The world of finance is undergoing a massive transformation, and one of the most significant drivers of this change is Decentralized Finance (DeFi). DeFi leverages blockchain technology to create decentralized financial systems that eliminate intermediaries like banks, allowing individuals and businesses to access financial services directly.

In the UAE, DeFi in UAE has been gaining significant traction, with the government and private sector both embracing the technology as part of their broader vision for economic growth and digital innovation. This article will explore the future of DeFi in the UAE, how it is reshaping the country’s financial landscape, and the opportunities and challenges associated with it.

Dubai Approves USDC & EURC as First Stablecoins Under Crypto Token Regime

Dubai’s financial watchdog has officially recognized Circle’s USDC and EURC as the first stablecoins approved under its crypto regime.

First stablecoins approved – USDC & EURC gain recognition under… pic.twitter.com/aZ9MzpIiIy

— Cryptic (@Cryptic_Web3) February 25, 2025

What is DeFi?

Decentralized Finance, or DeFi, refers to financial services and products built on blockchain technology, particularly on public networks like Ethereum. These services aim to recreate traditional financial systems—such as lending, borrowing, trading, and investing—without relying on centralized entities like banks or financial institutions.

At the core of DeFi is the concept of decentralization, which ensures that financial transactions are peer-to-peer and not controlled by any central authority. DeFi platforms use smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This allows for increased transparency, security, and accessibility, while also reducing costs and inefficiencies associated with traditional financial systems.

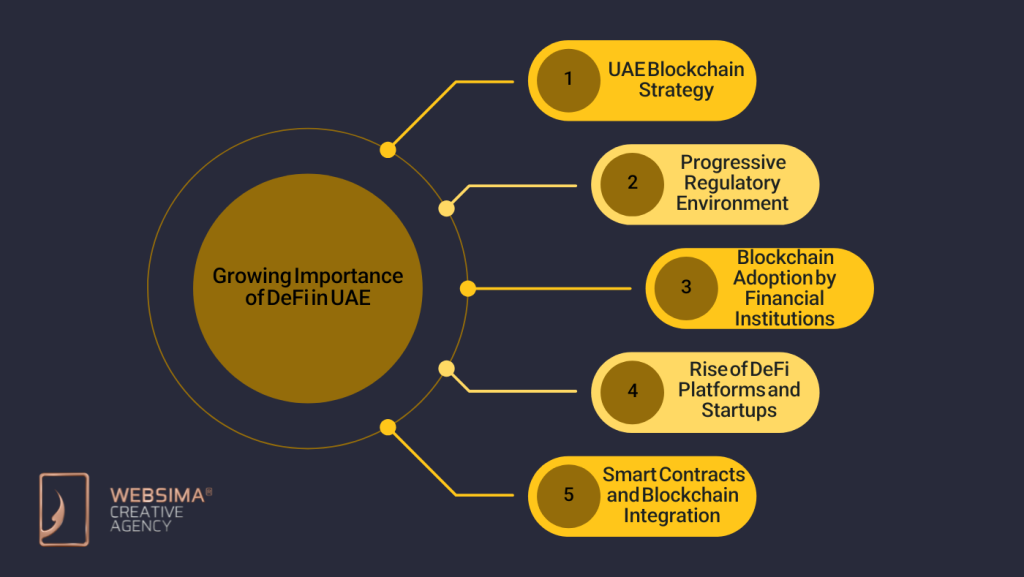

The Growing Importance of DeFi in UAE

The UAE has long been famous for its innovation-driven approach to business and technology. The country has been making strides in blockchain technology and digital finance, and DeFi in UAE is no exception. The UAE government has recognized the potential of DeFi to revolutionize financial services and has taken proactive steps to position the country as a global leader in the DeFi ecosystem.

1. UAE’s Blockchain Strategy

The UAE’s Blockchain Strategy 2021 is one of the key drivers behind the growing adoption of DeFi in the country. Launched in 2018, this strategy aims to transform the UAE into a blockchain-powered economy by utilizing blockchain technology across government services, business operations, and public services. The government’s vision includes the digitization of all documents, reducing the need for paper-based processes, and increasing the overall efficiency of the economy.

By encouraging the development and adoption of blockchain technology, the UAE is creating an ideal environment for DeFi to thrive. Blockchain’s ability to provide transparency, immutability, and efficiency makes it the perfect foundation for decentralized financial systems.

2. UAE’s Progressive Regulatory Environment

#Ripple just scored a major win with a #DFSA license to operate in Dubai’s DIFC—first blockchain payments provider there, unlocking a $40B market for faster, cheaper cross-border transactions

Big step for crypto in finance! Next up? We are betting on $XLM to follow… pic.twitter.com/ymrsYup0fK

— Prashora (@PrashoraOrg) March 13, 2025

A crucial factor in the growth of DeFi in UAE is the country’s regulatory framework. The UAE government has made significant efforts to create a favorable regulatory environment for blockchain, cryptocurrency, and digital finance companies.

The Dubai International Financial Centre (DIFC) has introduced a regulatory framework that encourages the development of fintech and DeFi businesses, making Dubai a hub for blockchain startups. The DIFC’s regulatory sandbox allows companies to test their decentralized finance products and services in a controlled environment while ensuring compliance with local laws.

Additionally, the UAE Central Bank and Securities and Commodities Authority (SCA) have provided guidelines for crypto-related businesses, ensuring a secure and legally compliant ecosystem for DeFi platforms and participants.

3. Adoption of Blockchain by Financial Institutions

DeFi in the UAE is also being driven by the adoption of blockchain technology by traditional financial institutions. Major banks and financial companies in the UAE are exploring the potential of blockchain and DeFi to improve efficiency, reduce costs, and enhance security. For instance, the Emirates NBD, one of the largest banks in the UAE, has begun exploring blockchain solutions for payments and trade finance.

Furthermore, the UAE’s Abu Dhabi Global Market (ADGM) has launched initiatives aimed at fostering blockchain adoption, including the establishment of a regulatory framework for digital assets and DeFi platforms. The regulatory clarity provided by ADGM is helping to create an ecosystem where DeFi projects can thrive while maintaining compliance with local laws.

4. Rise of DeFi Platforms and Startups in the UAE

As the demand for decentralized financial services grows, several startups and DeFi lending and borrowing platforms in the UAE are emerging. These platforms are bringing innovation to traditional financial services such as lending, borrowing, and trading.

For example, ADGM’s FinTech Abu Dhabi event attracts global DeFi startups, enabling them to showcase their innovations and network with investors, regulators, and financial institutions. These platforms are gaining traction not only in the UAE but also globally, as they offer enhanced transparency, lower fees, and greater accessibility compared to traditional financial systems.

The UAE’s growing fintech ecosystem is also attracting global DeFi companies, who are setting up operations in the country to benefit from its supportive regulatory environment and strategic location in the Middle East. As a result, the country is positioning itself as a leading hub for decentralized finance in the region.

5. Smart Contracts and Blockchain Integration in DeFi

At the heart of DeFi is the use of smart contracts, which are self-executing agreements written in code and deployed on a blockchain. As a result, these contracts enable decentralized applications (dApps) to operate autonomously, eliminating the need for intermediaries and reducing the risk of human error or fraud. Therefore, smart contracts play a crucial role in ensuring the efficiency and security of decentralized finance.

In the UAE, various blockchain initiatives are exploring the potential of smart contracts and DeFi to streamline business processes and improve transparency. For instance, the Dubai Land Department has integrated blockchain to enable property transactions and smart contracts to automate the buying and selling of real estate.

With the integration of smart contracts in financial services, DeFi in UAE is poised to become a game-changer for sectors like insurance, trade finance, and asset management.

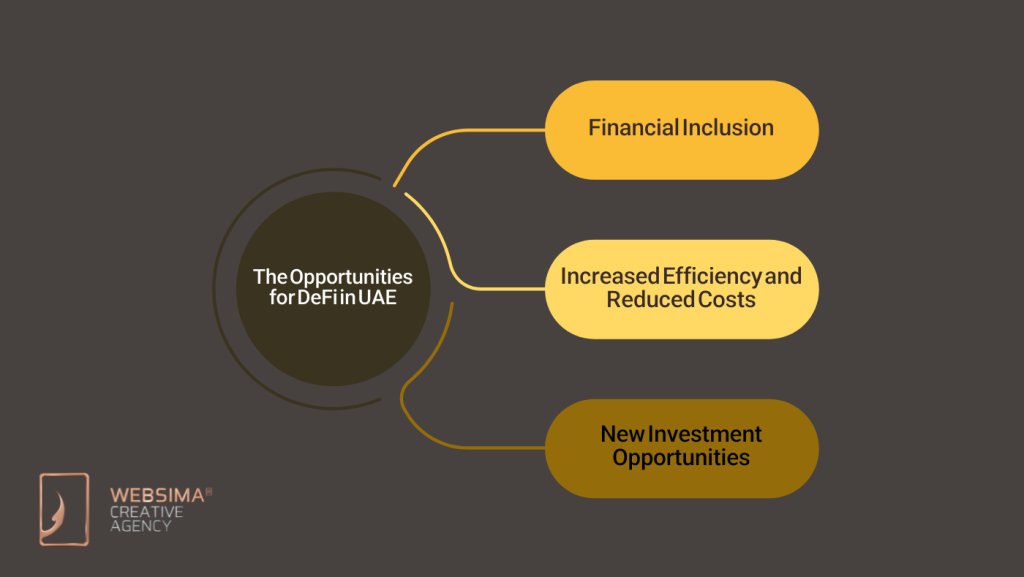

The Opportunities for DeFi in UAE

The adoption of DeFi in UAE presents numerous opportunities for both businesses and consumers. These opportunities include:

1. Financial Inclusion

DeFi has the potential to significantly improve financial inclusion by providing access to financial services for individuals who are unbanked or underbanked. In the UAE, where there is a significant expatriate population, DeFi can provide people with easier access to financial services like lending, borrowing, and remittances without the need for a traditional bank account.

2. Increased Efficiency and Reduced Costs

DeFi platforms can reduce the need for intermediaries in financial transactions, which, in turn, can lower transaction fees, increase transaction speeds, and make cross-border payments more efficient. For businesses, this means less reliance on costly middlemen and a more streamlined approach to handling financial transactions. As a result, businesses can save both time and money while improving their overall efficiency.

3. New Investment Opportunities

The DeFi ecosystem offers new investment opportunities through decentralized exchanges (DEXs), liquidity pools, and yield farming. These platforms allow investors to earn returns on their crypto assets by participating in lending, staking, or providing liquidity.

In the UAE, the rise of DeFi platforms and the country’s forward-thinking regulatory environment is making it easier for both individual and institutional investors to access these innovative investment opportunities.

Challenges Facing DeFi in UAE

While DeFi in UAE presents vast potential, there are also challenges that need to be addressed:

1. Regulatory Uncertainty

Although the UAE has made great strides in providing regulatory clarity for blockchain and digital assets, DeFi is still a relatively new concept, and more comprehensive regulations may be required to address issues such as taxation, intellectual property rights, and dispute resolution.

2. Security Concerns

DeFi platforms are often targeted by hackers, and the security of smart contracts is a significant concern. While blockchain offers enhanced security, vulnerabilities in smart contracts or platform code can still be exploited by bad actors.

3. Scalability Issues

While DeFi offers many benefits, scalability remains a challenge, especially on blockchains like Ethereum. High transaction costs and network congestion during peak times can limit the efficiency of DeFi applications. The development of more scalable blockchain solutions will be key to the future of DeFi.

Conclusion

DeFi in the UAE is quickly becoming a major force in the financial industry. Thanks to a supportive regulatory environment, a thriving fintech ecosystem, and the UAE’s commitment to blockchain innovation, the country is about to become a leading hub for decentralized finance in the Middle East.

The future of DeFi in the UAE looks incredibly promising, offering businesses and consumers the opportunity to access financial services that are more efficient, transparent, and inclusive. As the regulatory framework for DeFi continues to evolve, the UAE will likely see continued growth and innovation in the decentralized finance sector. Consequently, the region is set to play a pivotal role in shaping the future of global finance.

About Websima

If you’re looking to integrate DeFi in UAE into your business or explore blockchain solutions, Websima is a leading blockchain service provider in the UAE. We offer DeFi platform development, smart contract programming, crypto integration, and Web3 services in Dubai.

Let Websima help you navigate the DeFi landscape in the UAE. Contact us today to learn how we can help you leverage decentralized finance to drive innovation in your business.