Table of Contents

- Introduction: What Is DeFi Lending?

- How DeFi Lending Works in the UAE

- Smart Contracts as the Backbone

- Collateralization in DeFi Lending

- Interest Rates in DeFi Lending UAE

- How Rates Are Set

- UAE-Specific Context

- What Is Yield Farming?

- Popular DeFi Lending Platforms Accessible from the UAE

- Key Risks in DeFi Lending UAE

- Regulatory Landscape for DeFi Lending in UAE

- VARA

- ADGM

- What UAE-Based DeFi Users Should Consider

- FAQs

- Conclusion

- Build DeFi Solutions in the UAE with Websima

Introduction: What Is DeFi Lending?

Decentralized Finance (DeFi) has emerged as a transformative force in the global financial sector—and the UAE is rapidly becoming a hotspot for innovation in this space. DeFi lending enables users to borrow and lend digital assets without traditional banks, relying instead on smart contracts deployed on blockchain networks like Ethereum or Polygon.

BREAKING:

CIRCLE $USDC RECEIVED APPROVAL TO OPERATE AS MONEY SERVICES PROVIDER IN ABU DHABI. pic.twitter.com/wqNykCD4QY

— Ash Crypto (@Ashcryptoreal) April 29, 2025

Blockchain startups are succeeding in the UAE as the country is actively positioning itself as a crypto-friendly jurisdiction, several platforms now offer regulated or semi-regulated DeFi products, allowing investors and developers to benefit from transparent, trustless finance.

How DeFi Lending Works in the UAE

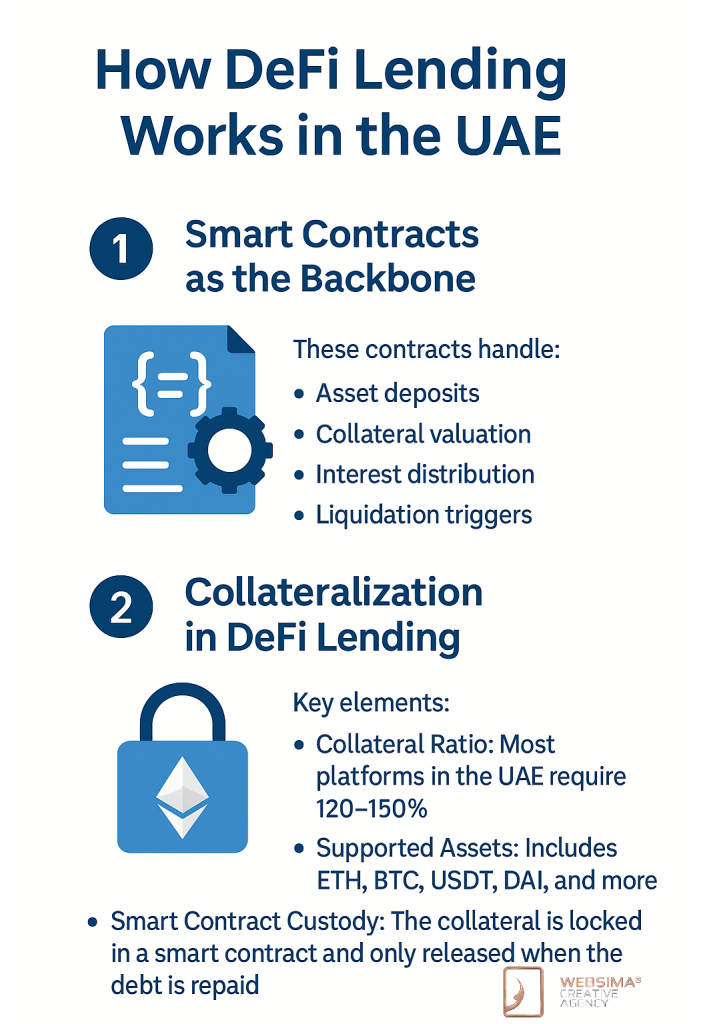

1. Smart Contracts as the Backbone

DeFi lending platforms operate through smart contracts, which are pieces of code that automatically execute agreements without intermediaries. When you lend or borrow, you’re interacting directly with a smart contract, not a bank or human broker.

These contracts handle:

- Asset deposits

- Collateral valuation

- Interest distribution

- Liquidation triggers

This automation ensures reduced overhead, minimal human error, and borderless financial access—all important factors along with audit and security practices for smart contracts in the UAE’s vision of becoming a blockchain hub.

2. Collateralization in DeFi Lending

Unlike traditional loans, DeFi lending platforms require overcollateralization. For example, if you want to borrow $100 worth of USDC, you may need to deposit $150 worth of ETH or BTC.

Key elements:

- Collateral Ratio: Most platforms in the UAE require 120–150%.

- Supported Assets: Includes ETH, BTC, USDT, DAI, and more.

- Smart Contract Custody: The collateral is locked in a smart contract and only released when the debt is repaid.

Some platforms in the UAE, like Aqarchain and Matrix token platforms, are experimenting with real estate-backed DeFi loans—collateralizing NFTs representing fractional property ownership.

Interest Rates in DeFi Lending UAE

Unlike fixed rates in traditional finance, DeFi lending interest rates are dynamic and influenced by real-time supply and demand on the platform.

How Rates Are Set:

| Mechanism | Description |

| Utilization Rate | The more borrowed assets vs. supplied, the higher the interest. |

| Algorithmic Adjustment | Protocols like Aave or Compound use algorithms to recalculate APYs hourly or daily. |

| Token Incentives | Yield farming incentives in the form of governance tokens (e.g., COMP, AAVE) can augment returns. |

UAE-Specific Context:

- Crypto lending platforms seeking VARA licensing must comply with additional disclosures about rate structures.

- Islamic-compliant DeFi is under exploration—interest-free lending via profit-sharing smart contracts.

What Is Yield Farming?

Yield farming refers to the practice of moving crypto assets across different DeFi platforms to maximize returns.

In the UAE, yield farmers might:

- Supply USDC on Aave for 3% APY

- Earn additional AAVE tokens (10% extra yield)

- Bridge assets to Binance Smart Chain for higher DeFi rewards

Yield farming is powerful but complex. Many UAE investors use automated DeFi portfolio tools or seek assistance from local crypto advisors due to the technical knowledge required.

Popular DeFi Lending Platforms Accessible from the UAE

| Platform | Type | Access from UAE | License |

| Aave | Lending protocol | ✅ | Unregulated (retail use common) |

| Compound | Lending protocol | ✅ | Unregulated |

| Nexo | CeFi/DeFi hybrid | ✅ | Offshore licensed |

| Aqarchain | Real estate DeFi | ✅ | Under UAE regulatory sandbox |

⚠️ Important: While these platforms are accessible, retail investors in the UAE should verify if use is compliant with VARA and ADGM guidelines.

Key Risks in DeFi Lending UAE

1. Smart Contract Exploits

Even audited smart contracts can be hacked. UAE investors should verify platforms have passed rigorous audits (e.g., CertiK, Quantstamp).

2. Collateral Volatility

A sudden market crash can trigger auto-liquidations, causing lenders or borrowers to lose value. Tools like Chainlink oracles are often used to reduce manipulation.

3. Regulatory Uncertainty

The UAE has progressive crypto regulation, but DeFi-specific laws are evolving. VARA currently does not license fully decentralized protocols but is expected to address them in upcoming frameworks.

4. Impermanent Loss

For those engaging in yield farming, pairing tokens like ETH/USDT in liquidity pools can result in impermanent loss due to price fluctuations.

5. Rug Pulls and Exit Scams

Unverified projects—especially on new blockchains—can disappear overnight. UAE regulators warn against engaging with anonymous teams or unlicensed platforms.

Regulatory Landscape for DeFi Lending in UAE

The UAE does not currently offer full licensing for decentralized protocols, but two major bodies provide relevant oversight:

1. VARA (Dubai Virtual Assets Regulatory Authority)

Oversees virtual asset service providers (VASPs) in Dubai. Current scope includes:

- Token issuance

- Custody

- Centralized lending platforms (CeFi/DeFi hybrids)

2. ADGM (Abu Dhabi Global Market)

Allows fintech testing in a sandbox. Some DeFi protocols—especially those involving tokenized securities, smart contracts, or Shariah-compliant finance—use this framework for pilot operations.

What UAE-Based DeFi Users Should Consider

- Use hardware wallets and avoid browser-based wallets for large amounts

- Monitor LTV ratios regularly to prevent liquidation

- Review the platform’s audit reports before depositing

- Stay informed through local meetups or DeFi-focused Telegram groups in the UAE

- Read terms & privacy notices, especially when using hybrid or CeFi-DeFi bridges

FAQs

Q: Is DeFi lending legal in the UAE?

A: Using DeFi platforms is not illegal, but retail users must understand the risks and should avoid platforms flagged by the UAE’s Securities and Commodities Authority or VARA.

Q: Do DeFi platforms require KYC in the UAE?

A: Pure DeFi platforms generally do not. However, centralized-DeFi hybrids like Nexo or Aqarchain may request KYC as part of compliance.

Q: Can I use AED to participate in DeFi lending UAE?

A: Direct AED deposits are not supported, but conversion via centralized exchanges like Binance or BitOasis is a common on-ramp.

Q: Are earnings from DeFi lending taxable in the UAE?

A: Currently, individuals are not taxed on crypto income, but this may change with global tax harmonization.

Conclusion

DeFi lending in the UAE presents a high-growth opportunity for tech-savvy investors and developers. With platforms like Aave, Compound, and emerging real estate-backed protocols, the region is set to play a leading role in decentralized finance innovation. However, risks—from smart contract bugs to regulatory shifts—require careful navigation.

By understanding how DeFi lending works, from collateralization to dynamic interest rates and yield farming, UAE users can make informed decisions and potentially reap substantial benefits in a compliant and secure manner.

Build DeFi Solutions in the UAE with Websima

At Websima, we help innovators, developers, and entrepreneurs build secure, scalable DeFi platforms tailored for the UAE market. Whether you’re developing smart contracts, launching a lending dApp, or ensuring regulatory alignment with VARA or ADGM, our blockchain experts have you covered.

- Smart contract development (Solidity, Vyper, Cairo)

- DeFi protocol audits and tokenomics modeling

- Integration with Chainlink, Aave, Uniswap, and more

- Regulatory consulting aligned with UAE frameworks

Transform your DeFi vision into reality—connect with us now.