Table of Contents

- Introduction

- What Is a Real Estate DAO?

- Regulatory Landscape: Foundation for Real Estate DAOs in Dubai

- Why Real Estate DAOs in Dubai Matter

- Benefits of Real Estate DAOs in Dubai

- Challenges and Considerations

- The Future Outlook

- Frequently Asked Questions (FAQ)

- Conclusion

- Partner with Websima

Introduction

Dubai has always been synonymous with innovation in real estate. From the tallest tower in the world to man-made islands, the emirate has consistently redefined global property benchmarks. But today, innovation is not only about architecture or design—it’s about ownership, accessibility, and investment models.

In 2024, the Dubai Land Department (DLD) announced plans to tokenize AED 60 billion (USD 16 billion) worth of property by 2033, representing roughly 7% of the emirate’s total property transactions. This move signals Dubai’s intent to fully embrace blockchain, tokenization, and decentralized finance as tools for making property investment more efficient and inclusive.

Another bullish day for @RealtyX_DAO, as we’re on the brink of launching our official #RWA platform, unlocking the value of Dubai’s vibrant property market.

Dubai Insights

Dubai’s Rise: Attracting Asia’s wealthiest for asset growth & portfolio diversification.

— RealtyX DAO RWA (@RealtyX_DAO) January 11, 2024

It is in this context that Real Estate DAOs in Dubai have begun to attract attention. Unlike traditional investment structures that rely on centralized management and large capital requirements, DAOs—Decentralized Autonomous Organizations—are community-driven and powered by blockchain technology. They enable groups of investors, regardless of geographic location or investment size, to pool funds, vote on decisions, and share returns transparently.

What Is a Real Estate DAO?

A Decentralized Autonomous Organization (DAO) is a blockchain-based model that enables groups of people to pool resources, vote on investment decisions, and share profits transparently. It can be applied to various industries such as Insurance DAO in Dubai as well as the real estate sector.

When applied to real estate, DAOs allow:

- Fractional Ownership: Investors buy tokens that represent a share of a property.

- Collaborative Governance: Token holders vote on acquisitions, management, and sales.

- Shared Returns: Rental income and capital gains are distributed proportionally.

- Liquidity Options: DAO tokens can often be traded on secondary markets.

This structure bridges the tangible security of property with the agility and transparency of blockchain.

Regulatory Landscape: Foundation for Real Estate DAOs in Dubai

The UAE legal framework to register DAO in freezones and the mainland is evolving. Dubai has consistently positioned itself as a global leader in blockchain adoption. The emirate has not only introduced tokenization through the Dubai Land Department but also created the Virtual Assets Regulatory Authority (VARA), the world’s first independent regulator for virtual assets.

- Dubai Land Department has partnered with fintech platforms to launch blockchain-based title deed tokenization, setting the stage for digital property ownership (Dubai Land Department).

- VARA provides a clear framework for digital assets, ensuring that DAOs and tokenized investments can operate within a regulated environment (VARA).

This combination of legal clarity and technological innovation gives Real Estate DAOs in Dubai a firm foundation to grow.

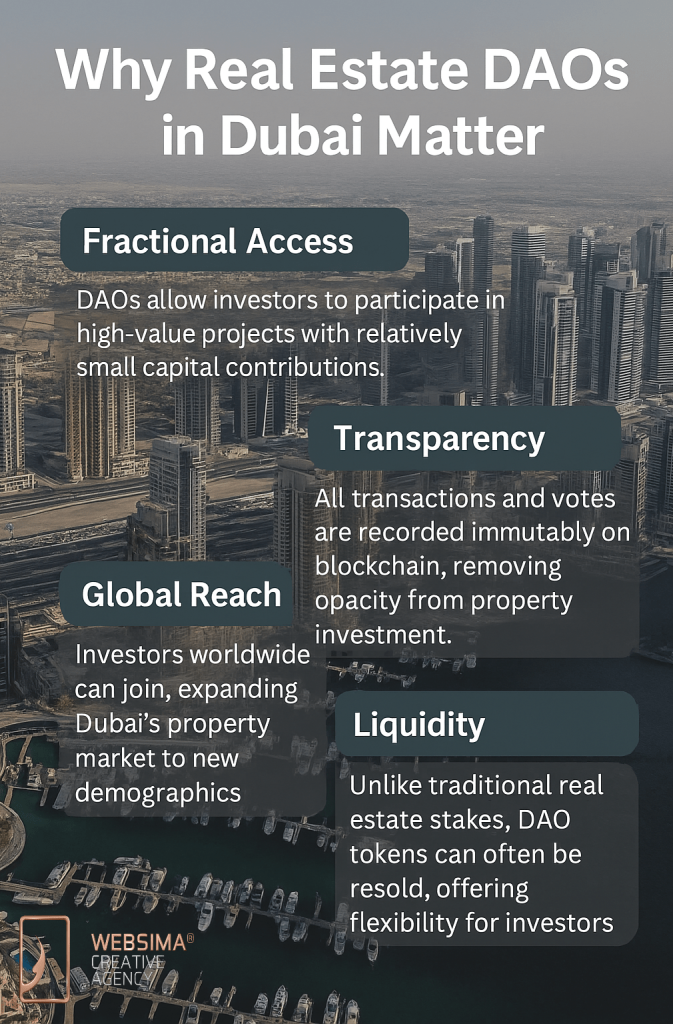

Why Real Estate DAOs in Dubai Matter

Fractional Access

DAOs allow investors to participate in high-value projects with relatively small capital contributions.

Transparency

All transactions and votes are recorded immutably on blockchain, removing opacity from property investment.

Global Reach

Investors worldwide can join, expanding Dubai’s property market to new demographics.

Liquidity

Unlike traditional real estate stakes, DAO tokens can often be resold, offering flexibility for investors.

Benefits of Real Estate DAOs in Dubai

- Democratized Investment – Makes prime property accessible to more people.

- Decentralized Governance – Decisions are shared among token holders.

- Innovation Alignment – Supports Dubai’s Vision 2030 goals of diversification and digital transformation.

- Flexible Applications – Can be applied to residential, commercial, or hospitality projects.

Challenges and Considerations

While the model is promising, there are challenges:

- Evolving Regulation: DAO-specific legislation is still developing.

- Smart Contract Risks: Code errors or vulnerabilities can expose investors.

- Governance Issues: Larger DAOs may face slower decision-making or internal conflicts.

- Market Education: Many investors remain unfamiliar with blockchain-based investment.

The Future Outlook

Globally, the tokenized real estate market is expected to grow from $3.5 billion in 2024 to $19.4 billion by 2033. With Dubai’s strong property market and progressive regulation, the emirate is at the best place to capture a significant share of this trend.

Real Estate DAOs in Dubai may become as common as Real Estate Investment Trusts (REITs), offering a more flexible, transparent, and globally accessible investment model.

Frequently Asked Questions (FAQ)

- Are Real Estate DAOs legal in Dubai?

Yes, while DAOs themselves are new, DLD’s tokenization initiatives and VARA’s regulations create a clear framework for their operation. - How much capital do I need to join?

This varies, but DAO models often allow much smaller investments than direct property purchases. - Can I sell my DAO tokens?

Yes, depending on the DAO structure, tokens may be tradeable on secondary markets. - What types of properties can DAOs own?

Residential, commercial, hospitality, and even sustainable developments are possible.

Final Thoughts

Real Estate DAOs in Dubai are more than just a technological novelty—they are a response to long-standing barriers in global property investment. For decades, real estate has been admired as one of the most stable and profitable asset classes, but it has also been criticized for being illiquid, expensive to access, and dominated by institutional investors.

By leveraging blockchain and community governance, DAOs resolve many of these challenges. They make it possible for a young professional in Europe to co-invest in a Dubai apartment with an entrepreneur from Asia and a family office in the U.S.—all through digital tokens, transparent voting, and automated profit distribution.

For Dubai, DAOs are not just a financial tool, but part of its broader Vision 2030 agenda, which emphasizes innovation, sustainability, and diversification. They align perfectly with the emirate’s push toward tokenization, digital regulation, and smart-city infrastructure.

Partner with Websima

At Websima, we recognize that the way people invest in real estate is changing. Blockchain, tokenization, and DAOs are no longer abstract concepts—they are practical tools that are already reshaping the Dubai property market.

Our mission is to guide investors, developers, and businesses through this transformation. Whether you are:

- An investor curious about how to participate in Real Estate DAOs in Dubai,

- A developer seeking to tokenize your next project, or

- A business leader exploring blockchain integration into your real estate strategy,

Websima provides the digital expertise, strategic insight, and technology solutions you need to succeed. From custom web platforms and digital marketing strategies to blockchain-ready infrastructure, our team ensures that you stay ahead of the curve.

To explore how Websima can support your journey into the future of Dubai real estate, visit Websima today.