Introduction: A New Financial Paradigm Emerges

The global banking industry is experiencing a profound transformation, and Dubai is at the center of this financial revolution. As one of the most forward-thinking cities in the world, Dubai is embracing Decentralized Finance (DeFi) with open arms. From reimagining traditional financial services to empowering underbanked communities, DeFi banking in Dubai is rapidly evolving from a niche concept into a core pillar of the emirate’s fintech strategy.

‼️BREAKING: DUBAI FINANCIAL SERVICES AUTHORITY CONFIRMS #XRP IS GOING TO BE INCORPORATED INTO MAJOR BANKING!! TOP DEFI ON THE #XRPL IS GOING TO SKYROCKET!!‼️

CTF TOKEN, THE TOP DEFI TOKEN ON THE XRP LEDGER ONLY NEEDS A MARKET CAP OF $20 BILLION TO JULY FROM $0.71 TO $748.50 PER… pic.twitter.com/f2QTvwQwtn

— FinanceBro (@FinanceBroYT) March 28, 2025

In this article, we explore how DeFi is reshaping Dubai’s banking landscape, the key drivers behind its adoption, and what it means for investors, startups, and financial institutions alike.

DeFi in Dubai: The Driving Forces Behind the Shift

Visionary Government Policies

Dubai’s progressive stance on fintech and blockchain adoption is pivotal to the rise of DeFi banking in Dubai. The emirate launched the Dubai Blockchain Strategy as early as 2016, aiming to become a global hub for blockchain innovation. This early commitment paved the way for regulatory frameworks like the Virtual Assets Regulatory Authority (VARA), which now governs DeFi protocols and digital asset firms operating in the region.

VARA’s clarity and structure attract top DeFi projects to the city, unlike jurisdictions that lack formal guidance.

Learn more about VARA’s regulatory framework

Tech-Savvy Demographics and Financial Inclusion

Dubai’s population comprises a digitally native, globally connected audience. With high smartphone penetration and internet usage, the city is a fertile ground for DeFi platforms, which require only a smartphone and a crypto wallet for access. This accessibility has enabled DeFi banking in Dubai to reach users previously excluded from traditional banking due to strict KYC or minimum balance requirements.

Institutional and Venture Capital Interest

One of the biggest banks in the UAE has launched crypto trading services.

Emirates NBD in Dubai is a state-owned bank that’s now allowing its customers to buy, sell, and hold crypto.

Right now, the service is limited to five cryptocurrencies – $BTC, $ETH, $SOL, $XRP, $ADA

— Lark Davis (@TheCryptoLark) March 8, 2025

Major institutional players and venture capital firms are flocking to Dubai to invest in DeFi protocols. According to a PwC fintech report, Dubai ranked among the top fintech hubs globally, with DeFi gaining a substantial portion of investment interest in 2024.

Explore the PwC Fintech Insights for MENA

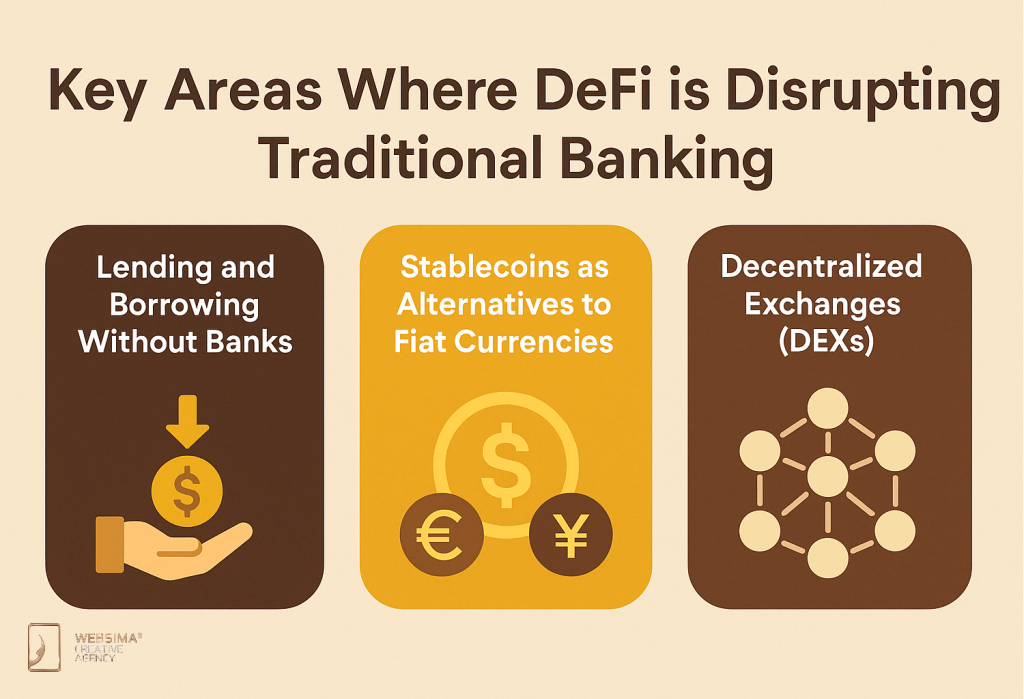

Key Areas Where DeFi is Disrupting Traditional Banking

1. Lending and Borrowing Without Banks

Through smart contracts, DeFi lending and borrowing platforms in the UAE allow users to borrow or lend funds instantly, without requiring a central bank or third party. Platforms like Aave and Compound are seeing increasing usage in Dubai, offering competitive yields and transparent loan terms.

Traditional banks in the UAE are beginning to feel the pressure, especially as DeFi services offer:

- Real-time interest rate adjustments

- No paperwork or intermediaries

- Global access 24/7

This model empowers users with full control, replacing trust in institutions with code and transparency.

2. Stablecoins as Alternatives to Fiat Currencies

Stablecoins such as USDT and USDC are widely used in DeFi banking Dubai ecosystems. These tokens provide a hedge against local currency volatility and enable instant settlement across borders. For Dubai’s vibrant expat population, stablecoins also facilitate seamless, low-cost international remittances.

Notably, the UAE Central Bank has begun working on its own CBDC (Central Bank Digital Currency), aiming to complement private stablecoins and offer regulated on-chain alternatives for banks and businesses.

3. Decentralized Exchanges (DEXs)

DEXs such as Uniswap and SushiSwap are gaining traction among retail and institutional users in Dubai. These platforms allow the trading of digital assets directly from wallets—without custodians or centralized intermediaries.

As a result, high-net-worth individuals and crypto-native traders in Dubai are shifting away from centralized exchanges due to:

- Enhanced privacy and security

- Lower trading fees

- Transparent protocols

This trend is reshaping how banks approach crypto custody and digital asset management.

Integration of DeFi With Dubai’s Financial Infrastructure

Emirates NBD and Blockchain Integration

Banks in Dubai are not passively watching this transformation—they are actively integrating blockchain-based services. Emirates NBD, one of the UAE’s largest banks, has already piloted blockchain for trade finance and digital checks.

As DeFi banking in Dubai gains momentum, legacy banks are exploring:

- DeFi liquidity pool participation

- Tokenized asset custodianship

- Smart contract-based compliance solutions

This hybrid model—combining centralized institutions with decentralized infrastructure—is fast becoming a unique hallmark of Dubai’s approach.

Rise of DeFi-Focused Fintech Startups

A surge in fintech startups is accelerating Dubai’s DeFi ecosystem. Companies like Fasset, Zignaly, and Centrifuge are establishing regional headquarters to tap into Dubai’s innovation-driven economy.

See how Fasset is building digital asset rails in emerging markets

These firms are delivering cutting-edge solutions like yield farming, on-chain insurance, and decentralized investment pools tailored for MENA users.

The Regulatory Landscape: Dubai’s Strategic Advantage

The legal landscape for DeFi platforms in Dubai is evolving. Dubai’s approach to DeFi regulation balances innovation with risk management. VARA mandates:

- Licensing for DeFi platforms serving UAE residents

- AML/KYC compliance via decentralized identity systems

- Smart contract audit submissions for security assurance

Rather than stifling innovation, Dubai’s laws are designed to foster safe experimentation, which appeals to global DeFi developers.

The Dubai International Financial Centre (DIFC) also hosts the Innovation Hub, providing sandboxes for DeFi pilots and access to VCs, legal advisors, and government grants.

Benefits of DeFi Banking for Users in Dubai

Here are the major user-side benefits driving the shift to DeFi banking in Dubai:

| Benefit | Traditional Banking | DeFi Alternative |

| Access | Limited (documents, in-person) | Open (wallet + internet) |

| Speed | Days to process loans | Instant smart contracts |

| Transparency | Opaque fee structures | Fully visible on-chain |

| Control | Bank custody | User custody |

| Hours | 9–5 business hours | 24/7 global access |

This new paradigm empowers Dubai residents—particularly freelancers, SMEs, and startups—to take greater control of their financial destiny.

Risks and Challenges of DeFi Banking to Watch

Despite its benefits, DeFi is not without risks. Dubai’s regulators and users must remain vigilant about:

- Smart Contract Vulnerabilities: Exploits like flash loan attacks can drain liquidity pools

- Regulatory Arbitrage: Projects relocating to Dubai may avoid tighter oversight elsewhere

- Scams and Ponzi Schemes: The anonymous nature of DeFi can attract bad actors

To mitigate these risks, Dubai’s fintech sector emphasizes code audits, insurance protocols, and educational initiatives on responsible DeFi use.

What the Future Holds for DeFi Banking in Dubai

Looking ahead, DeFi banking in Dubai is expected to:

- Integrate with real-world assets (RWA), like real estate and trade finance

- Align with tokenized securities under DIFC frameworks

- Serve as an innovation testbed for global DeFi standards

The upcoming COP28 follow-up and Dubai Future Foundation’s DeFi Lab will provide platforms for public-private collaboration on next-gen banking solutions.

As more DeFi-native institutions receive regulatory approval, Dubai is poised to set a global standard for how traditional finance can coexist and thrive alongside decentralized systems.

Power Your DeFi Project with Websima

Whether you’re launching a DeFi lending platform, building a decentralized exchange, or integrating tokenized assets with smart contracts, Websima is your partner in blockchain innovation. We specialize in:

- Smart contract development and audits

- Web3 website creation tailored to DeFi projects

- Licensing support and regulatory readiness in the UAE

Get in touch with Websima today to transform your DeFi vision into a secure, scalable reality.