Introduction

Dubai has a habit of turning “what if” into “what’s next.” That’s exactly what’s happening at the intersection of Islamic finance and Web3—a space where ethical investment rules meet transparent, programmable finance. In plain English: the emirate is blending Shariah-compliant principles (no interest, real assets, fair risk-sharing) with blockchains, smart contracts, and tokenization to create products that are both modern and moral.

If you’re a bank, fintech, or investor, this isn’t a niche experiment. It’s a new toolbelt for building and accessing Shariah-aligned products with less friction, more transparency, and broader participation—especially for cross-border investors who have historically faced paperwork and process bottlenecks.

Why Web3 maps so well to Shariah

The $4 Trillion Islamic Finance market is confined by TradFi. The solution?

Islamic Finance powered by DeFi, built on @solana.

inshAllah Finance is building that financial future for 2 Billion people, and that’s why we’re thrilled to announce that inshAllah has raised $2.1… pic.twitter.com/1pqBm2npJO

— iA (@inshAllahfi) June 30, 2025

Islamic finance asks for four big things: no riba (interest), no gharar (excessive uncertainty), asset-backing, and clarity of rights and obligations. Web3 aligns surprisingly well:

- Smart contracts formalize who gets what, when, and under which conditions—automatically and auditable on-chain.

- Tokenization makes ownership in real assets (property, equipment, sukuk pools) divisible and tradable, while keeping the asset link visible.

- Public ledgers deter hidden terms and back-room changes, and they make audits simpler.

The result? A financial experience that can be both compliant and convenient—especially when governments and regulators set clear guardrails.

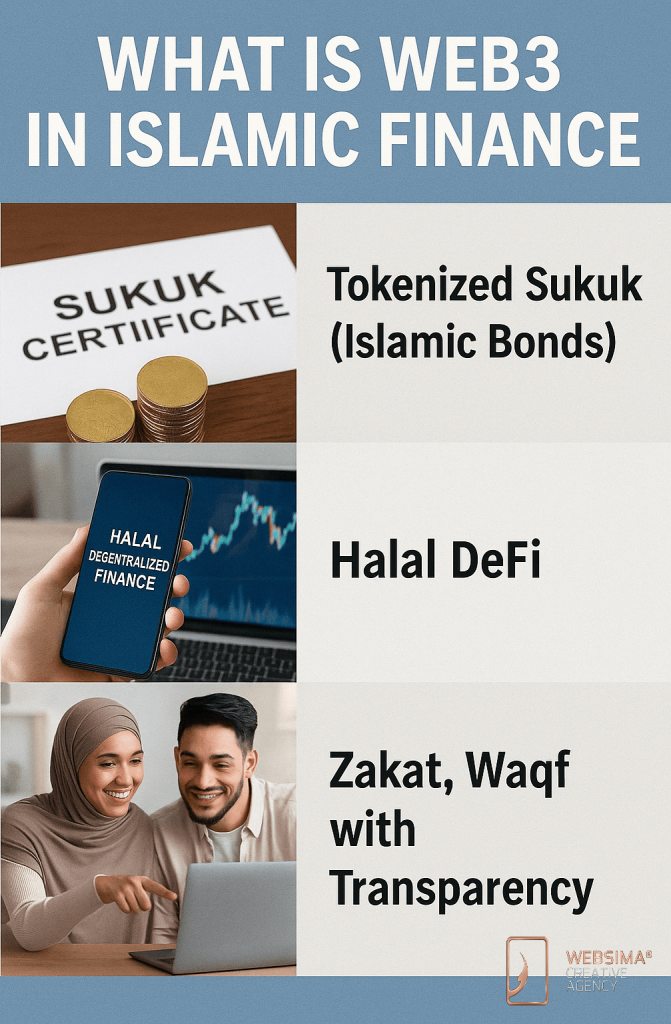

What “Web3 in Islamic Finance Dubai” looks like in practice

Let’s unpack the most important building blocks and how they’re being used (or piloted) in the UAE today.

1) Tokenized sukuk (Islamic bonds), done the right way

Sukuk have always been about sharing in asset-based returns instead of earning interest. On a blockchain, that same logic becomes more transparent and more liquid. Tokenization breaks a sukuk into smaller, digital shares that are easier to buy, sell, and settle—especially across borders.

A pivotal proof-point came when an Abu Dhabi-based Islamic bank executed a blockchain-based sukuk transaction—the first of its kind globally. The bank used distributed ledger technology to resell a portion of an existing sukuk in the secondary market, demonstrating faster settlement, cleaner ownership records, and a smoother investor experience. That single transaction signaled something bigger: Islamic fixed-income can live on modern rails without compromising its principles. alhilalbank.ae

2) Halal DeFi (without the “wild west”)

DeFi isn’t just “crypto lending.” In an Islamic context, it can be shaped around profit-and-loss sharing instead of interest, with real-asset backing (for example, rental streams from properties or equipment leases). Smart contracts can allocate profits, redeem principal, or trigger buybacks based on pre-agreed rules that Shariah boards review up front.

For retail investors, this means bite-size participation and automated distributions. For institutions, it means operational clarity and a digital audit trail.

3) Zakat, Waqf, and impact transparency

Charitable obligations (Zakat) and endowments (Waqf) benefit from traceability. If donations are tracked on-chain, stakeholders can see exactly when funds moved, who received what, and how allocations matched policy. It’s not flashy tech; it’s trust delivered in a dashboard.

The guardrails: why regulation is the secret advantage

Talk to any serious operator and you’ll hear the same thing: innovation is only as useful as the regulatory clarity behind it. Dubai’s framework—especially inside the DIFC—has matured in very practical ways.

- The DFSA’s Crypto Token regime defines how firms can operate with crypto tokens inside the DIFC, including recognition, compliance duties, disclosure, custody, market abuse prevention, and more. In mid-2024, the DFSA tightened and refined the framework, signaling a willingness to evolve rules as technology and markets mature. That kind of steady, official scaffolding is exactly what institutions need to build long-term products—especially in a Shariah context where governance is a feature, not a bug. DFSA

What does that mean on the ground? Product teams can design tokenized, asset-backed structures; compliance teams can map obligations without guesswork; and Shariah boards can review products against both religious standards and regulatory expectations.

Market size (and why it matters)

You can build the best platform in the world, but if the market is tiny, it’s a science project. Islamic finance is not tiny. The latest Islamic Finance Development Report (IFDI) shows global Islamic finance assets at roughly US$4.9 trillion in 2023 with growth expected toward US$7.5 trillion by 2028—a scale that invites serious product innovation and cross-border platforms. For a city that already specializes in trade, tourism, and capital flows, Web3-native, Shariah-compliant rails are a logical next step. LSEG

A simple playbook for teams building Shariah-aligned Web3 products

If you’re a bank, fintech, or asset manager in Dubai, here’s a pragmatic approach that avoids hype and focuses on delivery.

Step 1: Start with a real asset and a real need

Pick something tangible with predictable cash flows—income properties, equipment leases, infrastructure revenue rights, or a sukuk pool. Map the economic flows clearly. If the economics are fuzzy off-chain, they’ll be fuzzy on-chain.

Step 2: Design the Shariah-first structure—then digitize it

Engage your Shariah board early. Decide whether the structure is Mudarabah (profit-sharing), Musharakah (joint venture), Ijara (lease), or a sukuk variant. Only after the structure is approved should you model the token and smart contract logic.

Step 3: Implement smart contracts for distributions and controls

Program distributions on schedule, enforce eligibility (e.g., only approved wallet addresses), and encode redemption/buyback conditions. Add “pause” or “emergency stop” controls that Shariah and compliance teams can trigger if needed.

Step 4: Compliance by design

Align with the DFSA’s Crypto Token regime (if operating in DIFC) or the relevant UAE rules where you domicile activity. Build KYC/AML, wallet-whitelisting, disclosure, and auditability into the product from day one—not as a bolted-on module later. DFSA

Step 5: Investor experience > jargon

Abstract away crypto complexity. Give investors a clean dashboard: capital invested, expected profit share, last distribution, next date, supporting documents, and a clear “how this works” explainer. If a retail user needs a solidity primer to participate, you’ve already lost them.

Where tokenized sukuk shine (and where they don’t)

Shine:

- Secondary-market liquidity: Smaller, compliant units are easier to match with buyers.

- Distribution automation: No manual spreadsheet gymnastics at quarter-end.

- Cross-border inclusion: Qualified investors in other markets can participate without flying in to sign stacks of paper.

Don’t:

- Speculative trading: Shariah products aren’t designed to be casino chips.

- Opaque collateral: If the “asset backing” is a moving target or hard to value, no blockchain will save you.

- Governance theater: A token with unclear voting or oversight isn’t a Shariah-aligned instrument; it’s a risk.

What investors can reasonably expect

- Better transparency: You’ll see your holdings and distributions clearly.

- Lower friction: Onboarding and participation should be faster than legacy processes.

- More choice: Fractional units let you diversify across more assets or sukuk pools.

- Risk still exists: Market, credit, and operational risk don’t disappear because they’re on-chain; they just become more visible.

Risks and how teams mitigate them

- Smart contract bugs → Third-party audits, formal verification for critical logic, and failsafe “pause” roles.

- Custody and key management → Institutional-grade custody, recovery workflows, and clear responsibility matrices.

- Regulatory drift → Track DFSA circulars/updates, document design choices, and update disclosures as regimes evolve. DFSA

- Shariah divergence → Maintain a Shariah governance framework (advisory board minutes, approvals, ongoing reviews) and publish summaries investors can understand.

A realistic case study (how this looks end-to-end)

Imagine a Dubai-based developer with a completed, income-generating residential block. Historically, they’d tap bank financing or issue a conventional sukuk to recycle capital. With a tokenized sukuk:

- They structure a Shariah-compliant vehicle tied to rental income.

- Tokens represent proportional ownership rights to the sukuk pool; only whitelisted, KYC’d wallets can subscribe.

- A smart contract receives monthly rent from the property manager and allocates profit shares quarterly.

- Investors see a dashboard with their holdings, prior distributions, the next distribution date, and the on-chain transaction history.

- If an investor wants to sell, a compliant secondary venue matches them with a buyer; settlement is near-instant instead of days.

That’s not science fiction—the enabling pattern is already proven inside the UAE with that early blockchain sukuk transaction, and the local regulatory scaffolding is now far stronger than it was in 2018. alhilalbank.aeDFSA

What the next 24 months could bring

- More institutional pilots: Expect conservative rollouts—asset by asset, pool by pool—prioritizing post-trade clarity and distribution automation.

- Embedded Shariah tooling: Libraries for common structures (Mudarabah, Ijara) that Shariah boards can review faster.

- Better on-ramps: Wallet-free UX (custodial by default), plus seamless bank funding and redemptions.

- Cross-border corridors: As more jurisdictions clarify rules, you’ll see sukuk and real-asset tokens marketed compliantly to investors across Southeast Asia, the GCC, and beyond.

- Data-rich dashboards: On-chain proofs of asset performance (oracle-fed) to complement financial statements.

Quick FAQ (straight answers)

Is Web3 “too speculative” for Islamic finance?

Not when it’s designed around real assets, profit-sharing, and strict governance. The speculation risk comes from product design, not the ledger.

Do I have to hold crypto to participate?

No. Properly built platforms can let you fund and redeem in fiat while the underlying record-keeping and distributions happen on-chain.

Who makes sure it’s actually Shariah-compliant?

A recognized Shariah board reviews the structure, documents their opinion, and may perform ongoing oversight. Reputable teams publish that governance.

What’s the single best early use case?

Tokenized sukuk and income-producing real-asset pools—because the economics are already well understood and Shariah-aligned.

Bottom line

Web3 in Islamic Finance Dubai isn’t about gimmicks. It’s about taking things Islamic finance already values—clarity, fairness, real assets—and delivering them with better plumbing. The city’s regulatory stance gives serious teams permission to build, and the market size makes it worth doing properly. If you’re planning a pilot, lead with structure, governance, and UX—not buzzwords.

Want a build partner who speaks both Web3 and Shariah?

This is exactly where we work best. From tokenized sukuk design to asset dashboards and distribution smart contracts, we build for compliance, clarity, and scale. If you want to scope a project or validate an idea, reach out and we’ll map the steps, risks, and resources.