Introduction

Over the past decade, Dubai has become a global leader in blockchain adoption—not just as a technology user but as a cultivator of a startup ecosystem. For entrepreneurs building blockchain solutions in the UAE, the question often arises: How can I secure funding in this region?

From registering a blockchain startup in Dubai to government grants and accelerators as well as venture capital and equity crowdfunding, blockchain funding in Dubai is more diverse and accessible than ever before. The city’s proactive regulatory environment, financial incentives, and infrastructure provide a launchpad for Web3 ventures aiming to scale across the MENA region and beyond.

We’re excited to announce the global debut of SuiHub!

Together with Sheikh Al Mualla bin Ahmed Al Mualla, leaders of Expo City Dubai, and esteemed guests of the broader Dubai community we unveiled the first location: SuiHub Dubai.

Set strategically in the region’s… pic.twitter.com/biV56MkokT

— Sui (@SuiNetwork) October 24, 2024

This guide explores the full range of funding pathways available to blockchain startups in Dubai—and how to make the most of them.

The Funding Landscape for Blockchain Startups in Dubai

Blockchain is a strategic technology pillar in the UAE’s economic diversification plans. According to the Emirates Blockchain Strategy 2021, the government aimed to shift 50% of its transactions to blockchain platforms by 2021—and this goal has accelerated investment into blockchain ventures. That is why blockchain startups are succeeding in the UAE.

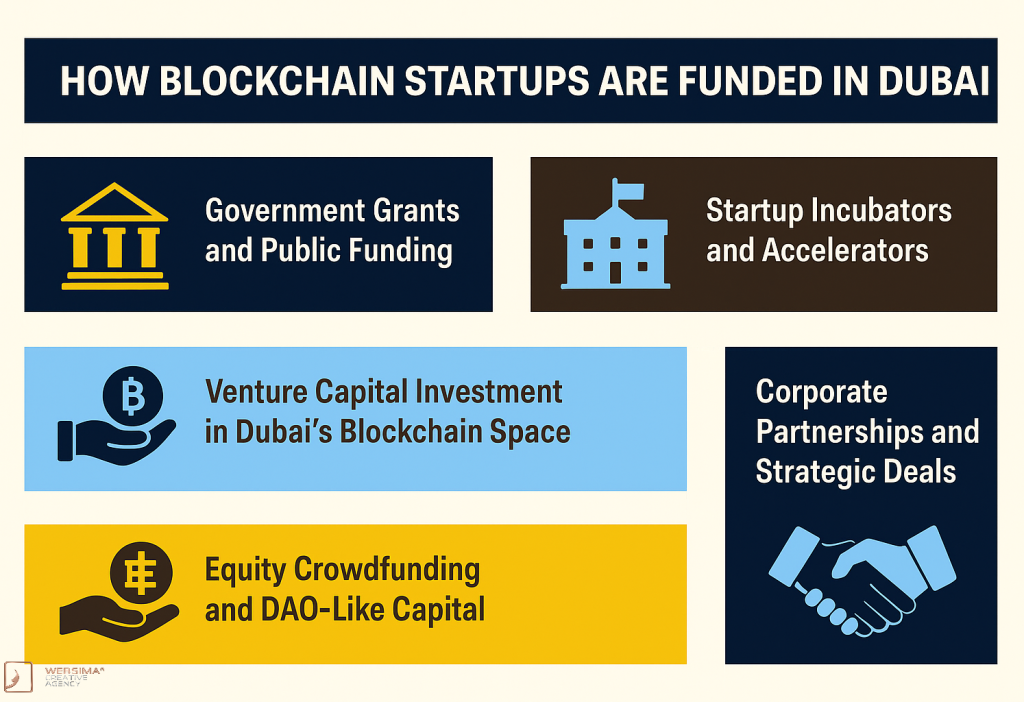

Here’s an overview of the main funding categories:

Categories of Blockchain Funding in Dubai:

| Type | Examples | Typical Use Cases |

| Government grants | MBRIF, Dubai Future Foundation | R&D, early-stage MVPs |

| Accelerators/Incubators | DIFC FinTech Hive, in5, Hub71 | Mentorship, funding, exposure |

| Venture Capital | BECO Capital, Global Ventures | Scaling, Series A & beyond |

| Equity Crowdfunding | Eureeca, VentureSouq | Community building, early capital |

| Corporate Funding | Strategic partnerships | Infrastructure, licensing deals |

1. Government Grants and Public Funding

Dubai’s government offers several non-dilutive funding programs, including equity-free grants and access to mentorship, networks, and pilot partnerships.

Mohammed Bin Rashid Innovation Fund (MBRIF)

The MBRIF is a federal initiative that supports innovative tech companies, including blockchain startups, with financing and accelerator support. The fund operates under the UAE Ministry of Finance and offers two programs:

- Innovation Accelerator: Provides mentorship, training, and connections to investors.

- Guarantee Scheme: Offers credit guarantees to startups in partnership with Emirates NBD.

Startups like Tradeling and Pure Harvest received early-stage support under this scheme, showcasing its potential to uplift Web3 infrastructure solutions.

Dubai Future Accelerators

The Dubai Future Accelerators (DFA) is a flagship program of the Dubai Future Foundation that connects startups with government and enterprise partners for 8–12 week co-creation cycles. Blockchain solutions have been deployed with Dubai Police, DEWA, and RTA through DFA.

Past blockchain use cases in the DFA include:

- Blockchain-based document authentication

- Decentralized identity verification

- Smart contract utilities billing systems

The DFA is an ideal entry point for early-stage companies looking to pilot with public entities.

Dubai SME

The Dubai SME, under Dubai’s Department of Economy and Tourism, offers grants, financial advisory, and access to government tenders for blockchain startups that qualify under its innovation category. It has also facilitated matchmaking events with angel investors and private banks.

2. Startup Incubators and Accelerators

Incubators in Dubai offer not only access to capital but also mentorship, office space, product development support, and investor introductions.

DIFC FinTech Hive

Operated by the Dubai International Financial Centre (DIFC), FinTech Hive is a premier accelerator for financial startups, including blockchain projects. It provides:

- 12-week intensive bootcamps

- Connections to banks and insurance companies

- Demo Days attended by investors and regulators

Blockchain startups like Sarwa, Hakbah, and Rain have graduated from this program.

in5 Tech

in5 is part of the TECOM Group and supports startups in blockchain, AI, and media. They provide:

- 24/7 co-working spaces

- Investment pitching opportunities

- Access to 500+ mentors and venture networks

The in5 Innovation Center hosts regular hackathons and demo days, offering exposure to both local and international capital.

AstroLabs Dubai

AstroLabs has helped hundreds of startups incorporate in Dubai and scale regionally. Blockchain companies can benefit from:

- Custom licensing in DMCC or DSO

- Talent acquisition assistance

- Strategic advisory for VC readiness

3. Venture Capital Investment in Dubai’s Blockchain Space

Dubai is home to a growing number of venture capital firms actively investing in Web3. These firms typically look for MVP-stage startups with early traction and a scalable revenue model.

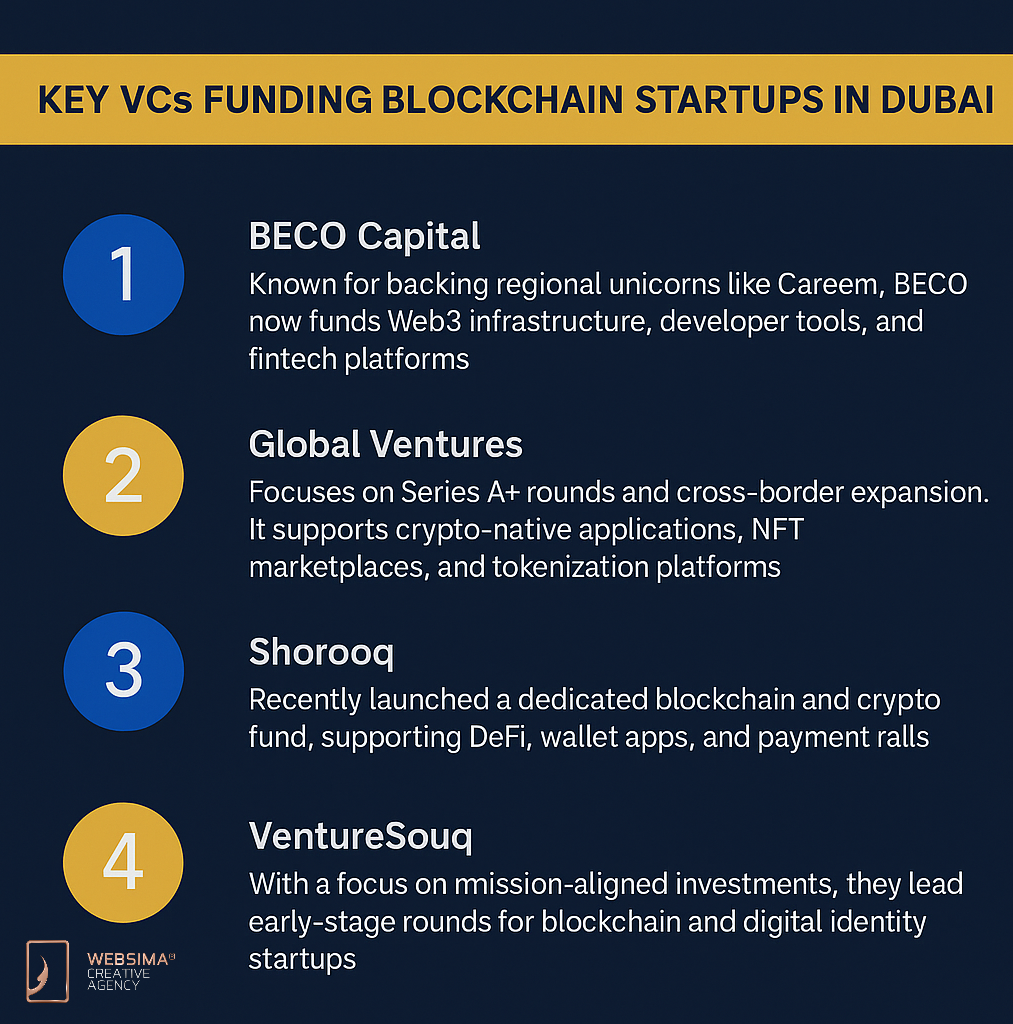

Key VCs Funding Blockchain Startups in Dubai:

- BECO Capital: Known for backing regional unicorns like Careem, BECO now funds Web3 infrastructure, developer tools, and fintech platforms.

- Global Ventures: Focuses on Series A+ rounds and cross-border expansion. It supports crypto-native applications, NFT marketplaces, and tokenization platforms.

- Shorooq Partners: Recently launched a dedicated blockchain and crypto fund, supporting DeFi, wallet apps, and payment rails.

- VentureSouq: With a focus on mission-aligned investments, they lead early-stage rounds for blockchain and digital identity startups.

Startups can also attend VC match events such as Step Conference, Fintech Surge, and Seamless Middle East, where pitch competitions attract both seed and growth-stage capital.

4. Equity Crowdfunding and DAO-Like Capital

As investor sentiment shifts toward decentralized models, equity crowdfunding and DAO-like community raises are gaining traction.

Eureeca

Eureeca is a DFSA-regulated platform that allows startups to raise funds from a broad base of accredited and retail investors. Blockchain startups can raise up to $5 million with transparent terms and pre-vetted investor profiles.

This method is suitable for:

- B2C Web3 applications

- Creator platforms

- Token launches seeking legal backing

Dubai-based companies like Addenda and ReserveOut successfully raised through Eureeca.

Token Launchpads

Startups registered under VARA or operating in DMCC Crypto Centre may also consider token raises via regulated launchpads or community rounds, provided they align with AML and investor protection guidelines.

5. Corporate Partnerships and Strategic Deals

Dubai-based corporations are increasingly partnering with Web3 startups to integrate blockchain into logistics, real estate, and financial products.

Example:

In January 2025, Dubai real estate giant DAMAC signed a $1 billion partnership with blockchain platform MANTRA to tokenize physical real estate across multiple developments.

Read the full article here

Such partnerships are not just PR—they offer blockchain startups:

- Large user bases for pilot testing

- Long-term licensing agreements

- Operational funding and PoC budget allocations

Navigating Regulatory Approvals for Blockchain Funding

VARA: Virtual Assets Regulatory Authority

Dubai’s VARA licenses and supervises blockchain firms dealing with digital assets. Startups must submit whitepapers, tokenomics models, and risk assessments to qualify for operations in the mainland or free zones.

DFSA and DIFC

If your startup is registered in DIFC, you must comply with DFSA digital asset rules. They also offer sandbox licenses for blockchain experimentation, especially in digital securities or stablecoin usage.

Funding Readiness: What Investors Look For

Before seeking funding, blockchain startups should prepare:

- A detailed whitepaper and business model

- MVP or proof of concept (PoC)

- Tokenomics breakdown (if applicable)

- Legal structure and compliance roadmap

- Founding team credibility

- Market validation or traction metrics

Investors in Dubai are increasingly focused on regulatory clarity, tech scalability, and team execution.

Final Thoughts

Dubai offers one of the most comprehensive blockchain startup ecosystems in the world. From early-stage government funding to growth-stage VC investments, blockchain entrepreneurs in the UAE enjoy a rare blend of legal clarity, institutional support, and open market access.

Whether you’re building DeFi, tokenization platforms, NFT infrastructure, or cross-border payments—blockchain funding in Dubai is structured to help you succeed.

Accelerate Your Blockchain Startup with Websima

At Websima, we empower founders with full-cycle support—from MVP development to funding strategy and regulatory compliance. Our services include:

- Pitch deck and grant application support

- Tokenomics design and whitepaper creation

- Smart contract development and audit

- VARA/DIFC licensing consulting

- Investor introductions and fundraising support

Looking for blockchain funding in Dubai?

Schedule your free consultation with Websima’s blockchain funding specialists today.