Introduction

With Dubai and Abu Dhabi emerging as global hubs for blockchain innovation, the UAE’s digital asset industry is booming. Yet for this ecosystem to thrive, strong compliance infrastructure—especially regarding Anti-Money Laundering (AML) laws—is essential. UAE Blockchain AML compliance isn’t optional for blockchain startups operating in the UAE. Whether you’re building a DeFi protocol, running a crypto exchange, or offering NFT services, you must be aware of challenges facing blockchain startups in the UAE in general and also be aware that aligning with AML laws UAE blockchain is critical for licensing, investor trust, and long-term success.

From advanced blockchain monitoring to targeted inspections, our multi-layered approach to AML/CTF supervision is designed to detect risks early, respond effectively, and build long-term trust in the market.

Swipe through to see how we oversee KYC/AML compliance.#VARA #AML… pic.twitter.com/sLlKhKqQS8

— Virtual Assets Regulatory Authority (VARA) (@varadubai) June 25, 2025

This article explores how AML laws apply to blockchain startups, the regulatory structure in the UAE, and how Web3 companies can stay compliant and operationally secure.

Why AML Compliance Matters for Blockchain Startups

While blockchain offers decentralization and transparency, it also presents risks that regulators take seriously:

- Pseudonymous wallets used for money laundering

- Rapid cross-border transfers enabling terrorist financing

- Fraudulent token offerings escaping scrutiny

The UAE has implemented robust AML rules aligned with Financial Action Task Force (FATF) standards. Startups operating in or from the UAE are legally required to put systems in place for:

- Know Your Customer (KYC)

- Suspicious activity reporting

- Risk assessment

- Recordkeeping

Failing to do so can lead to harsh penalties, including fines, license revocation, and criminal prosecution.

AML Legal Framework in the UAE

The UAE’s AML landscape blends federal legislation with zone-specific regulatory regimes.

Federal Legislation

- Federal Decree-Law No. 20 of 2018: The cornerstone legislation on AML and Counter-Terrorism Financing

- Cabinet Decision No. 10 of 2019: Details how entities must implement internal controls, due diligence, and reporting processes

A useful summary of these laws is available from:

AML UAE – Anti-Money Laundering Guide

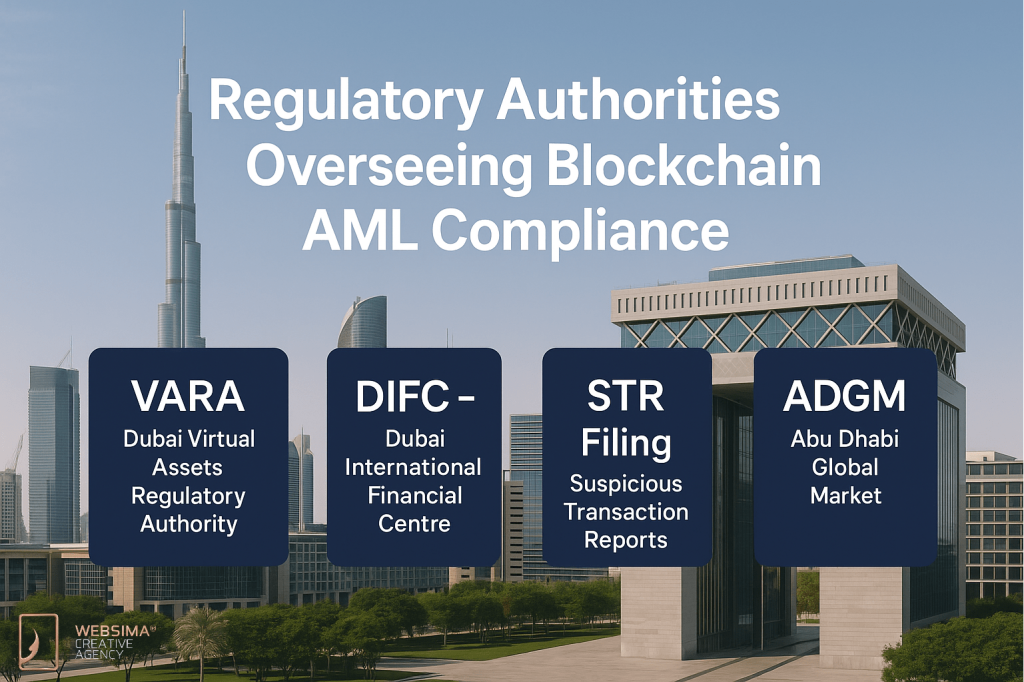

Regulatory Authorities Overseeing Blockchain AML Compliance

Depending on your location and license type, your business will fall under different supervisory authorities:

VARA (Dubai Virtual Assets Regulatory Authority)

VARA oversees AML compliance for VASPs (Virtual Asset Service Providers) in most of Dubai. Its rulebook aligns with FATF requirements and requires:

- Appointment of a Money Laundering Reporting Officer (MLRO)

- Submission of compliance reports

- Use of blockchain analytics for transaction screening

More on VARA’s regulations can be found here:

VARA Official Site – Regulations Section

DIFC – Dubai International Financial Centre

Governed by the Dubai Financial Services Authority (DFSA), DIFC-based blockchain startups must comply with its AML Module, which includes:

- Periodic internal audits

- Employee training

- Enhanced due diligence for high-risk clients

ADGM – Abu Dhabi Global Market

ADGM’s Financial Services Regulatory Authority (FSRA) has its own AML Rulebook, which enforces:

- Integration of RegTech tools

- Transaction monitoring

- STR (Suspicious Transaction Report) submissions

All regulators ultimately defer to the UAE’s federal AML law but enforce it differently depending on their jurisdiction.

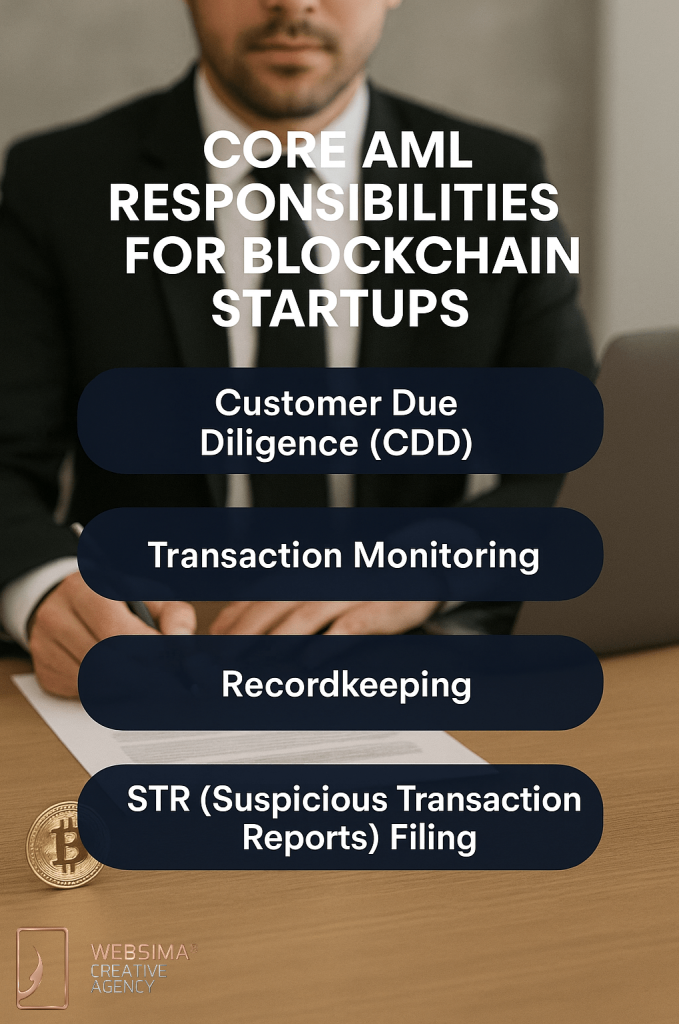

Core AML Responsibilities for Blockchain Startups

Whether licensed under VARA, DIFC, or ADGM, these are non-negotiable requirements:

Customer Due Diligence (CDD)

- Gather and verify user identity (KYC)

- Identify beneficial ownership for corporate accounts

Enhanced Due Diligence (EDD)

- Applied to high-risk customers and large or irregular transactions

- Includes deeper source-of-funds checks and senior approval

Transaction Monitoring

- Automated tools must flag suspicious behavior

- Crypto mixers, privacy coins, and wallet obfuscation techniques require scrutiny

Recordkeeping

- All KYC and transaction data must be kept for at least 5 years

- Easily retrievable for audits and investigations

STR Filing

- Suspicious Transaction Reports must be submitted to the UAE Financial Intelligence Unit (FIU) promptly

Penalties for Non-Compliance

AML violations can have serious consequences:

- Fines: Up to AED 1 million per violation

- License Suspension: VARA and other regulators may revoke licenses

- Criminal Charges: Applicable to responsible individuals (e.g., founders, MLROs)

- Blacklisting: Difficulty opening UAE bank accounts or raising capital

Example: In 2023, a crypto exchange was fined AED 950,000 for failing to submit STRs and failing to vet high-risk wallets properly.

Implementing AML in Your Blockchain Startup

To remain compliant and avoid legal trouble:

- Appoint a qualified MLRO early

- Adopt RegTech solutions like Chainalysis or Elliptic

- Draft a localized AML Manual based on VARA, DFSA, or FSRA guidelines

- Train all staff on AML red flags

- Conduct internal audits quarterly

These steps not only prevent violations but also speed up licensing and help build banking relationships.

Real Case Study: NFT Startup in Dubai

An NFT platform based in Dubai sought VARA approval in 2024. The key issue was AML compliance readiness. After:

- Hiring a full-time MLRO

- Adopting Sumsub for KYC

- Integrating Chainalysis KYT for wallet risk-scoring

- Drafting a UAE-specific AML policy

The startup secured a license in just 10 weeks and now operates seamlessly while onboarding over 100 creators monthly.

AML Tech Tools for Web3 Businesses

Here are top AML tools used by compliant UAE startups:

- Chainalysis – Wallet screening and transaction tracing

- Elliptic – Sanctions checks and forensic tracking

- Sumsub / Onfido – Automated KYC onboarding

- ComplyAdvantage – Global watchlist alerts

- TRM Labs – Blockchain-based risk management

Integrating these can automate most AML functions, reducing manual effort while increasing regulator confidence.

Common AML Mistakes to Avoid

- Relying on offshore AML policies not tailored to the UAE

- Failing to file STRs due to reputational concerns

- Underestimating the need for staff training

- Not classifying clients by risk tier

- Ignoring DeFi exposure in risk assessments

Every error can compound over time—proactive action is always cheaper than regulatory fines.

Benefits of Strong AML Compliance

- Banking Access: UAE banks prefer AML-compliant blockchain firms

- Faster Licensing: Regulatory approvals are smoother

- Investor Confidence: VCs assess compliance during due diligence

- Global Expansion Readiness: Compliance in UAE often aligns with EU and Singapore rules

AML readiness = growth readiness.

Final Thoughts

The future for blockchain and Web3 in the UAE looks bright, as the UAE rapidly cements its global leadership in blockchain and digital assets. Hence, regulatory integrity has become non-negotiable. While the country is highly supportive of innovation—with initiatives like the Dubai Blockchain Strategy and Abu Dhabi’s Fintech Sandbox—this support comes with an expectation: that startups will fully align with national and international compliance standards, especially in relation to AML laws.

For blockchain startups, this means building operational models where compliance is embedded from day one, not bolted on later. Whether you’re operating a crypto exchange, NFT marketplace, decentralized finance protocol, or token issuance platform, the UAE’s AML framework applies to you, regardless of whether you’re in a free zone like DIFC or ADGM, or operating under VARA in Dubai.

Need Help With AML Compliance?

Websima specializes in supporting blockchain and Web3 startups in the UAE. We assist with:

- Drafting AML policies

- Onboarding RegTech tools

- Setting up your compliance team

- Navigating VARA, DIFC, or ADGM licensing

Let us help your startup grow confidently and legally.

Contact Websima today to begin your AML compliance journey.