Table of Contents

- Introduction

- What Are RWA NFTs?

- Why Dubai Is Becoming a Hub for RWA NFT Innovation

- Tokenizing Gold: Bringing Tangible Assets On-Chain

- Fractional Ownership of Art Through NFTs

- Land Tokenization in Dubai’s Real Estate Market

- Regulatory Landscape: VARA, DIFC, and ADGM

- Key Platforms Offering RWA NFT Services in Dubai

- Risks and Challenges of RWA NFTs

- Future Outlook for RWA NFTs in Dubai

- Conclusion

- Frequently Asked Questions (FAQs)

Introduction

Dubai is rapidly emerging as a global leader in Web3 innovation, attracting investors, developers, and regulators who aim to redefine ownership of real-world assets (RWAs).

The rise of RWA NFTs—blockchain-based tokens representing gold, fine art, and real estate—is fueling a major shift in investment strategies. Globally, the RWA tokenization market already reached $24 billion in mid-2025, and analysts project exponential growth over the next five years (Spydra).

UAE Just Opened the RWA Floodgates!

Dubai has officially approved the FIRST-EVER tokenized money market fund — a historic milestone for real-world assets.

RWAs are now fully legal and tradable on-chain in Dubai. pic.twitter.com/Kd3P4dMxOj

— Coin Bureau (@coinbureau) July 8, 2025

Dubai’s regulatory innovation and strategic positioning make it a natural epicenter for this transformation.

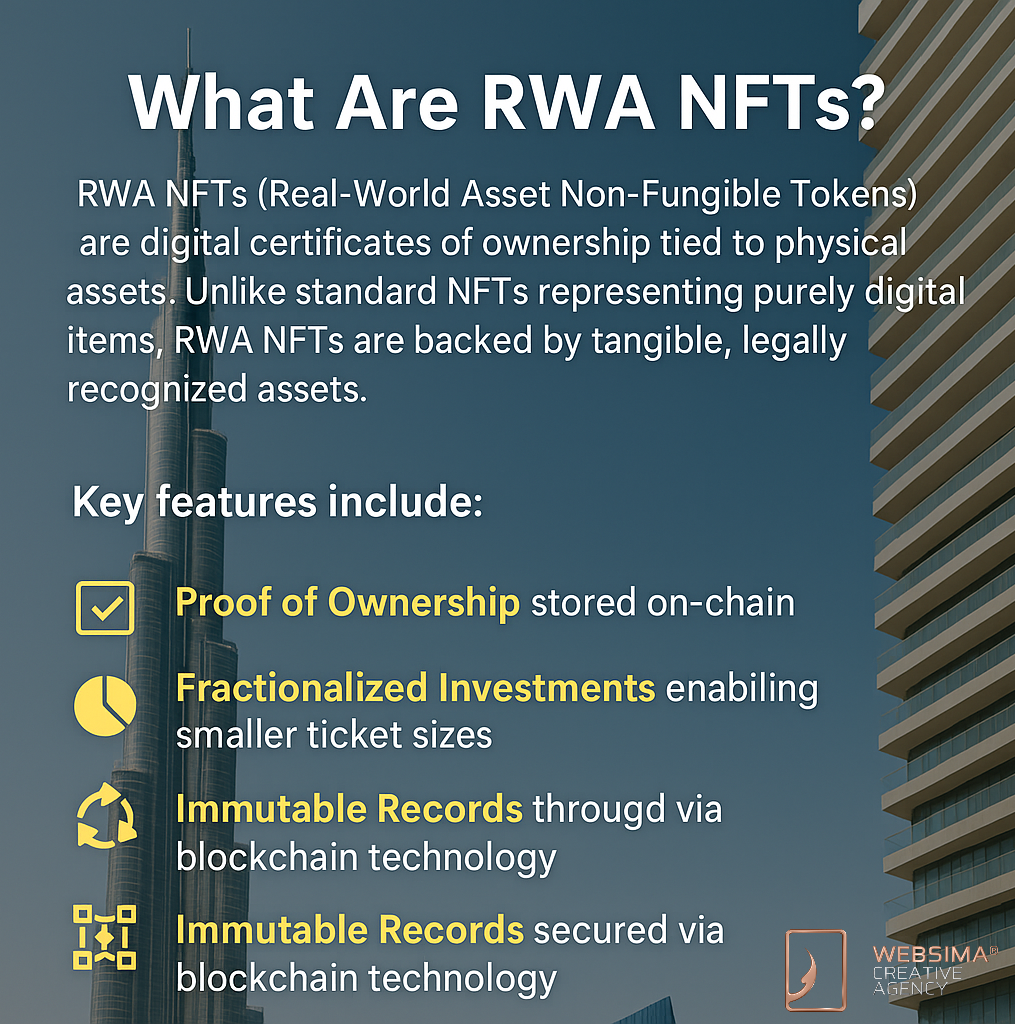

What Are RWA NFTs?

RWA NFTs (Real-World Asset Non-Fungible Tokens) are digital certificates of ownership tied to physical assets. Unlike standard NFTs representing purely digital items, RWA NFTs are backed by tangible, legally recognized assets and secured by blockchain along with AI which significantly improves fraud detection.

Key features include:

- Proof of Ownership stored on-chain

- Fractionalized Investments enabling smaller ticket sizes

- Enhanced Liquidity through secondary NFT marketplaces

- Immutable Records secured via blockchain technology

Why Dubai Is Becoming a Hub for RWA NFT Innovation

Dubai offers a unique regulatory and business environment for tokenization projects.

Key enablers include:

- VARA Framework: Dubai’s Virtual Assets Regulatory Authority (VARA) offers clear licensing and compliance paths for NFT-backed assets.

- Investor Demand: In May 2025 alone, Dubai recorded AED 66.8 billion (~$18.2 billion) in property transactions, with $399 million (17.4%) linked to tokenized real estate (Medium, Websima).

- Technological Ecosystem: Anchored by DMCC Crypto Centre, DIFC Innovation Hub, and ADGM RegLab.

- Government Vision: Initiatives like the Dubai Blockchain Strategy 2030 accelerate Web3 adoption across sectors.

Tokenizing Gold: Bringing Tangible Assets On-Chain

Dubai has long been a global gold trading hub, making it a natural leader in gold-backed NFTs.

- How It Works: Each NFT represents a defined amount of allocated physical gold securely stored in regulated Dubai vaults.

- Investor Benefits:

- Access to fractional gold ownership starting at micro-level investments

- On-chain transparency with audited reserves

- Fast liquidity via licensed NFT marketplaces

With Dubai handling approximately 25% of the world’s physical gold trade , tokenizing bullion is unlocking unprecedented access for global retail and institutional investors.

Fractional Ownership of Art Through NFTs

Dubai’s thriving luxury art market is being reshaped by NFT-driven fractionalization:

- Tokenizing Fine Art: Platforms tokenize museum-grade works stored in regulated galleries.

- Advantages:

- Democratized access to high-value art

- Improved liquidity for traditionally illiquid assets

- Blockchain-backed provenance and authenticity

Land Tokenization in Dubai’s Real Estate Market

Dubai’s real estate sector is leading the adoption of NFT-based land and property ownership:

- How It Works: Each NFT represents fractional ownership in a land parcel or premium property.

- Use Cases:

- Lower entry barriers for global investors

- Instant transfer of title deeds via smart contracts

- Greater transparency in property records

The Dubai Land Department (DLD) is piloting real estate tokenization programs, forecasting that 7% of all property transactions—worth over AED 60 billion (~$16 billion)—will be tokenized by 2033 (CoinDesk).

Regulatory Landscape: VARA, DIFC, and ADGM

Dubai’s proactive regulatory framework is pivotal to its RWA leadership:

- VARA: Regulates tokenized assets, ensuring investor protection.

- DIFC & ADGM Sandboxes: Enable controlled pilots for innovative tokenization solutions.

- Mandatory Compliance:

- Integrated KYC/AML verification

- Cross-border licensing for RWA trading platforms

- Audited custody arrangements for physical backing

For the NFTs smart contract dispute resolution in Dubai, VARA has its own setup, as does ADGM.

Key Platforms Offering RWA NFT Services in Dubai

Several Dubai-based platforms are spearheading the RWA NFT revolution, offering secure, legally backed, and fractional ownership of real estate, art, and gold through blockchain-native solutions:

- Prypco Mint – A government-backed initiative by the Dubai Land Department (DLD) enabling fractional property ownership through NFTs, starting from just AED 2,000 (~$545), with rental income distributed on-chain.

Website: https://mint.prypco.com - PRYPCO Blocks – A related platform offering real estate crowdfunding via NFTs, letting investors acquire fractional stakes in income-generating rental properties with ease.

Website: https://prypco.com/blocks - 10101.art – A Dubai-based platform transforming fine art investment by enabling fractional ownership of iconic artworks (e.g., Picasso, Banksy, Warhol) via RWA NFTs, with legal ownership verified on-chain and artworks housed at Monada Art Gallery.

Website: https://10101.art - DMCC & ComTech Gold Tokens (CGO) – A pioneering collaboration by the Dubai Multi Commodities Centre (DMCC) and Comtech Gold which tokenizes physical gold bars stored in DMCC-approved vaults. Each CGO token, recorded via DMCC’s Tradeflow platform, represents 1 gram of 999.9 purity gold. These tokens are Shariah-compliant, legally backed, and enable accessible investment from as low as one gram.

Website: Comtech Gold

Risks and Challenges of RWA NFTs

Despite rapid adoption, RWA NFTs face challenges:

- Regulatory Complexity: Frameworks are still evolving globally.

- Liquidity Gaps: Secondary markets are growing but remain immature.

- Custodial Risk: NFT value depends on secure vaults and registries.

- Valuation Accuracy: Transparent price discovery mechanisms are still maturing.

Future Outlook for RWA NFTs in Dubai

Dubai’s commitment to Web3 transformation ensures a strong future for RWA NFTs:

- Mainstream Adoption: Tokenized assets are projected to dominate retail investment platforms.

- DeFi Integration: Expect NFTs representing gold, property, and art to serve as collateral in decentralized lending.

- Institutional Capital: Dubai’s regulatory foresight is attracting global funds seeking exposure to digitally native RWAs.

Conclusion

Dubai is pioneering the RWA NFT revolution by seamlessly merging traditional asset markets with blockchain technology. With property tokenization already contributing 17.4% of monthly real estate transactions and gold-backed NFTs opening fractional markets, the city is laying the groundwork for borderless investment ecosystems.

For investors, innovators, and Web3 startups alike, RWA NFTs in Dubai present an unmatched opportunity to diversify portfolios, unlock liquidity, and participate in a global shift toward decentralized asset ownership.

FAQs

1. What are RWA NFTs?

Blockchain-backed tokens representing physical assets like gold, property, and fine art.

2. Are RWA NFTs legal in Dubai?

Yes, provided they’re issued via VARA-licensed platforms.

3. Can I invest in Dubai real estate via NFTs?

Yes. In May 2025, $399 million (~17.4%) of property sales came from tokenized deals, underscoring mainstream adoption.

4. What risks should I consider?

Regulatory shifts, asset custody, liquidity concerns, and valuation transparency.

5. How do I start investing in RWA NFTs?

Work with licensed platforms, complete KYC/AML, and select your preferred asset class.

Next Steps: Build Your Web3 Future with Websima

At Websima, we help blockchain startups, Web3 platforms, and tokenization ventures design, develop, and launch RWA NFT ecosystems in full compliance with VARA and Dubai’s evolving regulations.

Whether you’re planning to tokenize gold reserves, luxury artwork, or prime real estate, our experts deliver secure smart contracts, NFT marketplace integration, and regulatory alignment.

Talk to Websima’s RWA NFT Experts