The United Arab Emirates continues to lead the region in digital innovation. With the introduction of the Digital Dirham—its central bank digital currency (CBDC)—the UAE is moving towards a fully digitized economy. This initiative is more than just a payment evolution; it represents a major leap in blockchain integration and a significant opportunity for the growing NFT (Non-Fungible Token) ecosystem. As UAE digital currency blockchain strategies gain momentum, their implications for decentralization, transparency, and asset tokenization are becoming increasingly relevant.

The Central Bank of the #UAE (#CBUAE) has officially confirmed it will issue a retail Central Bank Digital Currency (CBDC) — the #DigitalDirham — by the end of 2025. This bold move… pic.twitter.com/dnpwVdfEfW

— M20 (@m20blockchain) April 11, 2025

This article explores how the UAE’s CBDC is reshaping the digital economy, what it means for blockchain development, and how it could accelerate NFT adoption across sectors.

What Is the Digital Dirham?

Background and Vision

The Digital Dirham is the UAE’s official central bank digital currency, developed and issued by the Central Bank of the UAE (CBUAE). This government-backed digital asset is designed to modernize payment systems by integrating Web3 in Dubai’s financial services for payment, reduce reliance on cash, and promote financial inclusion.

As part of the broader Financial Infrastructure Transformation (FIT) Programme, the CBDC initiative is considered a foundational pillar of the country’s digital economic strategy. It aims to support both domestic and cross-border transactions in a secure, efficient, and regulated environment.

Why Is It Important?

The Digital Dirham addresses key challenges in traditional finance such as transaction speed, high remittance costs, and lack of transparency. But most importantly, it introduces a highly secure, tamper-resistant system enabled by blockchain—making it a game-changer for the UAE digital currency blockchain landscape.

The Role of Blockchain in the Digital Dirham

================

UAE’S DIGITAL DIRHAM

IT IS A “REALITY” NOW

================Today saw the INITIATION OF THE FIRST CROSS-BORDER PAYMENT using the UAE Central Bank’s digital currency (CBDC), amounting to $135Mil to “CHINA” through the ‘M-Bridge’ Platform, the same day of the… pic.twitter.com/OBRm7hrnbC

— END (@AlashkarSally) January 29, 2024

Built on Blockchain Technology

The success of the Digital Dirham depends heavily on blockchain infrastructure. Unlike fiat currencies, CBDCs use distributed ledger technology (DLT) to facilitate secure, transparent, and immutable transactions.

Through its collaboration with companies like G42 Cloud and R3, the UAE is deploying a robust blockchain foundation for its digital currency—ensuring scalability, privacy, and compliance.

Benefits to the Broader Blockchain Ecosystem

The blockchain-driven nature of the Digital Dirham has several broader benefits:

- Improved Interoperability: CBDC frameworks encourage compatibility with other blockchain-based applications, such as decentralized finance (DeFi) platforms.

- Stronger Regulatory Models: By setting compliance standards, the UAE paves the way for transparent, regulated blockchain adoption.

- Accelerated Enterprise Adoption: With government endorsement, more businesses will explore blockchain integration for payments, contracts, and asset management.

How It Impacts NFTs and Digital Assets

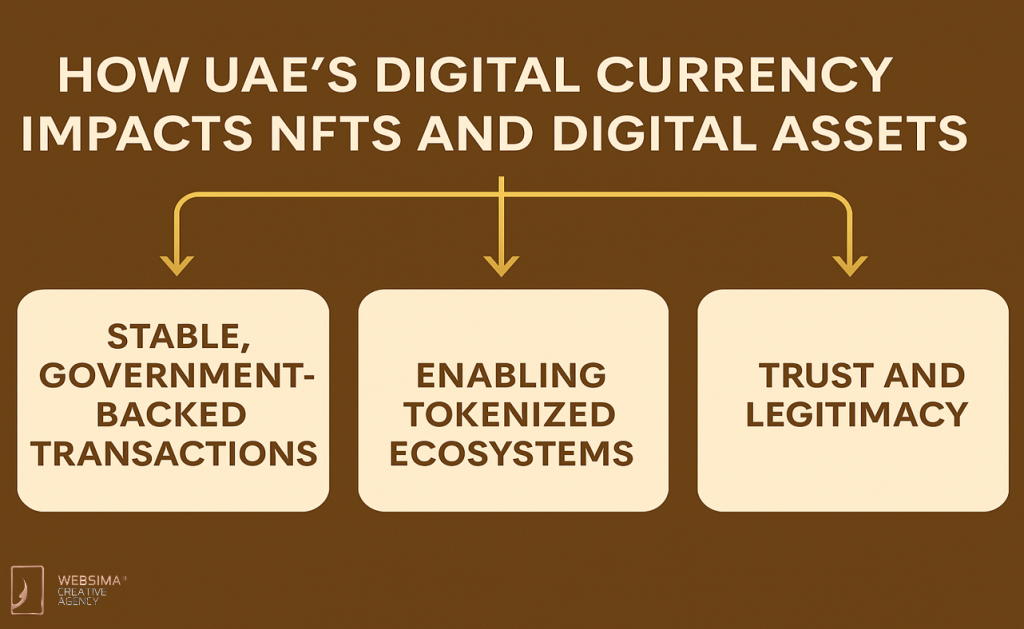

Stable, Government-Backed Transactions

NFT markets have traditionally relied on volatile cryptocurrencies like Ethereum. The introduction of a stable, state-backed currency like the Digital Dirham provides a reliable alternative for NFT buyers and sellers. This can significantly reduce transactional risk and enhance user trust.

Enabling Tokenized Ecosystems

Through the UAE digital currency blockchain infrastructure, it becomes easier to tokenize physical and digital assets—including art, real estate, and collectibles—into NFTs. This promotes the democratization of investment and ownership across various sectors.

Trust and Legitimacy

Government endorsement of digital currency improves the credibility of related digital asset sectors. This trust will likely accelerate NFT adoption, especially in regulated industries like healthcare, education, and logistics.

Survey Insights and Market Sentiment

UAE’s Positive Outlook on NFTs

A recent Fast Company Middle East survey shows that 72% of UAE respondents view NFTs positively, with the majority expressing interest in exploring digital assets for investment or creative projects. This openness indicates a fertile ground for NFT growth fueled by CBDC innovation.

Crypto Ownership and Blockchain Usage

According to KuCoin’s UAE Crypto Report, over 25% of UAE adults have some exposure to crypto assets, with blockchain awareness on the rise. As more residents adopt digital currencies, the stage is set for seamless integration with NFT and Web3 platforms.

Opportunities and Use Cases

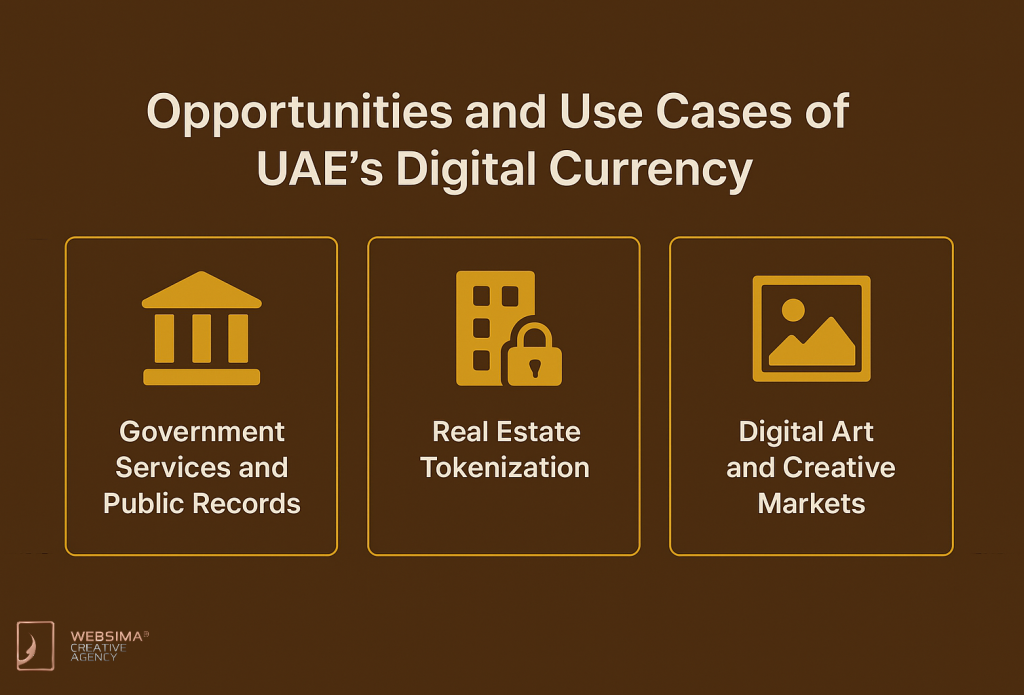

Government Services and Public Records

CBDC integration allows for instant digital payments in government services, from utility payments to licensing. Blockchain infrastructure can also support digital identity and smart contracts for NFT-based records such as property deeds or academic certificates.

Real Estate Tokenization

The UAE’s real estate market is one of the sectors most likely to benefit. Through the UAE digital currency blockchain ecosystem, properties can be tokenized and traded as NFTs in Dubai and UAE, simplifying ownership transfers and increasing investment liquidity.

Digital Art and Creative Markets

Dubai is already a hotspot for art and fashion. With secure, blockchain-enabled payment systems in place, artists and creatives can mint, sell, and license their digital works using the Digital Dirham—opening new monetization avenues for the creative economy.

Challenges to Overcome

Regulatory Clarity and Global Coordination

Although the UAE is progressive, establishing frameworks that align with international financial regulations (e.g., FATF, BIS) remains critical. Ongoing updates and transparency will be essential for long-term success.

User Adoption and Technical Literacy

Ensuring that citizens and businesses understand and trust the new systems will require education and public awareness campaigns. Bridging the knowledge gap will help maximize the impact of UAE digital currency blockchain innovations.

Infrastructure and Interoperability

Deploying scalable, interoperable platforms that can integrate with global CBDCs and decentralized apps will be a technical challenge—but one the UAE is well-positioned to meet given its strategic tech investments.

Conclusion

The Digital Dirham is more than a national currency in digital form—it is a catalyst for blockchain innovation and a booster for the UAE’s NFT economy. By prioritizing regulation, security, and innovation, the UAE is setting a global example of how digital currencies can elevate blockchain and tokenized ecosystems.

As UAE digital currency blockchain frameworks continue to mature, the world will be watching how the country blends central oversight with decentralized innovation to shape the future of digital finance.

Websima: Powering Blockchain, NFT, and Digital Currency Solutions in Dubai

At the intersection of blockchain, NFTs, and digital finance, Websima stands out as a trusted technology partner in Dubai. We help businesses navigate and succeed in the UAE’s evolving digital landscape with services such as:

- Blockchain development and Web3 integration

- NFT marketplace creation and smart contract programming

- Crypto payment and wallet solutions

- Digital currency advisory and technical implementation

- Blockchain company setup and licensing in the UAE

Whether you’re building NFT platforms or exploring opportunities in the UAE digital currency blockchain ecosystem, Websima offers end-to-end support tailored to your goals.

Ready to embrace the digital currency revolution?

Contact Websima today to build your future in blockchain and NFT technology.