Dubai has long been a global hub for innovation and luxury real estate. In recent years, the integration of blockchain technology into the real estate sector has transformed investment opportunities. One of the most revolutionary developments is the rise of NFTs in Dubai’s real estate market. Non-Fungible Tokens (NFTs) have introduced new ways for buyers, sellers, and investors to engage with property transactions, offering digital ownership, enhanced security, and fractional investment opportunities.

The rapid digitization of real estate transactions in Dubai is part of a broader trend that aims to increase efficiency, reduce paperwork, and enhance accessibility for global investors. As blockchain technology continues to mature, more stakeholders are recognizing the immense potential of NFTs in property transactions. From luxury villas and apartments to virtual real estate in the metaverse, Dubai is becoming a global hub for NFT startups and blockchain innovations.

Understanding NFTs in Real Estate

The need for NFTs in the real estate market arises from their potential to address inefficiencies in the traditional real estate sector, such as digital assetization, increased liquidity, enhanced transparency, simplified transactions, and decentralized investment #SEYT pic.twitter.com/7ZOcWRZrDR

— SEYT (@SEYT_Official) February 6, 2025

NFTs, or Non-Fungible Tokens, are unique digital assets that are stored on a blockchain. Unlike cryptocurrencies, NFTs are not interchangeable because each one has distinct properties. In real estate, an NFT can represent ownership of physical property, a virtual asset in the metaverse, or even a share in a larger investment project.

Dubai, known for its rapid adoption of cutting-edge technologies, has embraced NFTs as a means to facilitate transparent and efficient real estate transactions. The government’s support for blockchain initiatives has accelerated the incorporation of NFTs into property dealings, making it one of the most forward-thinking markets in the world.

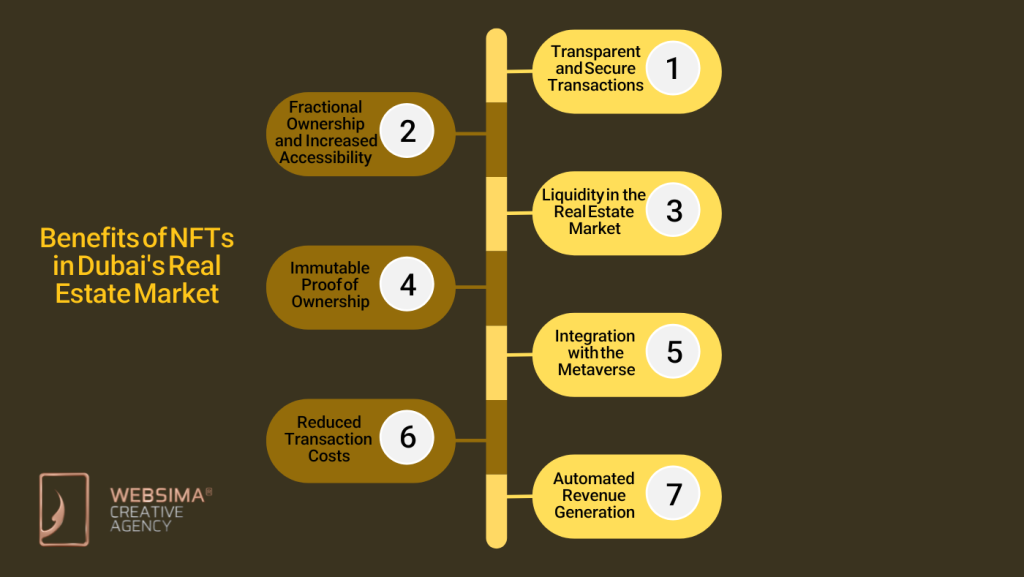

Benefits of NFTs in Dubai’s Real Estate Market

1. Transparent and Secure Transactions

Traditional real estate transactions involve intermediaries such as brokers, banks, and legal representatives, which can increase costs and processing time. NFTs eliminate the need for many of these intermediaries by using smart contracts. These contracts are self-executing agreements stored on the blockchain, ensuring transparency and reducing fraud.

2. Fractional Ownership and Increased Accessibility

One of the key advantages of NFTs in Dubai’s real estate market is their ability to enable fractional ownership. High-value properties can be tokenized into multiple NFTs, allowing investors to purchase smaller portions of a property. This democratization of real estate investment opens doors for a broader range of investors who may not have the capital for a full property purchase.

3. Liquidity in the Real Estate Market

Real estate is traditionally an illiquid asset, requiring significant time and effort to buy or sell. With NFTs, property transactions can be completed faster through digital marketplaces, allowing investors to trade fractional ownership in real-time. This increased liquidity attracts more global investors to Dubai’s booming real estate sector.

4. Immutable Proof of Ownership

Ownership records stored on the blockchain are immutable, meaning they cannot be altered or tampered with. This feature enhances security and trust, as investors and property owners can verify ownership instantly without the risk of fraud or disputes.

5. Integration with the Metaverse

Dubai has also become a leader in the metaverse real estate sector, where digital properties exist in virtual environments. NFTs play a crucial role in buying, selling, and developing virtual real estate. Investors can purchase NFT-based properties in digital worlds such as Decentraland and The Sandbox, further expanding the scope of Dubai’s real estate market.

6. Reduced Transaction Costs

By cutting out intermediaries, NFT-based real estate transactions significantly reduce costs associated with commissions, legal fees, and administrative processes. Blockchain technology enables a more direct and streamlined approach, making investments more cost-effective and appealing.

7. Automated Revenue Generation

NFT-based properties can be linked to smart contracts that automate revenue generation, such as rental payments or revenue-sharing agreements. For instance, landlords can set up automatic rent collection via blockchain, ensuring timely payments without the need for traditional banking systems.

Challenges Facing NFT Adoption in Dubai’s Real Estate Market

While NFTs present numerous advantages, challenges remain in their widespread adoption within Dubai’s real estate market.

1. Regulatory and Legal Frameworks

Dubai has made significant strides in blockchain regulation, but the legal framework surrounding NFTs in real estate is still evolving. Clear guidelines and compliance measures need to be established to ensure investor protection and seamless integration with traditional property laws.

2. Market Volatility and Speculation

NFTs are still a relatively new asset class, and their value can be highly volatile. Some investors may view NFT real estate as a speculative investment rather than a stable asset, leading to fluctuations in demand and pricing.

3. Technological Barriers

Not all investors are familiar with blockchain technology or comfortable using digital wallets. Widespread adoption of NFTs in Dubai’s real estate market requires educational initiatives and user-friendly platforms that simplify the purchasing process.

4. Cybersecurity Risks

As with any digital asset, NFT-based real estate transactions are susceptible to cyber threats such as hacking and fraud. Robust security measures and regulatory oversight are necessary to safeguard investors and property owners.

5. Interoperability Between Systems

A lack of standardization across different blockchain networks can pose challenges in NFT adoption. Ensuring that NFT property transactions are interoperable with existing real estate systems and platforms is crucial for mainstream adoption.

The Future of NFTs in Dubai’s Real Estate Market

Dubai’s commitment to technological innovation positions it as a global leader in blockchain-based real estate solutions. Several key trends are likely to shape the future of NFTs in the property sector providing lucrative opportunities to invest in NFTs in Dubai for a long term profit:

1. Government and Institutional Adoption

As regulatory frameworks become more defined, government agencies and major real estate developers may integrate NFTs into official property registries. This move would legitimize NFT transactions and encourage broader adoption.

2. Growth of Virtual Real Estate Ecosystems

Dubai’s interest in the metaverse economy suggests that digital real estate transactions will continue to gain traction. Investors may see opportunities in virtual cities, commercial spaces, and entertainment hubs within blockchain-based environments.

3. Hybrid Real Estate Models

Some projects may combine physical and virtual ownership, allowing investors to hold NFT-based deeds that represent both real-world and digital properties. This hybrid approach could redefine real estate investment strategies in Dubai.

4. Mainstream Adoption Through Simplified Platforms

As more real estate platforms integrate NFT technology, the buying and selling process will become more streamlined and user-friendly. Smart contracts, AI-driven analytics, and blockchain-based property verification systems will further enhance the market.

5. Increased Institutional Interest

Real estate investment firms and large-scale property developers may begin tokenizing assets to attract a wider investor base. Institutional participation will lend credibility to the NFT-based property market, driving further adoption.

Conclusion

NFTs are transforming Dubai’s real estate market by introducing virtual ownership, enhanced security, and new investment opportunities. As the city continues to embrace blockchain technology, the adoption of NFTs in property transactions is expected to rise. Despite challenges such as regulatory uncertainty and market volatility, Dubai remains at the forefront of NFT-based real estate innovation. With continued technological advancements and government support, NFTs could redefine property ownership, making real estate investments more accessible, secure, and efficient.

Websima, as the leading blockchain service provider in Dubai, is more than happy to help, if you are planning to start a blockchain-based business in Dubai. Blockchain, crypto and web3 web and website development, smart contract programming and development, Blockchain, Web3 and crypto company establishment are just a few out of many services that we provide. Feel free to contact us to book for a free consultation meeting with our talented team.