Introduction: Stablecoin rails for real-world commerce

The UAE’s payments landscape is evolving faster than ever. Traditional systems such as credit-card networks and international bank transfers, while reliable, are increasingly seen as expensive, slow, and inflexible. By contrast, stablecoin payments UAE are emerging as the next generation of settlement infrastructure—designed for speed, transparency, and programmable automation.

Stablecoins combine the reliability of fiat currencies with the efficiency of blockchain technology. They allow businesses to receive payments within seconds, automate reconciliation, and lower processing costs—all while remaining compliant with Dubai’s Virtual Assets Regulatory Authority (VARA) regulations.

JUST IN: Ripple announces Zand Bank and Mamo as first blockchain-enabled payments clients in UAE. pic.twitter.com/GkPZ8j5Us1

— Whale Insider (@WhaleInsider) May 19, 2025

This article explores how UAE merchants can adopt stablecoins for both point-of-sale (POS) and invoicing models, highlighting practical integration pathways, compliance frameworks, and the broader outlook as the UAE prepares for its own Digital Dirham initiative.

What Stablecoins Mean for UAE Merchants

Stablecoins are digital tokens pegged to a stable asset, typically a fiat currency like the US dollar. Unlike volatile cryptocurrencies, stablecoins are engineered for stability, making them ideal for commerce.

A well-known example is USDC, a regulated, fiat-backed stablecoin issued by Circle. It maintains full transparency through independent reserve audits and one-to-one redemption with USD. Merchants and payment processors across the world rely on it because of its liquidity and reliability. Learn more in the USDC overview by Circle.

The advantages of stablecoins for merchants are straightforward:

- Instant settlement: Payments finalize within seconds instead of days.

- Reduced transaction costs: Processing fees are significantly lower than traditional card systems.

- Audit-ready data: Every transaction is verifiable on-chain, providing a permanent record.

- Programmable logic: Refunds, loyalty rewards, and escrow conditions can be automated via smart contracts.

- Global reach: Merchants can serve customers worldwide without relying on legacy banking rails or worrying about currency conversion delays.

Regulatory Clarity: The UAE’s Leadership in Digital Payment Oversight

The UAE’s regulatory clarity sets it apart from other jurisdictions experimenting with digital payments. The Virtual Assets Regulatory Authority (VARA) governs all activities involving digital assets in Dubai, ensuring that innovation occurs within a transparent and controlled framework.

For merchants, the key takeaway is simple: accepting stablecoin payments doesn’t require a crypto license as long as the merchant uses a VARA-licensed payment gateway. These licensed gateways handle critical functions such as custody, conversion, AML (Anti-Money Laundering) screening, and transaction reporting.

To understand the scope and categories defined under Dubai’s regulatory environment, review the official VARA Rulebooks index.

Meanwhile, the Central Bank of the UAE (CBUAE) continues to pilot the Digital Dirham (CBDC), which will work in harmony with private stablecoins and licensed service providers. This hybrid approach—combining central-bank infrastructure with private innovation—positions Dubai as one of the most advanced payment ecosystems in the world.

How Stablecoin Payments Work for Merchants

Point-of-Sale (POS) Integration

In retail environments such as hospitality, healthcare, or luxury goods, stablecoin acceptance can be seamlessly added to existing POS systems:

- The merchant’s POS terminal or checkout device displays a QR code generated by a licensed payment gateway.

- The customer scans the QR code and pays in a supported stablecoin (e.g., USDC).

- The payment is verified on-chain within seconds.

- The payment gateway automatically converts the received stablecoins into AED and transfers the amount to the merchant’s account.

This process ensures near-instant finality, reduced fees, and lower reconciliation errors. POS providers operating under VARA supervision already offer plug-and-play integration options for UAE merchants.

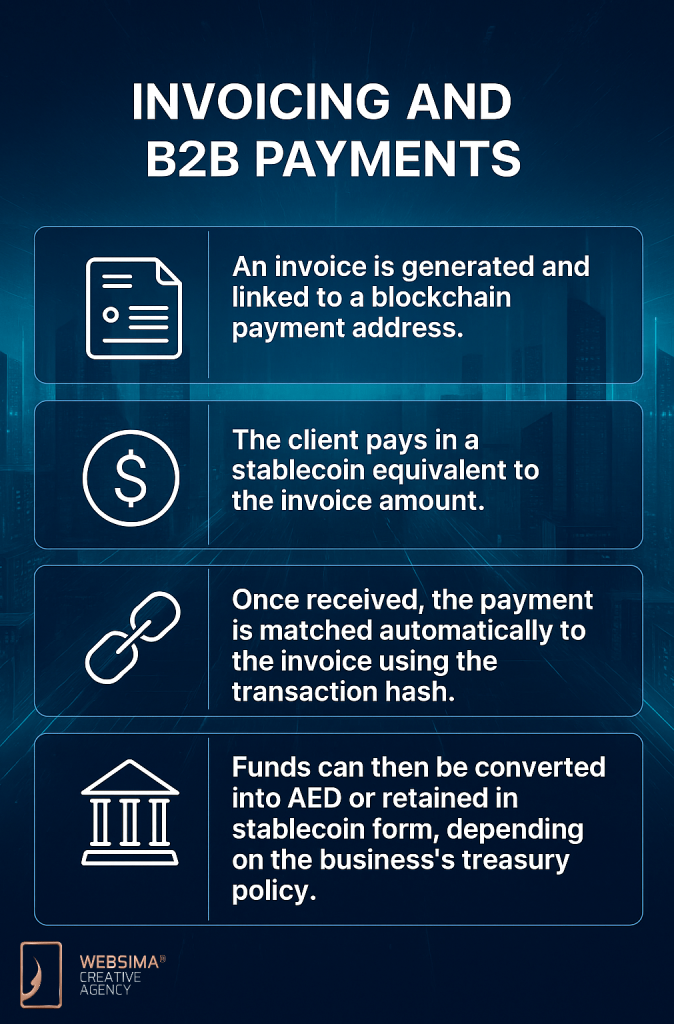

Invoicing and B2B Payments

For service-based businesses—consultancies, logistics firms, and exporters—stablecoin invoicing streamlines cross-border payments.

- An invoice is generated and linked to a blockchain payment address.

- The client pays in a stablecoin equivalent to the invoice amount.

- Once received, the payment is matched automatically to the invoice using the transaction hash.

- Funds can then be converted into AED or retained in stablecoin form, depending on the business’s treasury policy.

This automation removes the delays of SWIFT transfers and eliminates the need for manual reconciliation, saving finance departments hours each month.

Merchant Benefits of Adopting Stablecoin Settlement

| Advantage | Description |

| Faster cash flow | Transactions settle in seconds, improving liquidity. |

| Lower processing fees | Typical cost per transaction: 0.5–1%, compared to 2.5–3.5% for card payments. |

| Cross-border compatibility | Accept payments from clients anywhere in the world without FX restrictions. |

| Improved transparency | Every payment includes a verifiable on-chain record. |

| Automated reconciliation | APIs can link blockchain data directly to accounting software. |

In short, stablecoins allow merchants to operate with the speed of crypto and the reliability of traditional banking—without the volatility.

Compliance and Security Considerations

While the benefits are compelling, compliance and security remain non-negotiable. Dubai’s regulatory framework ensures that all stablecoin payment activities fall under the supervision of licensed intermediaries.

| Risk | Description | Mitigation |

| Counterparty risk | Risk of de-pegging or mismanagement by the issuer. | Use reputable, audited issuers such as Circle’s USDC. |

| Cybersecurity | Risk of wallet theft or private key compromise. | Employ multi-signature wallets and regulated custodians. |

| AML/KYC compliance | Unverified clients or unclear source of funds. | Work exclusively with VARA-licensed gateways. |

| Regulatory divergence | Differences in recognition across jurisdictions. | Follow VARA guidelines and seek local legal advice. |

By choosing trusted partners, merchants can enjoy the efficiency of blockchain-based payments without compromising compliance or reputation.

Case Study: Stablecoin POS Integration in Dubai

In 2024, a luxury restaurant group in Dubai integrated a stablecoin payment option across several venues. Within the first 90 days:

- Transaction fees fell by 65%.

- Settlement times dropped from 48 hours to 45 seconds.

- Tourist spending increased by 12%, particularly from European and Asian customers preferring digital assets.

The pilot proved that compliant stablecoin adoption is both technically feasible and commercially advantageous. Today, similar hospitality and retail merchants are adding stablecoin options through licensed PSPs to enhance operational efficiency.

Accounting and Reconciliation Advantages

Traditional payment systems create reconciliation challenges due to partial payments, chargebacks, or batching delays. Stablecoin payments simplify everything: each payment has a unique transaction hash that maps directly to the invoice or POS sale.

Finance teams can automate:

- Daily reconciliation: Match transactions to invoices automatically.

- Audit trails: Provide verifiable proof for regulators and auditors.

- Variance reporting: Detects and flag mismatches instantly.

With stablecoin data streamed directly into accounting systems, reconciliation time shrinks from hours to minutes.

The Role of Global Payment Networks

International payment providers are embracing stablecoin infrastructure. Visa, for example, has expanded its blockchain initiatives to allow digital-currency settlement directly on its network.

Learn more through the Visa Crypto overview, which outlines how stablecoins integrate into existing card-payment ecosystems.

This evolution ensures that merchants can accept stablecoins without replacing their existing systems—creating a unified payments environment where fiat, stablecoin, and card transactions coexist seamlessly.

Outlook 2025–2030: The Digital Dirham Era

The Digital Dirham, launched under the UAE Central Bank’s broader financial innovation strategy, will work alongside private stablecoins to create a fully interoperable financial ecosystem.

By 2030, UAE merchants will likely use multi-rail systems that combine AED, stablecoins, and CBDC payments under a single compliance framework. This will enable instant domestic and cross-border settlement while maintaining the transparency and oversight regulators require.

For a deeper analysis of how stablecoins and other financial innovations are reshaping global systems, refer to the IMF’s report on stablecoins and the global economy.

Frequently Asked Questions (FAQs)

- Are stablecoin payments legal for merchants in Dubai?

Yes. Merchants can accept stablecoin payments via VARA-licensed payment gateways that handle all AML and KYC requirements. - Which stablecoin is best suited for UAE merchants?

USDC is one of the most widely regulated and audited stablecoins, offering high liquidity and seamless conversion to AED. - What industries can benefit most from stablecoin payments UAE?

Sectors with frequent cross-border transactions—like tourism, professional services, and retail—see the most immediate benefits. - How do stablecoin payments affect accounting and auditing?

Each on-chain payment includes a timestamp and hash that simplifies reconciliation and provides an immutable audit trail. - Will stablecoin payments replace the UAE Dirham?

No. Stablecoins will complement fiat AED and the upcoming Digital Dirham, providing merchants with faster, more versatile settlement options.

Final Thoughts

Stablecoin payments UAE mark the convergence of speed, transparency, and compliance. For merchants, they’re not a speculative experiment but an operational upgrade that reduces cost and friction while aligning perfectly with the UAE’s digital-first vision.

The convergence of regulated stablecoins, automated invoicing systems, and VARA oversight is setting a new standard for how value moves across the UAE’s economy. Merchants who adopt now will be the first to benefit when the Digital Dirham officially connects with private payment infrastructure.

Websima Insight

At Websima, we help UAE merchants modernize their payment operations through secure, compliant, and future-proof stablecoin settlement systems. From POS terminal integration and smart invoicing to backend accounting automation, our blockchain specialists design solutions tailored to your business model and regulatory obligations.

Ready to build your next-generation payment stack?

Visit websima.ae/contactus to speak with our team.