Introduction

Dubai has long been a regional and global financial powerhouse. As a city that continuously embraces innovation—from skyscrapers powered by solar to paperless government services—its next logical leap is into Decentralized Finance (DeFi). And it’s already happening. Decentralized Finance offers a way to rethink traditional financial infrastructure using blockchain and smart contracts. It strips away the need for central intermediaries and opens doors to a new generation of financial services—from borrowing and lending to insurance and asset management.

Dubai Finance (DOF) has signed a Memorandum of Understanding (MoU) with https://t.co/HZnta4pnXb, a globally recognized cryptocurrency trading platform, to enable the payment of government service fees using cryptocurrencies—an initiative that marks a significant step in advancing… pic.twitter.com/iOh7kOz50p

— Dubai Media Office (@DXBMediaOffice) May 12, 2025

But what exactly is DeFi? Why is Dubai DeFi now trending among entrepreneurs, regulators, and venture capitalists? And how does decentralized finance fit into Dubai’s broader economic vision? This article explains everything you need to know.

What Is DeFi?

DeFi—short for Decentralized Finance—refers to a suite of blockchain-based financial applications that operate without intermediaries like banks, brokers, or payment processors.

Instead of relying on centralized servers, DeFi applications run on public blockchains, primarily Ethereum, using smart contracts—self-executing programs that automate agreements and transactions.

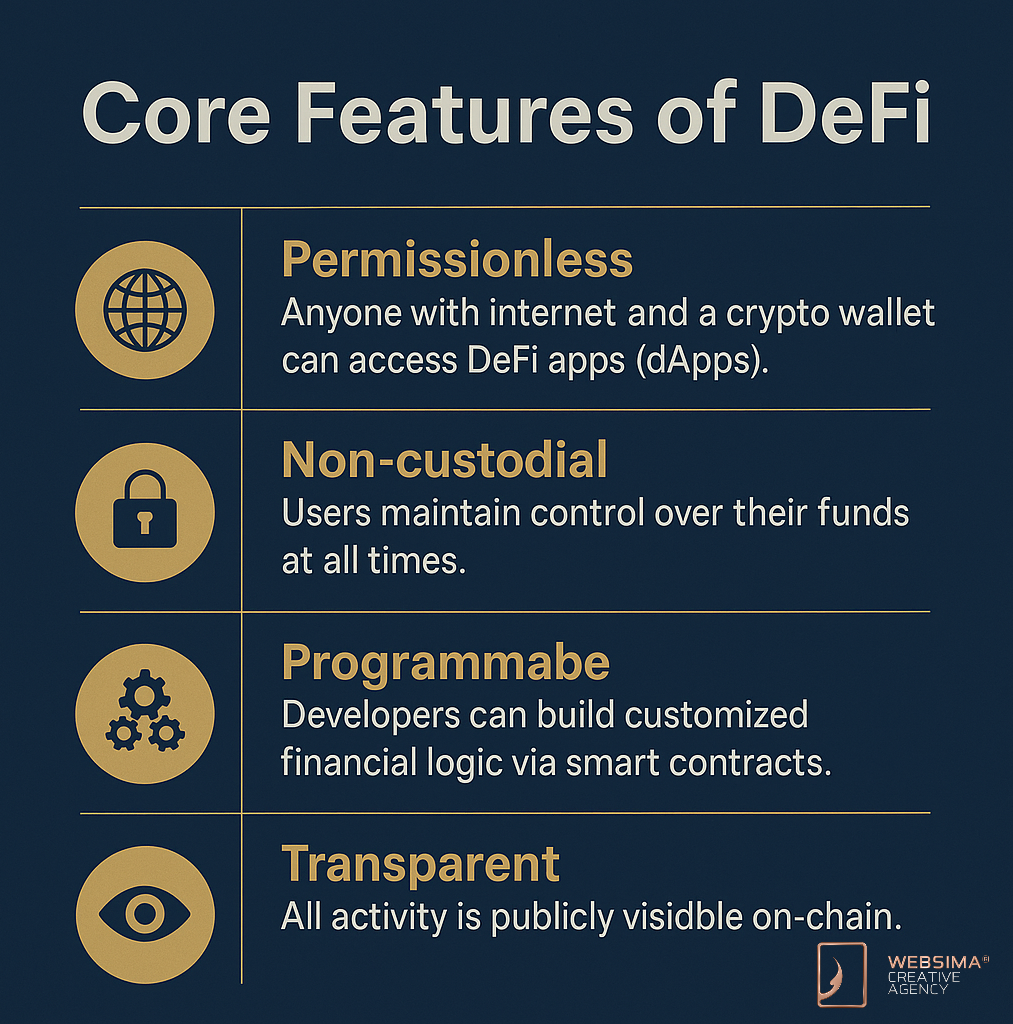

Core Features of DeFi:

- Permissionless: Anyone with internet and a crypto wallet can access DeFi apps (dApps).

- Non-custodial: Users maintain control over their funds at all times.

- Programmable: Developers can build customized financial logic via smart contracts.

- Transparent: All activity is publicly visible on-chain.

Popular DeFi services include:

- Lending and borrowing (e.g., Aave, Compound)

- Stablecoins (e.g., DAI, USDC)

- Yield farming and liquidity mining

- Decentralized exchanges (DEXs)

- Tokenized insurance and derivatives

Why DeFi Matters Now: A Global Perspective

In 2020–2021, DeFi exploded in popularity, growing from under $1 billion in total value locked (TVL) to over $200 billion at its peak. While the market has cooled, the ecosystem has matured, and regulatory attention has intensified.

According to a report by the World Economic Forum, DeFi could represent the next evolution of finance, especially in economies where trust in traditional institutions is low or infrastructure is underdeveloped.

Which makes Dubai’s interest in DeFi especially significant—it already has world-class financial infrastructure but recognizes the global shift toward decentralization.

The State of Dubai DeFi in 2025

Dubai is not new to blockchain innovation. The Dubai Blockchain Strategy, launched in 2016, aimed to shift 100% of applicable government documents to blockchain by 2030. Since then, the UAE has launched:

- The Virtual Assets Regulatory Authority (VARA), a world-first crypto regulator

- Multiple blockchain pilots in trade, healthcare, and real estate

- Crypto-friendly free zones like DIFC, DMCC, and ADGM

This regulatory readiness makes Dubai DeFi adoption smoother compared to countries still grappling with digital asset legislation.

Recent Developments

- In 2023, USDC and EURC were approved by the Dubai Financial Services Authority (DFSA).

- The UAE Central Bank announced guidelines for licensed stablecoins in 2024 (source).

- Dubai hosted the Global DeFi Summit in early 2025, bringing together innovators, VCs, and regulators.

These developments have drawn global startups to set up DeFi protocols, wallets, and BaaS (Blockchain-as-a-Service) solutions from Dubai’s innovation districts.

How DeFi Will Shape Dubai’s Financial Future

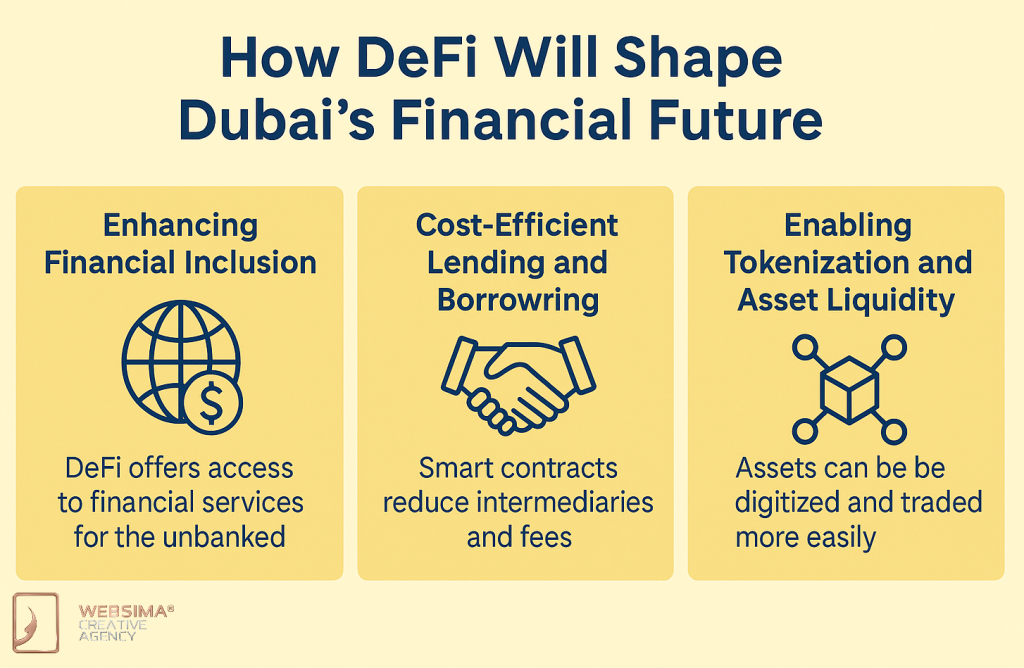

1. Enhancing Financial Inclusion

According to World Bank data, 1.4 billion adults globally remain unbanked. DeFi applications can change this. In Dubai, where a large population of migrant workers and freelancers rely on remittances and low-cost transfers, DeFi wallets and protocols can provide access to:

- Stablecoin-based remittances

- Crypto savings products

- On-chain credit scores and microloans

Dubai’s role as a global trade hub makes it uniquely positioned to export DeFi products to the unbanked world.

2. Cost-Efficient Lending and Borrowing

Banks and centralized lenders take days—or weeks—to process loans. In contrast, DeFi platforms for lending in Dubai is instant, global, and permissionless.

Protocols like Aave or Compound allow borrowers to deposit collateral (like ETH or USDC) and access loans automatically. Yield farmers and liquidity providers earn interest, often higher than traditional banks offer.

Dubai DeFi platforms can localize this model by integrating:

- Dirham-pegged stablecoins (like AE Coin)

- Credit delegation and risk modeling

- Sharia-compliant lending smart contracts

3. Enabling Tokenization and Asset Liquidity

DeFi can tokenize traditionally illiquid assets like:

- Real estate (fractionalized ownership via NFTs)

- Commodities (e.g., gold-backed tokens)

- Intellectual property (royalty-sharing via smart contracts)

Dubai already has the regulatory frameworks and tech talent to tokenize assets across these verticals—backed by transparent, decentralized rails.

Sectors in Dubai Poised for DeFi Disruption

Real Estate

Dubai Land Department (DLD) is already using blockchain for title transfers. DeFi can enable tokenized mortgage platforms, fractional investment pools, and automated rent agreements via smart contracts.

Trade Finance

With Jebel Ali Port as a global trade artery, Dubai is a natural testbed for DeFi in supply chain tokenization, escrow services, and invoice financing.

Insurance

DeFi platforms like Nexus Mutual and InsurAnce allow community-driven underwriting and smart contract claims processing. Dubai-based insurers could integrate similar models via regulated protocols for health, auto, or travel.

DeFi Risks and How Dubai Is Mitigating Them

1. Smart Contract Vulnerabilities

Many DeFi exploits result from poorly coded smart contracts. Dubai mandates independent audits and real-time transaction monitoring, setting an example for other regions.

2. Regulatory Ambiguity

While DeFi operates globally, jurisdictional clarity is key. With VARA and DFSA, Dubai has been a pioneer in legalizing and supervising DeFi, providing businesses with a sense of security and guidance.

3. Scams and Rug Pulls

Dubai authorities are introducing licensing frameworks and whitelisting mechanisms to reduce fraudulent DeFi launches.

Opportunities for Entrepreneurs and Investors

For Startups

Dubai’s Crypto Innovation Hub under DMCC and DIFC offers funding, co-working spaces, and legal guidance for DeFi builders. Areas of innovation include:

- Wallet UX and security

- Layer-2 integration

- Institutional DeFi

For Investors

DeFi staking, DAO governance, and token launchpads in Dubai offer both retail and institutional investors a regulated gateway into decentralized markets.

Startups can now raise capital from Dubai-licensed DeFi launchpads to launch a DeFi project in Dubai with token issuance, legal clarity, and stablecoin treasury management.

A Look Ahead: Dubai DeFi by 2030

Dubai has committed to digitizing 100% of its government services. DeFi will play a foundational role in:

- E-Dirham smart contracts for citizens and businesses

- Blockchain-based identity and credit scoring

- On-chain compliance reporting and auditing

- DeFi-compatible Central Bank Digital Currency (CBDC) systems

With deep investments in AI, blockchain, and open finance APIs, Dubai aims to become the “Ethereum of cities”—a programmable financial platform for residents, tourists, and investors.

Build the Future of Finance with Websima

At Websima, we specialize in designing and developing secure, scalable, and regulatory-aligned DeFi platforms from the ground up.

Whether you’re an enterprise seeking DeFi integrations, a startup developing smart contracts, or an investor launching tokenized products, our blockchain engineers and legal consultants will help you:

- Launch smart contract lending or staking protocols

- Integrate stablecoin-based payment systems

- Develop custom Web3 wallets and dashboards

- Ensure end-to-end compliance with VARA and DFSA

Ready to be part of Dubai’s decentralized future?

Schedule a free consultation and let Websima help you shape the next chapter in financial innovation.