Table of Contents

- Introduction

- Software-as-a-Service (SaaS) Platforms

- Token Economies

- Decentralized Finance (DeFi) Platforms

- B2B Blockchain Tools

- Case Study: Real Estate Tokenization in Dubai

- Challenges and Risks

- Benefits of Blockchain Adoption in Dubai

- How to Implement Blockchain Solutions

- Emerging Trends in Dubai’s Blockchain Landscape

- Conclusion

- Frequently Asked Questions (FAQs)

- Start Your Blockchain Journey with Websima Today

Introduction

Dubai is rapidly positioning itself as a global epicenter for blockchain innovation and becoming a , underpinned by visionary government strategies, a robust regulatory framework, and a thriving ecosystem of startups and enterprises. The city’s commitment to becoming a blockchain-powered economy is evident through initiatives like the Dubai Blockchain Strategy, which aims to make Dubai the first city fully powered by blockchain technology.

Brad Garlinghouse speaking in Dubai states

– “that blockchain is the underpinning of the next generation of financial service, and seeing Dubai and UAE lean into that will service them well”

It appears to be serving them well so far‼️ https://t.co/6i20H6FoAr pic.twitter.com/PF1D4A82IW

— Mr. Man (@MrManXRP) March 14, 2025

The potential of blockchain in Dubai spans across various sectors, offering transformative opportunities:

- Government Efficiency:

By integrating blockchain into public services, Dubai anticipates significant cost savings and enhanced transparency. According to Dubai Future Foundation, the implementation is expected to eliminate 398 million printed documents and 77 million work hours annually, translating to savings of approximately AED 11 billion .

- Industry Creation

The blockchain strategy is fostering new business models and startups, particularly in fintech, real estate, and supply chain management. Dubai’s supportive environment has attracted over 686 fintech companies, with a significant number focusing on blockchain and cryptocurrency innovations .

- International Leadership

Dubai’s proactive approach and regulatory clarity have made it a magnet for global blockchain enterprises. The establishment of the Virtual Assets Regulatory Authority (VARA) provides a comprehensive framework for virtual asset activities, further solidifying Dubai’s position as a leader in the digital economy. Hence, understanding Dubai’s Virtual Assets Regulatory Framework is crucial for market participants.

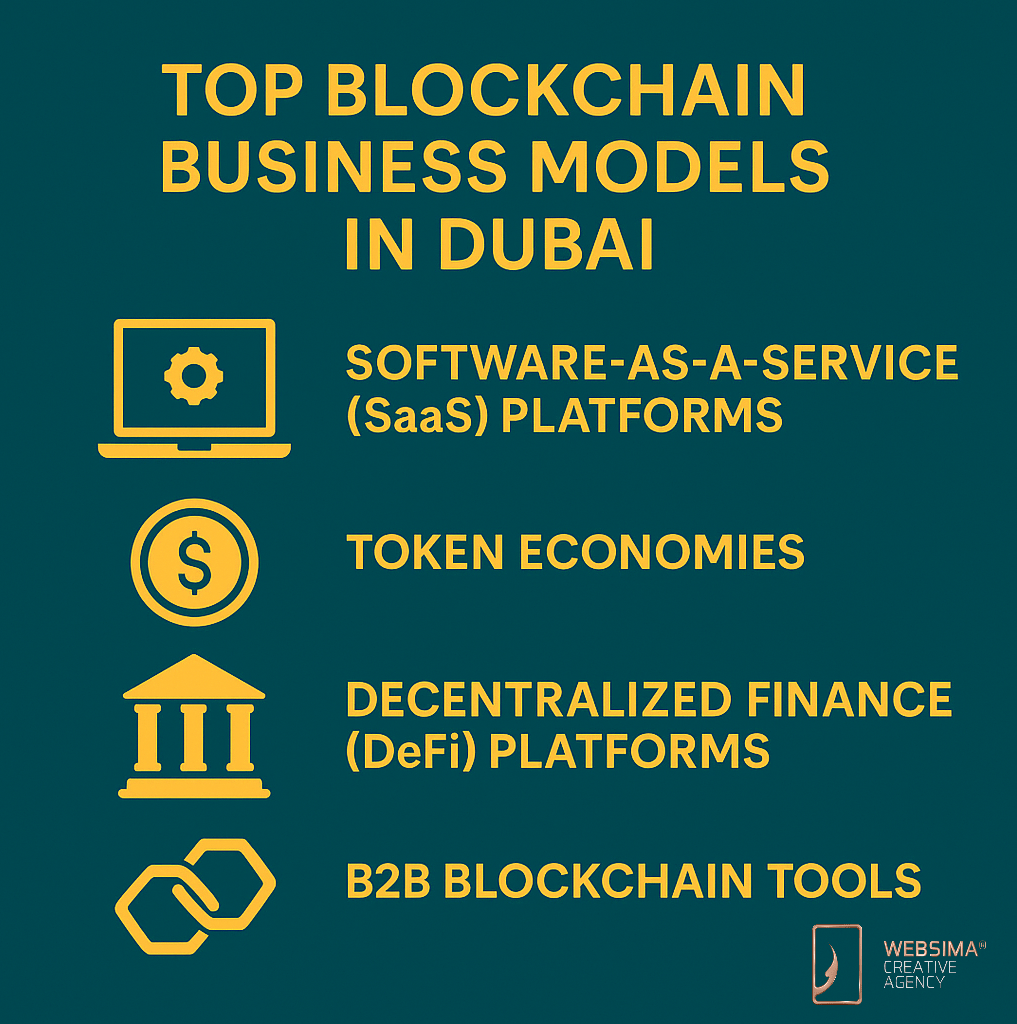

In this article, we delve into the top blockchain business models that are flourishing in Dubai, exploring how they leverage the city’s unique advantages to drive growth and innovation and also make Dubai a hotspot for blockchain startups in 2025.

Software-as-a-Service (SaaS) Platforms

SaaS platforms in Dubai are leveraging blockchain to offer scalable and secure solutions across various industries. These platforms provide businesses with tools to integrate blockchain without the need for extensive in-house development.

Key Features:

- Smart Contract Development: Automated and secure execution of agreements.

- Token Management: Creation and management of digital tokens for various applications.

- Decentralized Applications (dApps): User-friendly interfaces for blockchain interactions.

Notable Example:

- Websima DMCC offers comprehensive blockchain development services, including smart contract development and tokenization solutions.

Token Economies

Token economies are transforming traditional business models by introducing digital tokens that represent assets, rights, or access within a blockchain ecosystem.

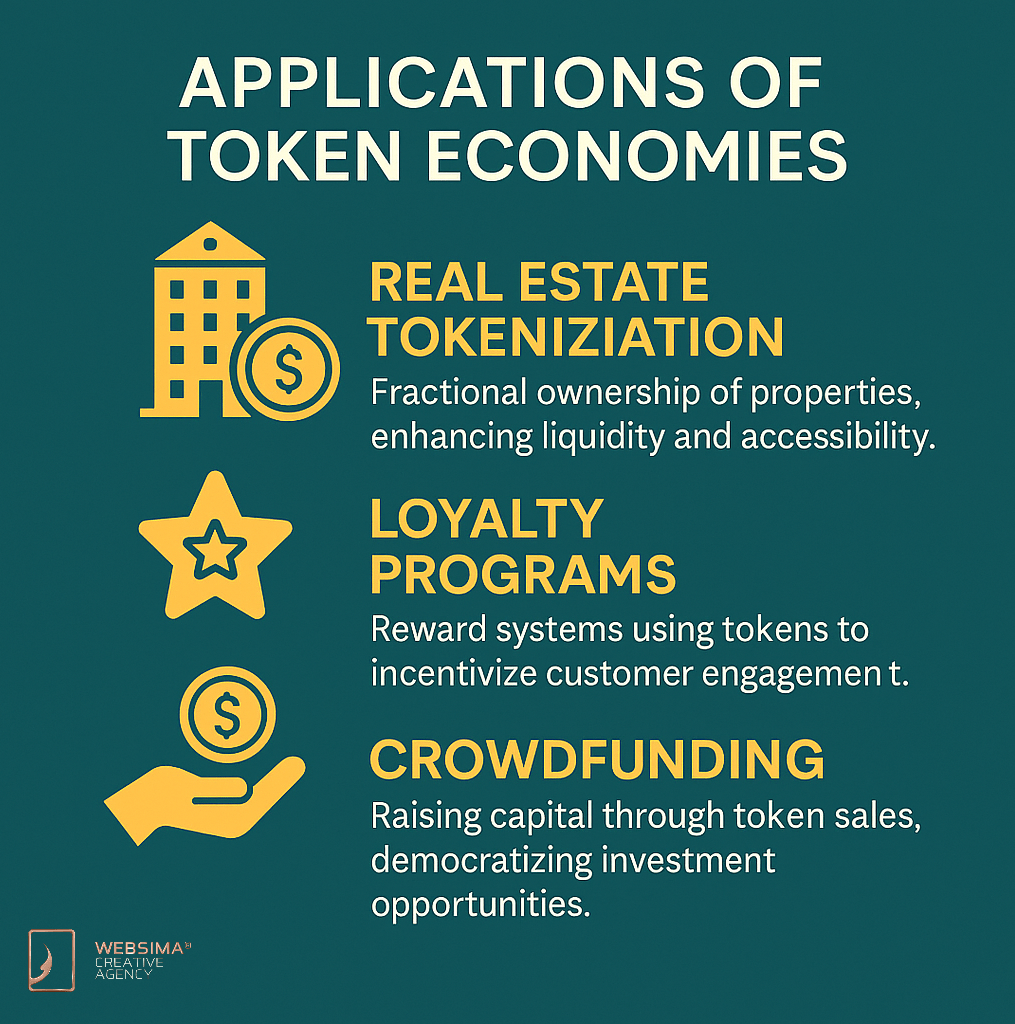

Applications:

- Real Estate Tokenization: Fractional ownership of properties, enhancing liquidity and accessibility.

- Loyalty Programs: Reward systems using tokens to incentivize customer engagement.

- Crowdfunding: Raising capital through token sales, democratizing investment opportunities.

Impact in Dubai:

The Dubai Land Department has implemented blockchain to streamline real estate transactions, reducing fraud and improving transparency, supporting the broader Dubai Blockchain Strategy.

Decentralized Finance (DeFi) Platforms

DeFi platforms in Dubai are redefining financial services by eliminating intermediaries and offering decentralized alternatives for lending, borrowing, and trading.

Core Components:

- Decentralized Exchanges (DEXs): Peer-to-peer trading platforms without centralized control.

- Lending Protocols: Platforms allowing users to lend and borrow assets using smart contracts.

- Stablecoins: Cryptocurrencies pegged to stable assets, facilitating transactions and savings.

Dubai’s Initiatives:

The establishment of VARA provides a regulatory framework that supports the growth of DeFi platforms, ensuring compliance and fostering innovation. For further context, see the DeFi Ecosystem Overview.

B2B Blockchain Tools

Business-to-Business (B2B) blockchain tools are enhancing operational efficiency and transparency in Dubai’s corporate sector.

Key Solutions:

- Supply Chain Management: Real-time tracking and verification of goods.

- Identity Verification: Secure and decentralized identity management systems.

- Smart Contracts: Automated execution of business agreements, reducing administrative overhead.

Industry Adoption:

Companies in Dubai are integrating blockchain into their operations to streamline processes and build trust. Websima’s insights on blockchain startups shed light on how entrepreneurs are capitalizing on these solutions.

Case Study: Real Estate Tokenization in Dubai

Dubai’s real estate sector is at the forefront of blockchain adoption, with tokenization enabling fractional ownership and increased liquidity.

Example:

DAMAC Properties partnered with blockchain platform MANTRA to tokenize $1 billion worth of real estate assets, allowing global investors to purchase fractional shares of properties.

Benefits:

- Accessibility: Lower investment thresholds for retail investors.

- Liquidity: Easier buying and selling of tokenized shares.

- Transparency: Immutable records of ownership and transactions on-chain.

Challenges and Risks

Despite the promise of blockchain business models, there are still hurdles to overcome:

- Regulatory Compliance: Businesses must stay updated on Dubai’s evolving laws.

- Technical Complexity: Blockchain integration requires high-level technical expertise.

- Cybersecurity: Protecting against smart contract vulnerabilities and data breaches is essential.

- Scalability: Certain blockchains face performance limitations in handling large-scale use cases.

Benefits of Blockchain Adoption in Dubai

The advantages for businesses embracing blockchain in Dubai are considerable:

- Operational Efficiency: Automation reduces processing time and labor costs.

- Enhanced Trust: Immutable records improve customer and partner confidence.

- Innovation: New revenue models and value propositions emerge from tokenization and decentralization.

- Access to Capital: Token-based fundraising models attract global investments.

How to Implement Blockchain Solutions

Companies ready to integrate blockchain should take a strategic approach:

- Identify Business Goals: Define where blockchain offers real value.

- Select the Right Model: SaaS, token economy, or B2B tools based on your niche.

- Engage Blockchain Experts: Partner with consultants or firms like Websima.

- Develop and Test: Start with a Minimum Viable Product (MVP).

- Ensure Legal Compliance: Work with legal teams familiar with UAE crypto laws.

- Scale Strategically: Use early results to guide full-scale deployment.

Emerging Trends in Dubai’s Blockchain Landscape

As blockchain matures in Dubai, several trends are becoming prominent:

- Integration with IoT and AI: Enhancing automation, monitoring, and data validation.

- Growth of NFTs Beyond Art: Use in real estate deeds, event access, and digital identity.

- Sustainable Blockchain Initiatives: Eco-friendly protocols and green token standards.

- DAOs (Decentralized Autonomous Organizations): Emerging in governance and venture capital sectors.

- Cross-border Blockchain Collaborations: Dubai forming alliances with other smart cities.

Conclusion

Dubai’s blockchain ecosystem is thriving across sectors, from finance and real estate to logistics and legal services. By embracing robust business models such as SaaS platforms, token economies, DeFi, and B2B blockchain tools, businesses can capitalize on Dubai’s proactive governance, tax advantages, and deep investor pool.

The future of blockchain in Dubai isn’t just bright — it’s already unfolding, and smart companies are moving fast to secure their place in it.

Frequently Asked Questions (FAQs)

Q1: What industries are adopting blockchain business models in Dubai?

A1: Key industries include real estate, finance, logistics, healthcare, and identity verification sectors.

Q2: What’s the regulatory body overseeing blockchain in Dubai?

A2: The Virtual Assets Regulatory Authority (VARA) oversees blockchain and crypto-related activities in the emirate.

Q3: How are token economies used in Dubai?

A3: Tokens are being used for real estate ownership, loyalty programs, venture funding, and NFT projects.

Q4: Is there a minimum capital requirement for launching a blockchain startup?

A4: It depends on the free zone and business structure, but some startups begin with as little as AED 50,000, though others may require over AED 200,000.

Q5: How can I start a blockchain business in Dubai?

A5: First, identify your target model (e.g., DeFi or B2B tools), then consult with firms like Websima to handle licensing, tech development, and legal compliance.

Start Your Blockchain Journey with Websima Today

Websima DMCC is your strategic partner for blockchain innovation in the UAE. From tokenized real estate models to custom DeFi platforms and B2B SaaS integrations, our team helps you turn bold ideas into secure, scalable realities.

Whether you’re launching your first dApp or building out a blockchain-as-a-service solution, Websima provides:

- Expert smart contract programming

- Regulatory guidance within Dubai’s blockchain ecosystem

- Full-stack development and token design

- Ongoing infrastructure support

Reach out to Websima today and take the next step toward blockchain-powered success in Dubai.