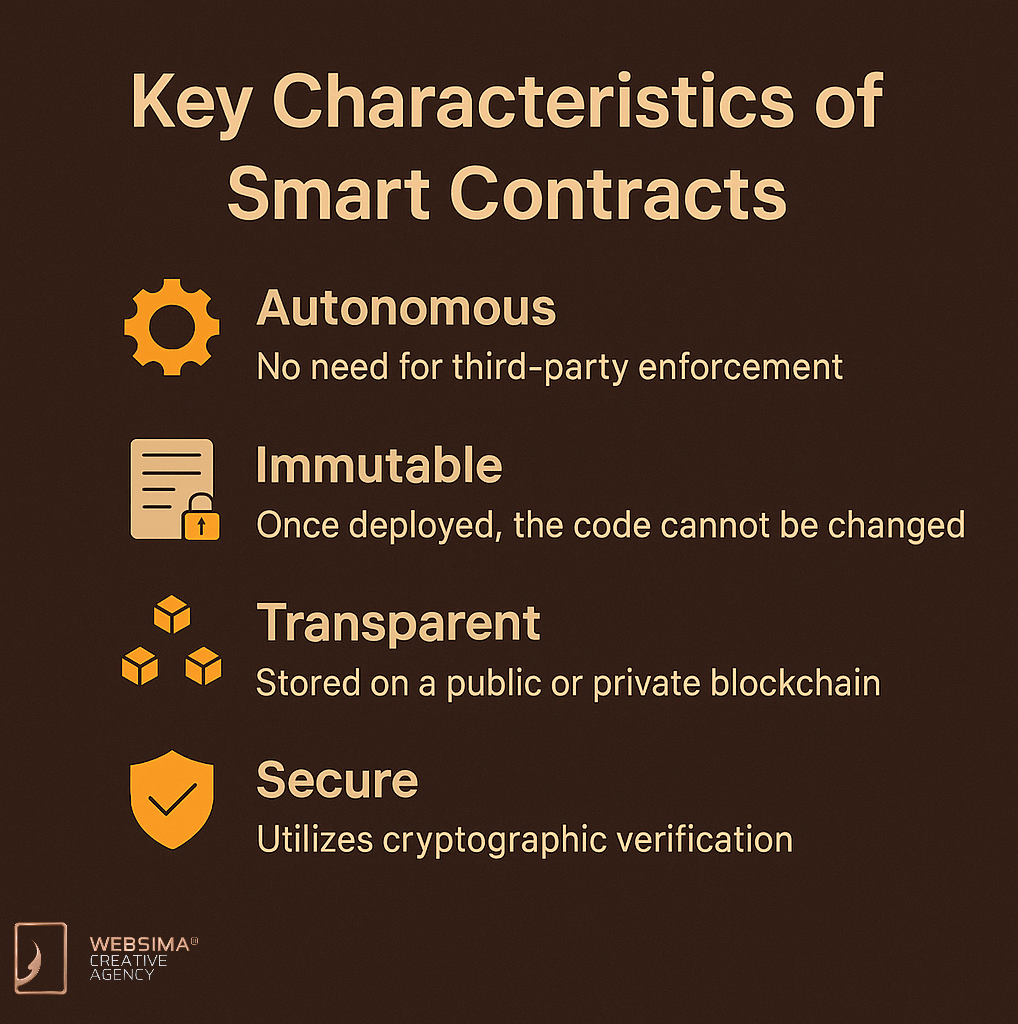

Key Characteristics:

- Autonomous: No need for third-party enforcement

- Immutable: Once deployed, the code cannot be changed

- Transparent: Stored on a public or private blockchain

- Secure: Utilizes cryptographic verification

These contracts remove ambiguity, reduce delays, and minimize administrative costs—making them ideal for real estate transactions, insurance claims, supply chains, and even government services.

The UAE’s Vision for Blockchain and Legal Innovation

The UAE has demonstrated a strong national commitment to blockchain integration, starting with the Emirates Blockchain Strategy 2021, which aimed to migrate 50% of government transactions onto blockchain.

Now, with the UAE Centennial Plan 2071 and forward-thinking cities like Dubai and Abu Dhabi leading the charge, smart contracts are no longer speculative—they’re fast becoming legal tools integrated into official processes.

Dubai’s Smart Dubai initiative that aims to make Dubai a hotspot for blockchain startups in 2025, and Abu Dhabi’s tech-forward ADGM (Abu Dhabi Global Market) ecosystem, provide fertile ground for legally secure smart contract usage.

Current Legal Status of Smart Contracts in the UAE

The UAE does not yet have a specific, codified “Smart Contract Law.” However, multiple existing laws are interpreted to validate their enforceability, particularly when used in regulated sectors.

Relevant Legal Foundations:

- Federal Law No. 1 of 2006 on Electronic Transactions and Commerce

- UAE Civil Transactions Law (Federal Law No. 5 of 1985)

- Electronic Signature Law (recognized under eCommerce regulations)

These laws emphasize intention to contract, mutual consent, and reliability of digital signatures—all principles that align with smart contracts.

In Dubai International Financial Centre (DIFC) and ADGM, which follow common law, smart contracts are even more likely to be upheld in court, especially when deployed with clear legal frameworks.

Recent Regulatory Developments Supporting Smart Contracts

The UAE has implemented several policy moves that strengthen the legal foundation for smart contracts:

1. Virtual Assets Regulatory Authority (VARA) — 2022

Established in Dubai, VARA’s role in virtual asset regulation in Dubai is to regulate blockchain-based assets and smart contract platforms.

2. Digital Economy Strategy — 2023

Pushes for seamless automation in trade, legal, and commercial operations.

3. DIFC Digital Economy Court

Launched to resolve disputes involving smart contracts and blockchain assets.

4. ADGM’s DLT Framework

Allows the legal use of distributed ledger technology for contractual operations.

These developments collectively suggest that smart contracts legal UAE viability is not just theoretical—it’s actively being reinforced by governing bodies.

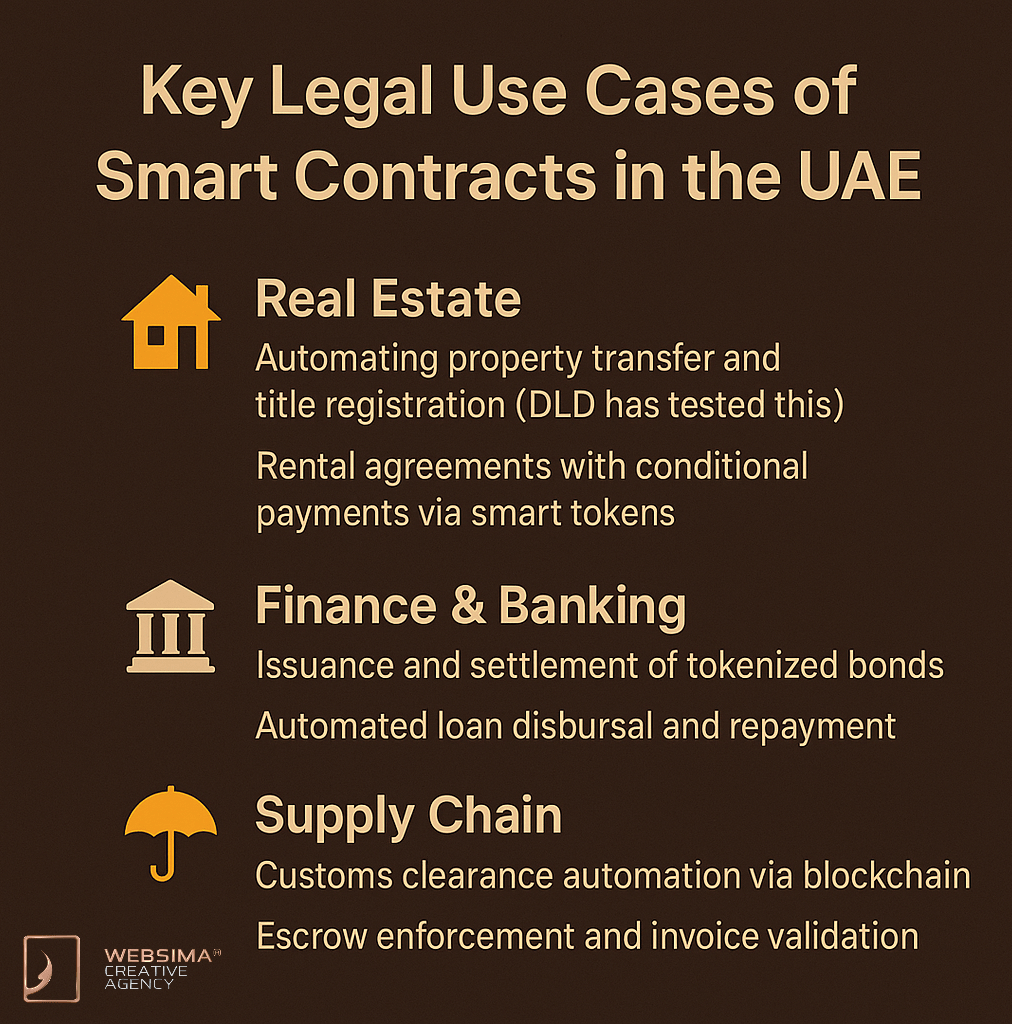

Key Legal Use Cases of Smart Contracts in the UAE

Smart contracts are already being used in sectors where legality and automation intersect. Some of the most promising applications include:

Real Estate

- Automating property transfer and title registration (DLD has tested this)

- Rental agreements with conditional payments via smart tokens

Finance & Banking

- Issuance and settlement of tokenized bonds

- Automated loan disbursal and repayment

Supply Chain

- Customs clearance automation via blockchain

- Escrow enforcement and invoice validation

Insurance

- Claims processing based on event triggers (e.g., weather data, IoT sensors)

The flexibility of smart contracts allows for wide-ranging legal implications—so long as code reflects a valid intention to contract.

Technical Standards and Legal Enforceability

To ensure legal enforceability, smart contracts must meet three key standards under UAE law:

1. Contractual Clarity

Even if coded, parties must clearly define:

- Intent

- Offer and acceptance

- Consideration (value exchanged)

2. Auditability

The code should be auditable by legal experts and third-party developers. This supports dispute resolution in court.

3. Proof of Identity

Digital signatures or biometric identification methods must be used to link parties to the contract legally.

Blockchain networks like Hyperledger Fabric (private) or Ethereum with DID (Decentralized ID) support these features.

Case Study: Smart Contracts in UAE’s Real Estate Sector

Scenario:

A property buyer in Dubai wanted to purchase a fractional share of a villa in Palm Jumeirah using a blockchain investment platform.

Solution:

- The transaction was handled via a smart contract coded to release ownership upon verification of payment on-chain.

- The Dubai Land Department (DLD) recognized the smart contract and validated the digital transaction through its blockchain registry.

Legal Framework:

- The eSignature was verified via UAE Pass

- The transfer complied with DLD blockchain integration policies

Outcome:

- Full ownership rights were granted

- A notarized digital certificate was issued

- No physical paperwork required

This real-world case shows how smart contracts are already functioning within legal UAE frameworks—especially when supported by government platforms.

Challenges and Legal Risks of Smart Contracts in the UAE

While promising, smart contracts also introduce legal challenges:

1. Code Ambiguity

If logic is unclear, courts may struggle to interpret contractual intent.

2. Jurisdiction Conflicts

Cross-border contracts may involve parties in regions without smart contract recognition.

3. Dispute Resolution Mechanisms

How do you resolve a bug-triggered transaction that locks funds or transfers assets improperly?

4. Cybersecurity Risks

Unauthorized code modifications, wallet theft, or malicious exploits can complicate legal claims.

Common Mistakes to Avoid

- Not Consulting Legal Counsel

Coders are not lawyers. Smart contracts should reflect legally binding terms, not just technical logic. - Skipping Code Audits

Security flaws or execution errors can lead to irreversible financial loss. - Using Public Chains Without Regulatory Clarity

Choose platforms that align with UAE data residency and security laws. - Ignoring Updates in UAE Law

Regulatory changes happen fast—stay informed through ADGM or DIFC.

Legal Fees, Licensing, and Compliance Costs

While using smart contracts is technically low-cost, legal and compliance-related expenses may include:

| Service | Estimated Cost (AED) |

| Smart Contract Legal Review | 5,000 – 20,000 |

| Code Audit (3rd Party) | 10,000 – 50,000 |

| DLT Business License (DIFC/ADGM) | 15,000 – 35,000 |

| VARA Licensing (if applicable) | Variable (based on activity) |

Additionally, some free zones now offer incentives or subsidized licenses for blockchain-based startups.

FAQs About Smart Contracts Legal UAE

Are smart contracts legally binding in the UAE?

Yes, if they meet the criteria of offer, acceptance, and mutual intent under UAE contract law.

Do courts accept smart contract evidence?

Yes. DIFC and ADGM courts are already trained in blockchain-related evidence handling.

Can smart contracts replace traditional agreements?

They can supplement or replace traditional contracts but should be drafted with legal oversight.

Is a smart contract the same as an e-contract?

Not exactly. Smart contracts execute actions; e-contracts are merely digital formats of traditional agreements.

Are smart contracts allowed in real estate?

Yes, particularly in fractional ownership models and tokenized property sales under DLD pilot programs.

Conclusion

The UAE’s legal framework is quickly evolving to embrace blockchain-powered smart contracts across sectors. While no standalone “Smart Contract Law” exists yet, existing electronic transaction laws, civil codes, and recent regulatory innovations provide a solid foundation for legal enforcement.

As Dubai and Abu Dhabi continue integrating smart systems in real estate, finance, and government services, smart contracts are becoming less of a novelty and more of a legal necessity. However, their full potential depends on businesses’ ability to navigate legal obligations—something that requires both technical precision and legal understanding.

Smart contracts are not “one-click agreements.” They are programmable legal instruments that, when used correctly, will revolutionize how business is conducted in the UAE.

Ready to Integrate Smart Contracts into Your UAE Business?

At Websima, we specialize in the legal development and deployment of smart contracts, designed specifically for the UAE’s evolving digital economy. From compliance-aligned code audits to legal documentation and platform architecture, our team ensures every smart contract you deploy is both technically sound and legally enforceable.

Whether you’re launching a tokenized real estate platform, an NFT marketplace, or automating commercial agreements,

Contact us today to ensure your smart contract strategy is 100% future-ready—and 100% compliant.