Table of Contents

- Introduction

- What Are NFTs and How Are They Used in Dubai?

- Legal Classification of NFTs in Dubai

- Regulatory Bodies Overseeing NFTs

- Key Laws Governing NFT Use in Dubai

- Licensing Requirements for NFT Businesses

- Tax Implications for NFT Transactions

- Compliance Tips for NFT Creators and Platforms

- Case Study: NFT Art Marketplace in DIFC

- Common Mistakes to Avoid

- Fees and Government Charges

- Frequently Asked Questions

- Conclusion

- CTA: Work with Websima on NFT Compliance and Development

Introduction

Dubai has emerged as a global hub for innovation and digital transformation—and NFTs (non-fungible tokens) are at the center of its evolution. As NFTs expand from digital art into real estate, gaming, and intellectual property, understanding the NFT regulations in Dubai is crucial for creators, investors, and startups. This guide offers a comprehensive breakdown of the current legal framework, compliance requirements, and market conditions shaping NFT activity in Dubai and as well as Dubai’s role in the NFT market.

What Are NFTs and How Are They Used in Dubai?

NFTs are blockchain-based digital assets that represent unique ownership of real or digital items such as:

- Art

- Music

- Real estate

- Fashion

- Identity documents

- Gaming items

In Dubai, NFTs are being adopted in:

- Real estate tokenization (ownership rights of property)

- Digital art marketplaces (exhibitions at DIFC, Art Dubai)

- Luxury and fashion (branded wearables as NFTs)

- Government services (Dubai Police launched NFT-based certificates)

Legal Classification of NFTs in Dubai

NFTs are not officially classified as financial securities or currency. However, they are still regulated due to their:

- Economic value

- Tradeable nature

- Potential links to investment and speculation

As of 2025, Dubai treats NFTs as digital assets that fall under the Virtual Asset Regulatory Authority (VARA) if used for commercial purposes or listed on a platform.

Regulatory Bodies Overseeing NFTs

NEW: Dubai’s crypto regulator says memecoins issued in the emirate must comply with VARA regulations. pic.twitter.com/eUCQQk2fRe

— Cointelegraph (@Cointelegraph) February 15, 2025

-

VARA (Virtual Assets Regulatory Authority)

- Governs all virtual assets in Dubai, including NFTs

- Issues operating permits for NFT platforms

- Enforces compliance with AML, KYC, and cyber rules

Website: https://vara.ae

-

DIFC (Dubai International Financial Centre)

- Oversees platforms located in the free zone (e.g., NFT art galleries)

- Applies common law principles for IP rights and digital contracts

Website: https://www.difc.ae

-

Dubai Economy and Tourism (DET)

- Issues trade licenses for NFT consultancies and creative agencies in Mainland

- Regulates IP registration, trademarks, and commerce

Key Laws Governing NFT Use in Dubai

NFTs are not yet covered by one dedicated federal law, but several regulations apply:

- Law No. 4 of 2022: Establishes VARA and gives it authority to regulate all digital assets in Dubai (excluding DIFC)

- Cabinet Decision No. 111 of 2022: Mandates AML/CFT compliance for virtual asset service providers

- Federal Decree-Law No. 45 of 2021 on Personal Data Protection: Applies to NFT platforms handling user data

- UAE Copyright Law (No. 38 of 2021): Protects creators of original content sold as NFTs

Licensing Requirements for NFT Businesses

If you plan to operate an NFT-related business or invest in NFTs in Dubai, you must:

- Register with VARA (if you’re launching an NFT platform, wallet, or trading service)

- Obtain a commercial license from DET or a free zone such as:

- DIFC for financial service-linked NFTs

- DMCC for media and creative NFTs

- DWTC for NFT marketplaces

- File an internal compliance plan outlining your AML/KYC procedures

- Use VARA-approved hosting and custody services for asset storage

Failure to obtain proper licensing can result in hefty penalties, including asset freezes or blacklisting.

Tax Implications for NFT Transactions

Currently, Dubai has:

- No personal income tax

- No capital gains tax

- 5% VAT, which may apply if:

- NFTs are sold via a UAE-registered platform

- The buyer is located in the UAE

Businesses must:

- Register for VAT if revenues exceed AED 375,000

- Maintain accurate sales records for VAT audits

If NFTs are linked to physical goods (e.g., luxury items), the underlying product may trigger customs or excise tax.

Compliance Tips for NFT Creators and Platforms

- Verify Ownership

Ensure that the digital or physical item linked to the NFT is legitimately yours. - Follow AML/KYC

If your platform allows trading or wallet creation, comply with identity verification standards. - Secure Smart Contracts

Use audited and verifiable code to prevent hacking or exploitation. - Respect IP Rights

Don’t tokenize content (art, music, photos) you don’t own—even partial infringement is punishable. - Disclose Terms

Always provide clear descriptions, refund policies, and usage rights on your NFT sales pages.

Case Study: NFT Art Marketplace in DIFC

Business Model: A digital art platform in DIFC enables artists to mint NFTs and sell them to collectors worldwide.

Legal Setup:

- Registered under DIFC’s Innovation Hub

- Complies with UAE Copyright Law and DIFC IP framework

- Uses Ethereum-based smart contracts and hosted digital wallets

Regulatory Steps Taken:

- KYC checks via a third-party vendor

- Smart contract audits conducted annually

- Privacy compliance via DIFC Data Protection Law

Outcome: The business expanded to serve global clients, partnered with Art Dubai, and now integrates AI art features.

Common Mistakes to Avoid

- Operating Without VARA License: If your service allows wallet creation, trading, or custody, you must register.

- Minting NFTs of Copyrighted Material: Even derivative works can lead to takedown notices or lawsuits.

- Lack of Data Privacy Compliance: Collecting user data without consent violates UAE and DIFC regulations.

- Unsecured Smart Contracts: Poor coding can lead to asset loss or theft.

- Assuming NFTs Are Untaxable: VAT may still apply depending on how and where NFTs are sold.

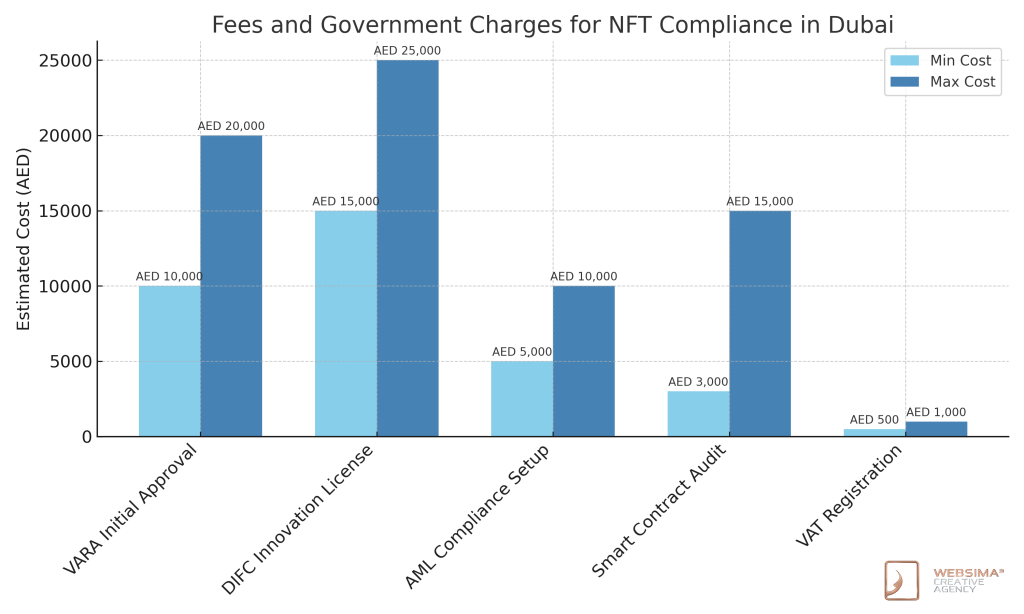

Fees and Government Charges

| Service | Estimated Cost |

| VARA Initial Approval | AED 10,000–20,000 |

| DIFC Innovation License | AED 15,000–25,000/year |

| AML Compliance Setup | AED 5,000–10,000 |

| Smart Contract Audit | AED 3,000–15,000 |

| VAT Registration | AED 500–1,000 |

Note: Always check with VARA or your chosen free zone authority for updated fees.

Frequently Asked Questions

Are NFTs legal in Dubai?

Yes, NFTs are legal but regulated. You must comply with VARA guidelines if engaging in commercial activity.

Can I sell NFTs without a license?

You may sell your own NFTs casually, but running a platform or marketplace requires a license.

Are NFTs taxed?

There is no income tax, but 5% VAT may apply to NFT sales within the UAE.

Is there a dedicated NFT law?

No standalone law exists yet, but multiple digital asset and IP laws cover NFTs.

Can foreigners launch NFT platforms in Dubai?

Yes, foreign entrepreneurs can set up in free zones like DIFC, DMCC, and DWTC with 100% ownership.

Conclusion

As Dubai races ahead in the Web3 world, NFTs are no longer just a trend—they’re a critical asset class in digital ownership, identity, and creative expression. However, operating in this space requires a clear understanding of NFT regulations in Dubai.

By aligning with VARA standards, respecting intellectual property laws, and obtaining the proper licenses, creators and startups can thrive within Dubai’s crypto-forward, pro-innovation ecosystem.

NFTs represent opportunity—but with opportunity comes responsibility. Navigating this space the right way ensures you’re not only compliant but also future-proof.

Work with Websima on NFT Compliance and Development

At Websima, we specialize in building Web3 platforms, smart contract development, and ensuring your NFT business aligns with Dubai’s regulatory frameworks.

Whether you’re launching a full NFT marketplace, integrating blockchain identity solutions, or creating tokenized collectibles, we handle:

- VARA registration guidance

- Smart contract audits

- Legal and IP compliance checks

- Web3 UX and full-stack development

Ready to launch your NFT project in Dubai with full legal clarity?

Contact Websima and let’s build something compliant, secure, and groundbreaking.