Table of Contents

- Introduction

- Dubai’s Blockchain-Driven Vision

- Regulatory Foundation Supporting Innovation

- Capital, Talent, and Infrastructure

- Major Blockchain Firms Choosing Dubai

- Local Startup Ecosystem and Global Events

- High-Impact Use Cases Across Sectors

- Dubai’s Edge Over Global Blockchain Hubs

- Key Challenges Facing Startups

- Success Story from the Dubai Ecosystem

- Mistakes New Founders Commonly Make

- Regulatory Landscape and Tokenization Readiness

- Frequently Asked Questions

- Launch Your Blockchain Journey

Introduction

Dubai has emerged as one of the world’s most active and supportive environments for blockchain entrepreneurship. Fueled by a tech-forward government, zero-tax policies, a thriving investor ecosystem, and tailored regulations, the rise of blockchain startups in Dubai is no accident. Founders are choosing this city not just for its infrastructure but for its fast-moving regulatory clarity and global reach.

This article explores the reasons behind Dubai’s appeal to Web3 and blockchain entrepreneurs. It outlines regulatory frameworks, access to funding, regional use cases, and how emerging businesses are scaling with confidence.

Dubai’s Blockchain-Driven Vision

Yesterday, our Growth Associate Elise Baratte attended “Setting Up in Dubai: Crypto Regulations and Business Growth” hosted by @VARADubai and @dmcccrypto!

A packed session on why Dubai is the place for crypto and RWA tokenization

Here’s what you need to know

1/ A thread… pic.twitter.com/OXEo3L8KPX

— Defactor (@defactor_) April 29, 2025

Dubai launched its Blockchain Strategy with the goal of becoming the first government to execute all applicable transactions on blockchain by 2025. The plan, led by Digital Dubai, estimates public sector savings of up to AED 5.5 billion annually. Its focus on government efficiency, industry creation, and international leadership sets a robust foundation for private innovation.

Regulatory Foundation Supporting Innovation

The establishment of the Virtual Assets Regulatory Authority (VARA) has significantly clarified Dubai’s legal environment for blockchain startups. VARA regulates exchanges, custodians, token issuers, and staking platforms while enforcing AML and KYC standards.

Additional initiatives include the FinTech Hive, which allows startups to test blockchain platforms under a controlled regulatory sandbox at Dubai International Financial Centre (DIFC).

Free zones such as Dubai Silicon Oasis and Dubai Multi Commodities Centre (DMCC) offer 100% foreign ownership, zero corporate tax, and dedicated blockchain business licenses.

Capital, Talent, and Infrastructure

Global crypto venture investment hit $5.4 billion in Q1 2025, with a growing share flowing into UAE-based startups. According to Reuters, Dubai is now a top destination for blockchain VC funds and family offices targeting Web3 infrastructure, tokenization, and crypto asset management.

Dubai’s long-term Golden Visa program attracts top-tier global talent, offering 10-year residency for tech founders and engineers. Combined with strong cloud infrastructure and high-speed connectivity, the city offers everything a startup needs to scale.

Major Blockchain Firms Choosing Dubai

The global shift toward favorable jurisdictions has made Dubai a magnet for top blockchain firms.

- Binance received provisional approval from VARA in 2022 and continues to expand in the region

- Bybit and Crypto.com established headquarters in Dubai

- Emirates NBD began integrating blockchain for financial verification and payment services

These strategic moves confirm Dubai’s status as a global base, not just a regional branch location.

Local Startup Ecosystem and Global Events

Dubai’s startup ecosystem thrives thanks to consistent exposure through world-class events:

- TOKEN2049 Dubai drew over 15,000 attendees in 2025

- GITEX Global and Expand North Star host thousands of tech startups, many blockchain-native

- Step Conference brings together Web3 founders, VCs, and developers across MENA

These events offer vital networking, funding, and collaboration opportunities for blockchain startups in Dubai.

High-Impact Use Cases Across Sectors

Real Estate

Dubai became a global leader in tokenized real estate. DAMAC Properties partnered with MANTRA to tokenize $1 billion worth of property in early 2025, creating new revenue models for both investors and developers.

Finance

Startups are building blockchain-based digital payment systems, asset-backed token exchanges, and decentralized lending platforms through DIFC’s FinTech Hive, while the Dubai Financial Services Authority (DFSA) supports security token frameworks.

Logistics

Supply chain integrity powered by blockchain is being adopted by DP World and Dubai Customs for cross-border and intra-GCC trade verification in order to pave the way to use blockchain in Dubai’s logistics industry.

Dubai’s Edge Over Global Blockchain Hubs

| Feature | Dubai | Other Hubs (Singapore, London, Zurich) |

| Regulation | Dedicated crypto regulator (VARA) | Varies, fragmented in some countries |

| Corporate Tax | 0% (for many free zone entities) | 17–25% |

| Foreign Ownership | 100% in free zones | Restrictions in some countries |

| Government Incentives | Golden Visas, fast licensing, tokenization support | Limited incentive programs |

| Infrastructure | Blockchain sandbox, cloud-first infrastructure | Mixed depending on country |

Dubai’s unified regulation, pro-business climate, and rapid government adoption of Web3 solutions distinguish it from more conservative jurisdictions.

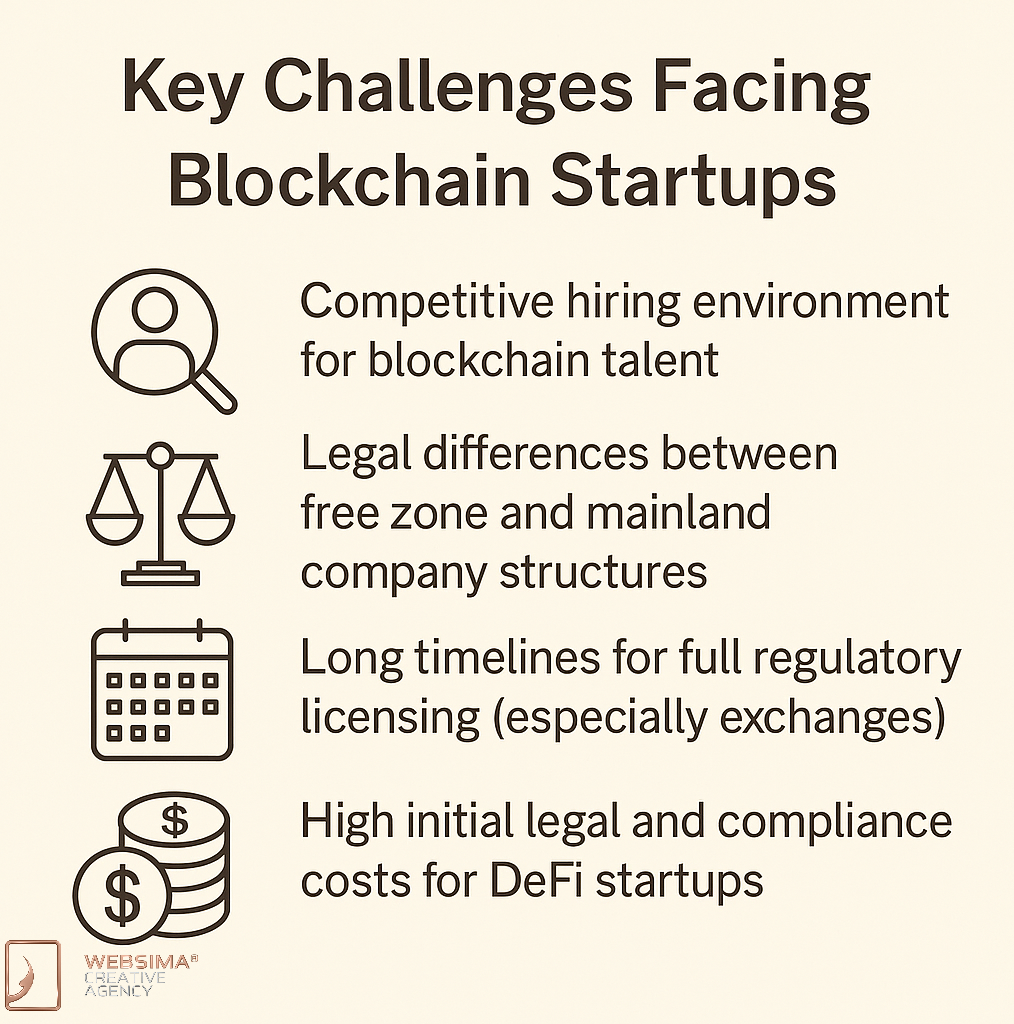

Key Challenges Facing Startups

Despite its advantages, startups should prepare for:

- Competitive hiring environment for blockchain talent

- Legal differences between free zone and mainland company structures

- Long timelines for full regulatory licensing (especially exchanges)

- High initial legal and compliance costs for DeFi startups

Those who navigate these early challenges benefit from long-term scalability and access to a supportive investor ecosystem.

Success Story from the Dubai Ecosystem

TokenTrust (a pseudonymous early-stage startup) entered DIFC’s FinTech Hive in 2024 and focused on fractional real estate tokenization.

Milestones within 12 months:

- Acquired VARA licensing for asset tokenization

- Raised $5 million from Dubai-based VCs

- Signed a pilot agreement with Dubai Land Department

- Enabled blockchain-based title transfers for co-owned properties

By 2025, TokenTrust had onboarded 1,200 investors and scaled into utility token issuance for rental income.

Mistakes New Founders Commonly Make

- Ignoring local regulatory requirements

- Failing to differentiate between VARA and DFSA jurisdictions

- Choosing the wrong free zone or mainland license

- Underestimating the importance of attending community events

Early-stage startups should work with experienced advisors to ensure legal compliance and secure early partnerships.

Regulatory Landscape and Tokenization Readiness

Dubai now supports full-stack blockchain operations under its legal frameworks:

- VARA oversees virtual asset activities and token classifications

- DFSA regulates security tokens and exchanges under common law

- Dubai Land Department supports blockchain-based property transactions

- DIFC and DMCC provide infrastructure and business licensing support

An overview of UAE’s blockchain regulation in 2025 indicates that his level of legal maturity makes Dubai one of the few global jurisdictions where blockchain startups can scale with confidence.

Frequently Asked Questions

Is Dubai a good place to launch a blockchain company?

Yes. It offers clear regulation, robust infrastructure, and access to both capital and government-backed programs.

Do I need a license to issue tokens in Dubai?

Yes. All token issuers must comply with either VARA or DFSA rules, depending on the type of token and business model.

Can I run a DeFi protocol in Dubai?

Yes, but you must first test in sandboxes such as FinTech Hive and receive regulatory approval before public deployment.

Are NFTs and Web3 games regulated?

NFTs are allowed under VARA but must be classified appropriately. Web3 gaming projects need legal review depending on their monetization model.

Launch Your Blockchain Journey

Dubai offers more than a destination—it’s a platform for blockchain innovation. From real estate tokenization to DeFi protocols and logistics solutions, entrepreneurs are building the future of Web3 right here.

Websima is your local partner for navigating the regulatory and technical landscape. We help startups:

- Apply for VARA/DFSA licensing

- Design and audit smart contracts

- Launch tokenized MVPs and secure capital

- Enter regulated sandboxes with legal clarity

Let’s turn your idea into a regulated, scalable Web3 solution.

Contact our team to begin your blockchain startup journey in Dubai.