Table of Contents

- Introduction

- What Is ESG and Why It Matters in Dubai

- How Blockchain Technology Supports ESG Compliance

- Dubai’s ESG Vision and Sustainability Frameworks

- Blockchain-Driven ESG Use Cases in Dubai

- Key Benefits of Blockchain in ESG Reporting

- Regulatory Landscape for Blockchain ESG in Dubai

- Challenges and Risks in Blockchain ESG Integration

- Global Best Practices and Lessons for Dubai

- The Future of Blockchain ESG in the UAE

- Conclusion

- Work with Websima on ESG Blockchain Solutions

Introduction

As Dubai accelerates its vision for a sustainable, tech-enabled future, Environmental, Social, and Governance (ESG) compliance has emerged as a cornerstone of policy and corporate strategy. Simultaneously, blockchain is redefining how cities and enterprises approach transparency, traceability, and trust. The convergence of these two powerful forces is shaping a new paradigm: Blockchain ESG Dubai. This article explores how blockchain is enabling Dubai to set global standards in ESG metrics, transparency, and sustainability reporting.

What Is ESG and Why It Matters in Dubai

ESG refers to non-financial performance indicators that assess a company’s impact on the environment, society, and governance practices. In Dubai, ESG compliance is driven by both global investor expectations and local initiatives like the Dubai Clean Energy Strategy 2050 and the Dubai Sustainable Finance Working Group.

Key ESG Pillars:

- Environmental: Energy usage, emissions, waste, resource efficiency

- Social: Labor rights, diversity, community engagement

- Governance: Board structure, data privacy, anti-corruption

With ESG becoming integral to economic planning, Dubai-based firms are under growing pressure to demonstrate ESG accountability with verifiable and auditable data—a gap blockchain can uniquely fill.

How Blockchain Technology Supports ESG Compliance

⚠️DUBAI JUST DID WHAT THE REST OF THE WORLD ONLY TALKS ABOUT.

They’ve started tokenizing real estate on the XRP Ledger.

Yes, it’s real. The pilot is live. And it could change everything.

Let me show you what’s happening. pic.twitter.com/iIcB7ITGv8

— All Things XRP (@XRP_investing) May 18, 2025

Blockchain brings decentralization, immutability, and real-time data synchronization—all essential traits for building credible ESG reporting frameworks.

Core Blockchain Features for ESG:

- Immutable records: Audit trails for emissions, supply chains, and social metrics

- Smart contracts: Automated compliance based on ESG benchmarks

- Decentralized oracles: Input real-world data like CO2 emissions from verified sensors

- Tokenization: Represent carbon credits, water usage rights, or ESG rewards on-chain

By replacing opaque manual processes with transparent digital ledgers, blockchain boosts ESG integrity and lowers reporting manipulation risks. This makes Blockchain ESG Dubai a critical framework for businesses needing traceable, tamper-proof data solutions.

Dubai’s ESG Vision and Sustainability Frameworks

Dubai’s leadership has committed to aligning economic growth with sustainable outcomes through various policy instruments and platforms.

Key Initiatives:

- Dubai 2040 Urban Master Plan: Focus on green infrastructure and livable cities

- UAE Net Zero by 2050 Strategy

- Dubai Sustainable Finance Roadmap (by DIFC and DFSA)

- Green Bonds and ESG Disclosures Framework: Promotes corporate ESG adoption

- Emirates Blockchain Strategy 2021: Targets 50% blockchain-powered government services

The integration of blockchain into these sustainability roadmaps positions Dubai as a global ESG tech innovator.

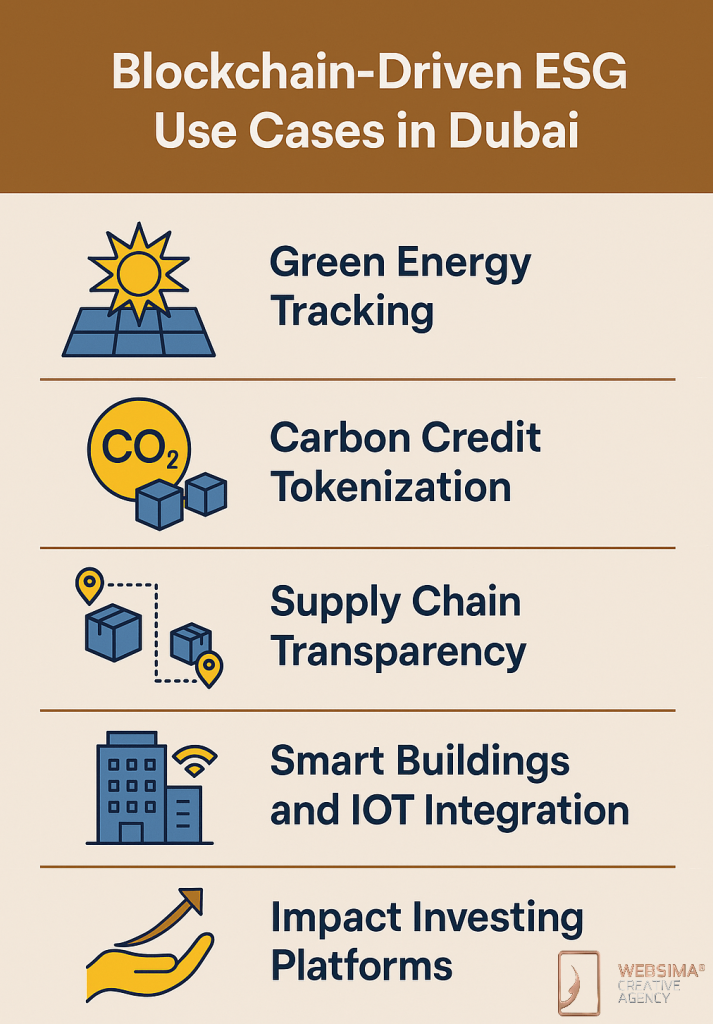

Blockchain-Driven ESG Use Cases in Dubai

1. Green Energy Tracking

Dubai Electricity and Water Authority (DEWA) uses digital meters to track solar and grid electricity. With blockchain, this data can be logged immutably and accessed by regulators or green investors.

2. Carbon Credit Tokenization

Startups are exploring blockchain carbon credit platforms that tokenize emission offsets. These digital assets enable transparent trading and verification. In the context of Blockchain ESG Dubai, tokenized carbon markets offer real-time monitoring and trading transparency.

3. Supply Chain Transparency

One of the uses of blockchain in Dubai’s logistics industry is to track ESG compliance. Blockchain helps track ESG compliance in global supply chains, especially for Dubai’s logistics and free zone businesses. It ensures that materials are ethically sourced and socially responsible.

4. Smart Buildings and IoT Integration

With Dubai investing heavily in smart buildings, blockchain can validate energy efficiency, waste reduction, and other green metrics collected via IoT devices.

5. Impact Investing Platforms

Blockchain-based platforms are emerging to match ESG-compliant startups with investors, increasing access to sustainable finance.

Key Benefits of Blockchain in ESG Reporting

| Benefit | Impact |

| Data Transparency | Verifiable ESG metrics for stakeholders |

| Real-Time Monitoring | On-chain data streams via IoT oracles |

| Automated Compliance | Smart contracts reduce human error in reporting |

| Stakeholder Trust | Public ledgers build confidence in ESG commitments |

| Efficient Auditing | Reduced cost and time for audits via blockchain immutability |

These benefits make Blockchain ESG Dubai more than a concept—it’s a strategic necessity.

Regulatory Landscape for Blockchain ESG in Dubai

The expanding scope of Blockchain ESG Dubai demands closer collaboration between fintech startups, regulators, and enterprise actors. Dubai’s blockchain and ESG compliance ecosystems are evolving under the oversight of various regulatory bodies:

️ Key Regulators:

- VARA (Virtual Assets Regulatory Authority): Oversees digital asset infrastructure and token issuance

- Dubai Financial Services Authority (DFSA): Sets ESG disclosure rules within DIFC

- Dubai Supreme Council of Energy: Enforces carbon regulation policies

- Ministry of Climate Change and Environment (MOCCAE): Tracks national sustainability metrics

Although there’s no unified ESG-blockchain law yet, companies must ensure alignment with both digital asset regulations and sustainability frameworks.

Challenges and Risks in Blockchain ESG Integration

Despite its promise, blockchain integration in ESG practices comes with challenges:

- Regulatory Ambiguity: Absence of clear ESG-chain laws in some jurisdictions

- Data Oracles: Trust in real-world data feeds remains a risk

- Energy Consumption: Some chains (e.g., Bitcoin) contradict ESG goals

- Technical Expertise: Organizations lack in-house blockchain ESG skills as an important challenge Blockchain startups faces in the UAE.

- Privacy vs Transparency: Especially in tracking social or governance metrics

To overcome these, Dubai firms need structured pilot programs and collaboration with blockchain compliance specialists.

Global Best Practices and Lessons for Dubai

Cities and nations pioneering ESG-blockchain integration offer valuable templates:

- Singapore: Green bond tokenization platforms

- Switzerland: Public-private blockchain for ESG audits

- California: Blockchain-based emissions reporting from smart factories

- European Union: Combining MiCA regulations with ESG directives

Dubai can localize these models by leveraging its blockchain talent, regulatory innovation, and global investor interest.

The Future of Blockchain ESG in the UAE

Looking ahead, the intersection of blockchain and ESG in Dubai will deepen through:

- National Blockchain-ESG Sandboxes

- Real-time ESG Ratings via Oracles and AI

- DAO-led Sustainability Projects

- Tokenized Green Bonds with Retail Access

- Web3 Platforms for ESG Crowdfunding

With Expo City Dubai and the Dubai Future Foundation embracing sustainable innovation, the city is poised to lead the Blockchain ESG movement in the UAE and beyond.

Conclusion

Dubai’s ambition to lead in both blockchain innovation and sustainable development has created fertile ground for Blockchain ESG Dubai to thrive. As ESG regulations tighten and stakeholder scrutiny grows, blockchain offers a future-ready solution to meet transparency, compliance, and reporting demands.

From green financing to supply chain ethics, blockchain enables traceable, secure, and verifiable ESG workflows. But to realize its full potential, firms must invest in proper infrastructure, regulatory compliance, and smart integration strategies.

Work with Websima on ESG Blockchain Solutions

At Websima, we don’t just build blockchain platforms—we help you align your Web3 innovations with Dubai’s evolving ESG standards.

Our ESG-Blockchain services include:

- Development of smart contracts for automated sustainability reporting

- Tokenization of carbon credits or ESG-linked assets

- Blockchain-integrated impact investment platforms

- Data privacy and governance frameworks for ESG audits

- Full-stack blockchain solutions that meet VARA, DFSA, and MOCCAE requirements

Whether you’re launching a green startup, transforming your supply chain, or preparing for ESG audits—we’re your trusted partner in Dubai.

Let’s build a future-proof, ESG-compliant blockchain solution.

Contact Websima now and turn your sustainability vision into verified action.